XLM has a significant volatility as the investor sentiment weakens and has faced a shortcoming. Despite the attempt to recover, Altcoin is struggling to reclaim the best.

Market conditions continue to deteriorate, and investors are hesitant to enter the market, contributing to the continuous decline in prices.

Good investors are uncertain

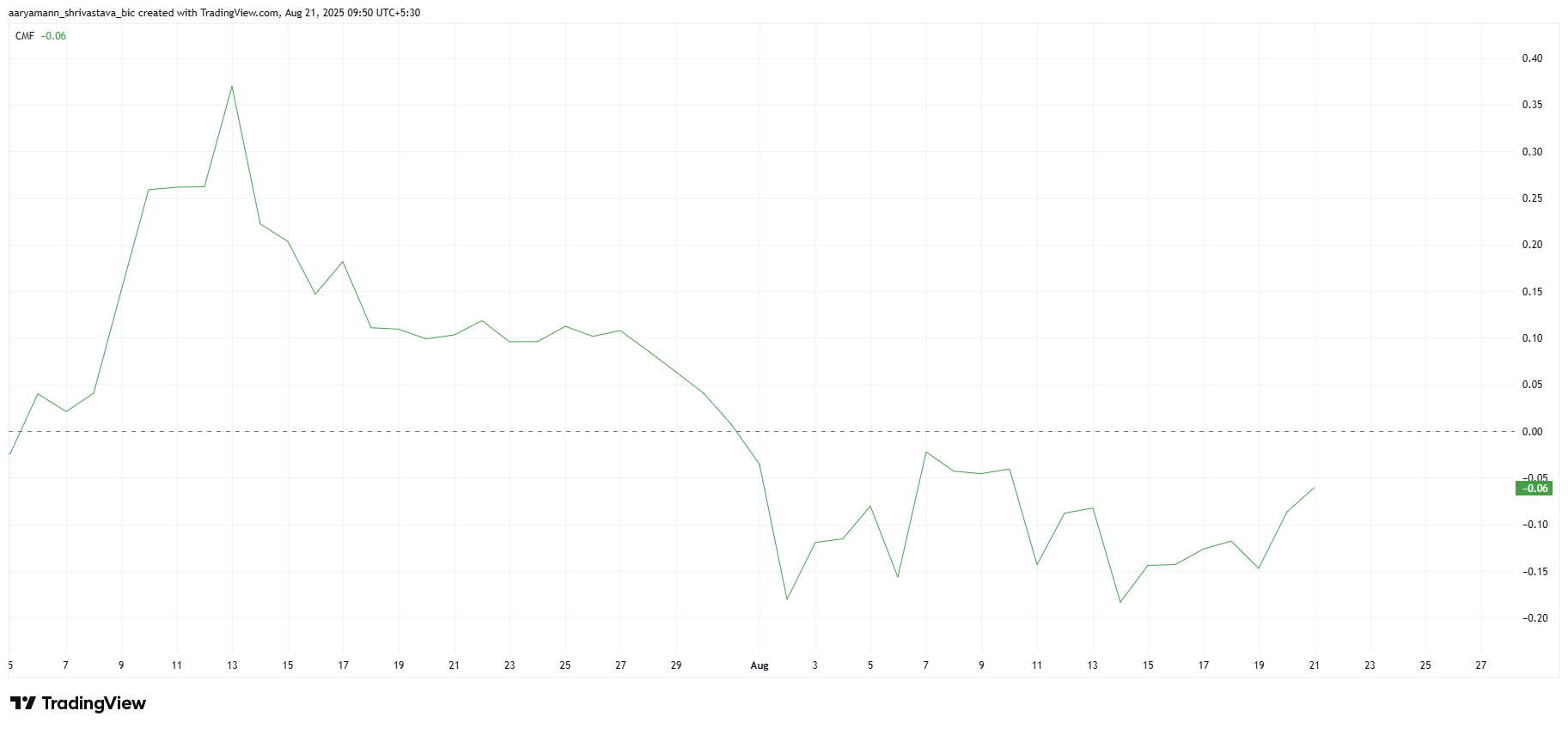

Chaikin Money Flow (CMF) is attached to the 0 line since the beginning of the month, indicating the strong leak of XLM. This indicates that the uncertainty of investors is interfering with new inflows into the assets.

As the CMF maintains a negative state, it reflects that there is a lack of trust in XLM’s short -term prospects. Investors seem to take out funds and cause continuous weakness in the market.

