Lighter (LIT) is a decentralized perpetual futures exchange built on Ethereum Layer 2. After distributing 25% of total supply through airdrop, investors expect LIT’s market capitalization to continue to rise.

Why do investors remain optimistic about Reiter’s potential, and what risks should they consider now? The following article examines these questions in detail.

boost

boost

Lighter rating surpasses Pump.fun and Jupiter.

Lighter previously raised $68 million at a $1.5 billion valuation. Shortly after launch, Coinbase listed LIT as the LIGHTER-USD trading pair. The current price is fluctuating around $2.7-$2.9, with a fully diluted valuation (FDV) of around $2.7 billion.

Following the airdrop, significant activity from whale investors was observed in the market. Lookonchain, an on-chain analytics account, reported that at least three whale wallets deposited 9.98 million USDC into Lighter to purchase LIT.

According to a BeInCrypto report, large buyers are absorbing LIT supply. This action helps maintain buying pressure and support the price. This suggests that some investors believe in the upside potential of LIT, especially in the early price discovery phase.

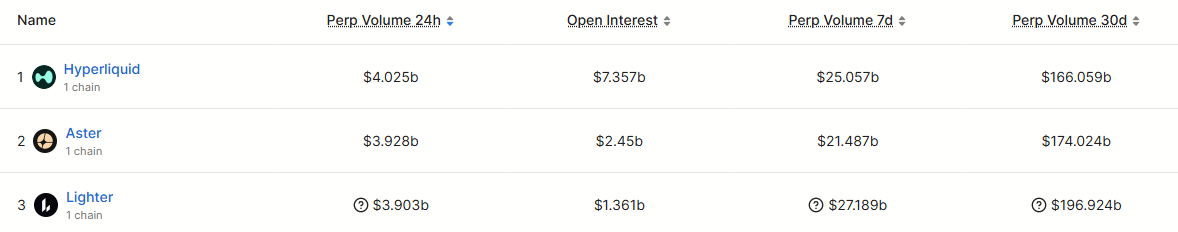

Despite being new, Lighter’s value has surpassed Pump.fun and Jupiter, according to data from CoinGecko. Lighter currently ranks 4th in the decentralized exchange (DEX) coin category, behind Hyperliquid, Aster, and Uniswap.

Investors believe Lighter’s FDV will not stop at $2.7 billion. They expect it could go much higher.

boost

boost

Investors expect the LIT (lightweight) valuation to match Aster or even Hyperliquid.

Several reasons support this belief.

firstIn terms of attention, the lighter stands out. Dexu AI reports that Lighter (LIT) currently has the highest profile among perpetual derivatives protocols.

After Jupiter and Hyperliquid, Lighter saw a significant increase in the number of ‘smart followers’. Lighter also has a strong Maxis community. It ranks third after Hyperliquid and Aster.

secondDespite its recent launch, Lighter has achieved comparable 24-hour trading volume to Aster. Its volume is very close to Hyperliquid. Lighter’s 7-day and 30-day volumes are significantly better than both competitors.

boost

boost

“Very fierce competition. Hyperliquid. Lighter. Aster. Only one will win…” said investor Alex.

As a result, investors believe that Lighter has the potential to reach a similar FDV (about $5.5 billion) as Aster. This scenario means that the price of LIT could double from its current level of $2.7.

Some investors even expect LIT to overtake HYPE. Hyperliquid’s FDV is approximately $25 billion. This means that LIT has increased by almost 10 times.

However, these comparisons rely heavily on sentiment based on hype. Some analysts strongly disagree.

boost

boost

What about the risks?

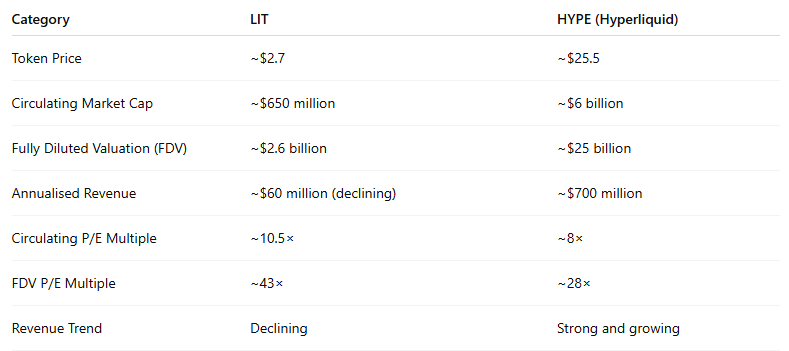

X user Henrik observed that Lighter has lost about 25% of its open interest over the past three weeks. He also compared the P/E ratios of the two projects. The comparison shows that LIT is trading at a higher valuation than HYPE despite its weaker fundamentals.

“Given this, LIT, despite its weak fundamentals, is currently more expensive than HYPE on both cyclical and fully diluted metrics. Additionally, while 100% of Hyperliquid’s profits will be used for redemptions, LIT’s revenue distribution and token value accrual are unclear. Fundamentally, there is no clear catalyst for LIT and the airdrop-related exodus is likely to persist for some time,” Henrik said.

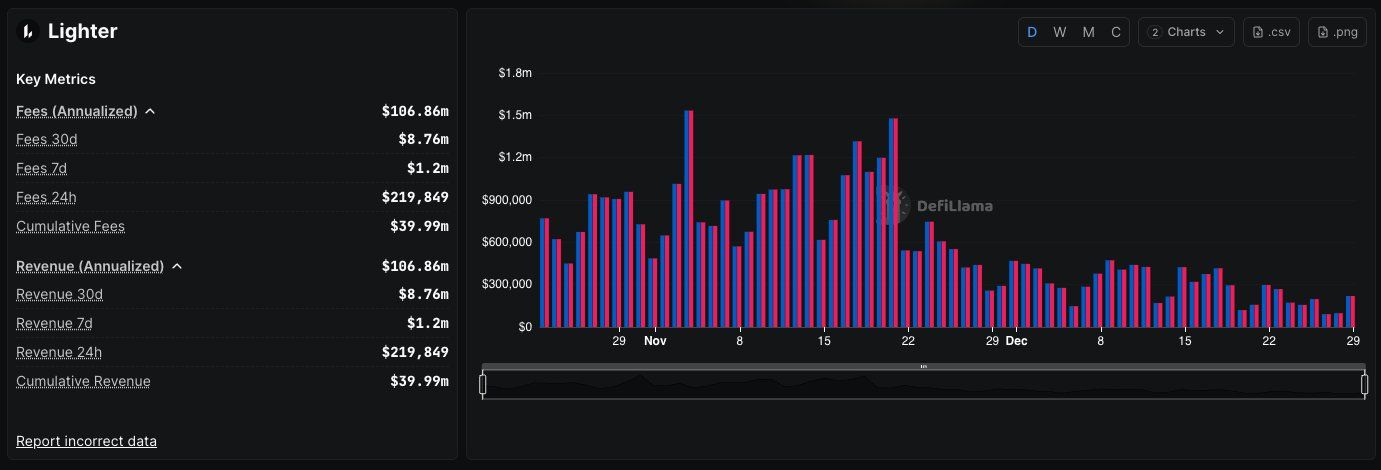

Additionally, concerns are growing due to declining returns following the Token Generation Event (TGE). Analyst TylerD observed that Lighter’s revenue decreased from $1.5 million per day on November 21 to $150,000 per day in December. This represents a 10-fold reduction.

Historical data shows that airdrop incentives often temporarily increase revenue by increasing transaction volume. But for long-term growth, Lighter needs to demonstrate a clear advantage over its competitors. Projects must also remain resilient in the face of broader market headwinds.