Year Finance beat Bitcoin in the race to claim back $20,000.

The protocol’s governance token YFI surged to $20,770 during the early trading session on Tuesday. The gains pushed the price up 178.42% from its early November low, confirming the start of a strong rebound following an 83% plunge.

Yearn Finance is trading almost 50 percent lower than its record high. Source: YFIUSD on TradingView.com

YFI’s resurgence rally follows the decision of cryptocurrency-based hedge fund PolyChain Capital to purchase nearly 2% of new YFI supply in two transactions. This comes even after Yearn Finance approved new improvement proposals following three days of voting.

YIP-54

According to Year Improvement Proposal 54 (YIP-54) listed on the official website, the upgrade will allow community members to audit costs related to hackathons, security audits, grants, bug bounties, and wages on a quarterly basis.

YIP-54 also allows a newly formed “operating fund” to “buy back YFI or other assets at its discretion.” This proposal is intended to assign more utility functions to YFI, making it an attractive investment as ETH on Ethereum. Angel investor Choi J. I left a comment.:

“(In my honest opinion) (YIP-54) 1) introduces real purchasing demand for the tokens, tying the value of the platform to the value of the tokens, and 2) skins in the game for contributors, who are part of the operating funds, now have native tokens. “It is provided.”

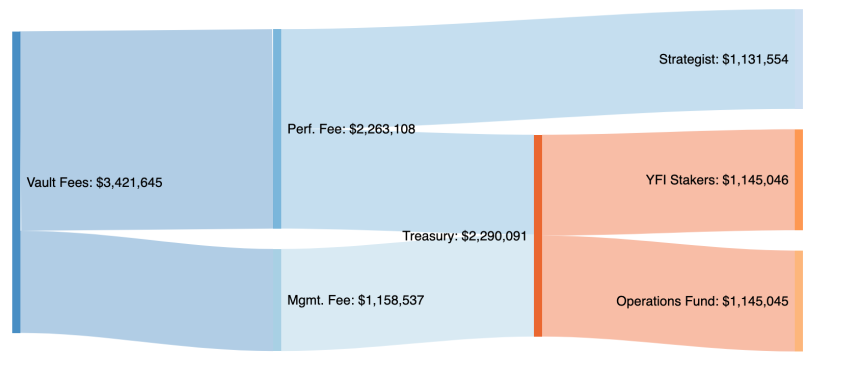

Yearn earned about $3.4 million in fees over the past four months.

Yearn Finance reward distribution plan. Source: Official Website

Governance also proposed launching a long-term vesting scheme for investors who wish to store their YFI tokens in the Yearn vault for a long period of time. This feature may be included in the next improvement proposal.

What’s next for YFI?

The prospect of more use cases combined with a long-term return strategy could increase investor preference for YFI. Meanwhile, about $1.1 billion of ETH could leave UniSwap liquidity pools and enter Yearn Finance vaults on Tuesday.

“It looks like most ETH being withdrawn is being converted to stablecoins, so we could see other protocols getting some love. $OVER, $GHOST, $CRV, $REN) as money moves,” said market analyst Jacob Canfield. “Look at TVL (Total Value Locked? Increase over next 48 hours).”

As many analysts agree, YFI’s technical commentary is showing bullish results so far.

$OVER It looks like this perfect ascending triangle is about to explode. ?⬆️? pic.twitter.com/2SWiXyvldb

— Alex Saunders ???? (@AlexSaundersAU) November 17, 2020

At press time, the YFI/USD exchange rate was $20,220.