Ethereum’s staking pool dynamics have undergone significant changes amid rumors surrounding legal troubles between Binance and CZ and increased regulatory scrutiny of centralized exchanges.

There has been a noticeable change in the dynamics of Ethereum staking pools over the past few weeks, indicating a significant slowdown in validator growth rates. This change resulted in a decrease in the daily issuance of Ethereum (ETH), which was directly affected by the amount of ETH actively staked in the pool.

Ethereum Validator Exodus: What’s Happening?

According to Glassnode’s analysis, there has been a high level of daily validator churn of approximately 1,018 validators since the beginning of October, which has coincided with a rise in cryptocurrency spot prices. Due to this move, Ethereum’s proof-of-stake (PoS) consensus mechanism experienced its first total effective balance decrease since the update.

Over the past eight weeks, the majority of validators leaving have done so willingly. This means that stakers are free to choose to leave the staking pool rather than slicing, which is the penalty for validators who violate the protocol.

There were only two instances of cuts during that time, one of which was significant and involved cutting 100 newly joined validators and fining them for signing two separate blocks simultaneously within the network.

ETH market cap currently at $244 billion on the daily chart: TradingView.com

Voluntary Attrition Survey

To act as a validator on the Ethereum network, you need to stake at least 32 ETH. The number of unique addresses holding this much ETH has been steadily declining since the rise began in October.

According to Glassnode, the majority of reported withdrawals over the past eight weeks have been voluntary. If a validator independently chooses to leave the ETH 2.0 staking pool, they are considered to have freely left the network.

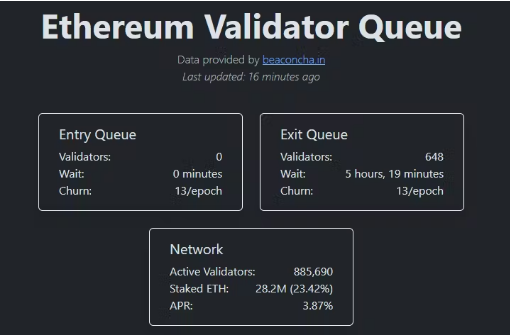

Source: Validator Queue

As of this writing, approximately 125,189 addresses hold at least 32 ETH, down 1% from October 1.

Despite these departures, both Kraken and Coinbase have seen their balances recover following Zhao’s resignation, suggesting that users still have trust in these services.

Additionally, the increase in daily ETH fee burn through EIP1559 is consistent with the change in ETH issuance. The 2021 London upgrade triggered the fee drain mechanism, which caused ETH supply to become deflationary once again.

The Ethereum network is going through a dynamic phase as it adapts to post-upgrade circumstances. The departure of validators and the movement of deposited capital indicate how the cryptocurrency market is changing and how investors are adjusting their strategies to take advantage of new possibilities and developments in the market.

Featured image from Freepik