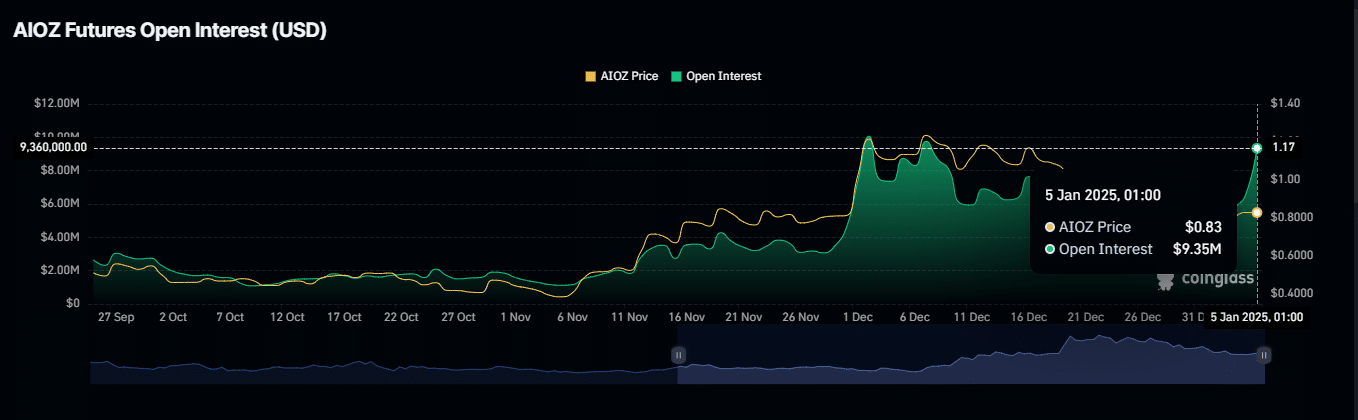

- There was a significant surge in open interest and trading volume, suggesting the potential for further gains.

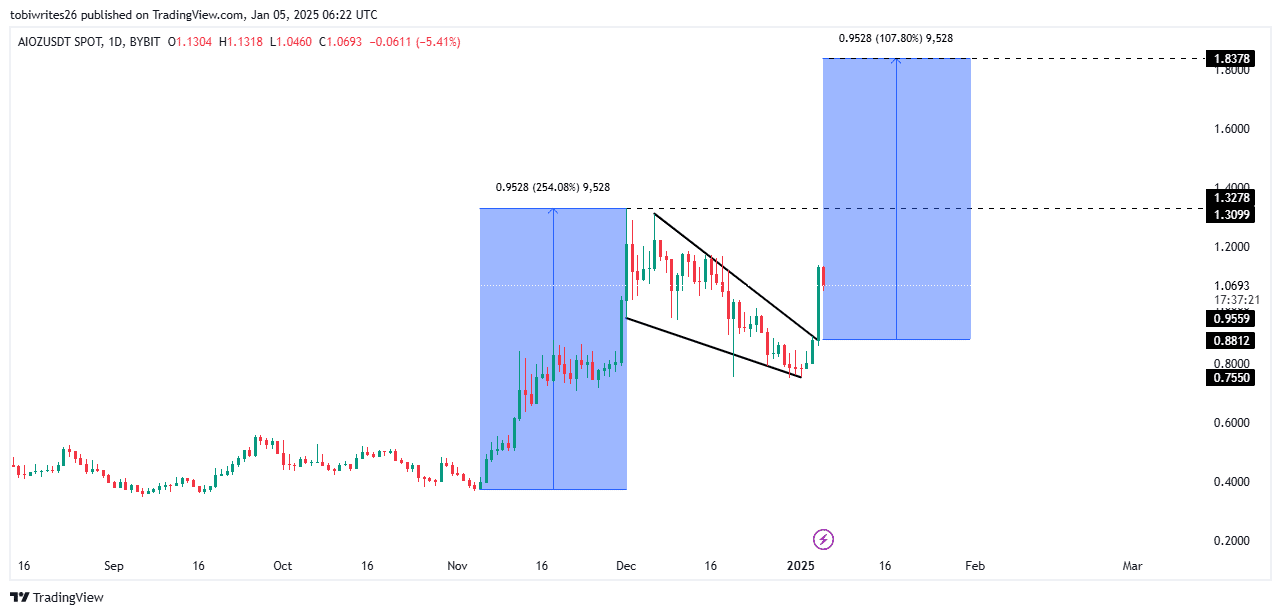

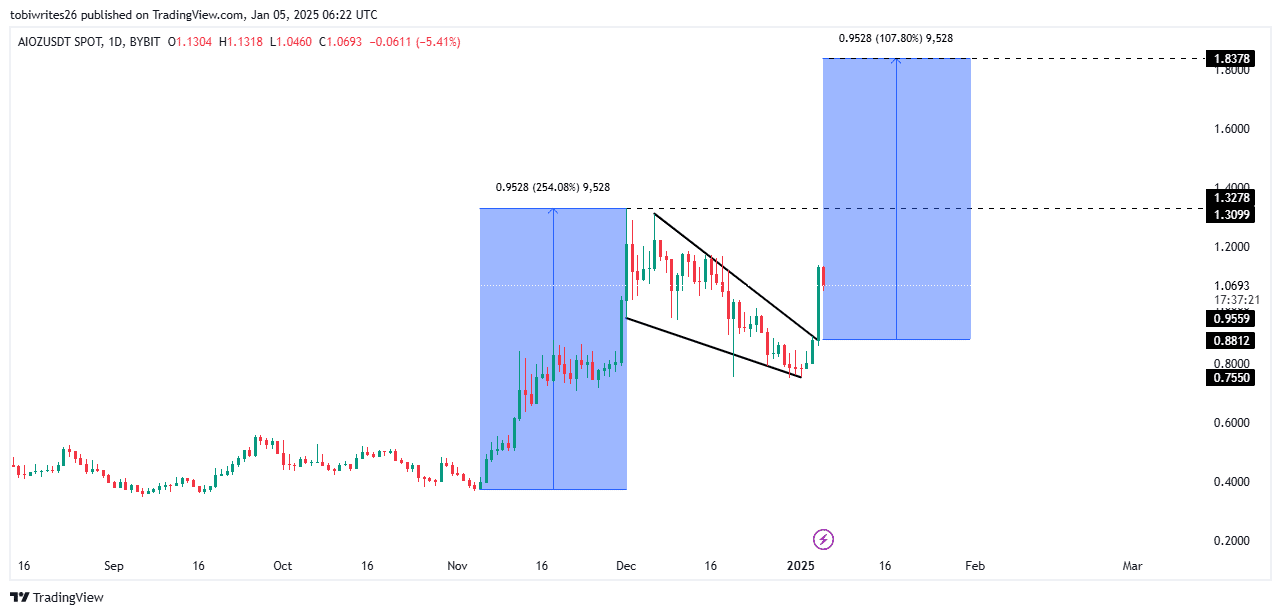

- On the chart, AIOZ was trading within a bullish flag pattern, which is usually a harbinger of a continued upward move.

AIOZ Network (AIOZ) price is up 21.75% in the last 24 hours, reducing its monthly loss to 7.86%. During the same period, market capitalization also increased by 21.77%, reaching $1.22 billion.

With the bullish momentum intact, AIOZ appears poised for even more growth.

AIOZ builds major momentum

AIOZ has attracted strong market attention over the past 24 hours, with key metrics highlighting increasingly bullish sentiment.

Derivatives open interest increased 27.47% to $9.35 million, reflecting increased trading activity. Although this alone does not confirm optimistic intentions, a simultaneous surge in both volume and price is indicative of positive sentiment.

Source: Coinglass

AIOZ’s trading volume surged 445.98% (4.4x increase) to reach $18.01 million, coinciding with a notable price rise.

Additionally, according to Coinglass, the funding ratio, a key indicator of market positioning, rose to 0.0282%, signaling continued bullish interest. As market activity increases, funding rates may increase further.

The bullish flag positions AIOZ to rise to $1.8.

AIOZ’s recent gains come from breaking out of a consolidation phase within a bullish flag pattern.

During the consolidation phase, prices often fall within a limited range, allowing buyers to accumulate assets to create a breakthrough.

Source: TradingView

For AIOZ, price range analysis shows that the asset is poised for a potential return of 107.80%, with an ultimate target of around $1.84.

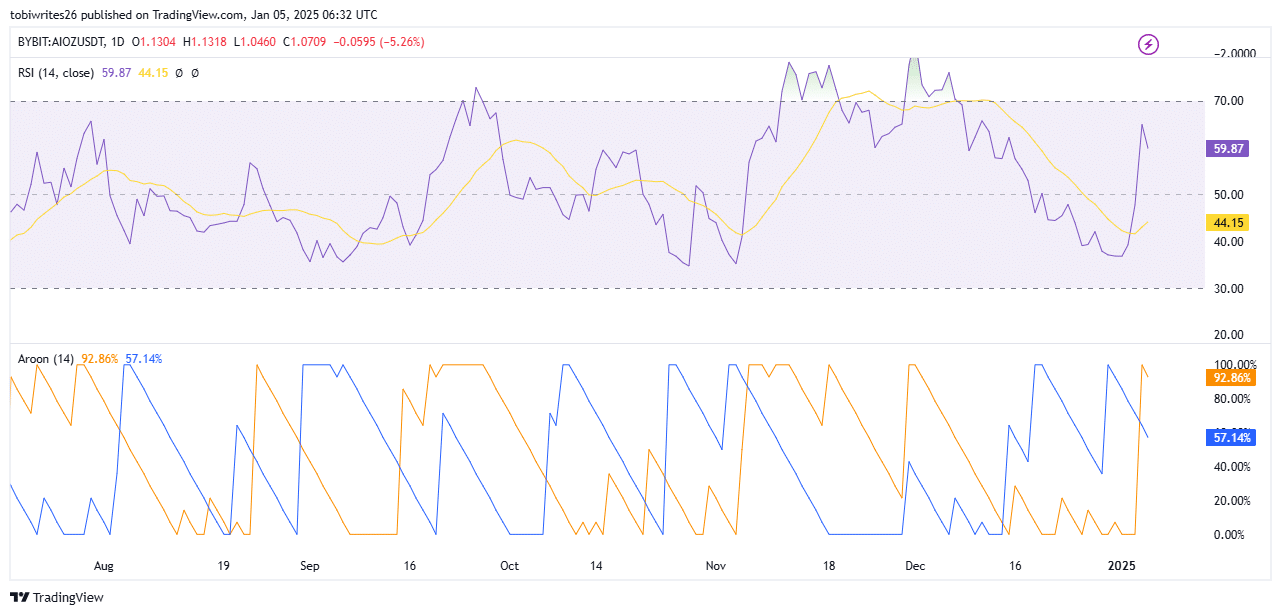

Since starting its uptrend, AIOZ has remained firmly in bullish territory as confirmed by technical indicators, suggesting that the rally is gaining steam.

More room for upside

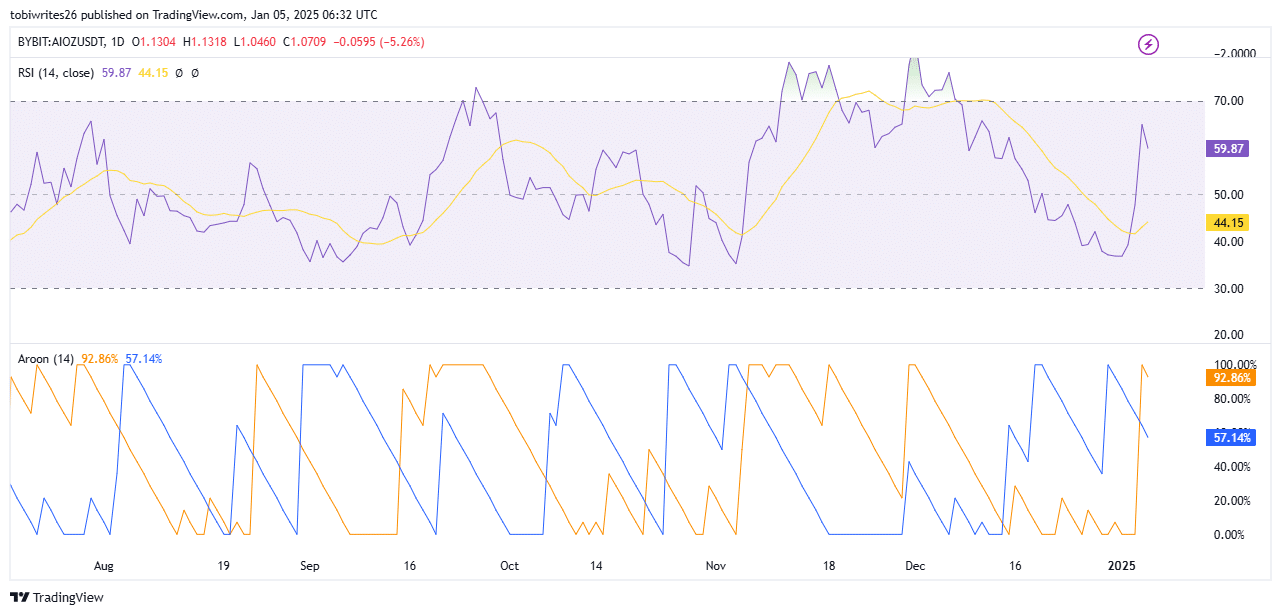

The Relative Strength Index (RSI) is currently at 59.87, remaining firmly in bullish territory, well above the neutral level of 50.

As a measure of price momentum, RSI above 50 signals that the momentum driving the ongoing price surge is strong and favors further upside.

Source: TradingView

The Aroon indicator supported this outlook with Aroon-Up at 92.86% and Aroon-Down at 57.14%.

Read AIOZ Network (AIOZ) price prediction for 2025-2026

When Aroon-Up significantly outpaces Aroon-Down, it indicates a strengthening bullish trend with room for further upside.

These indicators suggest that AIOZ could experience notable gains in the coming trading sessions.