According to the on -chain data, Etherum Exchange Net Flow has maintained a negative state of Etherum Exchange Net Flow, which may be ethical signs last week.

Ether Lee Exchange Netflow suggests a withdrawal trend.

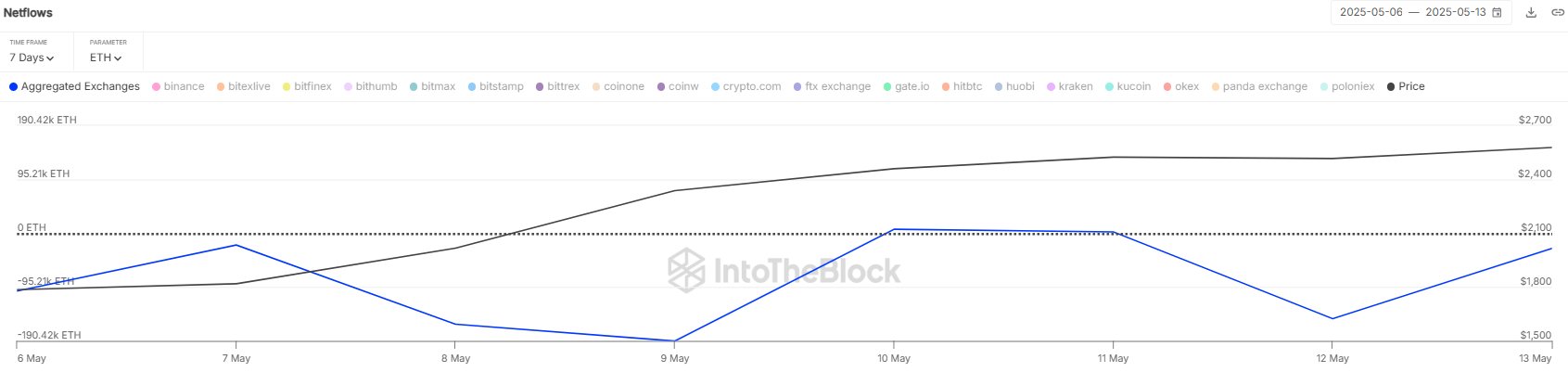

In the new post of X, Sentora (formerly Intotheblock), a provider provider of the engine Defi Solutions, talked about Ethereum’s latest trends. Here, “Exchange Netflow” represents a warm -chain metric that traces the net amount of cryptocurrency that moves or goes out to a wallet associated with the centralized platform.

If the value of this metrics is positive, it means that the investor deposits a pure token on this platform. One of the main reasons for the holder to transfer to the exchange is that this kind of trend for the purpose of sales can affect the weakness of the ETH price.

On the other hand, indicators of less than 0 suggest that leaks surpass the inflow. In general, investors take coins from the exchange custody for the long run, and this kind of trend can be optimistic about assets.

The chart shared by the analyst now shows the trend of Ether Leeum Exchange Net Flow last week.

The value of the metric appears to have been negative in recent days | Source: Sentora on X

As shown in the graph above, Ether Leeum Exchange Net Flow has been found to be negative inside the window, which means that the holder is drawing supply from the centralized exchange.

The total investors withdrew $ 1.2 billion with this leak. Sentora said, “The continued trend of net leaks that has been strengthened from early May has continued to accumulate signals and reduced sales pressure.

ETH has recently developed this strong development, but Cryptocurrency may not provide a chance to enter right now, as the analytical company Santiment explained in insights.

The data for the 30-day and 365-day MVRV Ratios of ETH | Source: Santiment

The indicators shared by the Analytics company are “MVRV (Malket Value to Remized Value) ratio” and basically measures the benefits of Bitcoin investors.

On the chart, Santimate contains two versions of the 30 and 365 days. The former informs the profitability of investors purchased over the last 30 days and the profitability of buyers last year.

As can be seen in the graph, Ether Lee’s 30 -day MVRV ratio has a notable positive value and suggests that the buyer gains significant profits. More specifically, the metrics are sitting in 32.5%, which is much higher than the 15% dangerous zone of the Altcoins recommended by the analysts.

“This doesn’t mean the price drops, but it’s likely that the rally will slow or stop until the 30 -day MVRV falls back to more reasonable.

ETH price

At the time of writing, Ether Lee Rium trades $ 2,600, up more than 43% last week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

DALL-E, SANTIMENT.NET, Intotheblock.com’s main image, TradingView.com chart

Editorial process Bitcoinist focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.