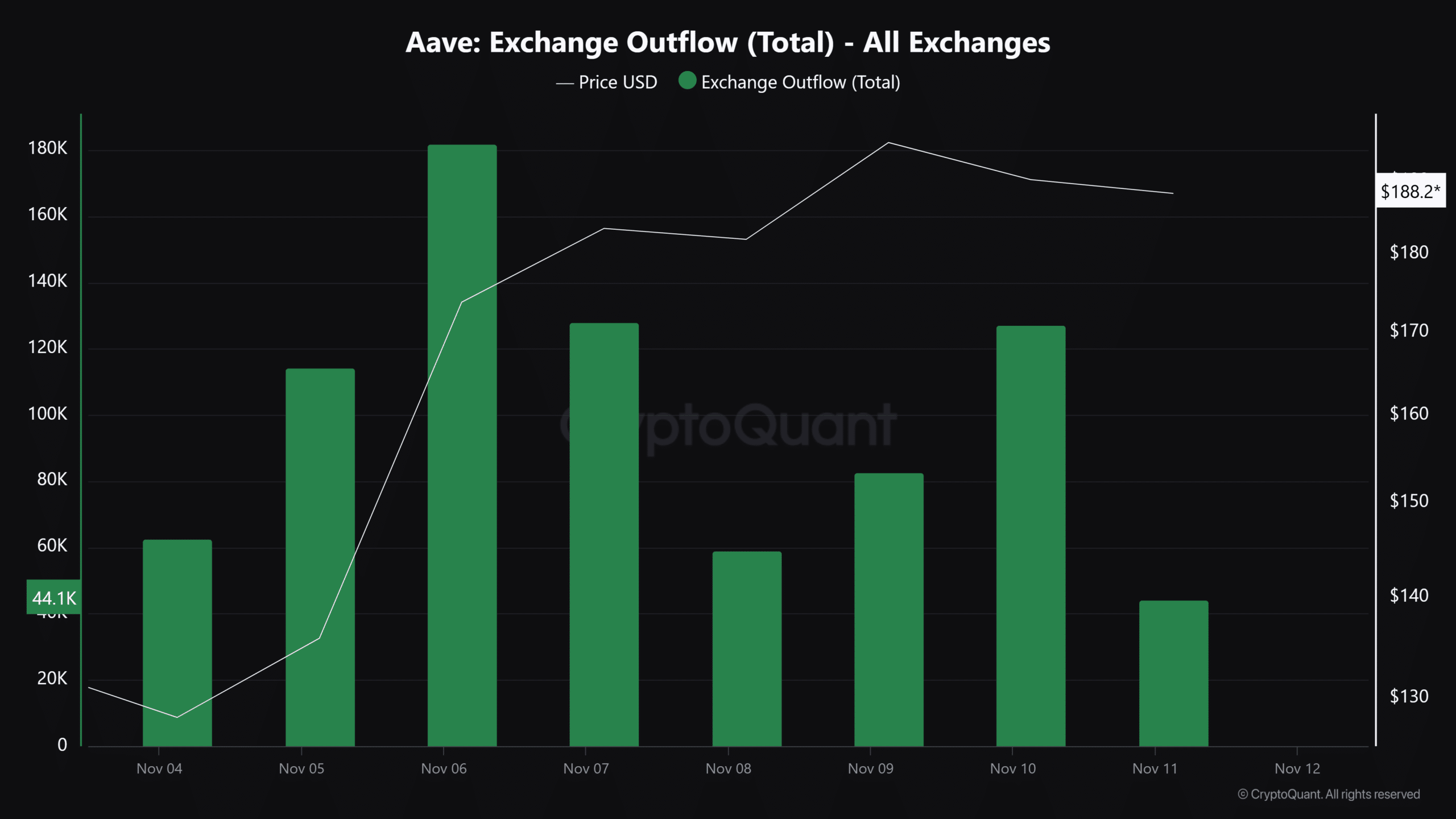

- AAVE exchange leaks gradually increased following the US election results.

