A widely known cryptocurrency analyst believes that a previously unnoticed altcoin is looking for a massive breakthrough.

Cryptocurrency trader Michael van de Poppe told his 722,400 followers on social media platform X that the Omni Network (OMNI), which aims to merge Ethereum’s (ETH) rollup ecosystem into a single, unified network, could soon surge by more than 16% from its current value and continue to rise.

“I am very interested in the new coins, especially those listed on Binance. OMNI is one of them and is due for a big breakout. It needs to break $16, but above all, it needs to hold support above $12.50.”

At the time of writing, OMNI is trading at $13.70, up about 3% over the last 24 hours.

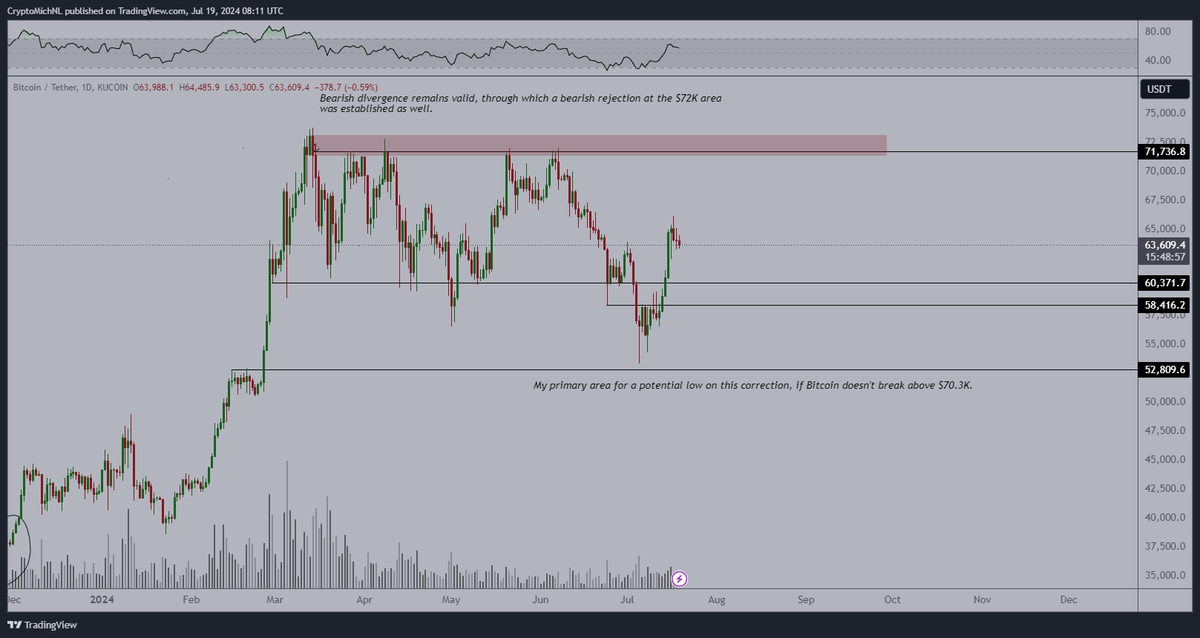

The analyst then said that Bitcoin (BTC) is likely to be in an uptrend and could reach its all-time high (ATH) of around $73,000 after a period of consolidation. He also believes that Bitcoin could rise due to the expected approval of a spot ETH exchange-traded fund (ETF).

“Bitcoin is back in a range, probably going to continue to an all-time high from here. I think we’ll see some more consolidation as ETH starts to see some strength after the ETF listing.”

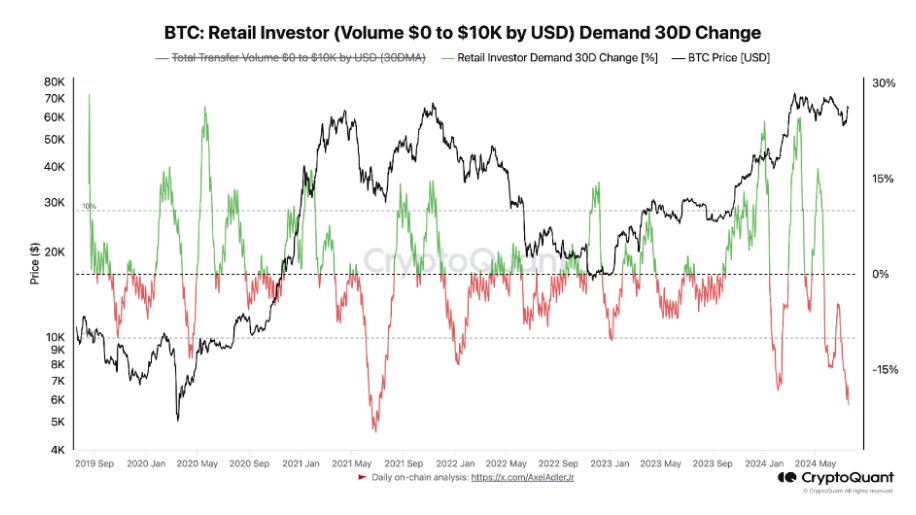

The analyst also shared a chart showing that retail investor demand is at its lowest in about three years, down less than 15% over the past 30 days, suggesting that demand from this investor segment could soon reverse course and send Bitcoin soaring.

“This is a great chart and visualizes the current sentiment. The gap between Web 2.0 institutional interest and Web 3.0 sentiment has never been wider. On the demand side, it’s at its lowest point in years. Bitcoin is going to reverse. Now is the time.”

At the time of writing, Bitcoin is trading at $66,852, up 5% over the last 24 hours.

Don’t miss out on the latest news – subscribe to receive email notifications straight to your inbox.

Price check task

Follow us XFacebook and Telegram

Surfing the Daily Hodl Mix

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investment in Bitcoin, cryptocurrencies or digital assets. Your transfers and transactions are your responsibility and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling cryptocurrencies or digital assets and The Daily Hodl is not an investment advisor. The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3