- Solana faces the main resistance of $ 135 and $ 144, with almost 5%of the total supply.

- Major support of $ 112 and $ 126 can stabilize prices, but relaxation of $ 94 can cause a sharp drop.

SOLANA (SOL) traders and investors closely keep the latest warm chain data as assets explore the important price levels.

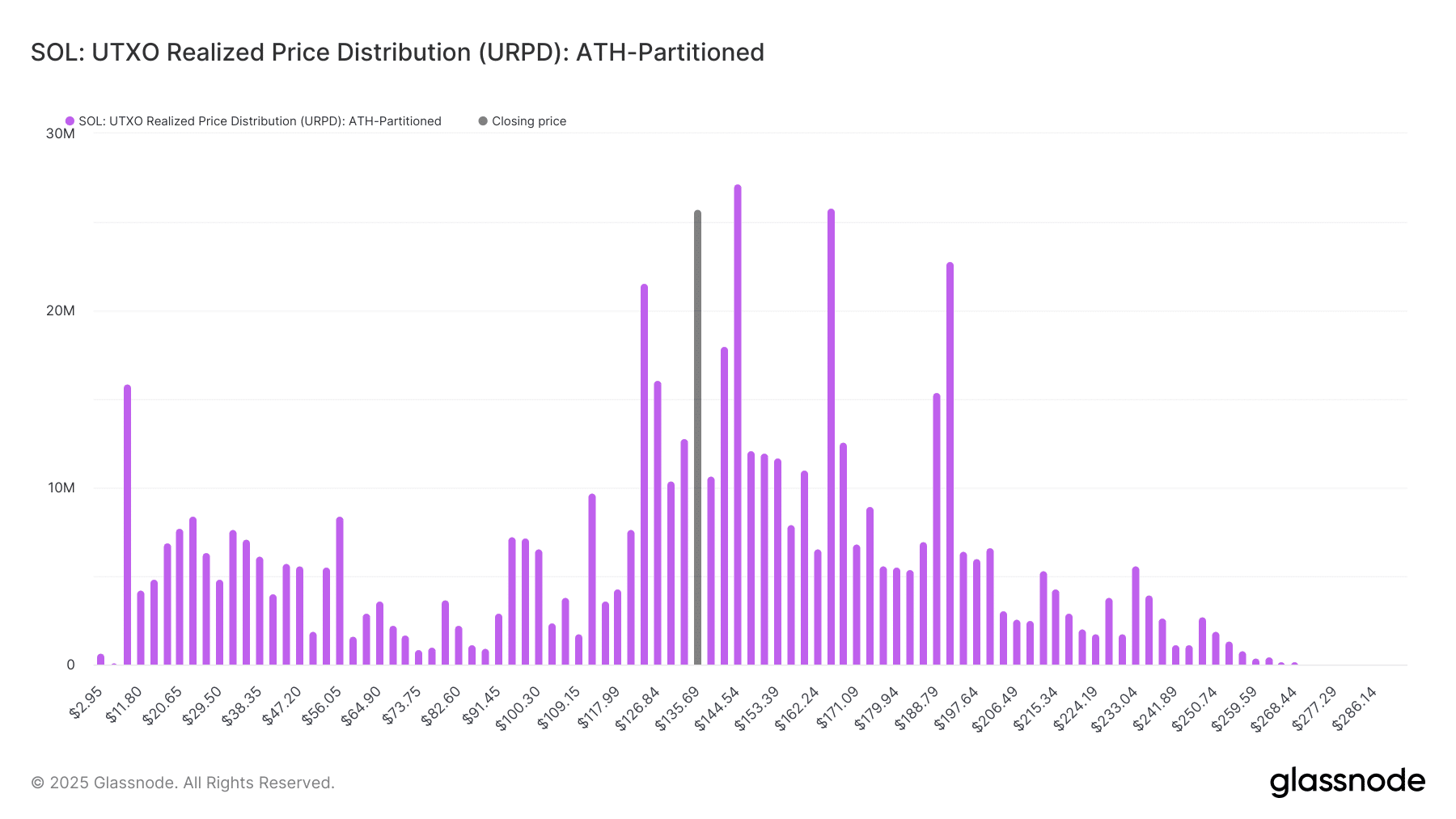

UTXO realization price distribution (URPD) emphasizes significant supply concentrations at various prices, providing insight into potential support and resistance zones.

As an attempt to stabilize the sole, understanding these important levels can help you predict the next movement.

Solana accumulation and support area

One of the main accumulation areas of Solana About $ 112.10 is about 9.7 million SOL or 1.67%of the total supply.

As of January 19, this level already has about 4 million SOLs and indicates that long -term investors are strengthening their status.

Historically, such an accumulation area is often a strong support. Investors can protect their entry prices and limit further decline.

The level of additional support is about $ 94, $ 97 and $ 100, accounting for almost 21 million soles or 3.5%of circulation supply. If SOL experience downward pressure, this level can act as a critical price floor.