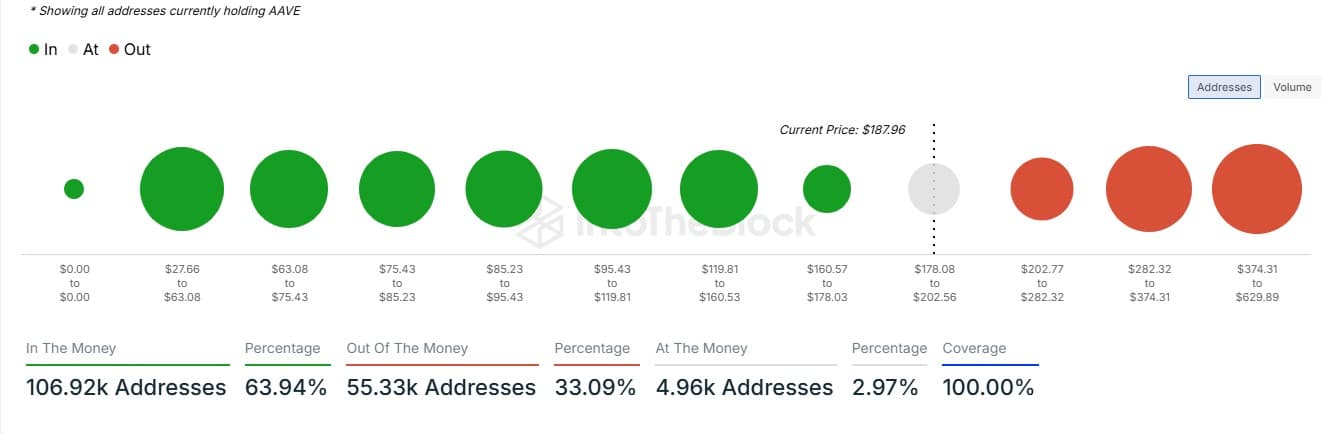

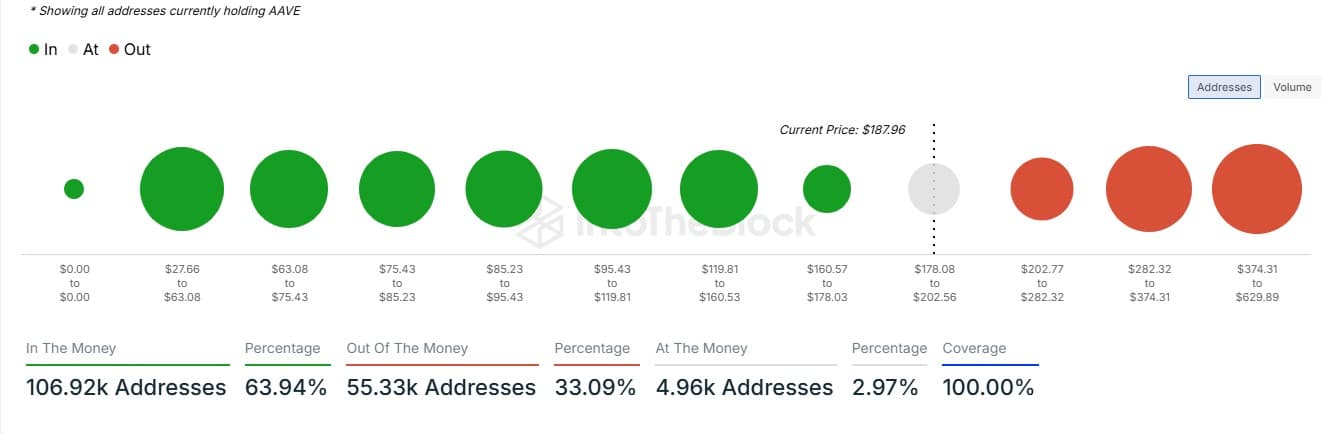

- The shift to long positions suggests growing market optimism, with 64% of active addresses currently in profit.

Following the US election results, Aave (AAVE) saw a noticeable decrease in exchange outflows. The decline once again signals investors’ cautious stance on possible regulatory changes.

However, over the past three days, AAVE exchange outflows have started to increase steadily. This upward trend may indicate some level of activity and trust building among market participants.

