- Abe was profitable at a time when Bitcoin and other large coins were struggling to stay afloat.

- On-chain indicators are bullish, but next week could see price declines and increased volatility.

Aave (AAVE) has performed very well over the past week. While Bitcoin (BTC) has plunged 11.25% since its high on Monday, July 29, the AAVE price has surged 11% from its high on Monday.

In a week dominated by bearish news, Bitcoin’s resilience and exceptional relative strength are good news for AAVE holders. Here’s what traders and investors should watch out for:

Aave had a solid strong performance in July and started August on a good note.

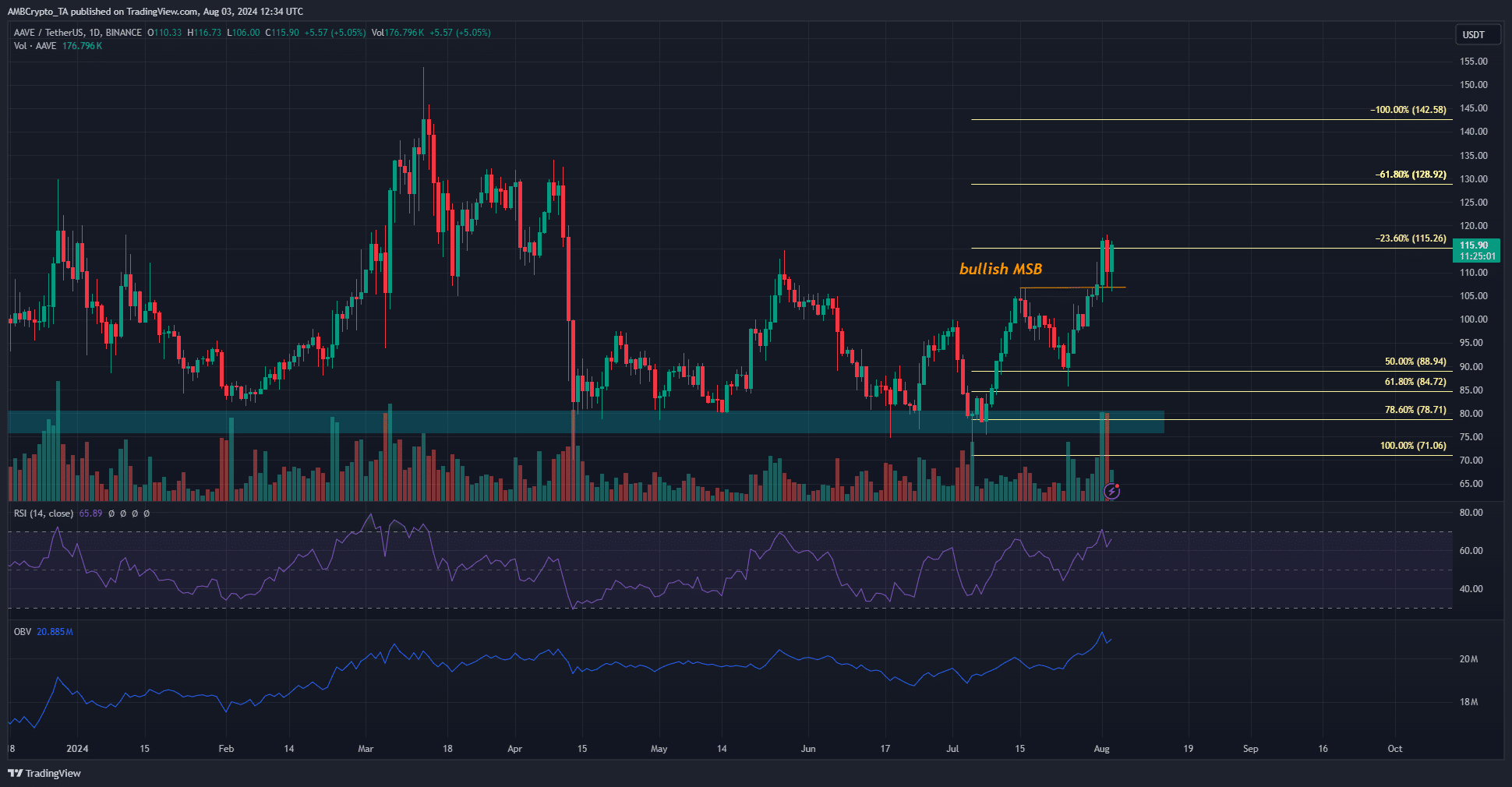

Source: AAVE/USDT on TradingView

A set of Fibonacci correction and extension levels were drawn based on the July rally from $71 to $106.7. The 50% correction level of $88.94 was tested as support on July 24 before the bulls reversed losses.

Over the past 9 days, AAVE has surged and broken out of a bullish market structure on the 1-day time frame. The daily RSI is at 65, indicating tremendous bullish momentum but not yet overbought.

OBV is also showing an uptrend, and there may be more room for expansion as it supports steady buying. The Fibonacci extension levels of $129 and $142 are well aligned with the local highs formed over the last 3 days, making them the next profit taking targets.

On-chain metrics show that volatility is likely.

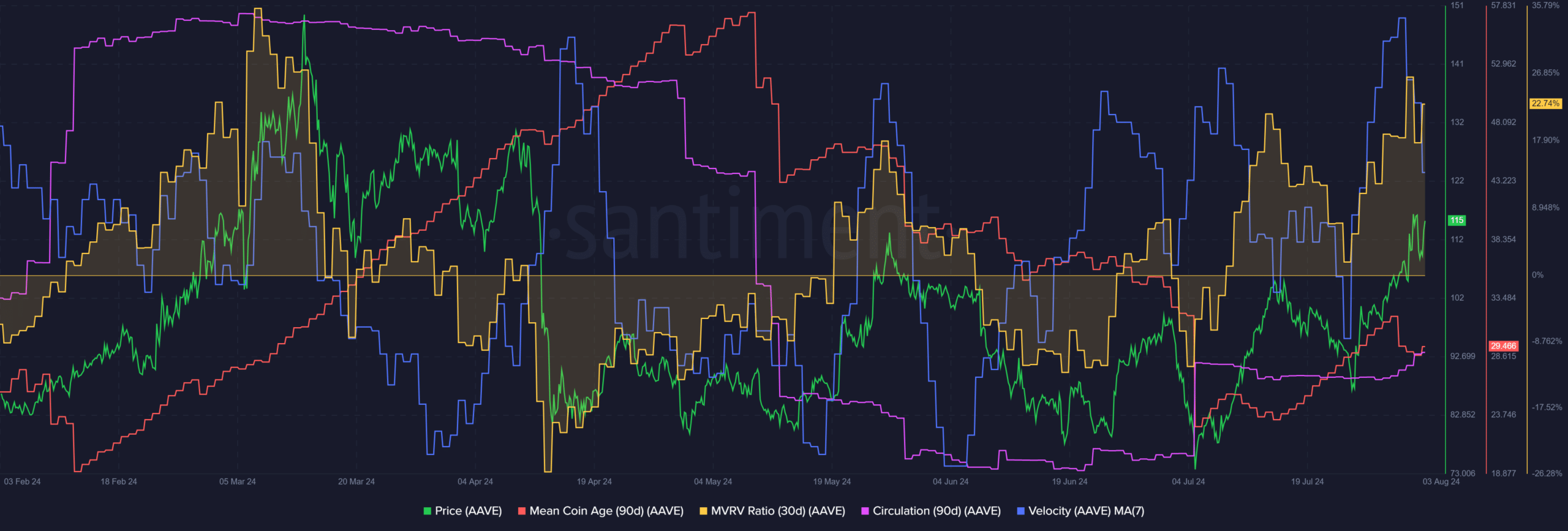

Source: Santiment

The Average Coin Age indicator has been trending upward slowly since early July, which is a sign of accumulation. However, the 30-day MVRV has hit a high not seen since March.

This could signal a strong selling wave from short-term holders who enjoy healthy profit margins.

Read Aave (AAVE) Price Prediction 2024-25

The distribution indicator has been trending upward over the past few days, and the velocity has also been trending upward. Together, they have shown strength, but also warned that short-term price volatility will increase.

Therefore, traders can expect the price to move towards $142 with a few downside moves.