According to Fox Business’s Charles Gasparino, financial firms are confident that the Securities and Exchange Commission (SEC) will rule in favor of approving a spot Bitcoin exchange-traded fund (ETF) after January 8, 2024.

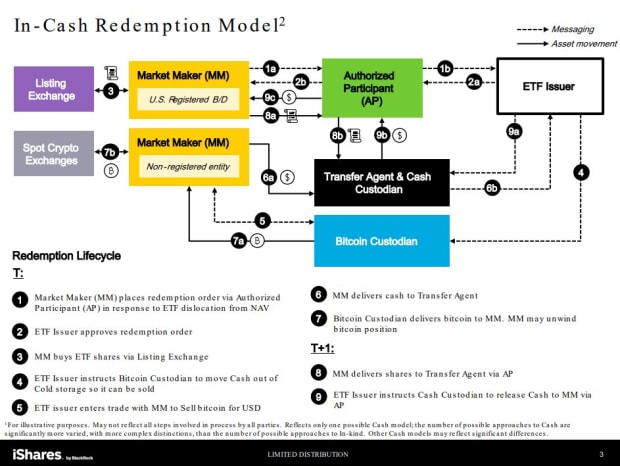

Gasparino’s post states that Bitcoin ETF shares can only be purchased with cash, not Bitcoin. Regulators said they were “concerned that ETFs are being used as a means of money laundering.” Over the past few weeks, spot Bitcoin ETF issuers like BlackRock have been meeting with the SEC to discuss the final details of their ETFs. There was one topic in particular when regulators were meeting with issuers: in-kind versus cash generation for ETF shares.

Bloomberg senior ETF analyst Eric Balchunas commented on the news, saying, “The SEC was worried about money laundering through spot creation of physical Bitcoin ETFs, which is why they are so into cash creation alone (which is a much more closed system) )..”

Earlier this week, BlackRock and other ETF issuers filed to comply with SEC regulations and allow ETFs to be issued in cash. To be clear, the ETF will hold physical Bitcoin, but the process of purchasing shares of the ETF will be done in cash. This means that investors provide cash to their preferred ETF issuer and then purchase physical Bitcoin to hold in the ETF. .

“BlackRock has gone cash-only. That’s basically settled. The debate is over. Spot will have to wait,” Balchunas said Monday.

If the SEC approves these proposed Bitcoin ETFs, it would be an important milestone in legalizing and integrating Bitcoin into traditional investment portfolios. This move also signals a shift in regulatory sentiment towards greater acceptance and regulation of Bitcoin.

Although the SEC has not issued an official statement regarding the purported discussions, Gasparino’s post has sparked interest and optimism within the financial industry, with stakeholders eagerly anticipating potential approval around January 8.