Do you want more token insights like this?Editor Harsh Notariya Daily Crypto Newsletterhere.

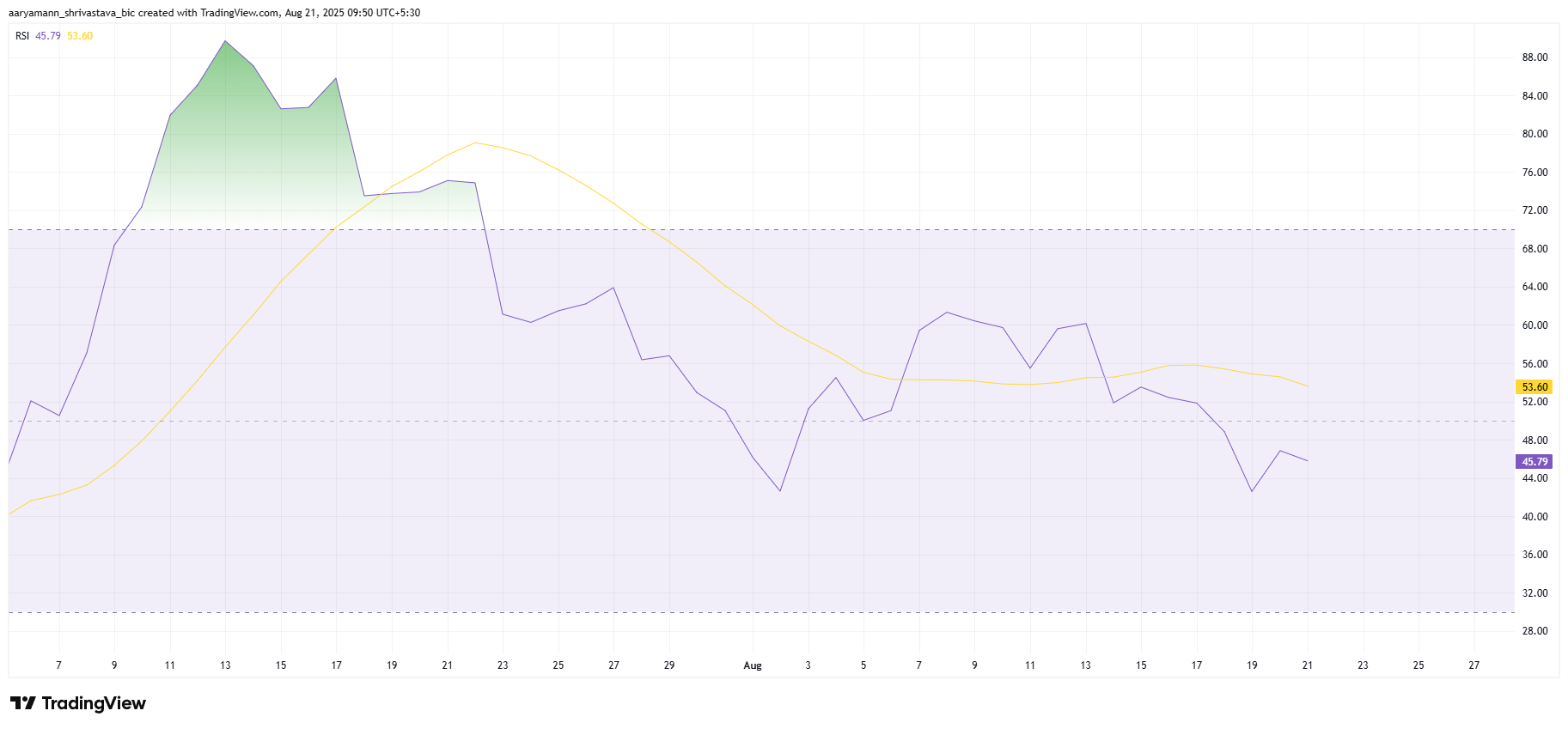

The relative strength index (RSI) of the XLM also slipped under the neutral line to strengthen its weak prospects. RSI is an important indicator of tracking the amount of exercise and market conditions, and the current location shows an increase in XLM’s weaknesses.

As the RSI trends, XLM’s extensive market environment is still undesirable. This is further supported by the concept that Altcoin is under much pressure and potential recovery seems to be far away for the time being.

XLM prices do not notice the decline

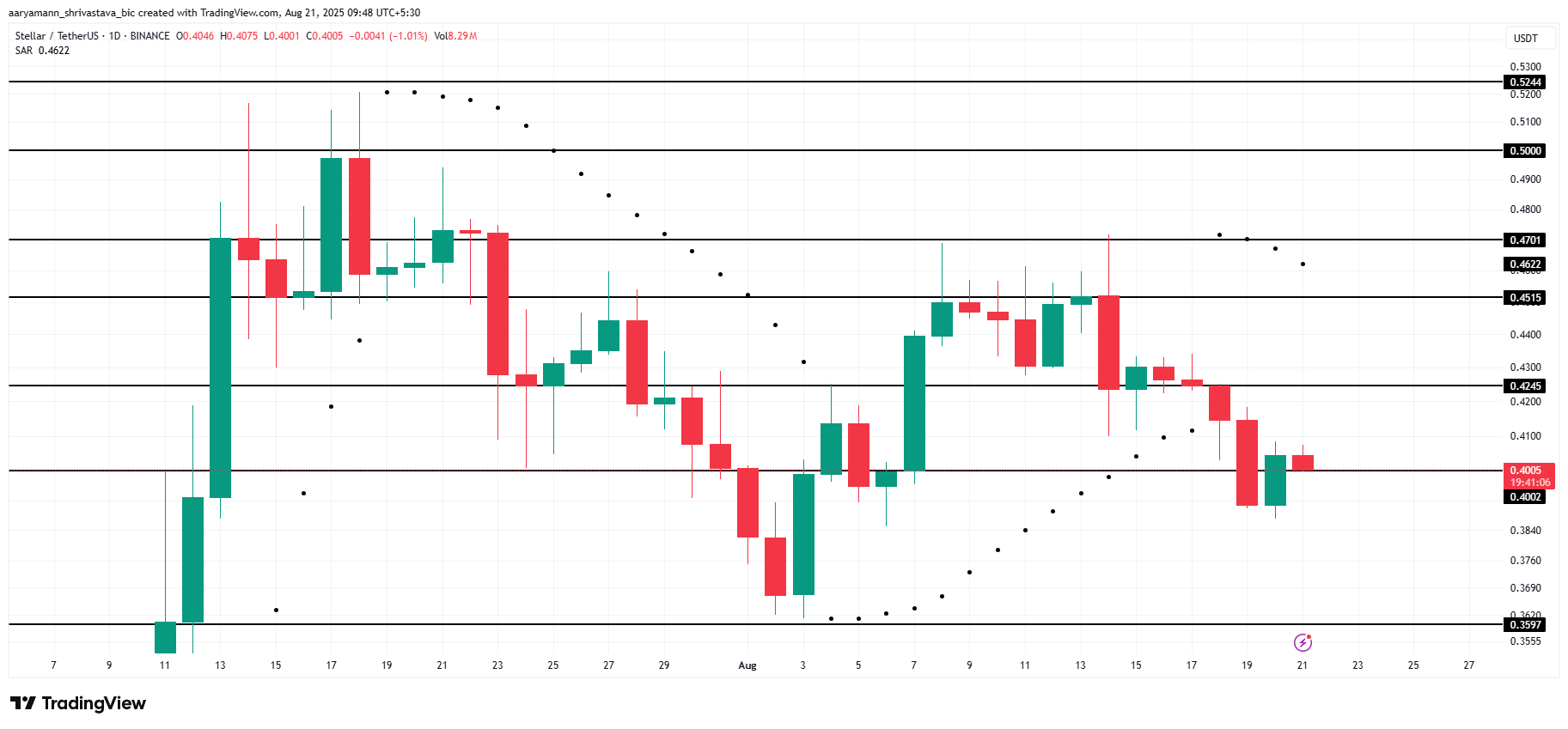

The price of XLM is currently $ 0.40 and we want to maintain this level. However, considering the current market conditions and the above indicators, there is little likely that XLM will recover in the short term. The parabolic SAR on the candlestick is difficult to check the ongoing decline, so it is difficult for Altcoin to reverse the trajectory.

The next important support for XLM is $ 0.35 and lasted a month ago. If the decline continues, the price may drop to this level, which can cause additional sales of investors. This can strengthen the weak market sentiment and extend the period of weak price behavior.

However, if the XLM bounces the level of $ 0.40, investors can change their emotions and return to the market to recover to $ 0.42 or $ 0.45. Successful rebounds will invalidate weaknesses.

Post Stella (XLM) prices face further downs, showing that the leaks did not appear for the first time in Beincrypto.