- Bitcoin’s dominance is strong, but Hold Altcoin conditions represent potential rebounds.

- The Altcoin seasonal index is extremely low and suggests that Altcoins can be prepared for recovery.

Since early 2025, Bitcoin (BTC) has darkened the market, drawing liquidity from Altcoin and leaving a long slum.

The main indicator now suggests that this trend can reach an inflection point. The Altcoin seasonal index has plunged to a low level of historically, suggesting in extreme overall acid conditions.

Do you have a long -awaited resurrection on the horizon with a momentum that keeps Bitcoin’s dominance but represents the signs of fatigue?

2025: Bitcoin year

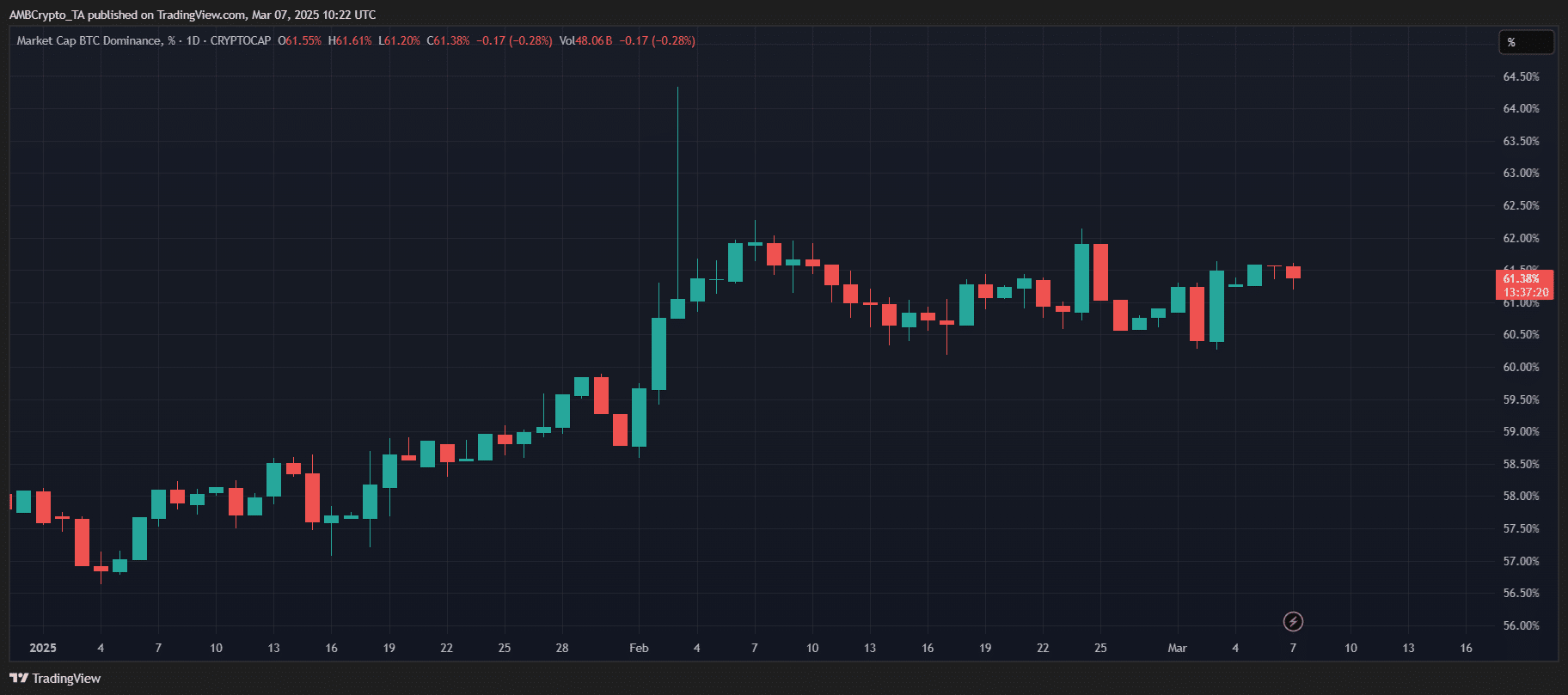

BTC.D (Bitcoin Dominance) has risen steadily since early 2025, emphasizing a strong impact on the encryption market. BTC.D has reached about 57% for a year and reached more than 64% by early February.

This rise was matched with Bitcoin’s rally, attracting liquidity in Altcoins and strengthening market dominance.

Source: TradingView

Drop: What does ALTS mean?

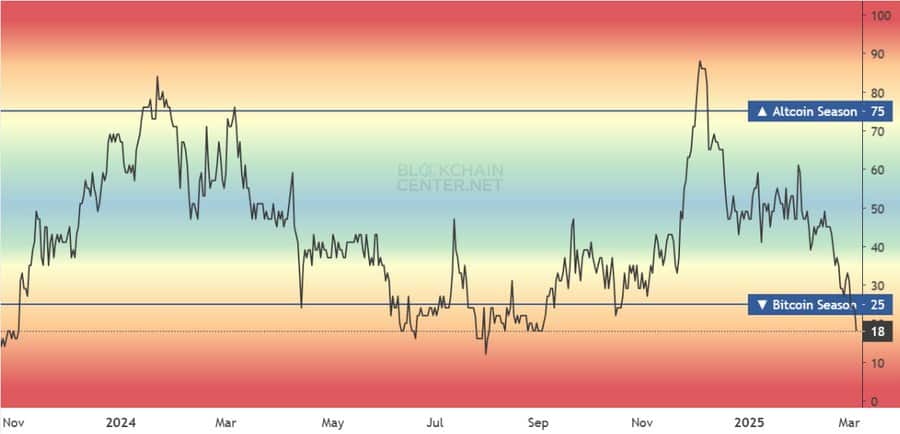

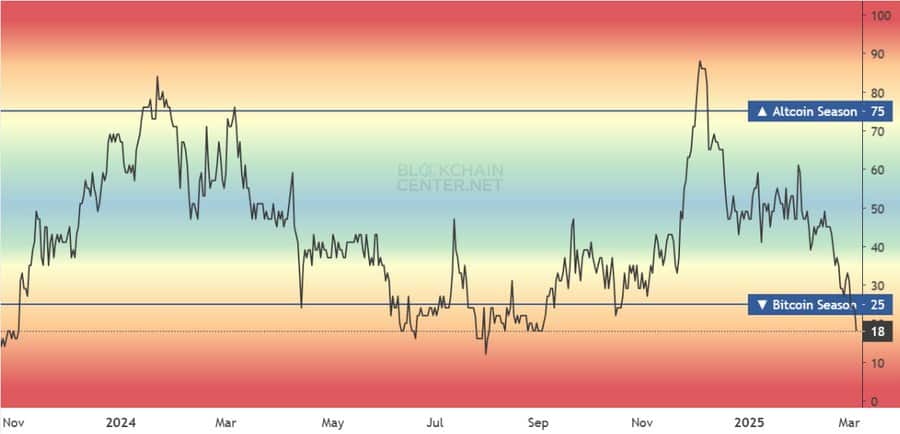

The Altcoin seasonal index has become close to the extreme lowest level since Bitcoin’s dominance began to surge in early 2025. In December 2024, the Altcoin indicator reached its peak, consistent with BTC.D’s temporary fullback.

Since then, however, Bitcoin has absorbed market liquidity and suppressed Altcoin performance.

Source: X

Historically, this deep recovery in the index showed an important inflection point, which bold conditions opened the way for the change of capital rotation.

While Bitcoin continues to trend, the current recession of Altcoin’s seasonality suggests a potential flooring step. If your feelings change, if your appetite is returned, you can set the stage of imminent recoil.

Altcoins: Going forward

Currently, the Altcoin seasonality index is 18 years old, and traders are seeing signs of reversal. Previously, in the early 2024 and mid -2023 levels, the previous dip was ahead of the strong ALT recovery.

But for real changes, Bitcoin dominance must show weaknesses and liquidity must flow back to Altcoins.

If Altcoins show stronger relative performance compared to Bitcoin, you can see the beginning of the relief rally.

However, careful optimism is recommended because external factors and recent regulatory development (many of these days) can continue to affect market epidemiology.

In other words, Altcoins suggests that Altcoins can soon recover and restore the lost land.