According to a leading cryptocurrency analyst, an indicator suggests that an upswing in Telegram-based gaming tokens is imminent.

Ali Martinez told his 72,600 followers on social media platform

NOT is the community token of Notcoin, a popular Telegram-based tap-to-earn mining game.

Martinez says:

“Increasing buying pressure could potentially prevent a rise from $0.012 to $0.014.”

At the time of this writing NOT trading at $0.000976, a jump to $0.014 would result in a profit of over 40%. The 86th-largest cryptocurrency asset by market capitalization has already risen more than 13% in the past 24 hours.

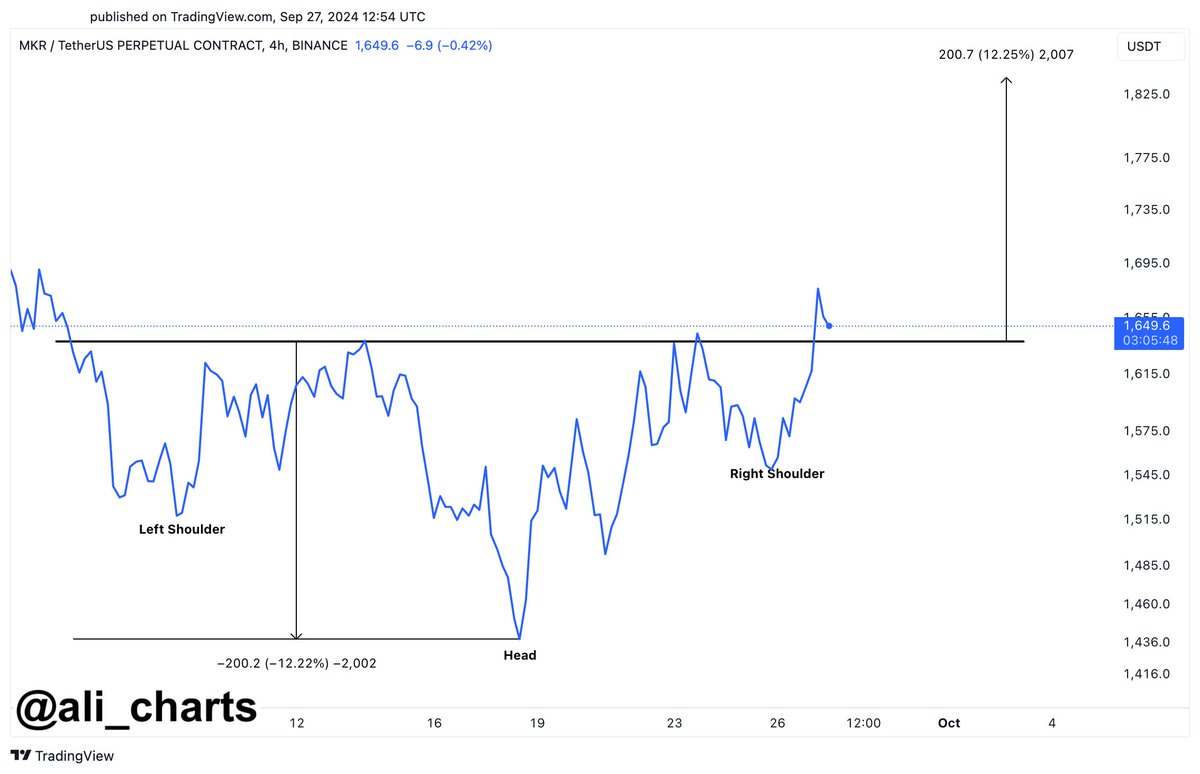

Martinez also pointed out that decentralized finance (DeFi) protocol Maker (MKR) appears to be forming a four-hour inverse head and shoulders pattern. The inverted head and shoulders structure is generally considered a bullish reversal pattern. This is because it means buyers no longer have to wait for prices to regain recent lows to enter.

Analysts say this pattern indicates a potential 12% breakout for MKR, which is trading at $1,700 at the time of this writing. The 65th-largest cryptocurrency asset by market capitalization is up more than 5% in the last 24 hours.

