- Could Abe break the $152 level after approaching $148?

- Aave’s fundamental indicators support a bullish cycle.

According to CoinMarketCap, as of the time of writing, Aave (AAVE), an open-source protocol for building non-custodial liquid markets, has seen significant gains, surging more than 30% over the past 30 days.

This price action reflects strong market interest, especially since Aave’s price is currently in the $130 range, the area with the highest volume.

Aave’s price action looks set to show further upside after reaching the $148 price level and breaking through the $152 level.

This bullish momentum is supported by the formation of a higher high following the daily consolidation, indicating that further upside is likely for the Aave price.

Source: TradingView

Aave has shown incredible strength on a weekly basis, closing the week up over 75% over the past three weeks.

This surge brings AAVE close to the weekly resistance level. This week’s price action suggests that Aave could close above $153, paving the way for a rally to $300 by October 2024.

Although the price has moved slightly lower this week, this is consistent with the weekly low formed prior to the bullish close, reinforcing the positive outlook for Aave price growth.

Source: TradingView

Abe’s macroeconomics look good…

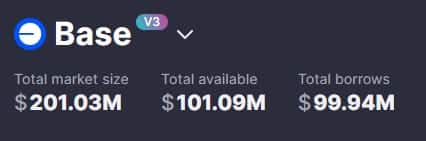

Fundamentally, Aave’s long-term prospects look strong, with the protocol recently becoming the first lending platform to surpass $200 million in market cap and $100 million in total value locked (TVL) on its base chain.

Additionally, Aave DAO launched the “Endless Summer” program, which provides Aave users with $100,000 USDC in monthly rewards.

Source: Aave Protocol

This initiative will further strengthen community engagement and position Aave as a leader in decentralized finance (DeFi).

