Altcoin/BTC Spot Trading Pairs was once considered a key channel for investors to increase Bitcoin stake. But this awareness is disappearing. The data shows a decrease in interest by listing many Altcoin/BTC pairs in early 2025.

Meanwhile, Altcoin/USDT Spot pairs are the primary way for traders who are pursuing profits.

Binance rejects multiple altcoin/btc spot pairs

In early 2025, Binance removed several Altcoin/BTC spot pairs from the platform. Today Binance has a low liquidity and low trading volume, which has announced listings of MDT/BTC, MLN/BTC, VIB/BTC, VIC/BTC and XAI/BTC. This is not the first announcement this year.

Binance said, “To protect the user and maintain the high -quality trading market, Binance can conduct regular reviews on all semi -store trading pairs and reject the chosen point transaction pairs due to various factors such as poor liquidity and trading volume.

Since the beginning of the year, Binance has announced seven listing announcements, influencing 34 spot trading pairs. 50%of these were Altcoin/BTC pairs and the rest were altcoin/eth or altcoin/bnb. In particular, it does not mean that the listing of the Altcoin/BTC pair is necessarily removed (e.g. ENJ, C98, Rez).

This change reflects the preference of a trader for Altcoin/Stablecoin pairs because of improved liquidity and low risk exposure.

Retail investors reduce Bitcoin holding while the institution is accumulating.

According to encryption data, retail investors have reduced their stake in BTC since the fourth quarter of 2024, and large -scale investors continue to accumulate.

“The sleeves are panic sales. Whales are accumulated, ”said Mister Crypto.

Since the approval of Bitcoin ETF and Trump’s new terms, Bitcoin has become a playground for institutional investors. The retail trader seems to be less interested because the high price of the BTC does not reach a lot of people. Instead, they have fewer BTCs, assigning more capital to Altcoin, especially memes coins.

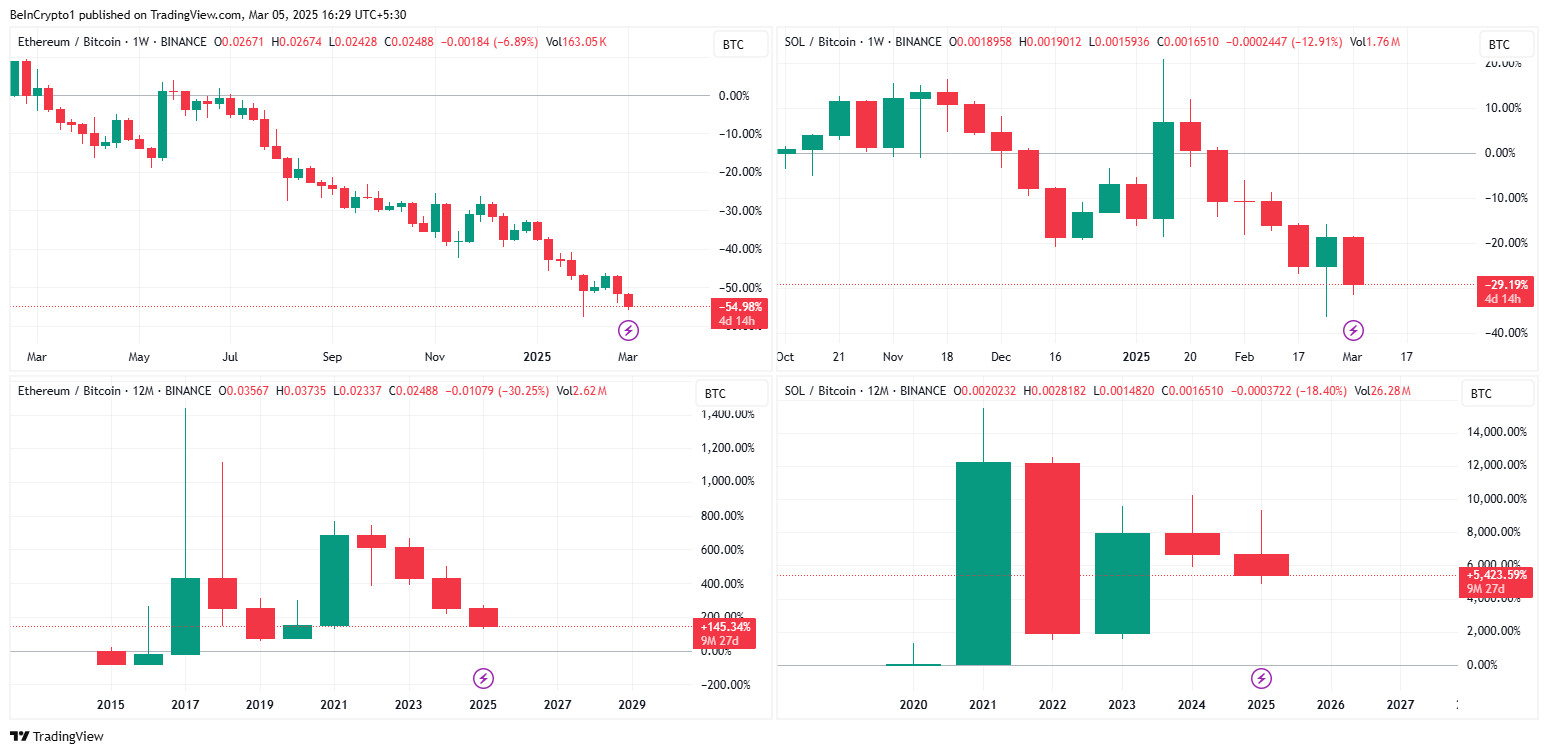

In addition, trading Altcoin/BTC pairs will be exposed at the same time at the same time, the trader, which is the volatility of Altcoins and Bitcoin. Even the largest number of liquid pairs, such as ETH/BTC and SOL/BTC, showed long -term decline and high volatility, increasing the risk of loss.

Market analysts also tend to focus on Altcoin/USDT Spot pairs, and Altcoin/BTC pairs pay less attention.

According to CoinmarketCap data, USDT’s daily trading volume exceeds $ 115 billion out of $ 147 billion in total market trading volume. This confirms that USDT remains a basic channel for traders looking for opportunities.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.