Recent data from IntoTheBlock shows that Dogecoin’s network activity has decreased significantly over the past week, despite the cryptocurrency’s price rising sharply.

To assess whether these trends indicate bullish or bearish market sentiment, the analysis uses blockchain data and insights provided by IntoTheBlock, a valuable crypto tool specializing in extracting and analyzing data directly from blockchain networks.

Dogecoin’s Dilemma: Are You Facing a Price Correction, or Are You Ready for a 30% Gain?

The current state of Dogecoin (DOGE) on the daily chart shows a strong bullish trend. The cryptocurrency successfully broke past the golden ratio resistance near $0.082 to hit a new high. This achievement effectively concludes the previous revision phase. Dogecoin is now facing the next important Fibonacci resistance level at around $0.093.

If Dogecoin breaks this resistance, the price is likely to rise another 30%, targeting the golden ratio level of around $0.12. Supporting this bullish outlook, the Moving Average Convergence Divergence (MACD) histogram is trending upward and the MACD line is at a bullish crossover.

Exponential moving averages (EMAs) also indicate golden crossovers, reinforcing bullish trends in the short and medium term. However, the Relative Strength Index (RSI) is indicating a bearish divergence, which may lead to corrective price action in the near term.

If a price correction in DOGE occurs, the next important Fibonacci support levels are expected to be around $0.078 and $0.07, respectively.

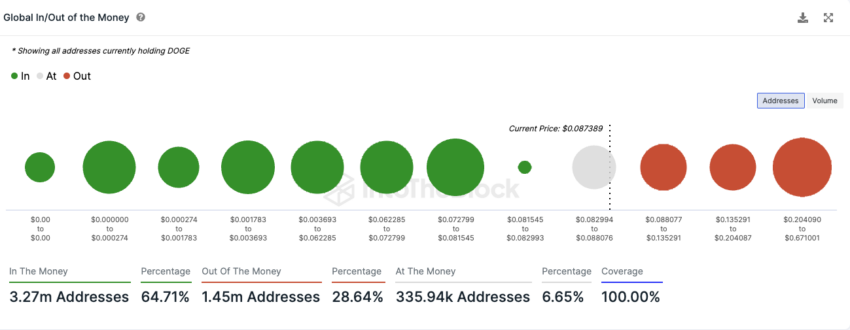

More than 60% of Dogecoin addresses are profitable: positive trend

Currently, approximately 65% of Dogecoin (DOGE) wallet addresses are in a profitable position, meaning they are in the ‘green zone’. Conversely, approximately 29% of these addresses have experienced losses, placing them in the ‘red zone’.

Additionally, nearly 6.7% of DOGE holders are at breakeven, meaning that selling DOGE tokens at the current market price will result in no profit or loss.

This distribution of profits and losses among DOGE holders reflects the cryptocurrency’s recent market performance and price movements.

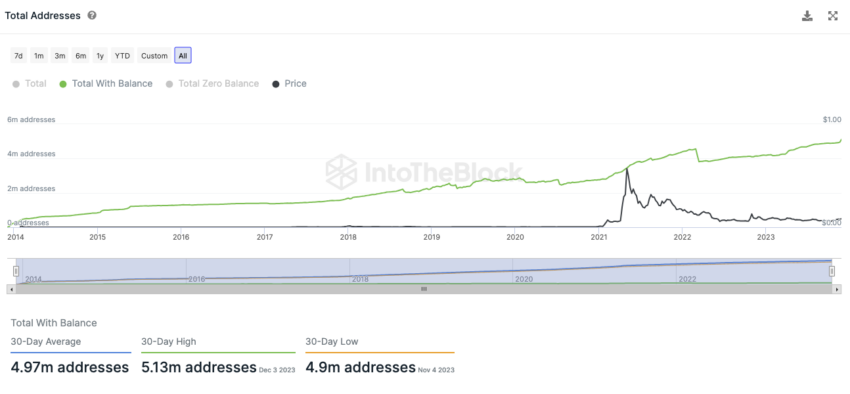

Expansion Beyond the Horizon: Dogecoin Network Experiences Growth

The Dogecoin network is showing signs of growth. The average number of addresses holding Dogecoin (DOGE) balances over the past 30 days was approximately 4.97 Million. At some point during this period, the number of addresses reached approximately 5.13 million.

This data represents an increase of approximately 50,000 addresses since the last analysis. This increase in the number of addresses with DOGE balances reflects positive dynamics within the Dogecoin community and network, suggesting a broadening user base and growing interest in Dogecoin.

The Dogecoin network has seen a sharp decline in activity over the past week

The Dogecoin network has seen a significant decrease in activity over the past week. This downturn is evidenced by a more than 51% decline in the number of active DOGE addresses. This sharp decline indicates a noticeable decline in transactions or movements involving Dogecoin.

Additionally, the creation of new DOGE addresses decreased by approximately 67% during this period. This significant decline suggests that the influx of new participants or investors into the Dogecoin market has slowed.

