Bitcoin is recovering some of its gains over the past few days. The number one cryptocurrency by market capitalization could be on the verge of a bigger retracement, which could push it back into the $30,000 area.

As of this writing, Bitcoin (BTC) is trading at $40,950, having lost 2% in the last 24 hours. On the weekly chart, the cryptocurrency is recording a 3% loss, and with the exception of Avalanche (AVAX), the top 10 tokens by market are all posting similar performances.

Has Bitcoin hit a regional high? Bull Run slows down.

Bitcoin over the weekend rejected Critical resistance level at $43,500. According to a pseudonymous analyst, a “significant resistance block” has been placed by major players once the BTC price falls to current levels.

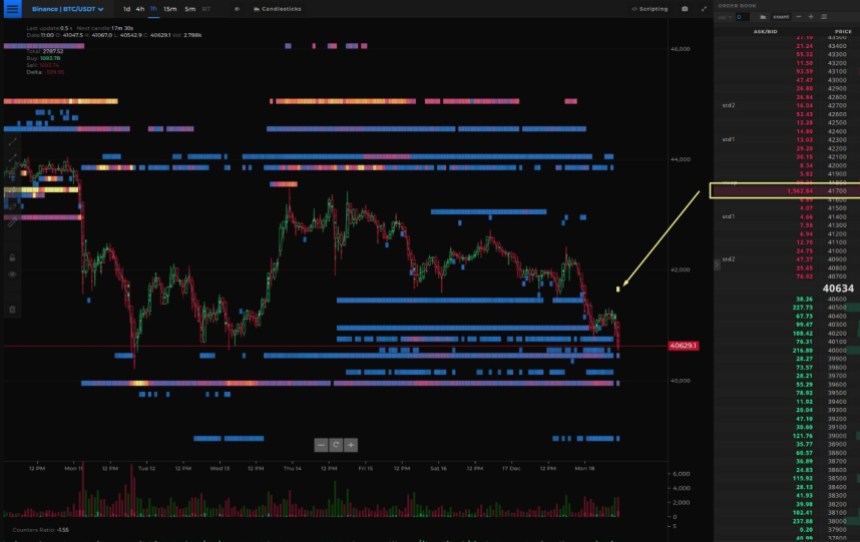

The chart below shows that the sell order is 1,562 BTC, or approximately $7 million. It also shows strong support for BTC as the bullish momentum disappears.

That said, Bitcoin may be slowing down, but the area around $40,000 could provide important support for a potential rebound. The analyst had this to say about the increase in sales orders appearing on the books:

BTC Binance Spot Adds Massive Resistance This is what the tower looks like. A significant resistance block of 1562 BTC has just arrived on the order book.

BTC whales on the move

While many believe the market can absorb the surge in selling pressure, cryptocurrency analytics firm Material Indicators showed Bitcoin is losing support from major players. Over the weekend, players selling orders worth $1 million or more “sold” their positions.

The company has been warning traders about this possibility by claiming that the recent bullish price action is a strategy to siphon liquidity from retail investors. Once these small players jumped in, the whales began “distributing” or selling their coins to the congregation.

In that sense, the company has set the potential local high price for BTC at $45,000. Keith Alan, one of Material Indicators’ senior analysts, said: decided For current price action:

The good news is that at some point, the market turns to accumulation and prices can get to that point. It’s bad to look for bulls right now, but I don’t expect a straight line to go down. Time to be patient and see how things unfold from here.

Cover image by Unsplash, chart by Tradingview

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.