- ADA fell 21.78% last week.

- Cardano has seen market sentiment turn bearish as sellers dominate.

After hitting a recent high of $1.3 a week ago, Cardano (ADA) plummeted to a low of $0.911.

In fact, at the time of writing, Cardano was trading at $1.02. This represents a 12.25% decline on the daily chart. Prior to this, the altcoin showed an upward trend, rising 75.91% on the monthly chart.

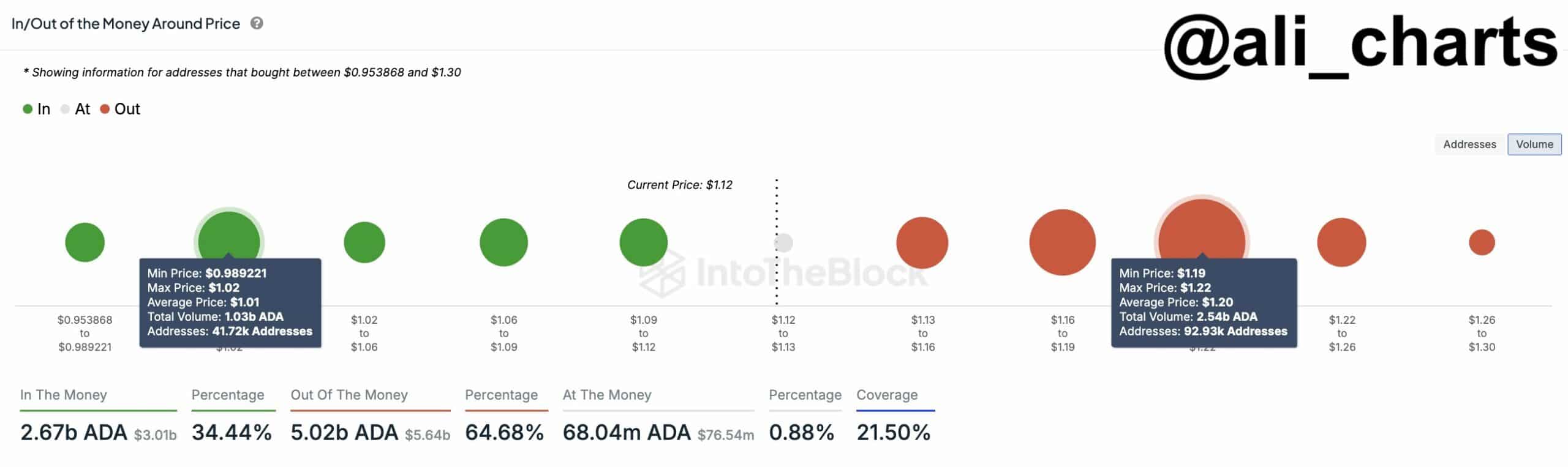

Recent market conditions have got analysts talking. One of them is Ali Martinez, who sees $1.2 as a critical support level.

market sentiment analysis

In his analysis, Martinez talks about Cardano’s support level being around $1.2, with 2.54 billion ADA tokens held in 93,000 addresses.

Source: X

According to him, a drop below this level risks falling below $1 until the altcoin finds another upward momentum.

But the analyst noted that the ADA is repeating its 2020 cycle. During this period, Cardano showed a strong rise from $0.141 to $1.547.

Therefore, a decline can create a buying opportunity and lead to a recovery. Martinez claimed that once it recovers, the ADA will reach between $4 and $6.

What the ADA Chart Says

Following last week’s sharp decline, analysis by AMBCrypto shows that Cardano has seen a change in sentiment from bullish to bearish as sellers dominate the market.

Source: TradingView

This dominance among sellers is evidenced by ADA’s Relative Strength Index (RSI) falling from 79 to 53. This suggested higher selling pressure in the market.

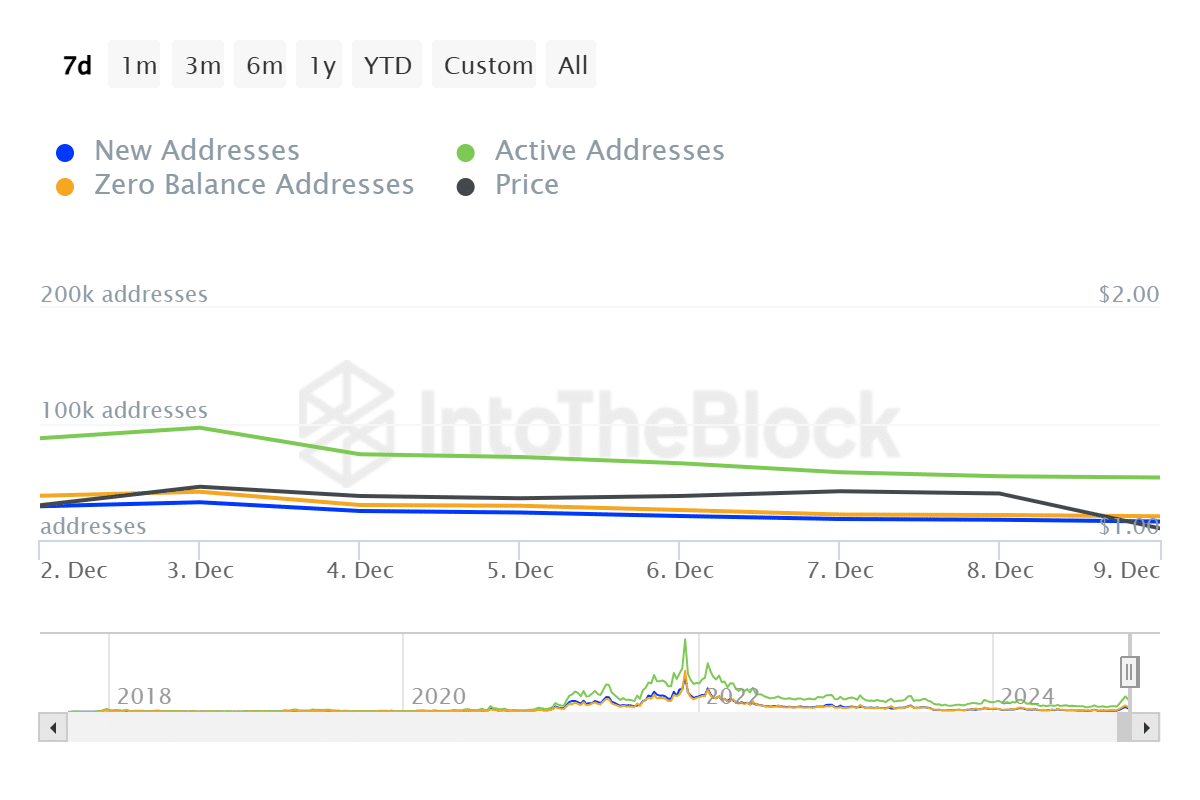

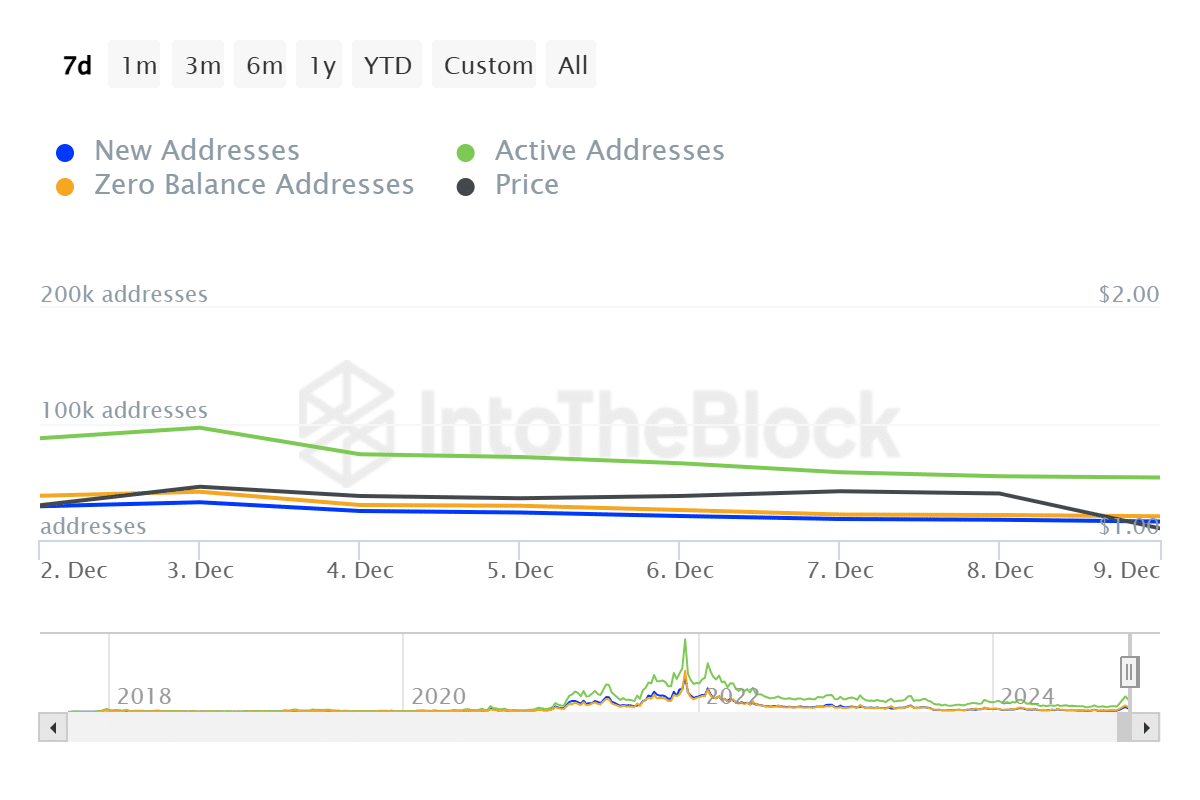

Source: IntoTheBlock

Additionally, Cardano’s active addresses decreased from 170.83k to 90.36k. A decline in active users reduces network usage, adoption, demand, and investor interest.