Additionally, the number of addresses with no DOGE balance decreased by approximately 16%. This decrease may indicate that the movement of a dormant or inactive address is being activated or closed.

Overall, these statistics indicate a significant decline in participation and interest in the Dogecoin network over the past week, indicating a phase of reduced activity and engagement within the Dogecoin ecosystem.

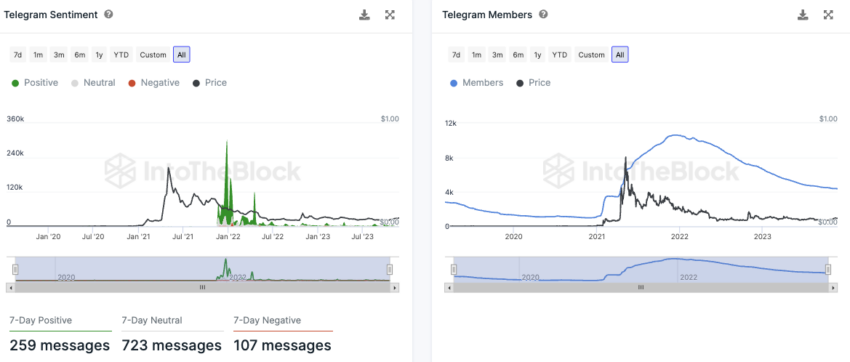

Dogecoin sentiment on Telegram: mainly positive vibes

The sentiment surrounding Dogecoin on Telegram channels appears to be primarily positive, as evidenced by the number of news articles. There were nearly 259 positive news articles about Dogecoin. This is more than double the number of negative news stories, which numbered approximately 107.

Read more: Best airdrops of 2023

These differences suggest a generally favorable perception or acceptance of Dogecoin within the Telegram community or among users discussing the cryptocurrency on the platform.

However, despite these positive news reports, the Dogecoin Telegram group has seen a noticeable decline in membership since late 2021. This decline in group membership may indicate waning interest or engagement among the community, regardless of a positive news story.

It may also reflect broader trends in the cryptocurrency market or changes in the way people gather information and discuss digital currencies.

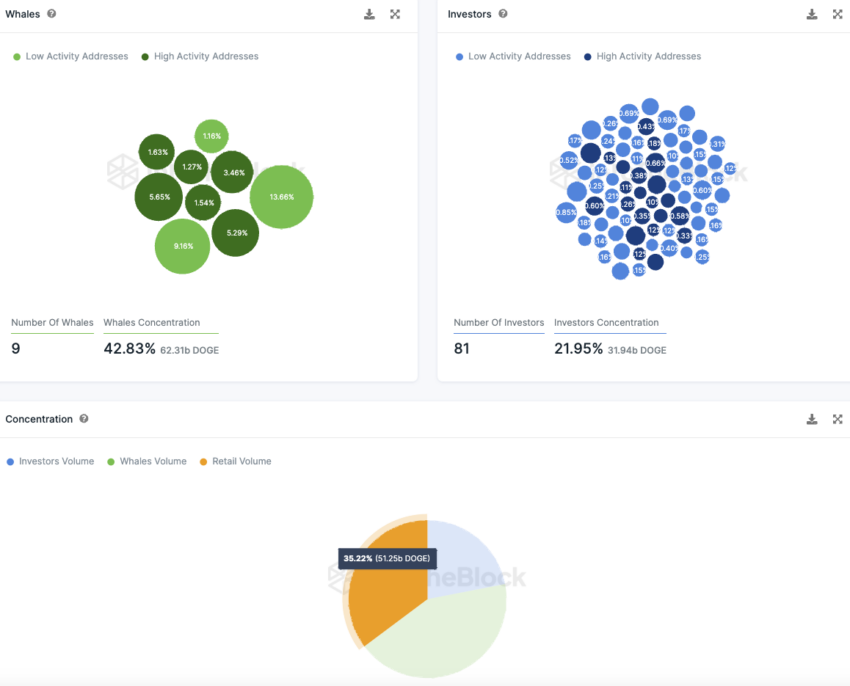

Retail investors hold more than one-third of Dogecoin supply

Dogecoin’s ownership distribution shows significant concentration among large investors and whales. Specifically, there are approximately 81 large investors, each owning between 0.1% and 1% of all Dogecoin tokens.

Collectively, these investors hold approximately 22% of the total Dogecoin supply. This indicates that a significant portion of cryptocurrency is in the hands of a relatively small group.

There are also 9 whale addresses on the Dogecoin network. These whales are particularly notable because they each own at least 1% of the total Dogecoin supply. It accounts for approximately 43% of the total.

This concentration of ownership in whale addresses highlights a key aspect of Dogecoin’s ownership structure. When a small number of companies control a significant portion of the total supply.

The remaining stake in Dogecoin, approximately 35.22%, is held by small investors. These are addresses that each hold less than 0.1% of Dogecoin tokens and are classified as retail investors.

This segment represents the broad base of individuals or small holders within the Dogecoin ecosystem.

Read more: 9 Best AI Cryptocurrency Trading Bots to Maximize Your Profits

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions.