- ADA has surged more than 15% in the past week, with technical charts showing signs of a bullish reversal.

- The increase in active addresses and increased public interest indicates that interest in the ADA is growing.

Cardano (ADA) has since experienced a notable price rebound. Long correction period Early this year. ADA has experienced a significant downward trend since hitting its highest of the year above $0.77 in January.

However, in the past week the asset has surged more than 15% and this bullish trend has been extended over the past 24 hours, with the stock now trading at $0.41, up 2.6%.

Potential Advantages of ADA

This rise has caught the attention of the Cardano community, with analysts now assessing whether this movement is sustainable or just a short-term bounce.

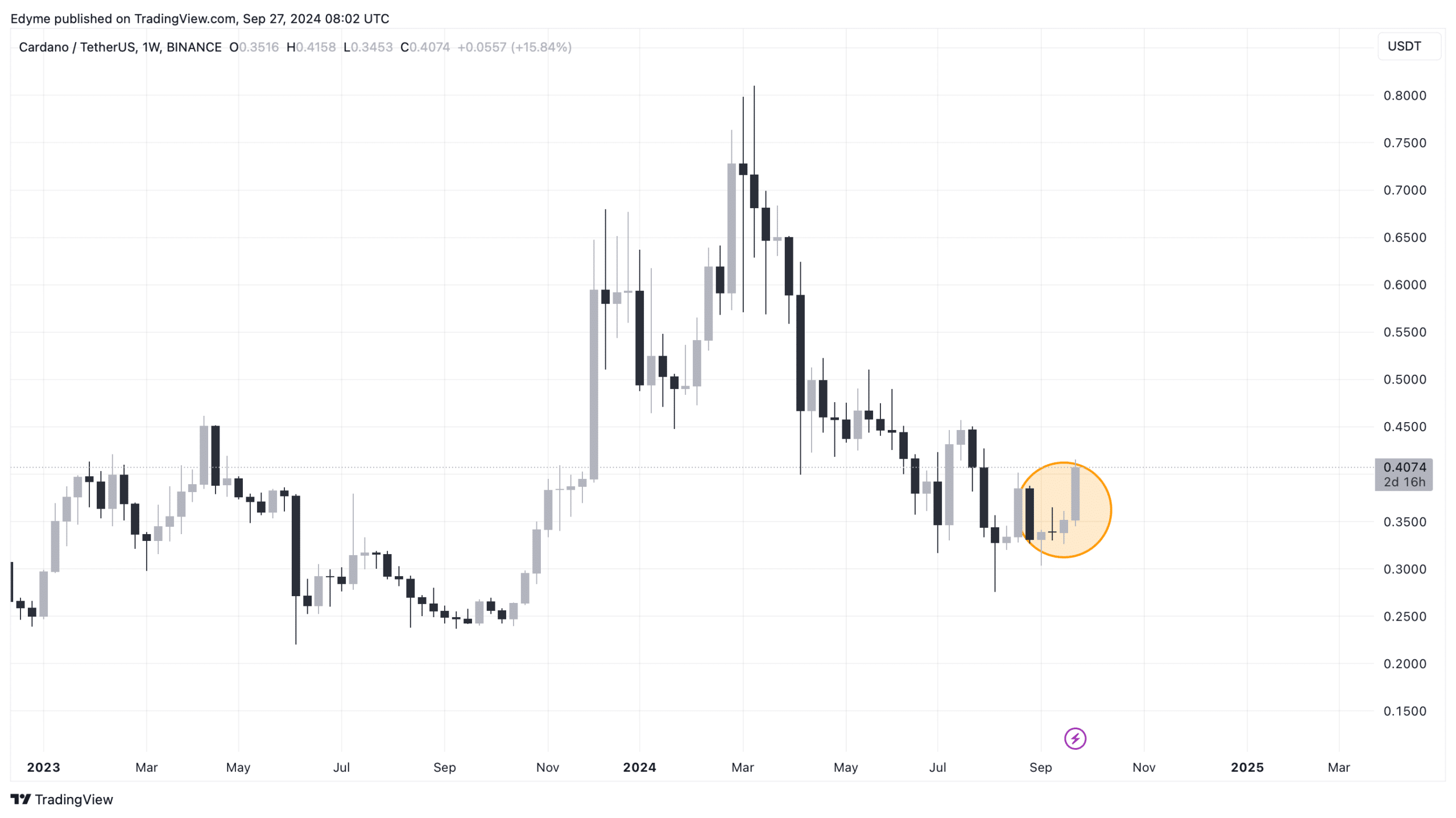

A closer look at ADA’s weekly price chart reveals important bullish signals. A bullish candlestick pattern has formed on the chart, appearing behind an inverted Dragonfly Doji.

Source: ADA/USDT on TradingView

This pattern is traditionally considered an important reversal indicator, indicating that the downside correction may be concluding and the price may move higher.

The presence of this pattern indicates the potential for continued upward momentum for ADA, hinting at the potential for a long-term rally.

Backed by the basics

From a technical perspective, ADA’s rally looks set to continue.

However, it is essential to cross-check these signals with the underlying fundamentals to determine whether this bullish momentum is supported by solid market factors.

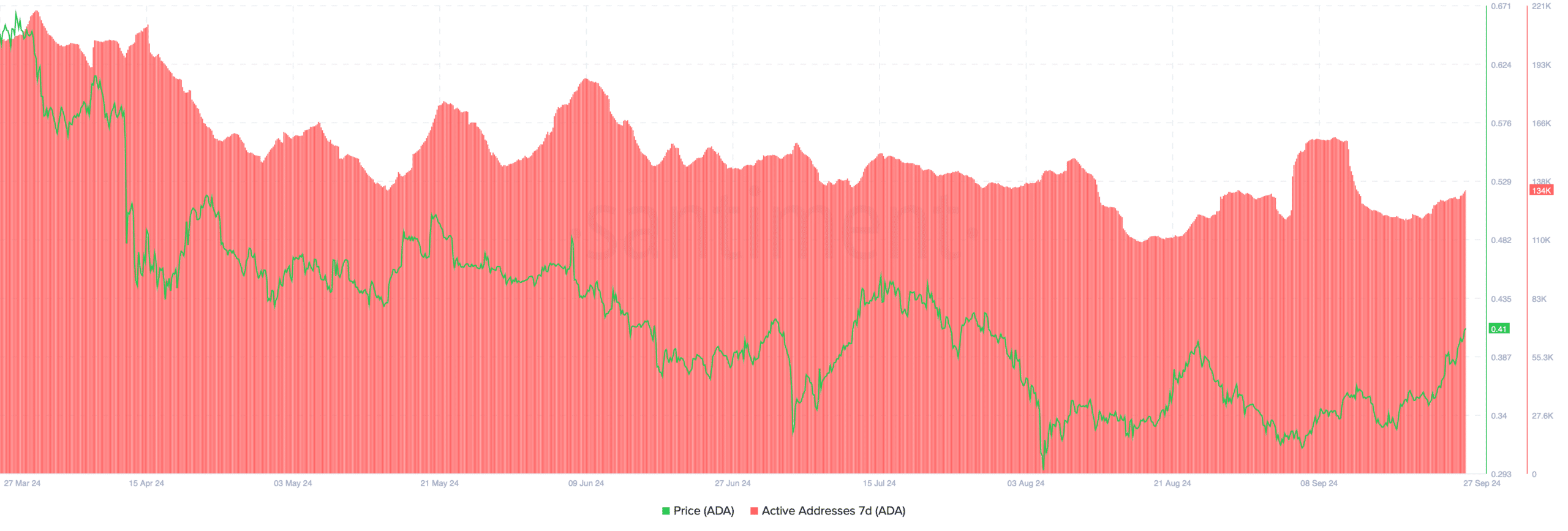

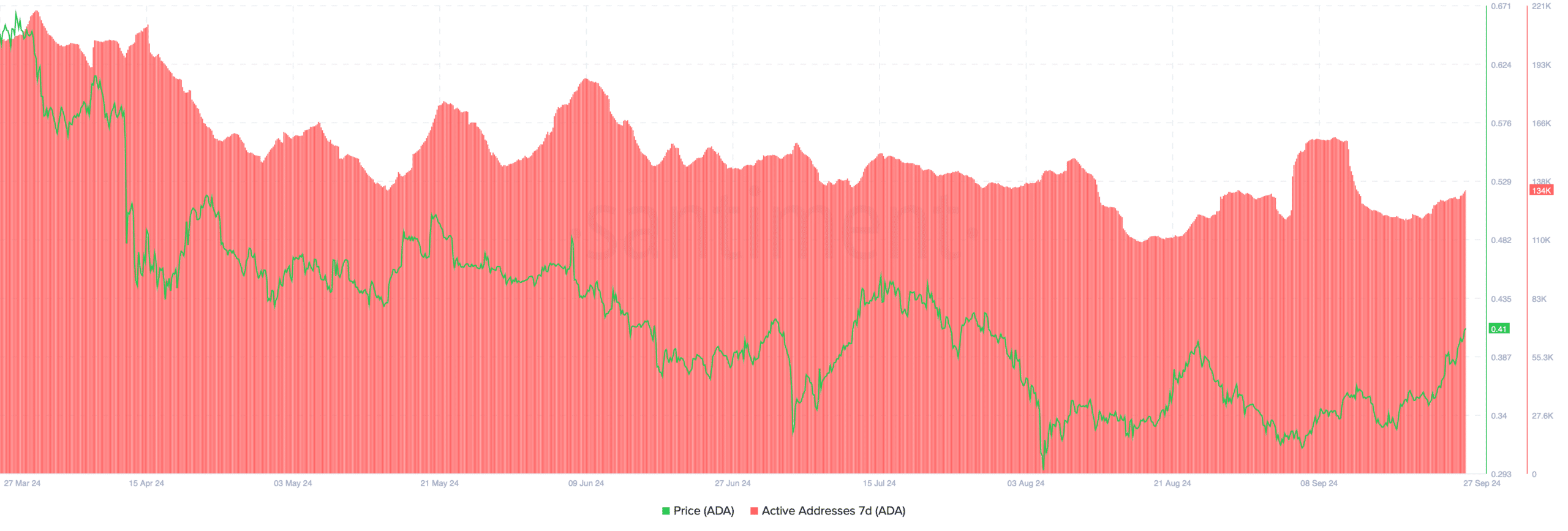

A key indicator to consider is ADA’s retail interest, as measured by the number of active addresses.

According to data The number of active addresses for ADA on market intelligence platform Santiment has recently increased.

Earlier this month, the metric hit a high of over 150,000 active addresses, but later fell to 120,000. However, recovery efforts are currently underway and the number of active addresses exceeds 130,000 at press time.

Source: Santiment

This increase in active addresses suggests renewed retail interest in ADA and could indicate increased transaction activity and demand.

A rise in active addresses is often associated with increased buying pressure and can lead to positive price action for an asset.

If this trend continues, it could strengthen ADA’s current upward momentum and support the possibility of a sustained rally.