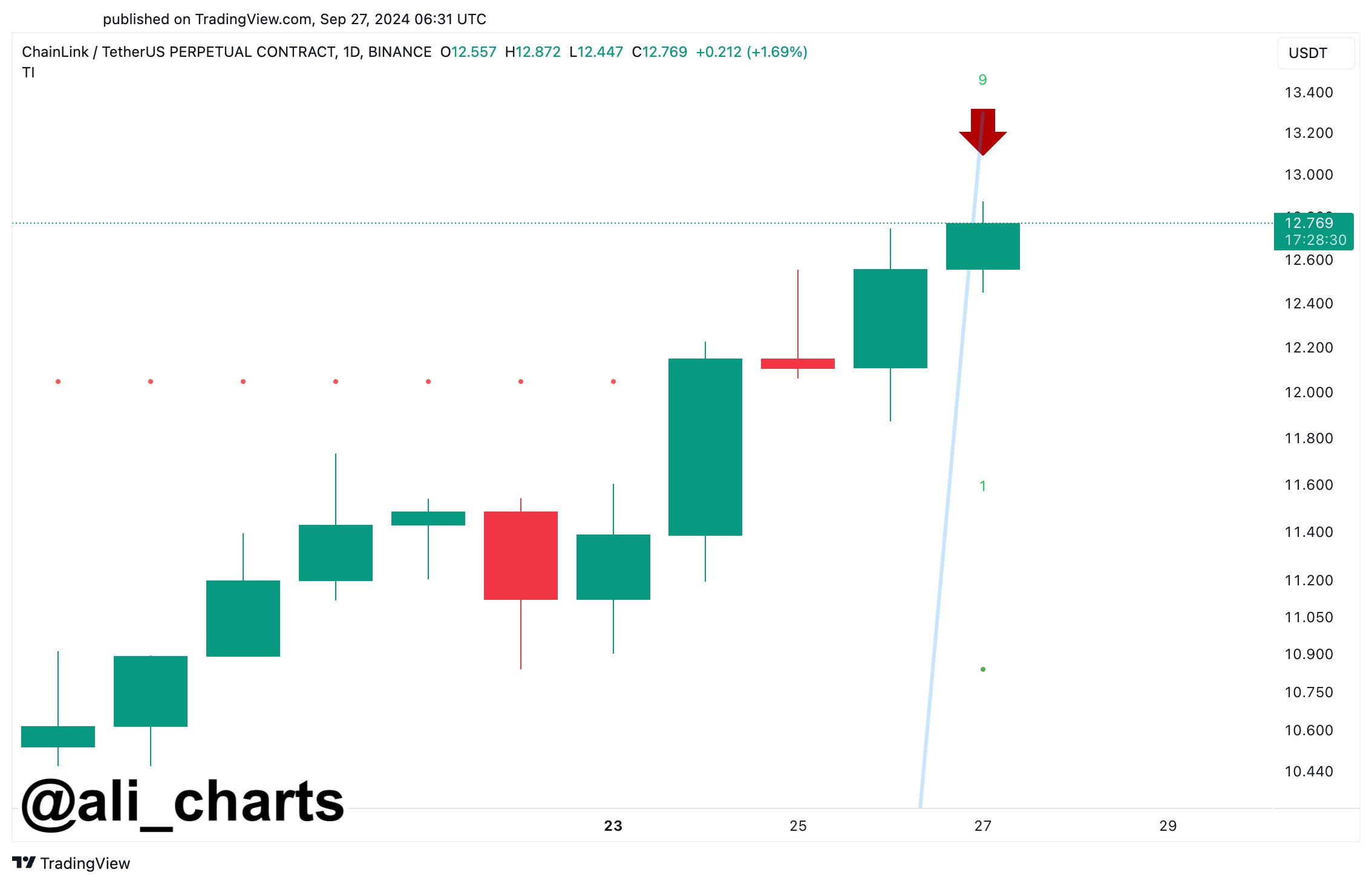

Conversely, Martinez points out that the Tom DeMark (TD) Sequential indicator has signaled a bearish signal on the daily chart of LINK, the underlying asset of decentralized oracle network Chainlink. The signal indicates the possibility of a simple correction.

Traders use the TD Sequential indicator to predict a potential trend reversal in a token based on the closing prices of the previous 13 bars or candles.

LINK is trading at $12.72 at the time of this writing. The 17th-largest cryptocurrency asset by market capitalization is up more than 1% in the past 24 hours.

Don’t miss a beat – subscribe to get email alerts delivered straight to your inbox

Check Price Action

follow us XFacebook, Telegram

Daily Hodl Mix Surfing

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that your transfers and transactions are entirely at your own risk and you will be responsible for any losses you may incur. The Daily Hodl does not recommend the purchase or sale of any cryptocurrency or digital asset, and The Daily Hodl is not investment advice. The Daily Hodl engages in affiliate marketing.

Image created by: Midjourney