join us telegram A channel to stay up to date on breaking news coverage

The US Federal Reserve (Fed) is preparing to join the “payments revolution” and bring cryptocurrencies from the “periphery” of finance into the mainstream.

At the Federal Reserve’s Payments Innovation Conference in Washington on October 21, Governor Christopher Waller said the central bank would give stablecoin issuers and fintech companies access to its payments system through a proposed ‘skinny’ master account.

The move highlights a dramatic shift in the Fed’s approach to digital assets and decentralized finance. Waller said technologies such as stablecoins, tokenized assets and AI are “no longer on the periphery, but increasingly embedded in the fabric of payments and financial systems.”

“Payments innovation is advancing rapidly, and the Fed must keep up,” he said. “We intend to actively participate in that revolution.”

The Fed plans to be part of a “technology-driven” revolution in payments.

Speaking to a room full of industry leaders, including Chainlink CEO Sergey Nazarov, Coinbase CFO Alesia Haas, Circle Chairman Heath Tarbert and several Fed officials, Waller said the decentralized finance (DeFi) community is no longer “viewed with suspicion and disdain.” “I don’t,” he said.

Today, Governor Chris Waller showed incredible leadership on the idea of a “skinny” Fed account for payments use cases by eligible institutions.

This will provide many opportunities to advance the United States as a leader in payments and stablecoins. pic.twitter.com/QTIfYnRsfx

— Nathan McCauley ⚡ (@nathanmccauley) October 21, 2025

“Rather, I welcome you today to join us in a conversation about the future of payments in the United States and on our home soil, something that would have been unimaginable just a few years ago,” he said. “As you all know, we are immersed in a technology-driven payments revolution.”

Simplified Account Offering for Fed, Stablecoin, and Fintech Providers

Waller said he had instructed Federal Reserve officials to explore “accounts in payment” to provide more support “to those who are actively transforming the payment system.”

These accounts will be a lighter version of a master account and will be aimed at companies that do not necessarily need “the bells and whistles of a master account or access to the full range of Federal Reserve financial services.”

He said so-called ‘skinny’ payment accounts would be available to ‘legally qualified entities’ who must follow the central bank’s guidelines for assessing accounts and service requests.

Institutions receiving these accounts face certain operating restrictions designed to limit their exposure to the Federal Reserve balance sheet.

Additionally, the account does not earn interest on the deposited balance. They may also have mandatory balance limits to control their size.

He went on to say that the “skinny” master account would exclude discount window borrowing and certain Fed payment services where the central bank cannot adequately control overdraft risk.

“The idea is to tailor the servicing of these new accounts to the needs of these businesses and the risks they present to the Federal Reserve and the payments system,” Waller said in his speech.

“So what’s important is that the review timeline for these low-risk payment accounts is streamlined,” he added.

The Federal Reserve’s opening of the stablecoin sector comes just months after U.S. President Donald Trump signed the GENIUS Act into law in July.

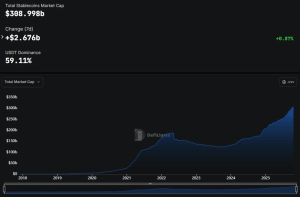

This is the first regulatory framework at the federal level to set requirements for stablecoin companies seeking to issue tokens in the United States. The stablecoin market capitalization exceeded $300 billion for the first time.

Stablecoin market capitalization (Source: Dipilama)

The new “skinny” master accounts could benefit Ripple, Kraken, Circle, and Custodia Bank.

The new “skinny” master account could speed up the approval process for cryptocurrency-based companies like Ripple, Kraken, and Custodia Bank, which are pursuing Fed master accounts through lengthy legal processes.

One of the reasons the process took so long was because traditional financial banks also rejected applications.

Ripple’s CEO addressed this backlash while speaking at DC Fintech Week earlier this month, calling banks “hypocritical” for saying the cryptocurrency sector should be held to the same standards without being given access to infrastructure like Fed master accounts.

It could also benefit other companies in the digital asset space seeking access to the Fed’s payments infrastructure.

One of them is USD Coin (USDC) issuer Circle, which has applied for a national bank/trust charter. This is often considered a prerequisite for full Fed account access.

Related articles:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage