- Aave has surged 3.79% in the last 24 hours.

- With a bullish crossover and strong buying pressure, Aave is positioned to reach $200.

Aave (AAVE) posted a strong rally after hitting a local low of $153 a day ago, hitting a high of $184.

In fact, at the time of writing, Aave was trading at $181. It recorded 3.79% over the past day. Likewise, the altcoin rose on the weekly and monthly charts, up 8.25% and 24.52%, respectively.

Despite this price increase, Aave still remains approximately 72.89% below ATH of $666.

Current market conditions therefore raise questions about whether the price recovery is sustainable or merely a market correction.

What Aave’s Charts Say

According to AMBCrypto’s analysis, Aave is experiencing strong upward momentum amidst increasing buying pressure. Therefore, altcoins performed strongly on Stoch RSI.

Over the last 48 hours, Stoke have moved to settle on 41. This means buyers are controlling the market and prices may rise in the short term.

Source: TradingView

This strength is further confirmed by the Relative Strength Index (RSI).

In the last 24 hours, RSI confirmed an upward trend after the MA reversed from 58 to 54, further reinforcing observations of strong buying pressure.

Likewise, the strength of this upward trend is also confirmed by the DMI. Because +DMI is 23 and it stays above -DMI. This means that while the downtrend has exhausted itself, the upward momentum is strong.

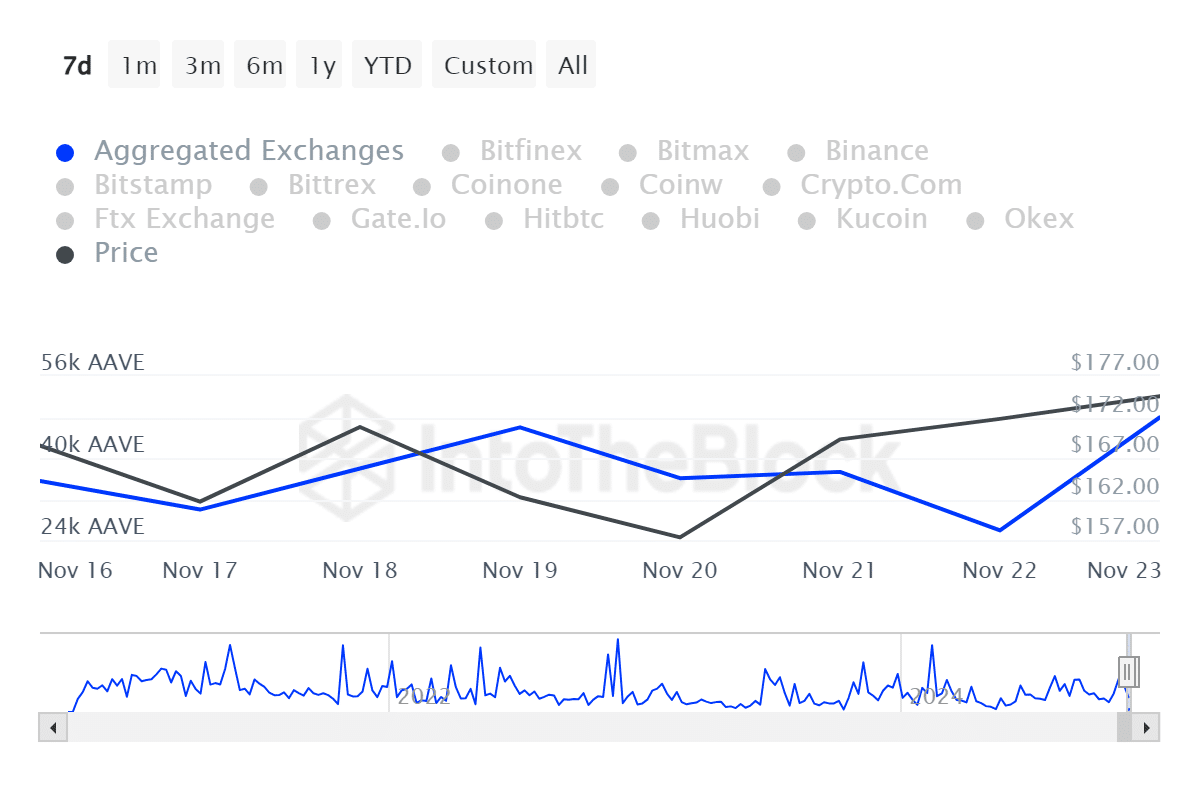

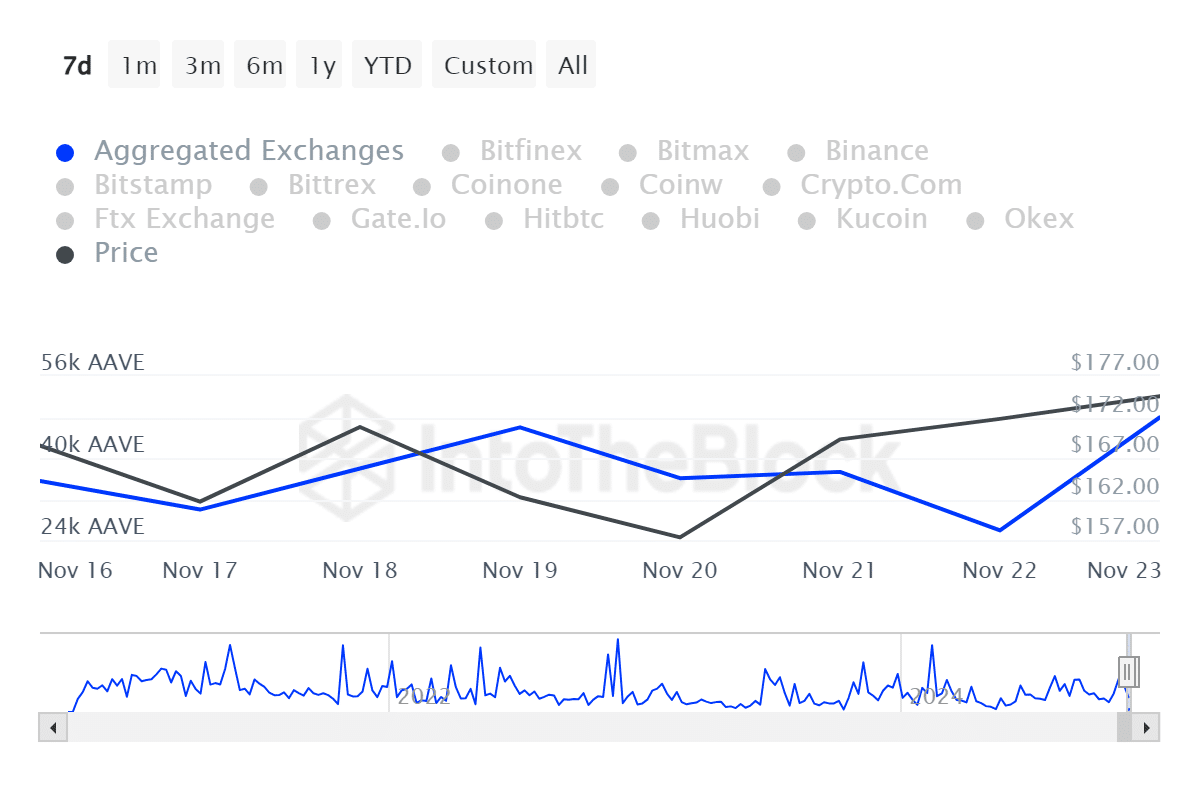

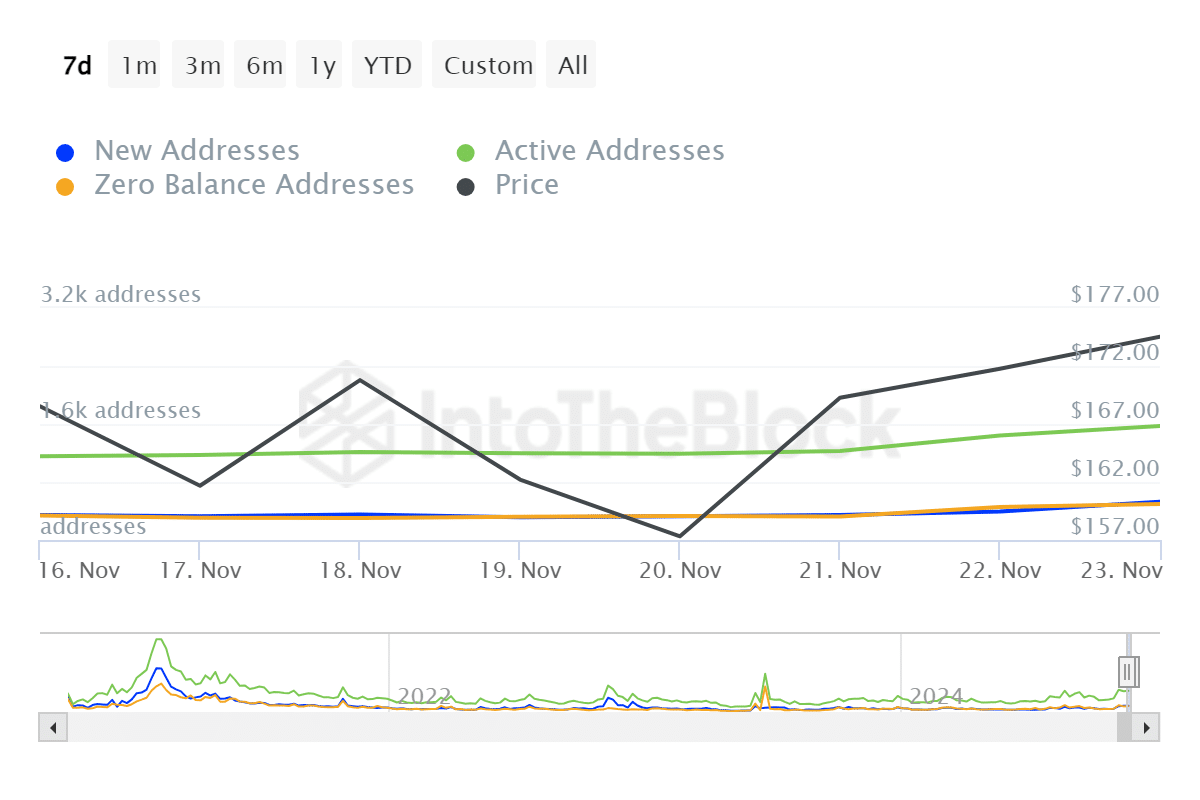

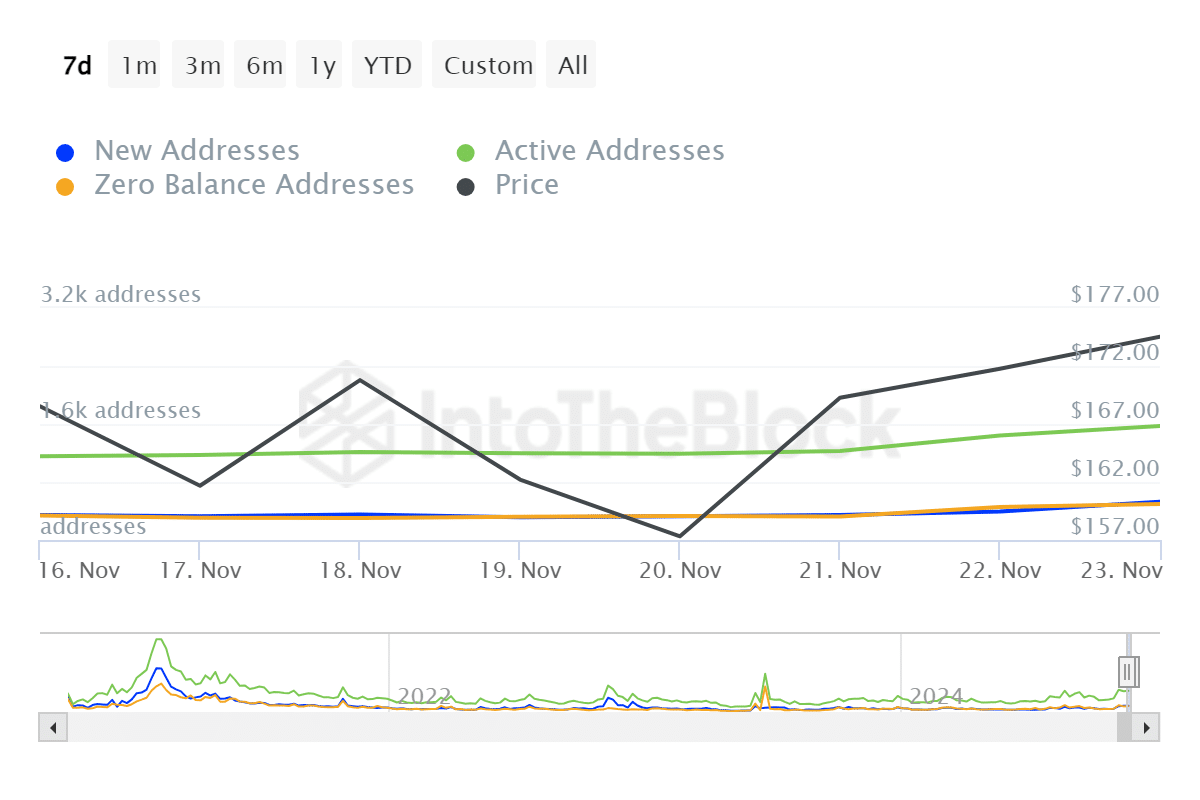

Source: IntoTheBlock

Furthermore, Aave investors are showing high optimism. This is evidenced by the high outflows from exchanges.

According to IntoTheBlock, outflows surged to a weekly high of 47.95K, reflecting the confidence of investors moving tokens from exchanges to personal wallets and cold storage.

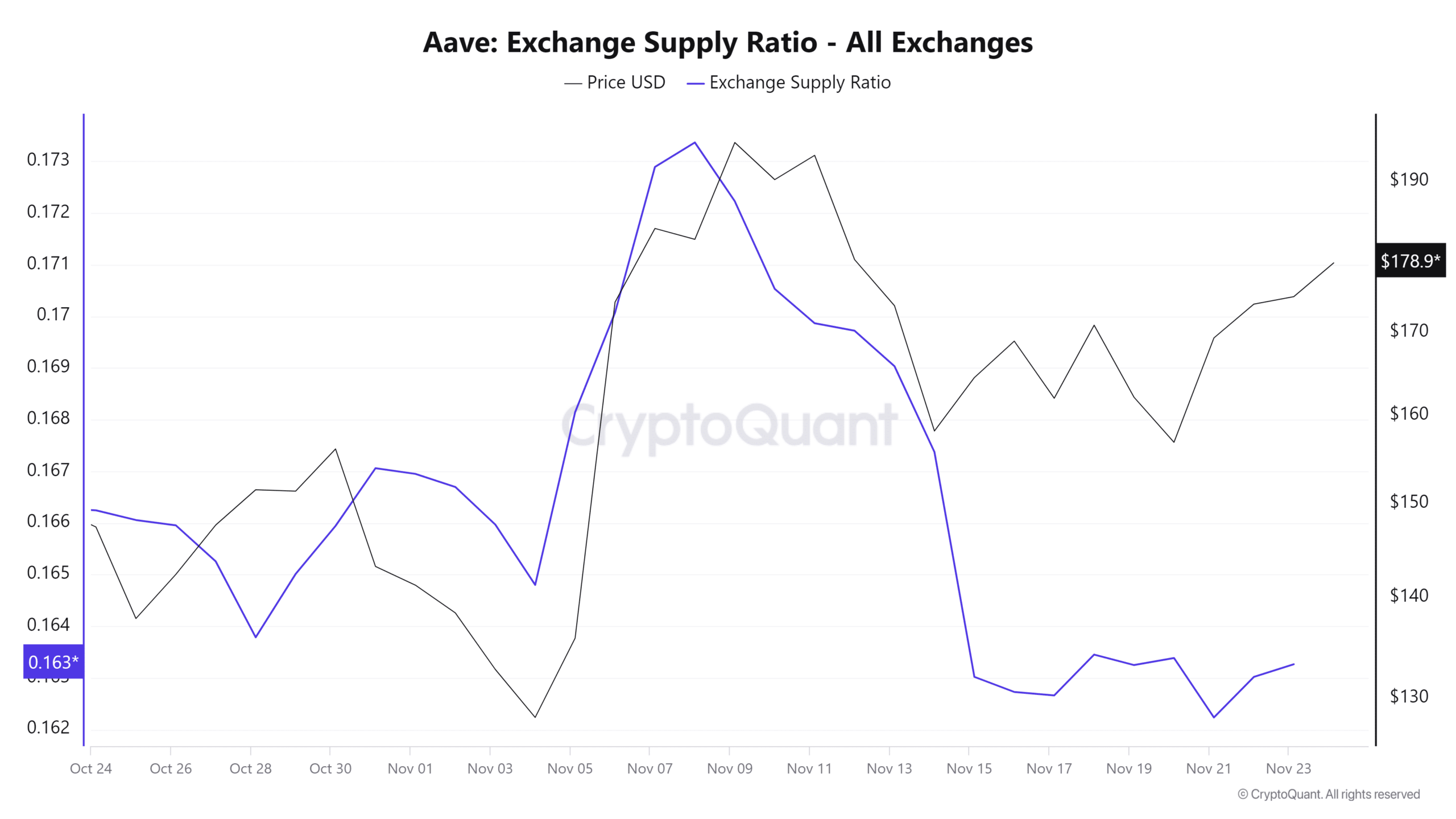

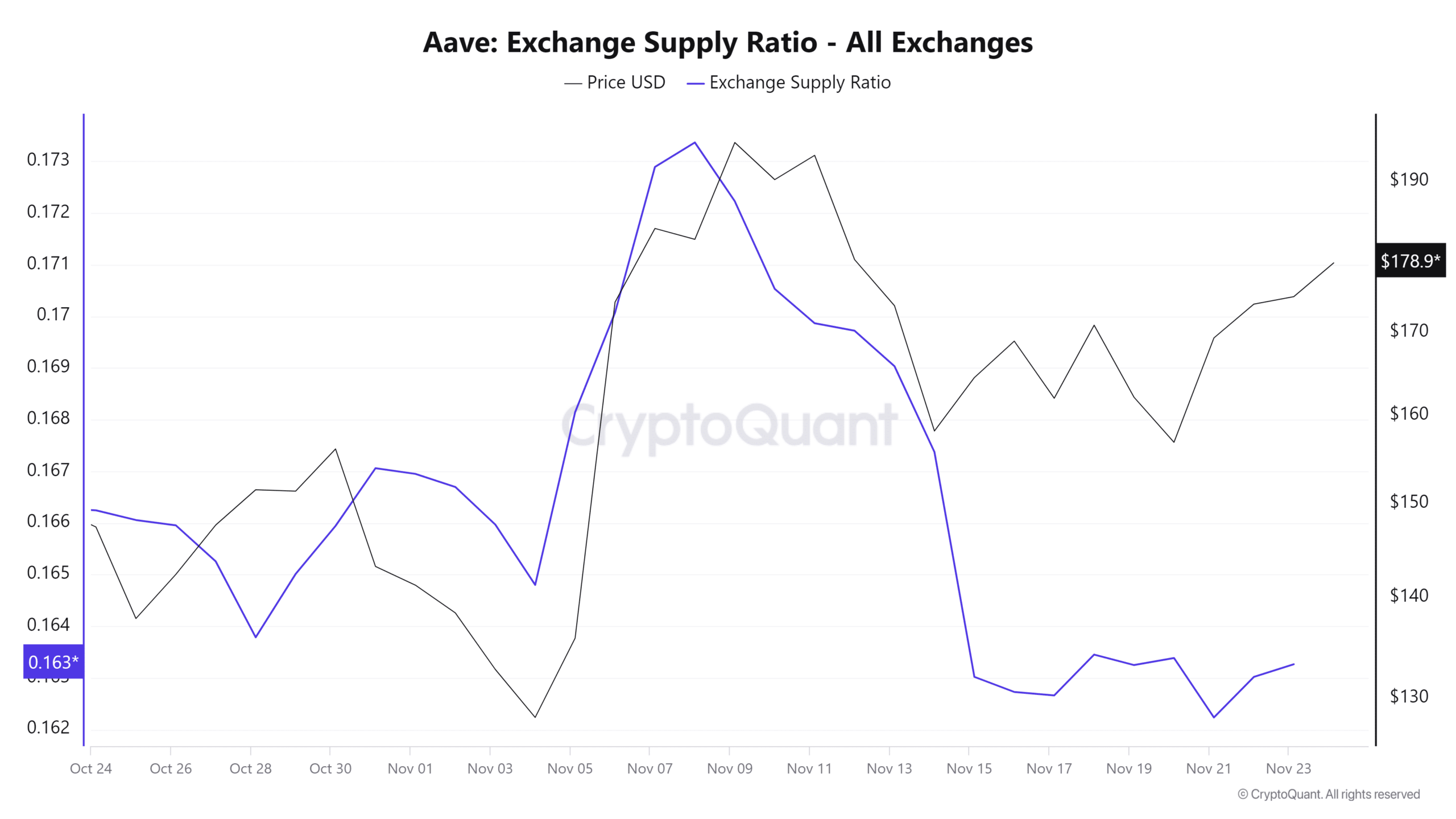

Source: CryptoQuant

This phenomenon is further evidenced by the decrease in the supply exchange rate. According to CryptoQuant data, the supply exchange rate has decreased over the past 48 hours, hitting a monthly low.

These developments suggest that investors are withdrawing more Aave from exchanges than depositing them.

Source: IntoTheBlock

Read Aave (AAVE) Price Prediction for 2024-25

Finally, we see that these price increases did not come from market speculation, but from strong on-chain activity.

This is evidenced by the fact that active addresses on Aave have skyrocketed over the past few days, hitting a two-week high of 2.6K. This demonstrates increased demand, adoption and engagement, which are key to driving up prices.