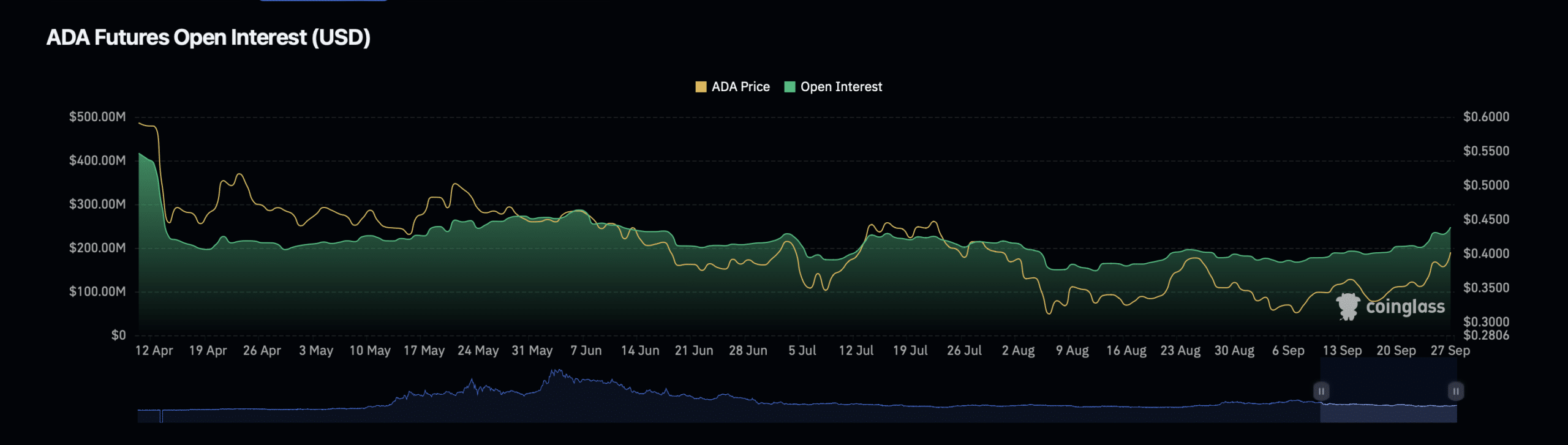

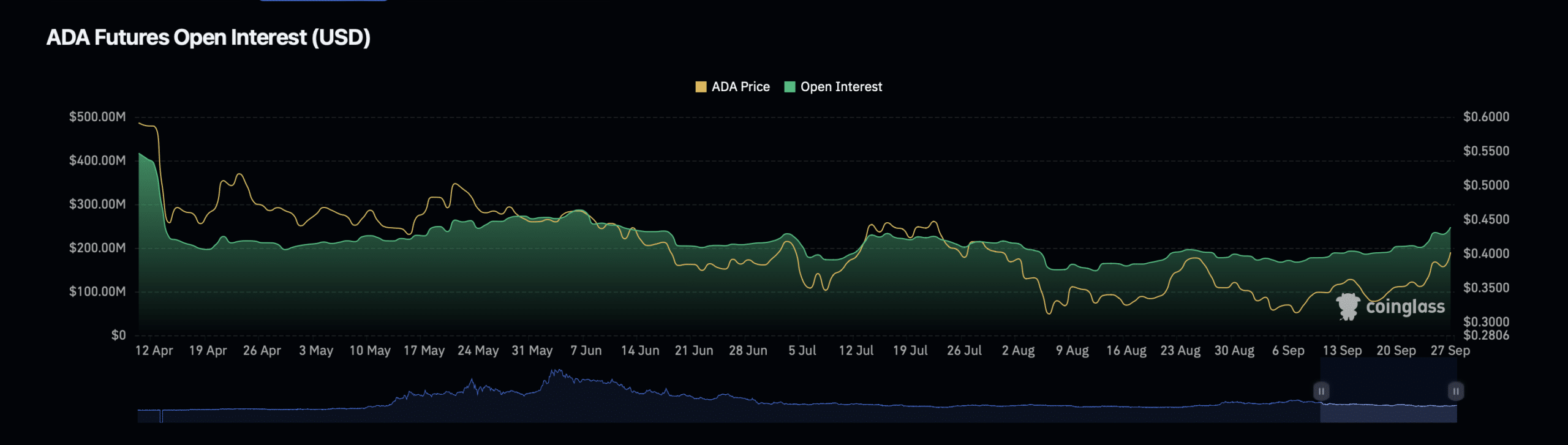

Another important indicator contributing to a potential bullish trend in ADA is open interest, which reflects the total number of open contracts in the futures market.

data According to data from Coinglass, ADA’s open interest increased by 6.77% to a value of $255.04 million.

This increase in open interest is reflected in an increase in open interest trading volume, which has surged 57.87% to $442.38 million at press time.

Source: Coinglass

Read Cardano (ADA) price prediction for 2024-2025

An increase in open interest along with a rise in price is generally considered a sign of confidence among traders, suggesting that new money is entering the market.

This scenario is consistent with the possibility of continued price increases. This is because more capital flowing into the ADA futures contract could amplify price movements and extend the current rally.