Bitcoin continues its upward trend for eight consecutive weeks. While this shows the bulls are firmly in control, it also suggests that the rally may become overextended in the near term. This may be one of the reasons why Bitcoin and altcoins plummeted on December 11th. The drop led to the liquidation of more than $500 million in cryptocurrencies.

Although leveraged traders get lost in sharp downturns, this does not necessarily mean a change in trend. A correction in an uptrend is considered a healthy signal because it reduces excessive speculation and shakes off weakness. It also provides an opportunity for long-term investors to add to their positions at lower levels.

However, in the short term, institutional investors appear to be becoming cautious after Bitcoin’s relentless rally over the past eight weeks. Inflows into digital investment products slowed to $43 million last week, according to the CoinShares Digital Asset Fund Flows Weekly Report released on December 11. In particular, the inflow of short positions increased, suggesting that investors were expecting a short-term adjustment.

The decline is unlikely to deepen as investors remain positive about Bitcoin’s prospects in 2024. Asset manager VanEck has created 15 cryptocurrencies. prediction Including price forecasts indicate that a bullish phase is just around the corner in 2024. The company expects $2.4 billion to flow into its Bitcoin exchange-traded fund in the first quarter of 2024. We also expect Bitcoin to hit a new all-time high in the fourth quarter of 2024.

This work is not limited to Bitcoin. Several altcoins are starting to break out of long-term downtrends, indicating a potential trend change. Many analysts believe it is time for altcoins to shine again after Bitcoin’s meteoric rise.

Will Bitcoin and major altcoins find buying support at lower levels, or will the correction deepen? Let’s study the chart to find out.

BTC/USD market analysis

Bitcoin surged above the rising wedge pattern on December 2, invalidating the bearish setup. Failure to set up a negative is a positive sign in terms of attracting buyers. This began a rapid rally, reaching $45,000 on December 5th.

After a tight consolidation near its 52-week high, the BTC/USD pair broke on December 11, indicating that traders are rushing for the exits. This brought the price down to the 20-day simple moving average (SMA).

In an uptrend, traders typically buy dips in the 20-day SMA. Therefore, it is an important level to continue to monitor. If the price rises from current levels, the bulls will again attempt to clear the $45,000 overhead hurdle. That could allow the pair to surge to $48,000 and then to the psychological level of $50,000.

However, negative divergence in the Relative Strength Index (RSI) suggests that the bullish momentum is slowing. This is a sign that the currency pair may be spending some time in a range or may witness a deeper correction in the near future.

Selling momentum may strengthen if the price falls below the 20-day SMA. This could open the door for a decline in the 50-day SMA. This level is likely to witness solid buying by the bulls again.

ETH/USD market analysis

We expected Ethereum to maintain a range between $2,142 and $1,520, but the bulls had other plans. They pushed the price above $2,142 on December 2nd, signaling the start of a new upward trend.

Typically, after breaking out of significant resistance, the price falls and retests the level. The ETH/USD pair fell from $2,403 on December 9 to $2,142 on December 11.

The $2,142 level is likely to witness a tough fight between bulls and bears. If the price bounces from this level, it means buyers have turned $2,142 into support. That would increase the likelihood of a rally to $2,516 and then $2,950.

Conversely, if the price falls below $2,142, several aggressive bulls will be trapped. This could first pull the pair down to its 50-day SMA and later to $1,900.

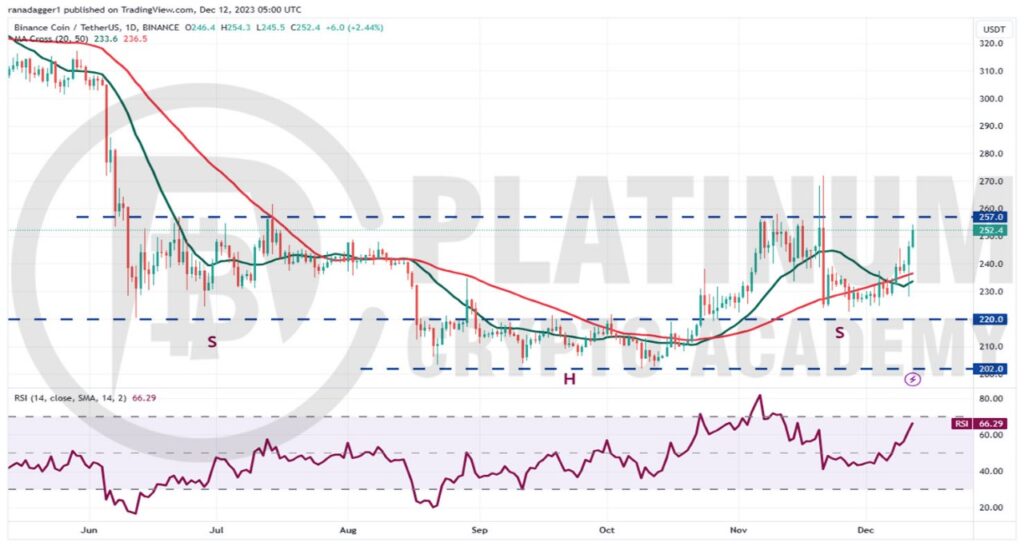

BNB/USD market analysis

Binance Coin has maintained a range between $220 and $257 over the past few days. Bears tried to drive the price below $220, but bulls held on, indicating solid demand at lower levels.

The BNB/USD pair gained momentum on December 8 after bulls pushed the price above the moving average. The price has reached the indirect resistance of $257, which is an important level for bears to defend.

If the seller fails in his effort, the pair will complete an inverted head-shoulders pattern. This bullish setup signals the start of a new uptrend and has a target price of $312.

Instead, if the price drops sharply from $257, it would be a sign that the bears are actively defending the level. The pair can then extend their stay within the range for a few more days.

XRP/USD market analysis

Bulls attempted to initiate a rally in XRP, but bears successfully defended the descending trendline on December 9th. This suggests that bears are still active at higher levels.

Sellers try to push the price below the moving average to further strengthen their positions. If they do so, the XRP/USD pair could fall into the $0.58 to $0.56 support area.

The bulls are expected to defend this area to the best of their ability. Failure to do so may result in accelerated selling. The pair could then plummet to strong support at $0.45.

For bulls to bounce, they need to get the price above the downtrend line quickly. This could pave the way for a rise to $0.75 and then $0.85.

ADA/USD market analysis

Cardano gained momentum after breaking above $0.46 overhead resistance on December 8. The ADA/USD pair quickly moved all the way to $0.65 on December 9, sending a FOMO signal among traders.

The uptrend over the past few days has pushed the RSI deep into overbought territory, suggesting that the rally has overheated in the near term. This usually leads to modifications or consolidation.

Failure to hold the price above $0.60 may have led short-term traders to take profits on December 11th. However, as seen in the long tail of the candlesticks on the day, it is a positive sign that the bulls bought the bears near $0.50.

After a sharp rally over the past few days, the currency pair may enter a consolidation phase. The currency pair may fluctuate between $0.50 and $0.65 for some time.

The uptrend could resume if the bulls push the price above $0.65. The pair could then soar to the next target of $0.79.

Hopefully, you enjoyed reading today’s article. Check out our cryptocurrencies. blog page. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.