- Abe broke through $150, hitting a new yearly high.

- Actual retail long positions and open trade positions also showed an upward trend.

AAVE recently broke through the $150 price level, marking a new cycle and a yearly high.

Analysts believe that if Aave holds above the $154 price level, the price could surge to potentially $260, which would represent a 75% increase from the current price at the time of writing.

Aave briefly rejected the $154 level, but this is typical of major resistance points. The strength of Aave’s price action suggested that this was a pause before further upside movement.

The MACD indicator, which has been in a downtrend since August, has now turned bullish, indicating a potential rally. Aave started September strong, hitting a new high for 2024.

Source: TradingView

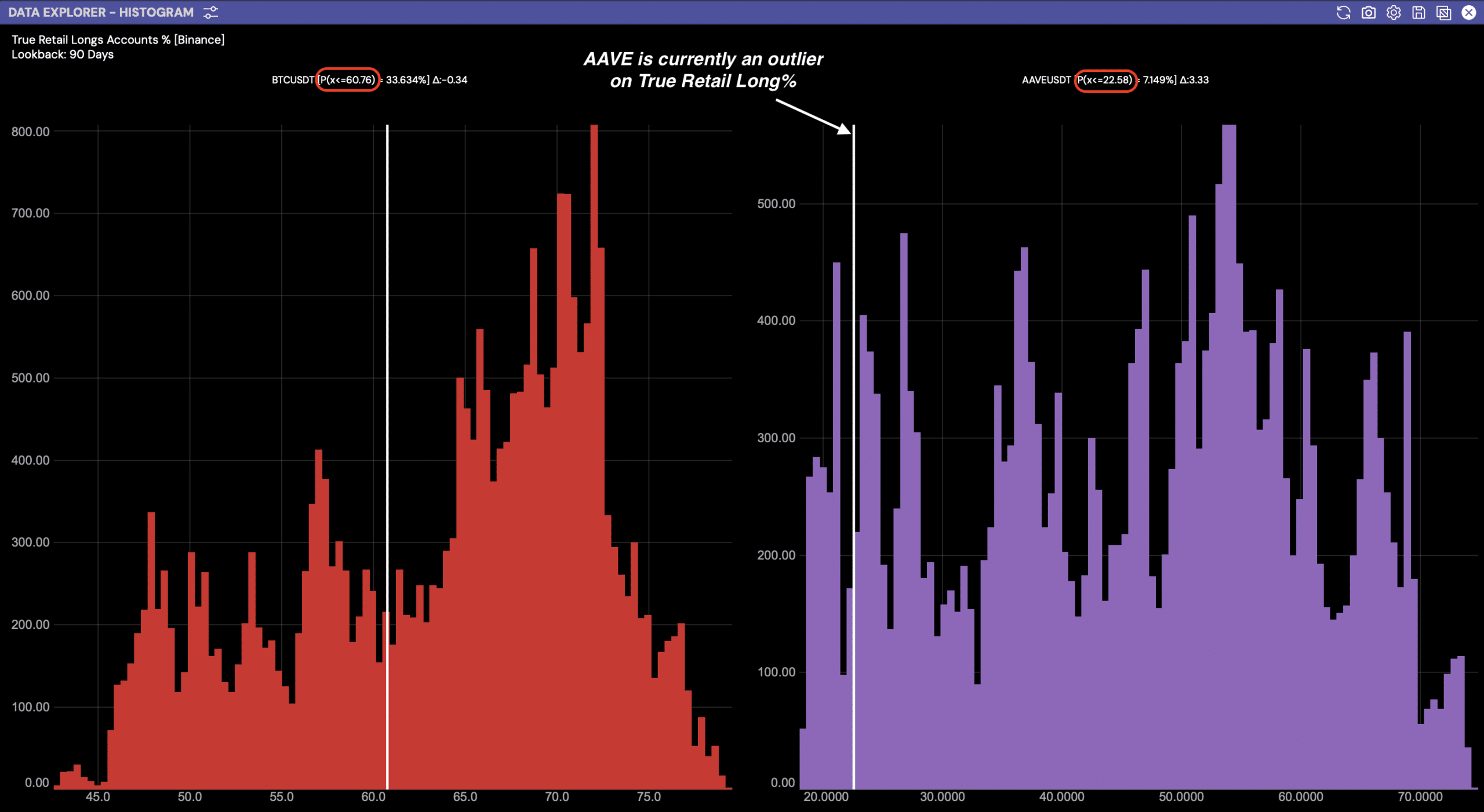

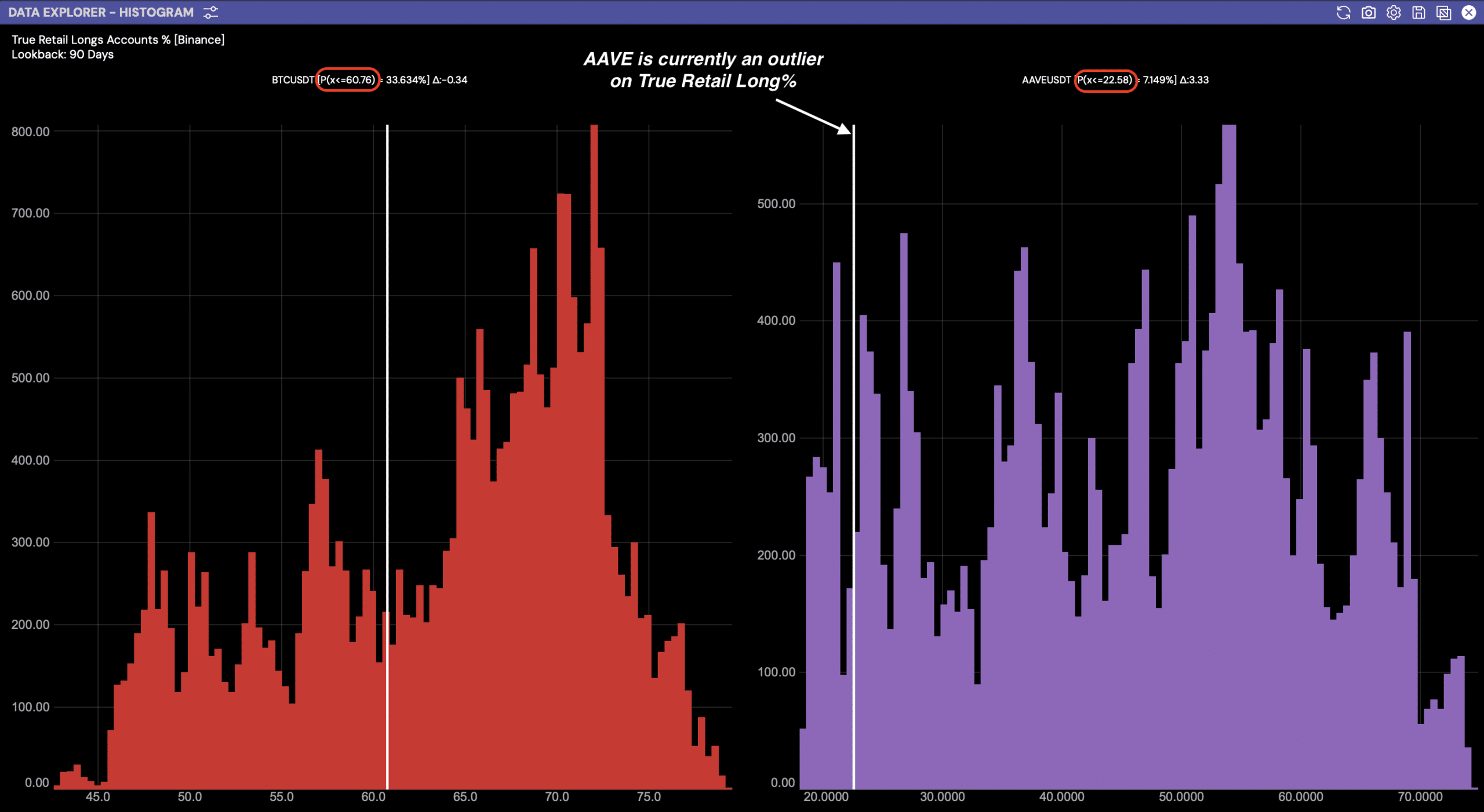

True Retail Long Account Ratio

AAVE’s performance is notable, especially when compared to the retail long account ratios for BTC/USDT and AAVE/USDT, according to research from Hyblock Capital.

At the time of writing, only 22% of retail accounts held long positions, while open interest showed increasing growth.

This ratio, which reflects the previous price decline before the rally, indicates that long traders are dominating short traders. This trend suggests that AAVE may be preparing for another price surge.

Source: Hyblock Capital

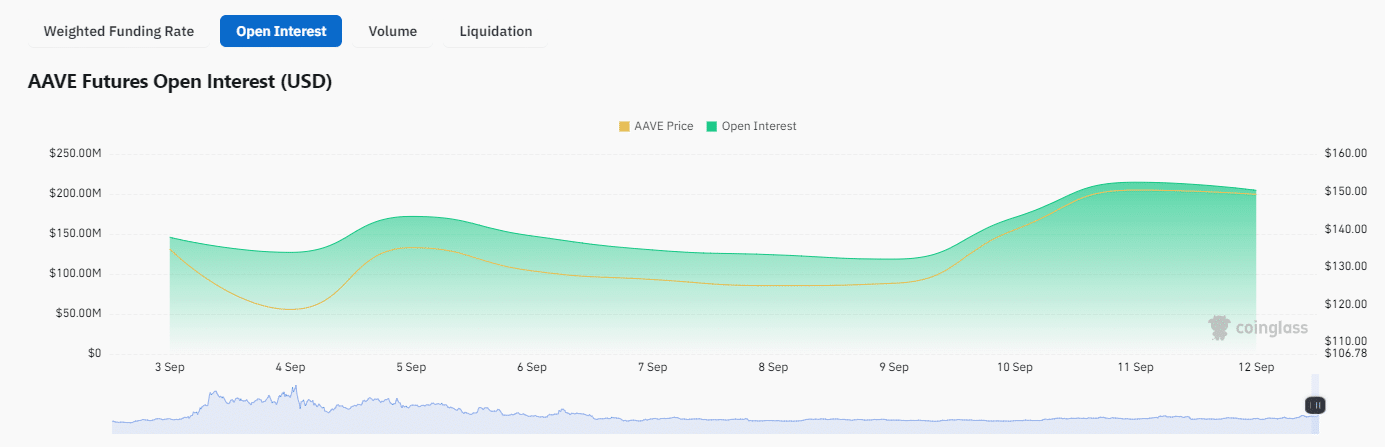

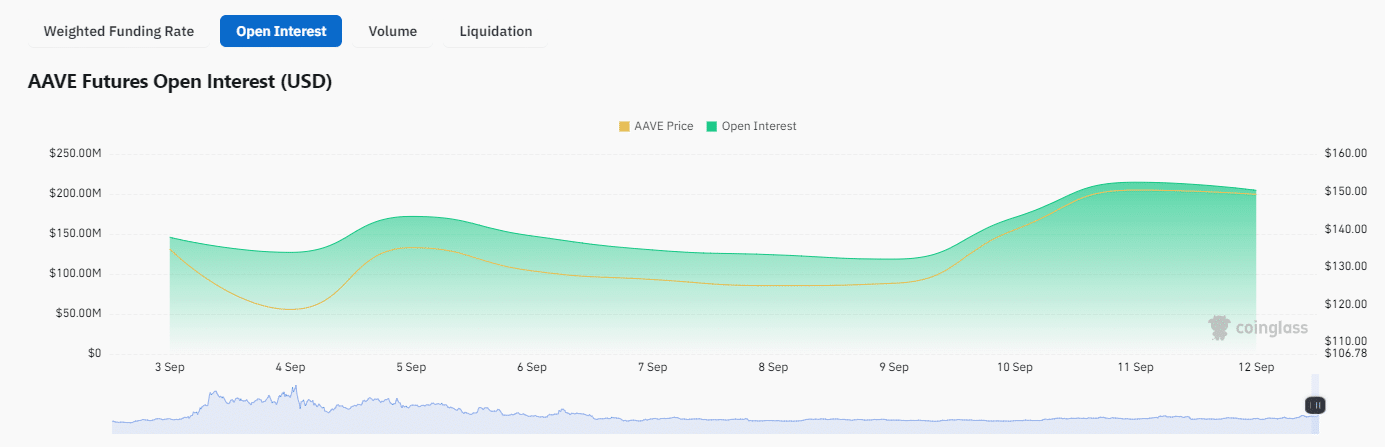

Open interest while on the move

Further analysis using Coinglass shows that Aave’s open interest has been steadily increasing, particularly in September of this year.

According to the latest data, the open interest of AAVE stands at $204.58 million, with the price at $149.26. This is a positive indicator, supporting the possibility of a price surge in the near future.

