A new chapter in the Ethereum story

Hello everyone, my name is Louise, a DeFi cryptocurrency trader at Platinum Crypto Academy. Today I’m excited to explore the latest development in the cryptocurrency world: the launch of Blast, Ethereum’s new layer 2 network. As a cryptocurrency enthusiast who has been a part of this dynamic industry for many years, I have been eagerly tracking all the twists and turns of this groundbreaking platform. This is not just another update in the blockchain space. This is a pivotal moment that could redefine the future of Ethereum.

When I first heard about the launch of Blast and its impressive $55 million in revenue in a matter of hours, I knew we were witnessing a historic moment in blockchain technology. This level of financial support, and the resulting locking of over $535 million in user funds, is a clear indicator of the cryptocurrency community’s readiness for more scalable, efficient, and cost-effective blockchain solutions. As a trader, I understand the importance of these numbers. This represents our collective expectations for a more efficient blockchain ecosystem.

Why Blast stands out to investors

- High user engagement and trust: The fact that Blast secured more than $535 million in user funding shortly after launch is a strong indicator of market trust and interest. This level of engagement suggests a strong user base and potential for long-term growth, key factors I consider when evaluating investment opportunities.

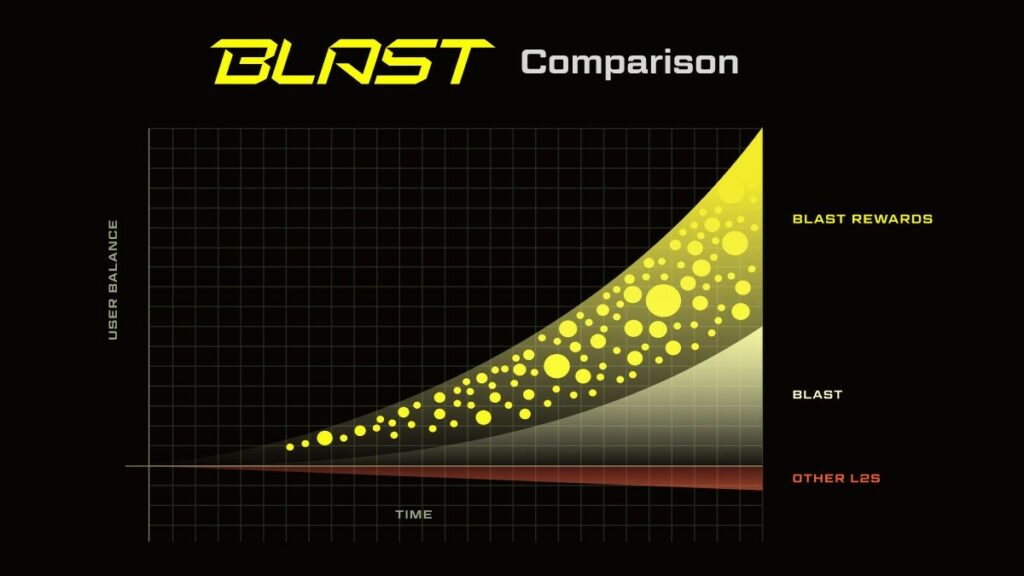

- Innovative yield model: In particular, Blast’s default return model is attractive, offering significant returns on Ethereum and stablecoins. This feature not only enhances the usability of the platform, but also makes a strong case for both short-term gains and long-term investment potential.

- Solving the limitations of Ethereum: Blast is positioned to play a significant role in the future of blockchain technology by solving the scalability, speed, and cost issues of Ethereum Layer 1. Platforms that solve real-world problems tend to maintain market traction, making them attractive for strategic investments.

Blast Investment Opportunity

As someone who is deeply involved in the DeFi space, I am always looking for promising investment opportunities and Blast has definitely piqued my interest. Here’s why:

High user engagement and trust: The rapid freezing of over $535 million in user funds on Blast is a strong indicator of market confidence and interest. This level of engagement suggests a strong user base and potential for long-term growth, key factors I consider in all investment opportunities.

Innovative yield model: In particular, Blast’s default return model is attractive, offering significant returns on Ethereum and stablecoins. This feature not only enhances the usability of the platform, but also makes a strong case for both short-term gains and long-term investment potential.

