- Smart Money participants in the market have reduced their position in the penguins half in the penguins because of potentially weak foundations.

- Spot and derivatives followed the lawsuit. But the possibility of assembly is still powerful.

PUDGY PENGUINS’s Pengu Momentum has been weakened by 135% rally last month. The 24 -hour exercise, which is a 1.94%price increase, clearly indicates that there is insufficient market sentiment.

When analysts try to decide whether the rally will continue or whether the penguin will fall further, AMBCRYPTO’s analysis shows that PENGU shows two -way price movement on the chart.

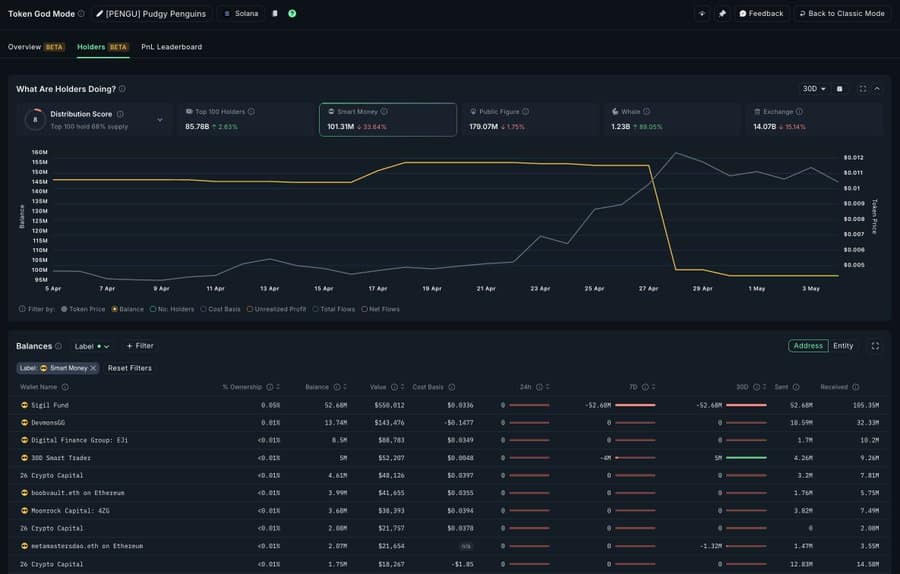

Smart Money reduces exposure to PENGU

Smart money investors are famous for strategic trading, discounted asset purchases and premium sales.

The investors now suggest that they are profitable by selling 33%of penguin tokens.

According to further analysis, the decrease began after selling 52 million penguin tokens with a smart money wallet called ‘Shigil Fund’. This event was over half of the price of Pengu.

Source: Nansen

This movement often inspires the lack of trust among investors observed in many of the highest wallets.

The on -site market reflects the weakness of this growth.

At the time of writing, EXCHANGE NETFLOWS has changed for the first time since April 27.

This change indicates that the seller is moving its assets from personal wallets to exchange. So far, about $ 318,000 has been sold.

If Smart Money and Spot Traders start selling at the same time, they generally indicate that major prices may fall as market sentiment is opposed to assets.

The rate of financing is checked for weaknesses.

FR (Funding Rate) (FR) -The cost of maintaining the futures status checks the weakness of the market.

In the last 24 hours, the total FR has changed to -0.0038%.

Source: COINGLASS

This means that short -term traders currently have most unstable futures contracts and pay a premium to maintain their position.

As long as the seller continues to pay, it suggests that the market can be advantageous and the price may continue to be lowered.

In OKX, sales volume was dominant with a reading value of 0.93, and the Binance Traders shows a similar position at a ratio of 0.9613.

Strong Roadmap in the future

According to the technical analysis, despite the weakness of the weakness, the fall of the penguin seems to be positioning assets for significant price rally for the next few days.

The price began after testing the resistance level of the triangle pattern that PENGU is currently trading.

This optimistic triangle structure usually sets up the stages of upward exercise, and the price is expected to rise to at least the peak of the pattern.

Source: TradingView

In order for Pengu’s rally to begin, the price must fall to $ 0.010559, forming the basics of the pattern.

If the penguin reinvests this area, it can cause an increase of 42.44% at that level.

Currently, Smart Money and Spot Traders are likely to adjust sales to lower prices. This strategy allows you to accumulate discounts before potential main rise.