Additionally, an increase in foreign exchange outflows could be a sign that traders are cashing in on profits in the short term and once again taking positions for strategic opportunities.

Source: CryptoQuant

The bull gradually takes control.

AMBCrypto’s analysis of Coinglass long/short ratio data shows several movements in the AAVE market. While there used to be considerable indecision among traders between buying and selling, recently there has been a noticeable bias towards long positions.

This change probably marks the beginning of a wave of optimism in the market as traders begin to anticipate price increases after the recent market correction.

The gradual move toward buying shows collective expectations that prices will rise.

Source: Coinglass

Holders prepare strategic positions.

The profitability of active addresses adds another layer to the evolving market landscape. A total of 64% of AAVE active addresses are profitable at current prices, according to data from IntoTheBlock.

This is a strong indicator of the health of the market, as most participants are profiting from their positions despite recent market volatility and fears.

Source: IntoTheBlock

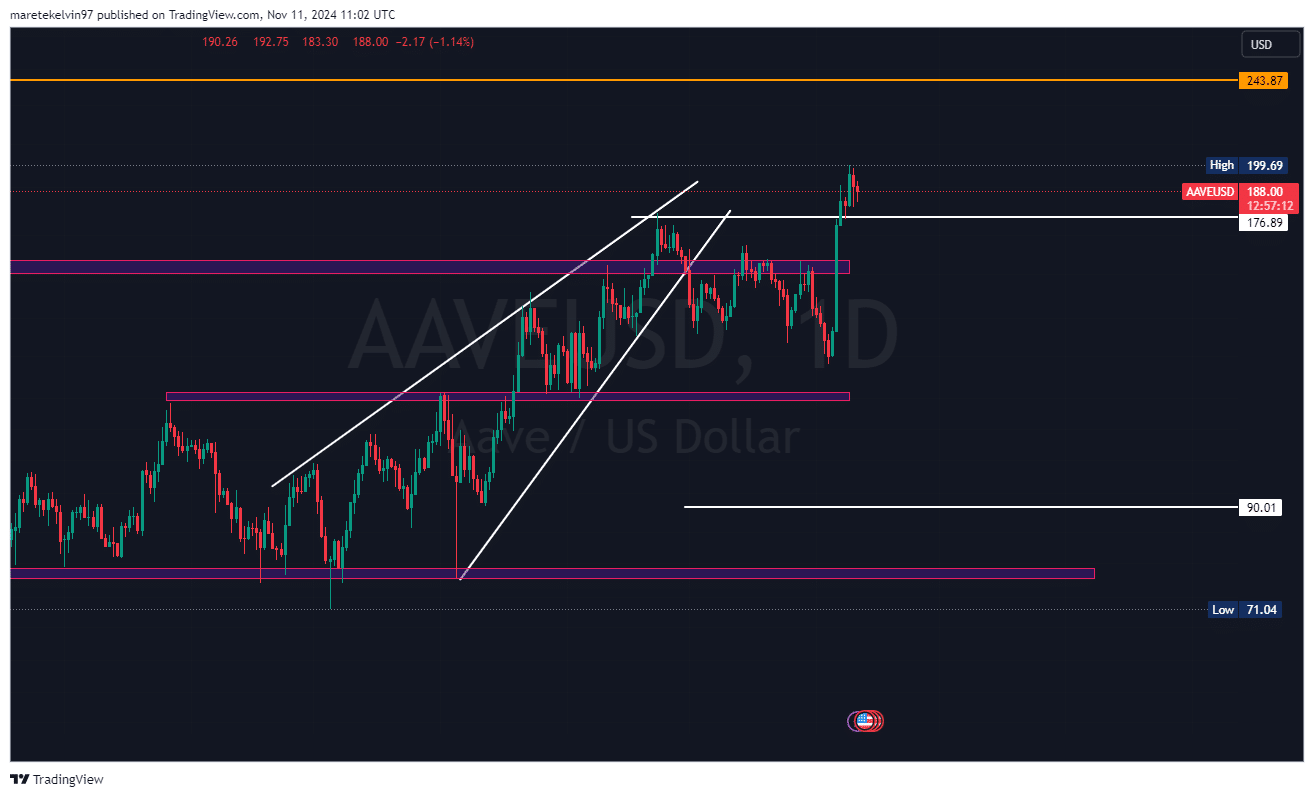

What ties everything together

The interplay between increasing exchange outflows, conversions to long positions, and strong profitability among active addresses is associated with AAVE’s price action. Aave’s market, which initially declined after the election, is now showing signs of revival.

