- Abe surged 14% to $143, hitting a five-month high.

- Bitcoin has broken through $61,800, with prices up 4% amid renewed resilience in the cryptocurrency.

Aave continued to outperform its peers, surging to its highest level in five months on August 21. Meanwhile, the Bitcoin price surged 4% in 24 hours to break $61,800.

AAVE soared 14% to its highest level in five months.

Decentralized finance (DeFi) protocol Aave (AAVE) was one of the biggest gainers on Wednesday after surging more than 14% to hit a high of $143. Aave’s native utility and governance token reached this level amidst a flurry of whale activity over the past few days.

There has also been positive news about Aave since the DeFi project’s Aave V3 was deployed on the ZKsync Era Mainnet.

Aave V3 debuts on Era Mainnet. @zksyncExpanding the DeFi user base and new institutional use cases while achieving unprecedented scalability, privacy, and security. pic.twitter.com/blNlUjsalX

— Aave Labs (@aave) August 21, 2024

AAVE Price Prediction

With a rise above $143, Aave’s price has moved to its highest level since March 2024, a period when Bitcoin was riding the halving craze and spot BTC exchange-traded funds (ETFs) were at all-time highs.

AAVE’s recent push to the current levels means that the altcoin could be looking for new gains in the $177-$200 range. However, the surge in AAVE’s price has seen a sell signal flashing on the daily chart.

Cryptocurrency analyst Ali Martinez shared her price outlook for AAVE this morning.

The last 4 times TD Sequential showed a sell signal #Ghost The daily chart has seen an average correction of 27%. The same sell signal has now appeared, suggesting a potential downside. $Ghost. pic.twitter.com/12yZwLT5tp

— Ali (@ali_charts) August 21, 2024

Bitcoin bulls aim to break $60,000

Bitcoin has struggled for momentum since the brutal selloff in early August, but bulls have not wavered much. Buyers have shown a strong will to rally above $60,000.

Over the past 24 hours, the benchmark cryptocurrency has risen above this critical level and now looks set to continue extending its slight lead.

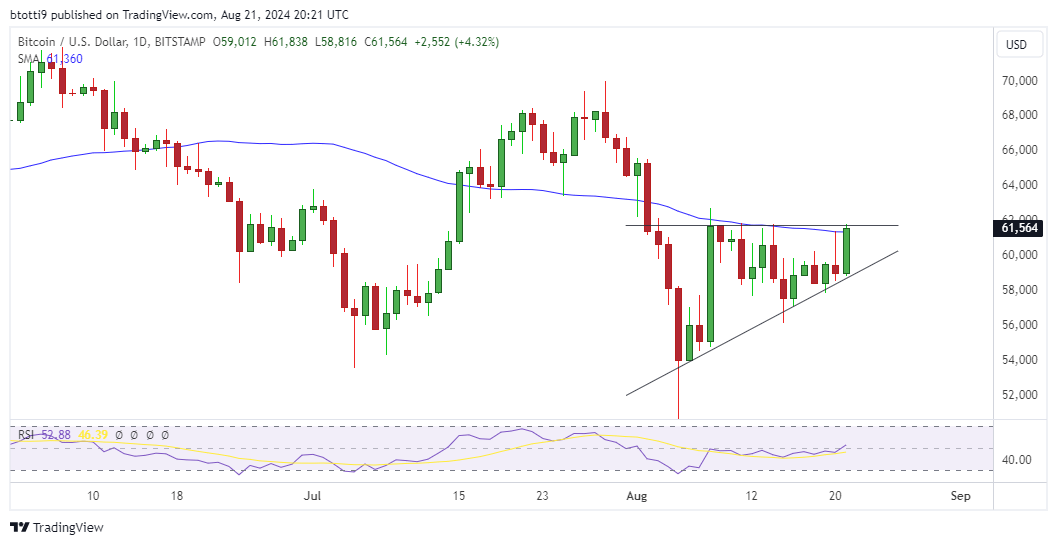

BTC hit an intraday high of $61,838 on the largest cryptocurrency exchange, Bitstamp.

BTC Chart

Due to the uptrend, the BTC/USD pair is touching the 50-day simple moving average, highlighting the formation of an ascending triangle pattern. For technical analysts, an ascending triangle is considered a bullish chart pattern with a horizontal line along the resistance level.

Meanwhile, a swing low follows an ascending trend line, forming a narrowing triangle as prices turn upward.

Bitcoin’s daily chart suggests the same is true for BTC after the August 5 low of $49,577. It is worth noting that the 50-day SMA is currently acting as a strong hurdle. If the bulls make a decisive move up, the price could target the key supply wall around $68,255.

However, if weakness reappears, key support levels could be around $58,266 and then $55,800.