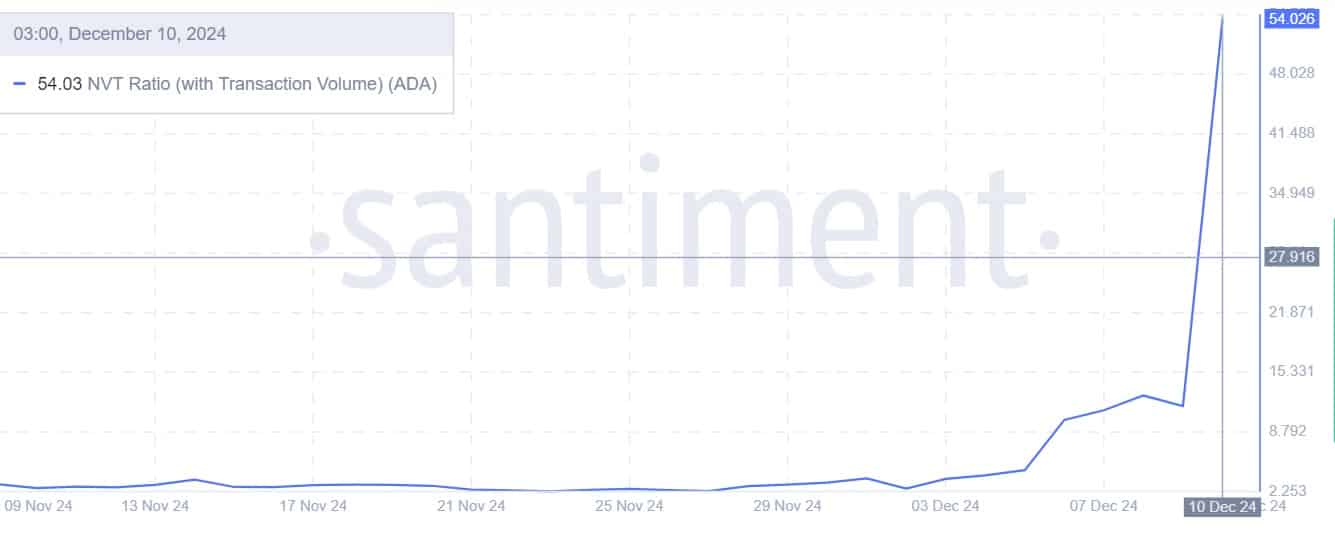

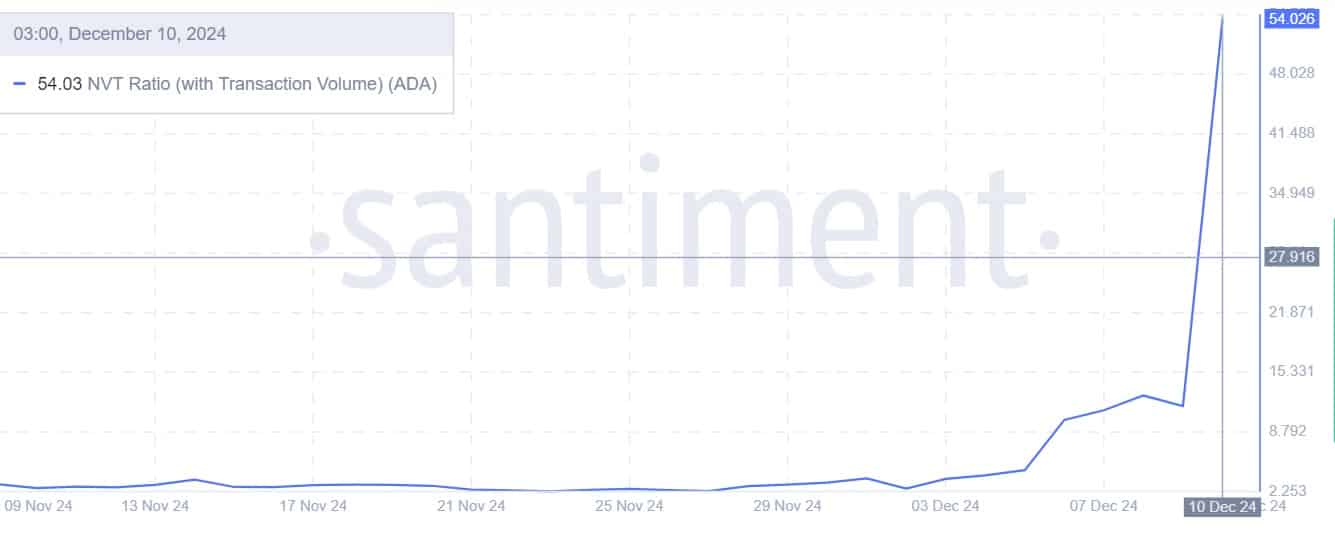

Source: Santiment

This decline in network usage is further accentuated by the recent surge in NVT rates (including transaction volume). The altcoin’s NVT ratio surged from 11.63 to 54.03, indicating that the altcoin’s market capitalization is growing faster than its trading volume.

Historically, high NVT ratios are associated with market highs or overbought conditions. Therefore, if trading volume cannot keep up, market speculation decreases and prices fall.

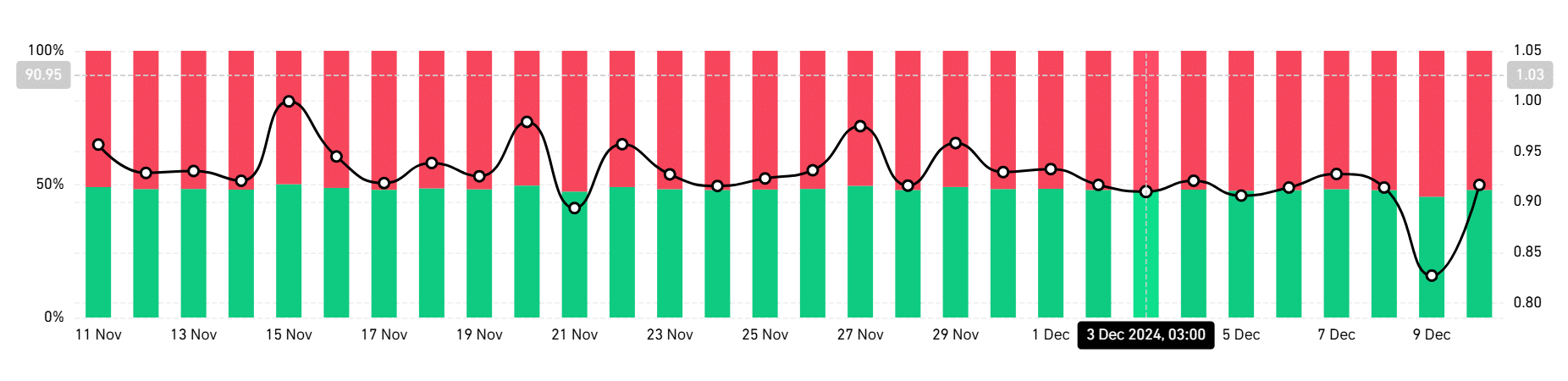

Source: Coinglass

Finally, a shift in market sentiment was seen as more investors continued to take short positions. According to Coinglass’ long/short ratio, short position holders hold 52% of the total. This suggests that most investors are betting on prices falling.

Read Cardano (ADA) price prediction for 2024-2025

Simply put, Cardano is currently in a correction wave and the altcoin could see further declines. If this negative sentiment persists, ADA could fall to $0.9, while bearish sentiment could push ADA to $0.77.

However, a trend reversal allows ADA to recover to the $1.2 level.