Before Michael Saylor fell Bitcoin maximalism, the phrase “there is no second best” now immortalized as a meme, has been a staple of the cryptocurrency space. So “cryptocurrency” itself has become a worthless epithet to describe the weight and importance of Bitcoin.

To a Bitcoin maximalist, a Bitcoin is a Bitcoin and a cryptocurrency is an altcoin unless it is a shitcoin. Now that Bitcoin is headed toward a bull market, fueled by the fourth halving hype and the approval of a Bitcoin ETF, Saylor’s MicroStrategy is already over $1.2 billion in unrealized profits territory.

Bitcoin meme creators wasted no time visualizing the results of their Bitcoin maximization strategies.

With these results in hand, it is time to take a closer look at Bitcoin’s maximization. Is the simple holding of BTC tokens more sophisticated than all the altcoin derivatives trading in the world?

Core Beliefs of Bitcoin Maximalism

In essence, Bitcoin maximalism is an extension of first-mover advantage. Satoshi Nakamoto, who launched the Bitcoin mainnet in January 2009, began an innovative proof of concept. Is it possible to build a peer-to-peer currency in a secure way?

Can blockchain-based wealth transfer and storage be resistant to network manipulation? Satoshi achieved this through a clever combination of cryptography and economic incentives. At its foundation is Bitcoin’s proof-of-work algorithm. This forces network participants (miners) to use computational resources when adding new blocks of transaction data.

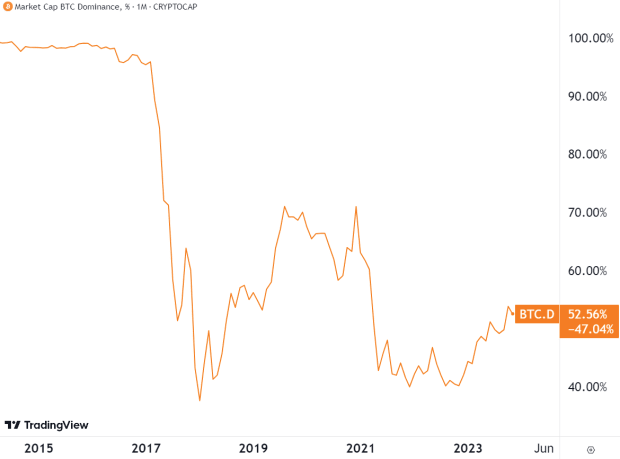

In return, miners are rewarded with up to 21 million BTC tokens. And because the state of the ledger must be agreed upon by all miners, there is no single point of failure that can be exploited. It wasn’t until February 2017 that this groundbreaking concept began to shake up altcoins, weakening Bitcoin’s market capitalization dominance.

The cryptocurrency landscape has diversified with the rise of ICOs (initial coin offerings) over the past eight years to make people more familiar with the new concept. One of the beneficiaries of this wave, Ethereum co-founder Vitalik Buterin, equated Bitcoin’s maximalism with the maximalism of Bitcoin’s dominance.

“The position is that building something on top of Bitcoin is the only right way to do things, and doing anything else is unethical.”

From this perspective, the evolution and consolidation of Bitcoin maximalism is predictable.

- The benefits of being a first mover lead to the legitimization of blockchain-based wealth.

- In this process, Bitcoin market capitalization becomes dominant.

- Bitcoin market capitalization dominance leads to a more secure network.

- As peer-to-peer currency networks become more secure, public trust increases.

- As public trust increases, mass adoption increases.

- Greater mass adoption will drive the BTC price higher, reinforcing all of the previous steps.

It’s easy to see then how a flood of altcoins could disrupt these stepping stones. Indeed, the ICO craze of 2017 confirmed the idea that Bitcoin maximalism is righteous.

That said, Satis Group conducted a study that found that 78% of ICO projects are scams. They were nothing more than liquidity scams using project objectives as bait. Failed ICOs were 4% and dead ICOs were 3%.

But this discovery was minor compared to the catastrophic peak of cryptocurrency failures in 2022. Starting from Terra (LUNA), Chelsea, and Three Arrows Capital (3AC) to FTX, BlockFi, and more, cryptocurrency enthusiasts have taken a hit of at least $60 billion.

Not only are altcoins suspect, but entire corporate buildings connected to blockchain networks have also become suspect. As a result, these blows influenced each other, lowering the price of Bitcoin to its last price of $16.5,000 in November 2020.

As public trust in “cryptocurrencies” has been shaken and the entire cycle has been effectively rendered invalid, Bitcoin maximalists have become more eager to point out Bitcoin’s founding virtues of decentralization and self-governance.

