- ADA has surged 21.35% over the last 7 days and 2.5% over the last 24 hours.

- New developments such as whale activity and the Chang hard fork have changed market sentiment.

After a sustained downtrend, Cardano (ADA) has surged once again. At the time of writing, ADA has surged 21.35% over the past 7 days, with trading volume up 26.85% over the past 24 hours to $324 million.

According to CoinMarketCap, Cardano’s market cap has increased by 2.36% in 24 hours, reaching $14.3 billion. The question on every trader’s mind is why the sudden reversal occurred.

What’s Driving the Surge

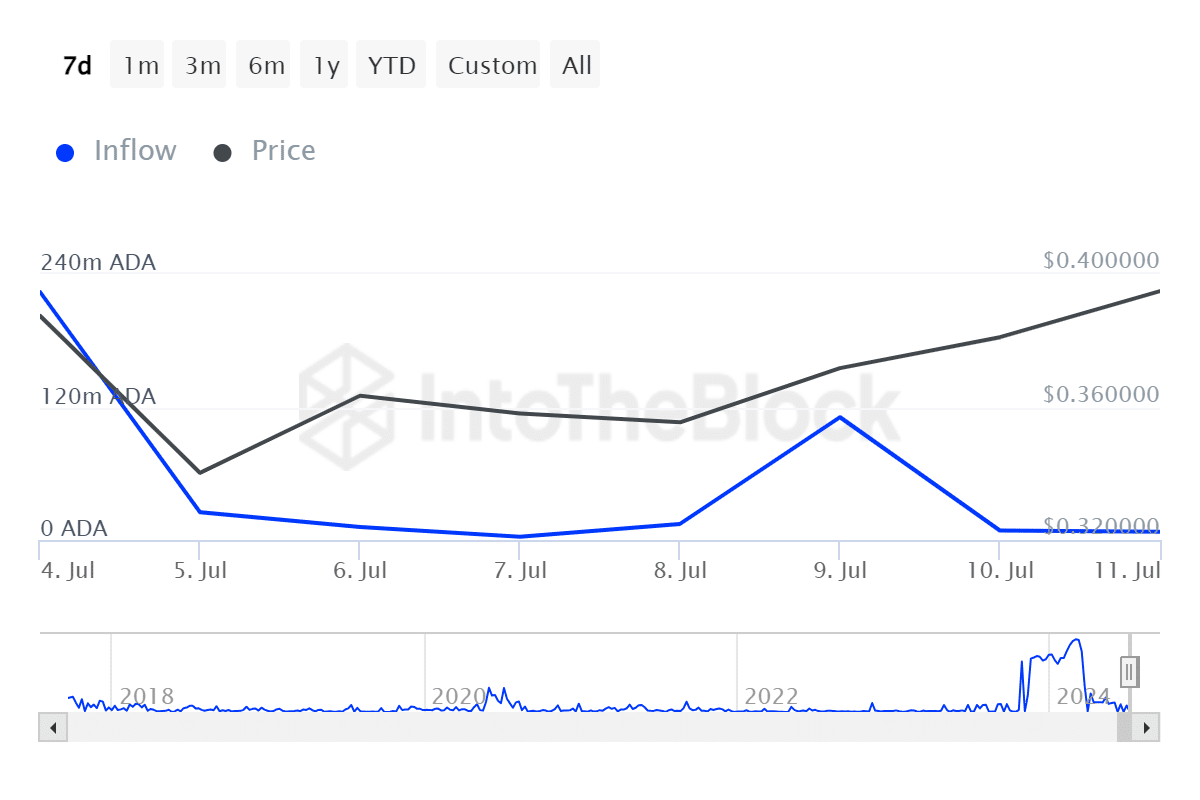

This surge has left traders and market analysts speculating on the cause. For one, ADA has experienced an exponential surge in whale activity over the past seven days.

According to AMBCrypto’s IntoTheBlock analysis, inflows from large holders increased from $14.51 million to $110.8 million between July 8 and 9.

That’s a 1,218% increase from its previous high of $223.8 million on July 4 to $25 million on July 5.

Source: IntoTheBlock

The increase in large purchases showed that investors were buying at lower prices in anticipation of future price increases. The surge in whale activity increased demand for altcoins, further pushing up prices.

Also on July 9, Charles Hoskinson announced the completion of the Chang hard fork. As development activity increases, investors are confident that Cardano will have a brighter future.

ADA: What the Price Chart Shows

According to AMBCrypto’s analysis, ADA was experiencing an upward momentum at the time of writing. The altcoin’s Chaikin Money Flow (CMF) was above zero at 0.07 at the time of writing.

A positive CMF indicates that buying pressure is continuing and buyers are dominating the market. Therefore, a positive CMF is a bullish signal, potentially indicating that prices can continue to rise.

Source: TradingView

Similarly, the Money Flow Index (MFI) is at 51, indicating increasing buying pressure and a bullish turn in market sentiment.

As the amount of money flowing into the altcoin increased compared to the amount flowing out, there was increasing buying interest in the market.

Source: TradingView

Cardano’s Relative Strength Index (RSI) is at 52 and the RSI-based MA is at 44, indicating a bullish bias at the time of writing. Therefore, the RSI above the moving average indicates that the bullish momentum is strengthening.

So the recent higher than average RSI indicates strong upward pressure.

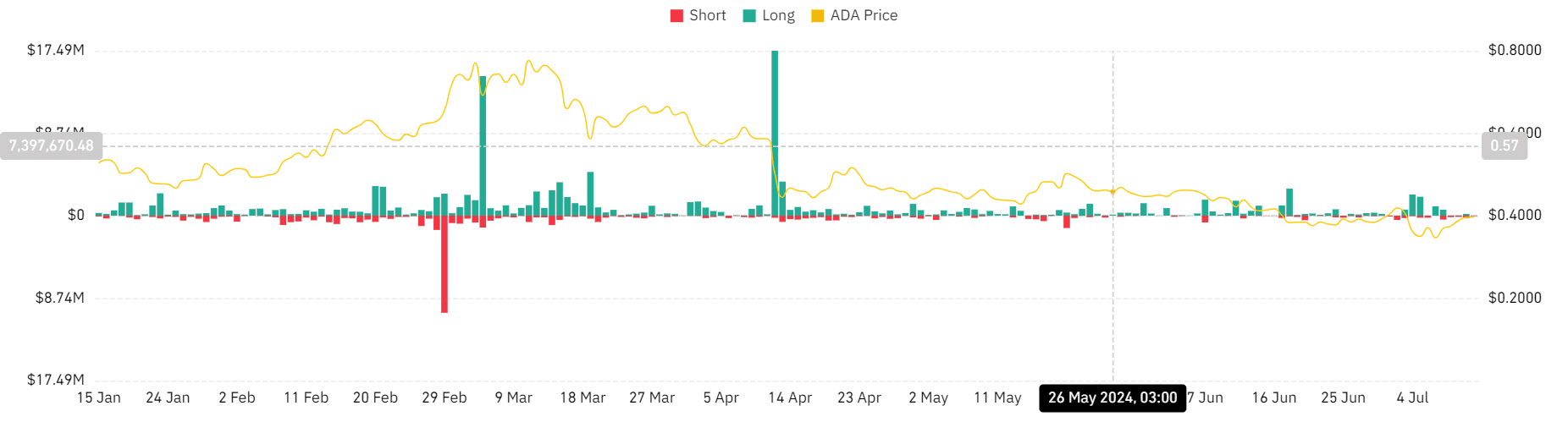

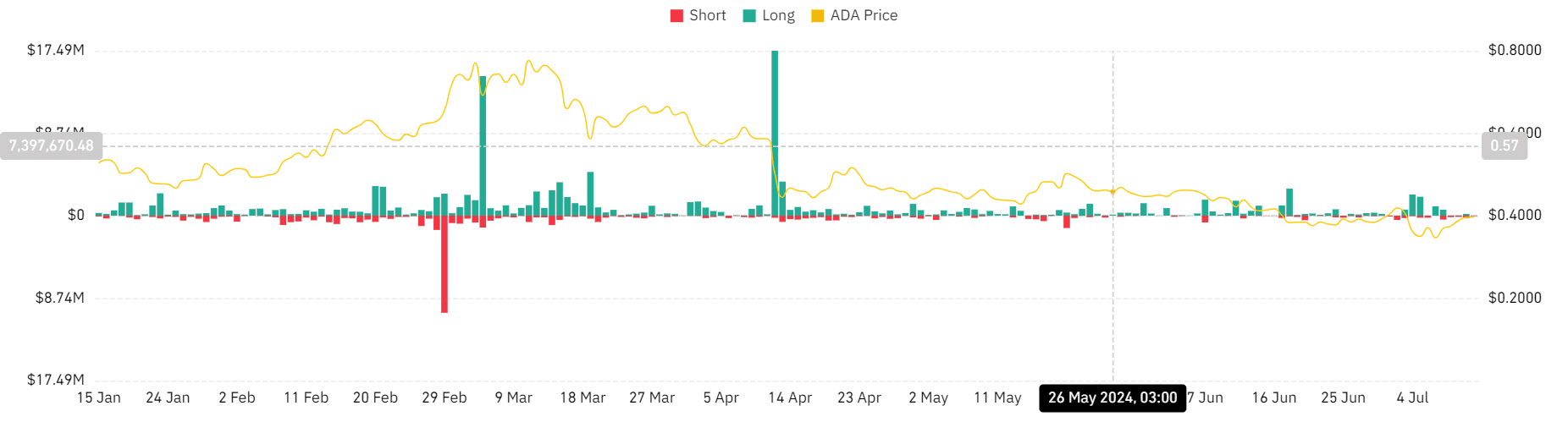

Source: Coinglass

Looking more closely, AMBCrypto’s Coinglass analysis shows that ADA short and long position liquidations have been decreasing over the past seven days. Long position liquidations have decreased from $2 million to $0 at the time of writing.

The downtrend suggests that investors are confident about the future potential of altcoins and have positive market sentiment.

How much will ADA soar?

ADA was trading at $0.40 at the time of writing after rising 2.5% over 24 hours. If the market sentiment of increased buying pressure leads to upward momentum, ADA could experience a short-term rally.

Is your portfolio green? Check out our ADA yield calculator

Therefore, the continued uptrend momentum will extend the price to the next resistance level of $0.457. A break above the above resistance level can push the price further to $0.521.

Therefore, if the daily chart closes below $0.385, the bullish outlook will reverse towards $0.362.