Read Aave (AAVE) price prediction for 2024-2025

The combination of these indicators suggests cautious optimism as traders begin to take increasingly measured risks. The resilience and strategic positioning of the AAVE community may suggest that exciting times may be ahead.

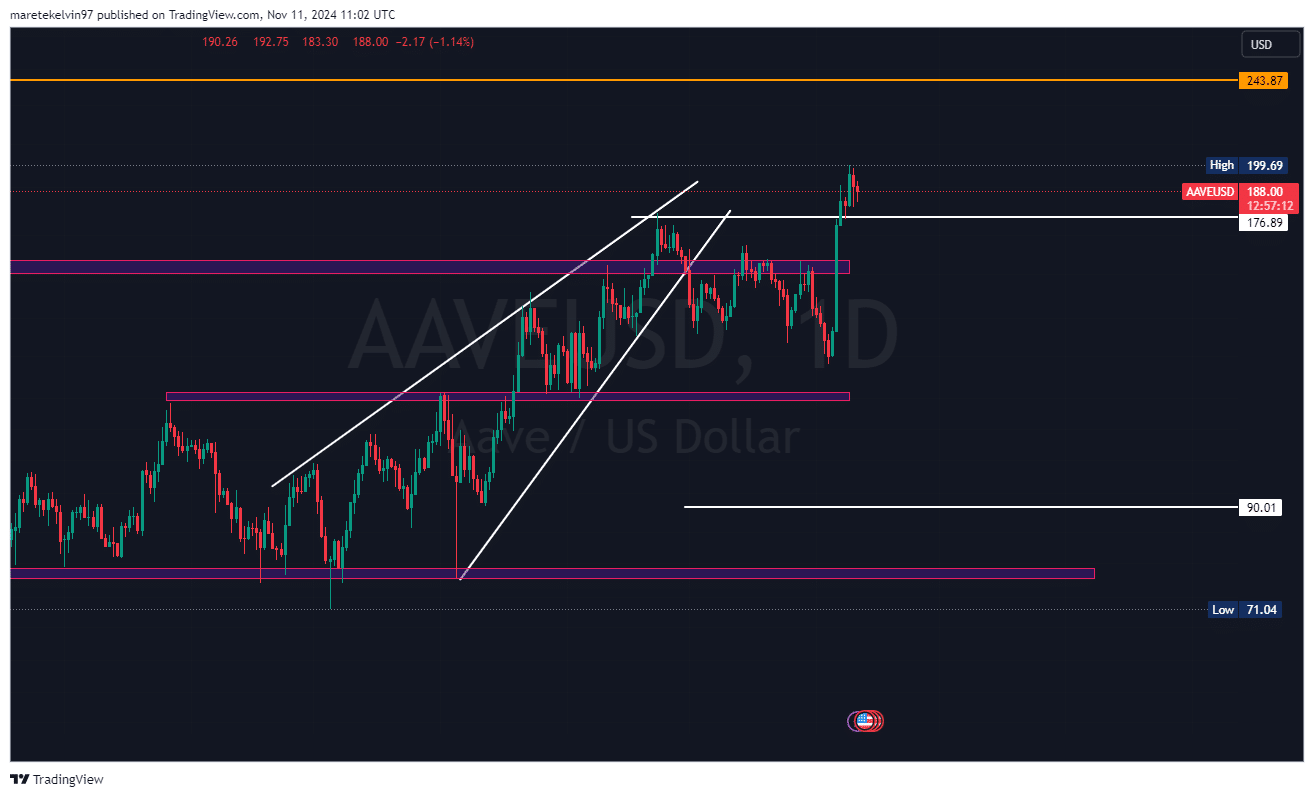

AAVE price may take a short-term correction towards the $177 key support level before the expected rally to test the higher resistance level.

Source: TradingView