Addressing Ethereum’s limitations: Blast is positioned to play a significant role in the future of blockchain technology by solving the scalability, speed, and cost challenges of Ethereum layer 1. Platforms that solve real-world problems tend to maintain market traction, making them attractive for strategic investments.

However, as with any new blockchain technology, investing in Blast comes with risks and rewards. The controversy surrounding the withdrawal policy and the mixed reactions from the cryptocurrency community are factors that require careful consideration. As a cryptocurrency expert, I believe these discussions are essential to the evolution of the network and the broader blockchain industry.

Dive deeper into calculated investment strategies

As a seasoned DeFi trader at Platinum Crypto Academy, my approach to investing in new technologies like Blast’s layer 2 network has always been methodical and informed. Below is an expanded look at how to explore such investment opportunities.

- In-depth analysis of development progress: I make it a priority to stay updated on Blast’s development milestones. This includes tracking technical updates, new features or services being added, and how these developments align with the initial roadmap. To assess the likelihood of long-term success, it is important to understand the pace and direction of progress.

- Monitor user adoption and community sentiment: User adoption rate is a key indicator of a platform’s viability. I research user demographics, growth trends, and how the platform is received by the wider cryptocurrency community. We also pay close attention to community forums, social media discussions, and feedback from early adopters to gauge overall sentiment and satisfaction.

- Addressing current controversies and governance issues: The controversy surrounding Blast, especially the controversy surrounding the withdrawal policy, is a matter of considerable concern. I’m watching closely how the Blast team addresses these issues, communicates with users, and implements any necessary changes. Resolving these issues and transparency of the governance process are important factors in assessing the trustworthiness and stability of the network.

- Understand broader market trends: The cryptocurrency market is influenced by various factors such as regulatory changes, technological developments, and changes in investment sentiment. I analyze how these broader market trends could impact Blast, especially considering its position as a layer 2 solution for Ethereum. This includes keeping an eye on the overall health of the DeFi market, regulatory news, and technological trends in blockchain and cryptocurrencies.

- Risk Assessment and Diversification: Investing in new blockchain technology carries inherent risks. I conduct a thorough risk assessment of Blast, taking into account factors such as market volatility, technical risks, and competition. Based on this assessment, we develop a diversification strategy to mitigate potential risks. This may involve spreading your investments across different assets or sectors within the cryptocurrency space.

- Long-term vision and short-term profits: Blast offers opportunities for short-term profits, especially through its innovative return model, but also considers long-term potential. This includes assessing sustainability, potential for widespread adoption, and how it can evolve in the ever-changing blockchain technology landscape.

- Active participation and continuous learning: Lastly, as with any investment, it is important to remain actively engaged and continually educated about the latest developments in Blast and the wider DeFi ecosystem. This includes participating in community discussions, attending webinars or conferences related to Ethereum and Layer 2 solutions, and constantly updating your knowledge base.

Do explosive skeptics raise doubts about proprietary smart contracts?

The security integrity of Blast smart contracts has been a major point of contention. The key to skepticism lies in the control and access mechanisms governing deposited funds. Smart contracts written by Pacman are perceived as potentially risky due to their centralized access to all deposited funds.

The crux of the problem is that transferring ownership of the contract to the multi-signature Gnosis Safe requires the consent of three out of five signatories to the transaction. Despite the widespread use of these agreements for trust and flexibility in Web3 projects, for Blast the anonymity and novelty of the signer wallet raised red flags. Ambiguity in the identity of the person who can change the terms of a smart contract is considered a serious vulnerability.

Jarrod Watts, a developer at Polygon, echoed these concerns, highlighting the need to rely on unfamiliar multi-signature groups to modify contracts or recover funds. He considers it an unstable setup. Watts does not explicitly predict misappropriation of funds, but despite acknowledging the innovative aspects of the L2 yield generation concept, he points to governance and transparency issues that cloud Blast’s future prospects.

conclusion

My investment in Blast is a mix of strategic decision-making and personal belief in the transformative power of blockchain technology. As a DeFi trader, I approach Blast with a dynamic strategy, balancing the excitement of being part of groundbreaking technology with the pragmatism required in the volatile world of cryptocurrency investing. To me, Blast represents not only a potential financial gain, but also a step toward a more efficient and scalable blockchain future.

I hope you enjoyed today too article. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.