The OpenAI deal sent AMD shares soaring 30% and sparked a rally across the AI mining sector.

OpenAI’s deal to buy tens of billions of dollars in AMD processors will boost the chipmaker’s stock price by 30% and increase the number of AI-connected miners across the market.

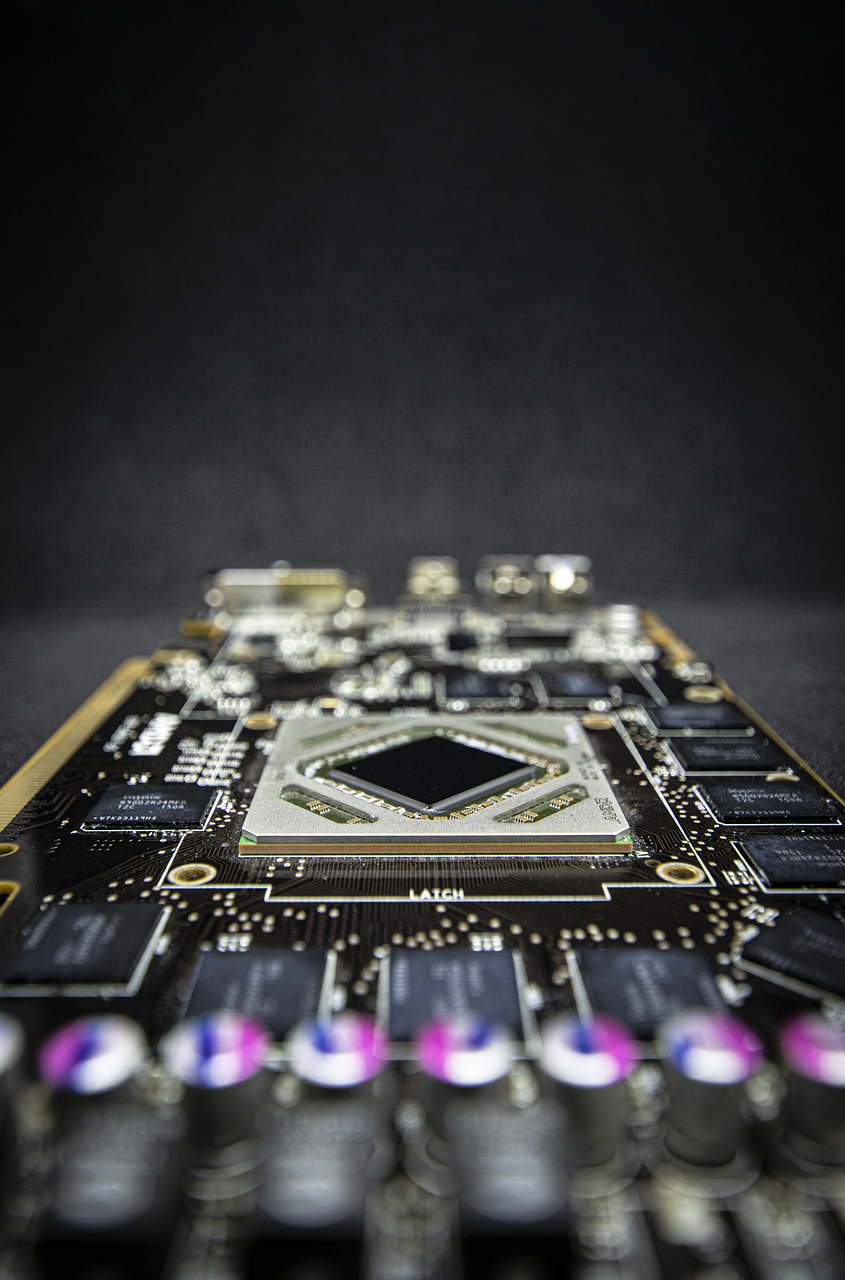

OpenAI has agreed to buy tens of billions of dollars worth of computer chips from Advanced Micro Devices (AMD), sending the chipmaker’s shares soaring 30% and sparking a rebound across the artificial intelligence (AI) and high-performance computing (HPC) sectors.

AMD surges multibillion-dollar chip deal with OpenAI as AI miners see double-digit profits

According to the Financial Times, the deal could allow OpenAI to acquire up to a 10% stake in AMD over time. AMD’s stock price rose to around $225 following the announcement. The chips acquired under the deal are expected to provide a total of 6 gigawatts of computing power capacity. OpenAI executives estimate development costs per gigawatt of capacity are approximately $50 billion, including both chips and supporting infrastructure.

The agreement has sparked gains across AI-related and Bitcoin mining companies, which often benefit from the expansion of key infrastructure in the computing sector. In Monday’s US trading session, Bitfarms rose 8%, IREN rose 12% to a record $56, Hive Digital rose 12%, Cipher Mining added 7%, CleanSpark rose 5% and TerraWulf rose 5%.

Galaxy Digital, which converted its Helios Campus into a large-scale AI and HPC data center, also benefited from this rally. In August, the company secured $1.4 billion in financing to upgrade the facility and signed a long-term lease with CoreWeave that guarantees up to 800 megawatts of computing capacity. Galaxy shares rose 5% on Monday following AMD’s announcement and the launch of its new GalaxyOne wealth management platform, which offers an FDIC-insured cash account with a 4% return and automated investments in cryptocurrencies and U.S. stocks.

Galaxy Digital’s stock price has now risen 116% since the beginning of the year.