Source: Coinglass

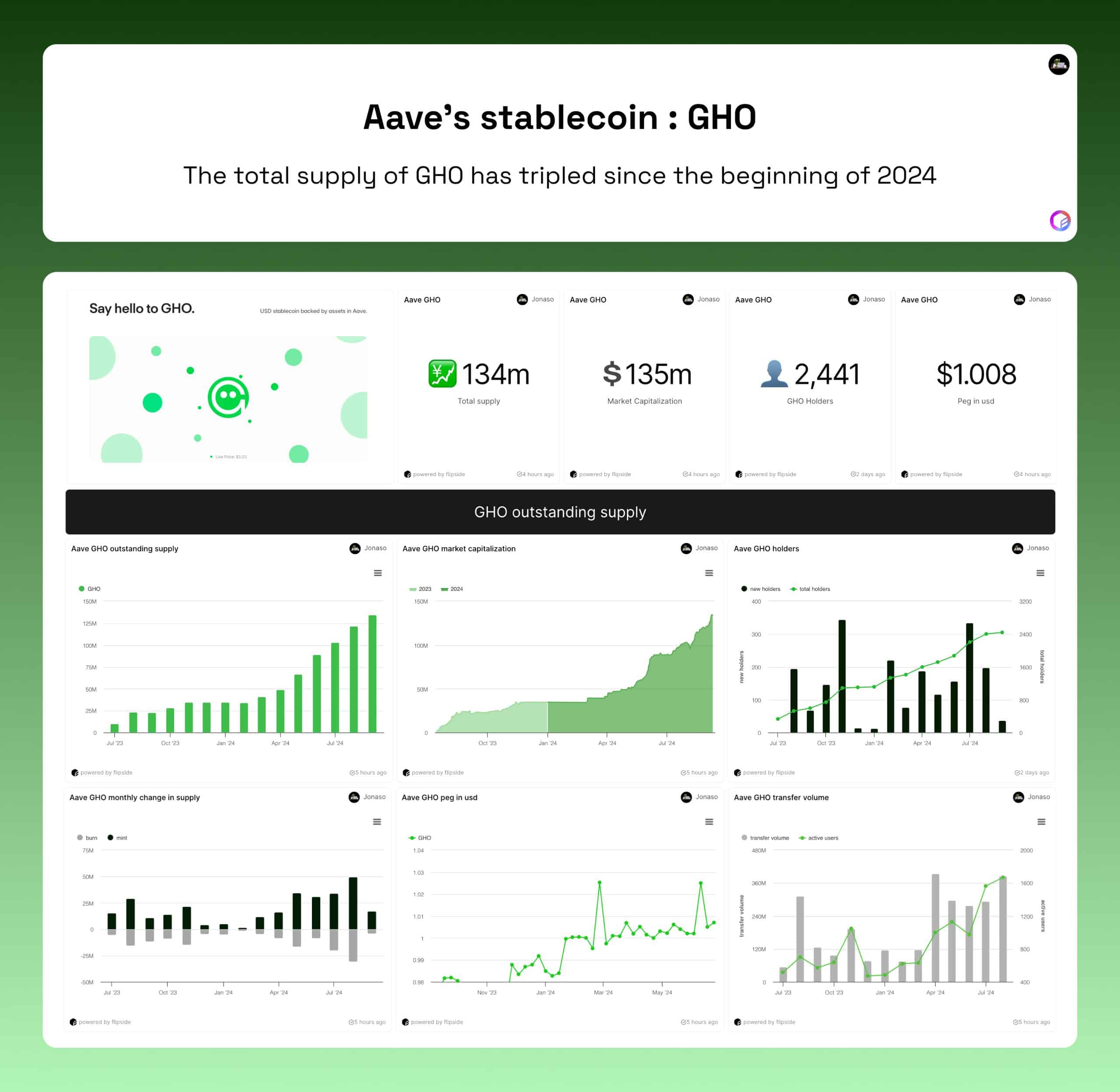

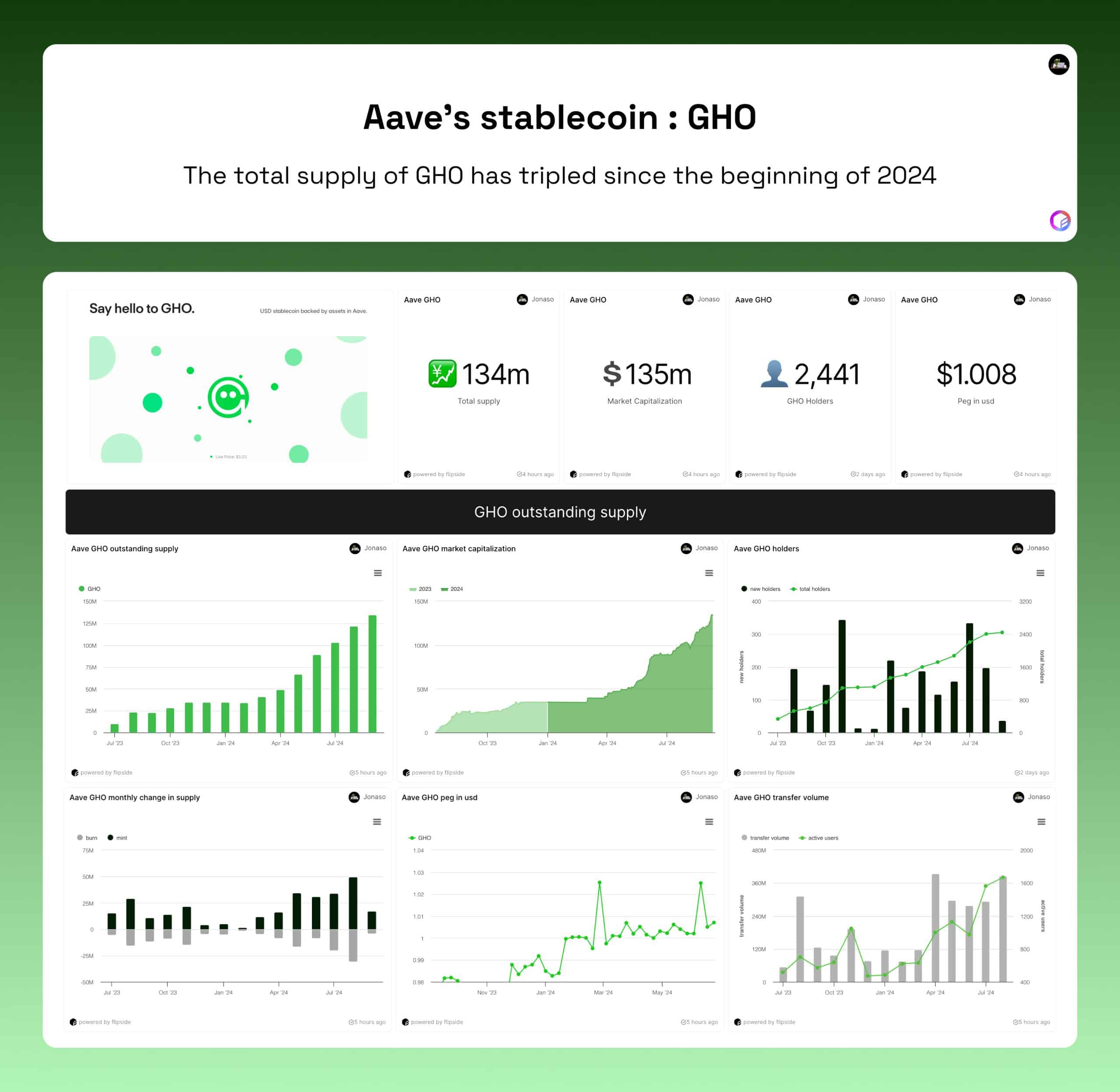

Aave’s GHO Growth Is Strong

Aave’s native decentralized stablecoin, GHO, has also been experiencing strong growth. At the time of writing, GHO’s supply has grown to 135 million tokens, with a market cap of $135 million.

The total number of holders also reached an all-time high of 2.4K users. Around 76% of the GHO supply, or about 103 million tokens, were staked by 1.59K stakers.

GHO is highly stable as it is firmly pegged to the US dollar with no major price fluctuations.

Source: X

Finally, Aave’s founder hinted at expanding GHO’s distribution to other blockchains. Currently, Aave V3 is live on several networks, including Ethereum (ETH), Arbitrum (ARB), Base, Avalanche (AVAX), Polygon (MATIC), and Optimism (OP).

However, GHO is only deployed on ETH and ARB, leaving room for further expansion on other networks, as we read in Stani Kulechov’s X post.

“This leaves GHO with significant room to expand into additional networks.”

This potential expansion could spur additional growth in both Aave and GHO, providing additional support for higher prices.

Read Aave (AAVE) Price Prediction 2024-2025

Overall, the price outlook for Aave is positive. The price could move higher due to increasing Open Interest, bullish technical indicators, and increased adoption of the GHO stablecoin.

If market conditions continue to be positive, AAVE could see significant gains in the coming months.