Under this range, the supply concentration is minimal up to $ 56. This lack of liquidity suggests that destroying less than $ 94 can lead to a rapid sale.

Resistance and sales pressure

In terms of resistance, a significant supply concentration exists at $ 135 and $ 144.

The $ 135 level has about 26.6 million Solana in its stake, and $ 144 has almost 27 million soles and accounts for almost 5%of the supply.

Source: Glass Node

This level is an important accumulation area before, and many investors can be sold at a quarterly price. This can lead to the formation of strong resistance.

In addition, URPD data recently emphasized the accumulation of $ 123 and $ 126, reflecting 16.2 million SOL (2.7%of supply) and 19 million soles (3.2%of supply).

As a result, these levels can act as a resistance point when it provides short -term stability and especially when the amount of upward exercise is weakened.

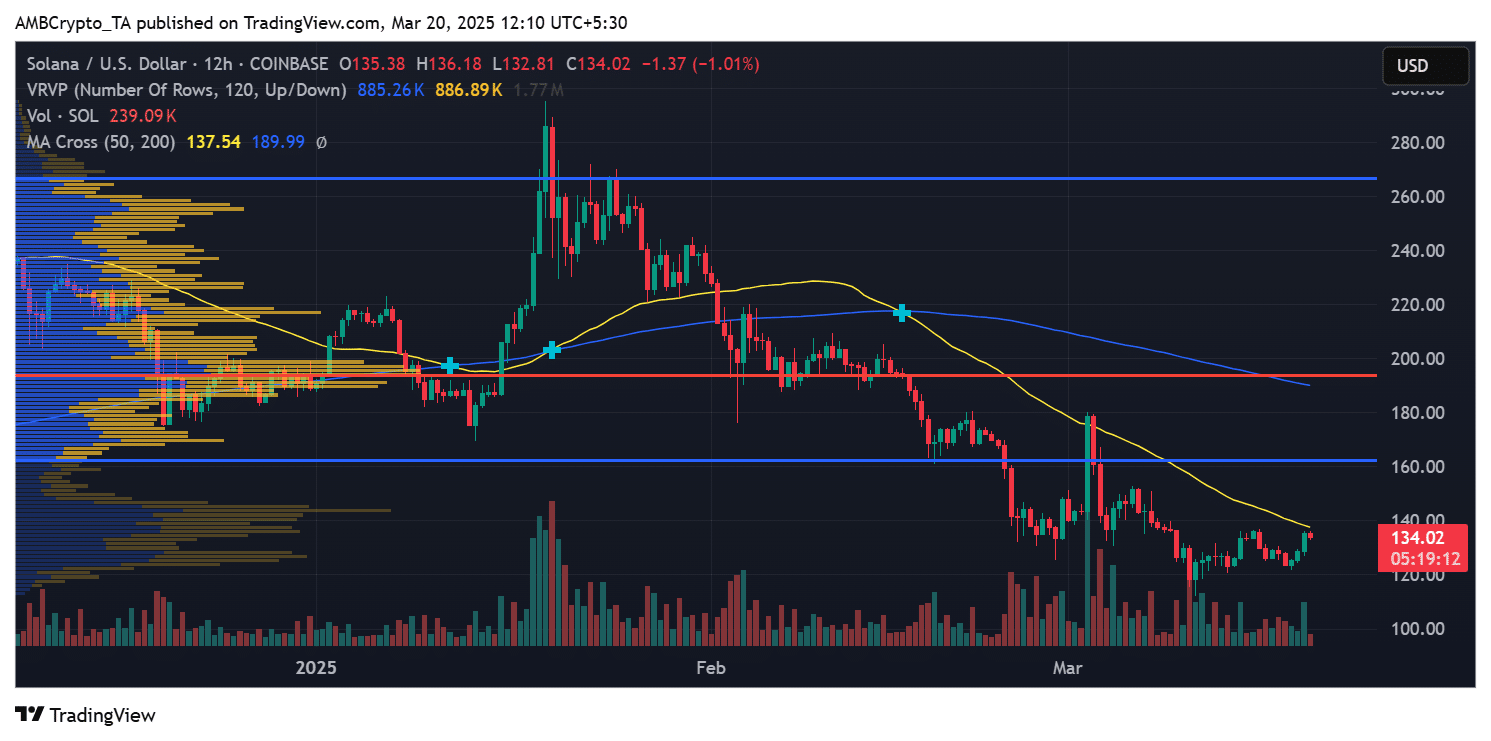

How SOL can trend

Solana’s current price behavior suggests the battle between the bull and the bear in this important supply area. If the purchase interest is maintained around the level of identification, the SOL can try to pursue the past resistance near 135- $ 144.

Source: TradingView

But if you don’t have more than $ 94, you can expose your assets to increase your risk of falling. The trader must carefully monitor the volume trends and fluid zones to measure the following important movements of assets.

By defining potential market behaviors, these supply concentrations will decide whether Solana can recover higher prices or face further retreat.