But despite these lessons, does it make sense to prioritize Bitcoin over altcoins?

Economic rationale for preferring Bitcoin

Bitcoin maximalists face a difficult dilemma. There is a finite amount of money you can pour into assets, including Bitcoin. This is market liquidity. Bitcoin has been the target of a flurry of altcoins for at least a decade, with thousands of altcoins enjoying a first-mover advantage.

With a current market capitalization of $735 billion, it is much more difficult to get more weight, and therefore a higher price. When BTC price passed $50,000, Bank of America calculated that it would take $93 million in net inflows to move the price by 1%.

This means that even if new investors fully understand Bitcoin’s status as a hedge against currency declines, their profit ratios will be significantly reduced. Points to note:

- If you purchased 100 SOL in July 2021, you would have paid ~$2,500.

- By November 2021, its value had increased to up to $25,000.

- This 9x increase was only possible in the early days of Bitcoin when the market capitalization was low.

Even during the recent bull market, without the Fed’s money supply component, Solana investors could have tripled their profits from October to November. The same dynamic is at play with numerous other altcoins and even memecoins.

With this in mind, Bitcoin maximalists adopt a unique approach that sees Bitcoin as a key player in the evolution of the currency rather than simply an asset for short-term profits. The core of this approach is aligning technical pattern analysis with long-term strategies to explore Bitcoin market dynamics.

Philosophical foundations of maximalism

Even for those who have never purchased a single cryptocurrency token of any kind, the rapidly evolving blockchain space has delivered valuable lessons that have garnered public attention.

Concepts previously confined to the niches of economic theory suddenly entered blockchain life: money supply, inflation rates, token economics, token allocation, vesting, burning, utility, and governance.

It then became easy to apply this mental model to the dollar itself. Applying token economics to USD, some Bitcoin Mania He even called the dollar “the ultimate shitcoin.”

- 1 node

- Circulating volume of $2.3 trillion

- Total supply: $33.75 trillion (paid to creditors)

- 1% of holders own 53% of the stake (worth $19.16 trillion).

- It has lost 94% of its value over the past 100 years.

- Arbitrary supply adjustments result in roller coaster inflation and economic downturns.

This is a new mental modeling enabled by Bitcoin that was previously unavailable to the public. For Bitcoin maximalists, the pioneering cryptocurrency represents the first viable alternative to single-node (central bank) systems. Satoshi Nakamoto eventually launched Bitcoin as a response to central banks bailing out commercial banks with taxpayer money.

To store or transfer wealth, people no longer need to ask anyone for permission. More importantly, there is no central entity that can weigh in on the Bitcoin network and regulate the money supply. As a result, money can finally become truly personal and serve as a savings vehicle.

What will maximize Bitcoin in the long run is that there is no need for an off/on lamp for Bitcoin. Rather, the Bitcoin standard will form a new decentralized currency system. Auditable, transparent, and limited, they envision a system that would fundamentally end government corruption and its propensity for war.

Meanwhile, since they currently use a debt-based monetary model, all fiat currencies encourage risky investments to outperform the inflation rate. While the Fed’s coveted inflation rate is 2%, Bitcoin is heading for an inflation rate of less than 1% following the fourth halving in April 2024.

At this point, altcoin proponents may say, “But hundreds of altcoins have negligible inflation rates and limited coin supply.” Bitcoin maximalists have a simple rebuttal. Bitcoin, which uses a proof-of-work algorithm, is based on physics – or, as Michael Saylor puts it, “digital energy.”

In fact, anyone can clone an altcoin, which in turn will have a capital (stake) network impact due to more staking. Likewise, you can also clone open source Bitcoin code. However, this is completely irrelevant since Bitcoin is secured by network energy, not capital. One leads to centralization and the other does not.

conclusion

Bitcoin is unique in that it has no attachment to any organization or personality. The same goes for the army of opposing altcoins starting with Ethereum. The cost of this distributed resilience is paid for with energy, not capital shares. This has been the source of numerous articles and statements from politicians attacking Bitcoin’s energy use.

Nonetheless, even these environmentally oriented pressures seem to have lost steam. Can anyone truly say what a fair price is for financial sovereignty? Looking at that horizon, Bitcoin maximalists are more focused on escaping the central banking system than short-term altcoin profits.

Although some maximalists see all altcoins as wasteful distractions along the way, it is clear that Bitcoin will be integrated into the altcoin ecosystem. Ultimately, incentives create their own blockchain environment regardless of opinions.

This is a guest post by Shane Neagle. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.