Cryptocurrency Investor Ryan Sean Adams assert As of December 4, Ethereum (ETH)’s current value of around $2,200 is said to be almost “interesting” considering the intensified on-chain activity and blockchain’s role in that space.

Venture Capitalist: Here’s Why Ethereum Is Vastly Undervalued

Adams cited data such as the first smart contract platform generating billions of dollars in annual “gas” fees and turning into deflation after the merger in September 2021. million validators By staking, you can receive rewards of 5% or more. Moreover, the venture capitalist pointed to the possibility of the U.S. Securities and Exchange Commission (SEC) approving a spot Ethereum ETF in the long term.

Currently, the world’s most famous traditional financial companies, BlackRock and Fidelity, have applied to issue these derivatives. The SEC has not yet approved a spot crypto ETF, but is expected to approve one or several in early Q1 2024.

Overall, the cryptocurrency market expects all spot ETFs, including Ethereum, to attract billions of dollars in institutional capital. In addition to external factors such as the SEC and ETFs, Adams pointed out that demand for mainnet block space is increasing due to multiple layer 2 solutions running off-chain rollups in parallel with Ethereum.

ETH value is created from on-chain activity.

According to L2Beat, Ethereum layer 2 solutions hold over $14.9 billion in total value locked (TVL), managing billions of dollars and processing tens of thousands of transactions every day, with the most popular platforms including Arbitrum One, OP Mainnet, Starknet, and Base. Last week, Adams observed that major layer 2 rollups were the top 10 consumers of Ethereum block space.

Adams suggested that Ethereum’s rise this cycle is almost mathematically inevitable, comparing Ethereum using traditional metrics such as its price-to-earnings (P/E) ratio, which compares favorably against tech companies like Amazon and Zoom.

Based on the above factors, the venture capitalist believes that Ethereum could multiply tenfold, rising to over $22,000 per coin. Still, investors can’t accurately gauge how long the market will “remain irrational” and significantly undervalue the second-most valuable coin.

In response, Uniswap founder Hayden Adams agreed that Ethereum fundamentals will lead to appreciation. Still, the founder think As Ryan Sean Adams explains, Ethereum does not get its strength from its speculative properties. Uniswap founders are confident that demand from active protocols launching on the mainnet and competing for scarce block space will directly push prices higher.

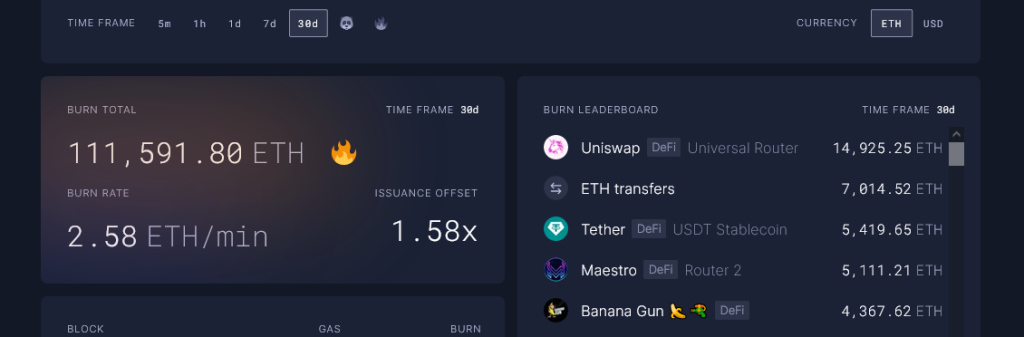

According to Ultra Sound Money, Uniswap helps Ethereum burn the most coins. In the past month alone, Uniswap has taken more than 14,900 ETH out of circulation, helping to further deflate the network.

Featured image from Canva, chart from TradingView