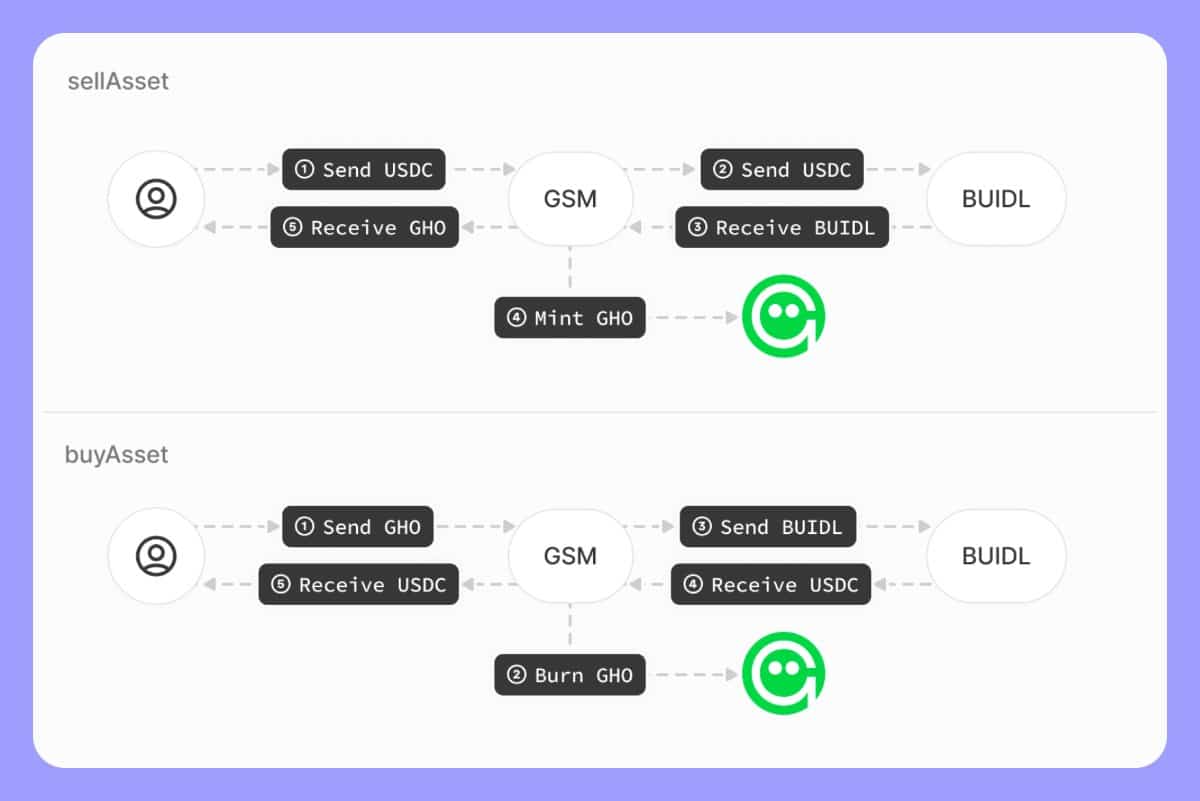

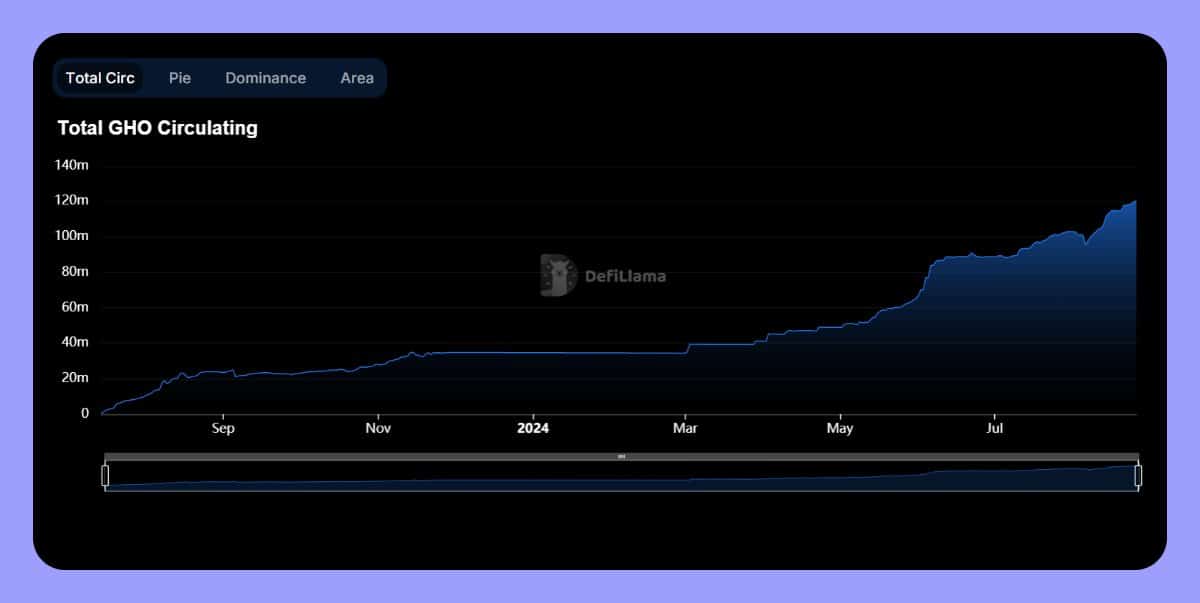

Another bullish development for Aave is the introduction of the proposed GHO Stability Module, which aims to maintain the stability of Aave’s flagship stablecoin, GHO, during periods of high demand.

Leveraging USDC surplus from BlackRock’s BUIDL with over $500 million in assets, this module seeks to provide a hedge against DeFi market volatility while creating additional yield opportunities.

Source: X

Integration with BlackRock’s BUIDL infrastructure is expected to enhance Aave’s products and services and drive further price momentum.

Impact of 1:1 swap between USDC and GHO

The GHO Stability Module also includes a 1:1 swap between USDC and GHO, providing a seamless user experience with instant conversion.

Realistic or not, AAVE’s market cap in BTC terms is:

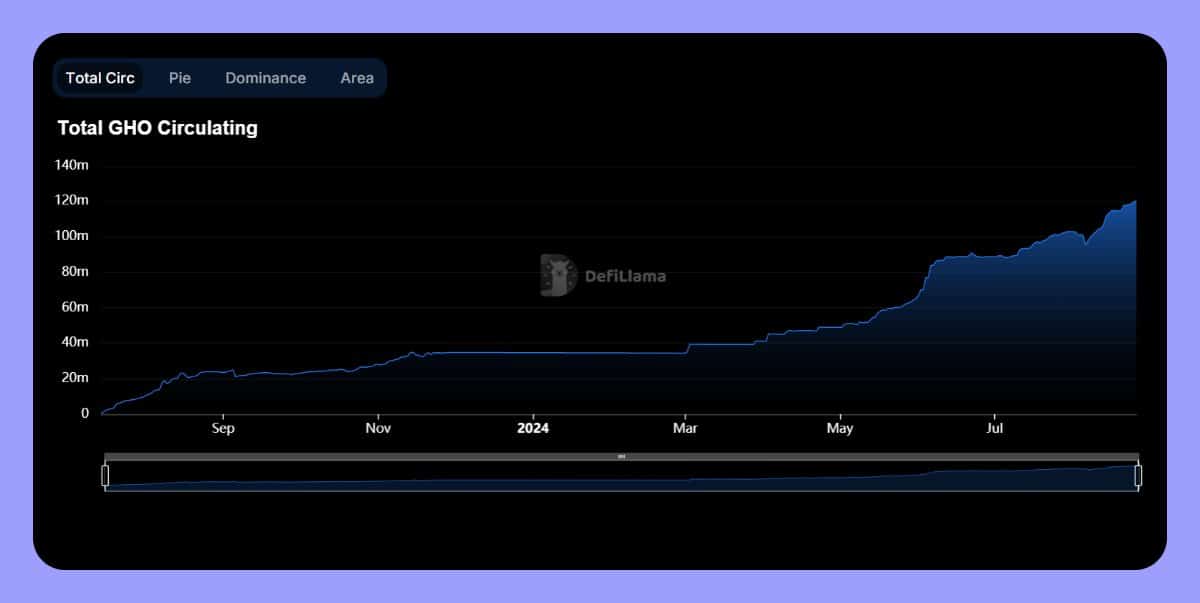

Swap fees are accumulated in GHO and paid out monthly dividends from BUIDL, increasing activity within the Aave (AAVE) ecosystem. As GHO adoption increases, Aave’s market presence also increases, driving its price higher.

Source: DefiLlama

Abe’s strong market structure, combined with favorable macroeconomic factors, creates conditions for further price appreciation in the coming months.