One analyst explained how Bitcoin’s trading availability has quietly declined during the asset’s recent consolidation phase.

Bitcoin could be well positioned to hit a new all-time high

In a new post on X, analyst Willy Woo discusses recent trends in Bitcoin inventory on centralized exchange platforms.

Related Reading

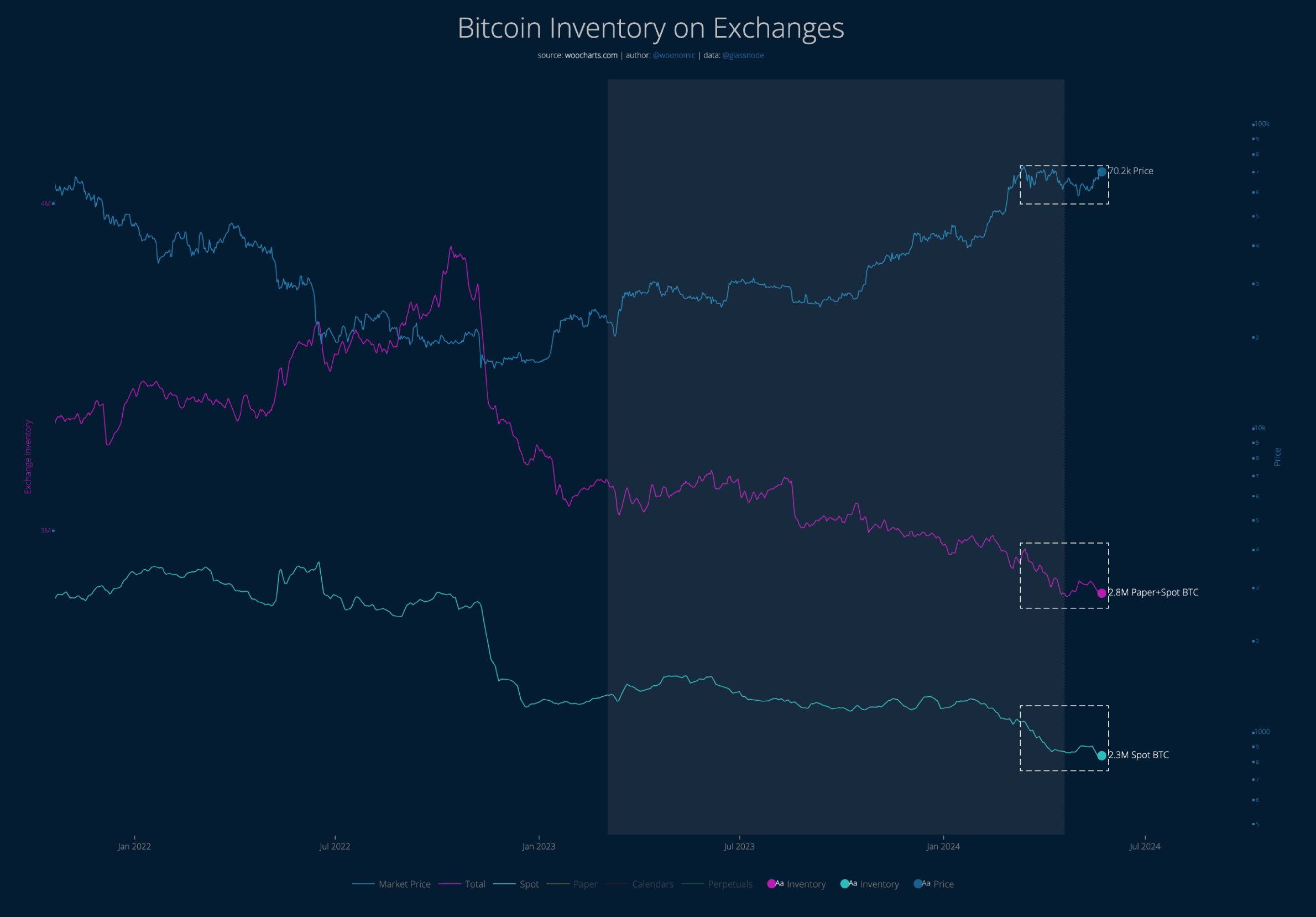

The chart below shows how spot and paper BTC holdings have changed over the past few years.

As you can see from the graph, Bitcoin in spot wallets has been decreasing over the past few months. The total amount of BTC controlled by central authorities has now been reduced to 2.3 million.

It is also clear that the total sum of spot BTC and “paper” BTC (highlighted in purple) has decreased simultaneously. Paper BTC here refers to cryptocurrency-related derivatives that do not require investors to actually own the asset.

Therefore, given the decline in combined exchange inventory for cryptocurrencies, the decline in spot BTC does not appear to be due to paper BTC replacing it.

Typically, the supply on exchanges is considered the portion of the Bitcoin supply that is “available” for trading. Therefore, due to the way supply-demand dynamics work, having less available supply can be a constructive signal for a cryptocurrency.

Looking at the graph, we can see that this decline in exchange inventory occurred during a difficult period for cryptocurrency prices after hitting all-time highs (ATHs). As Wu pointed out,

While everyone is freaking out about Bitcoin Over the past two months, the price has not risen, the available BTC has been quietly spread out and, importantly, no paper BTC has been printed in its place.

Therefore, the fact that available supply has decreased during that period could be a bullish signal for that coin. “It’s only a matter of time before BTC hits a new all-time high,” the analyst said.

Related Reading

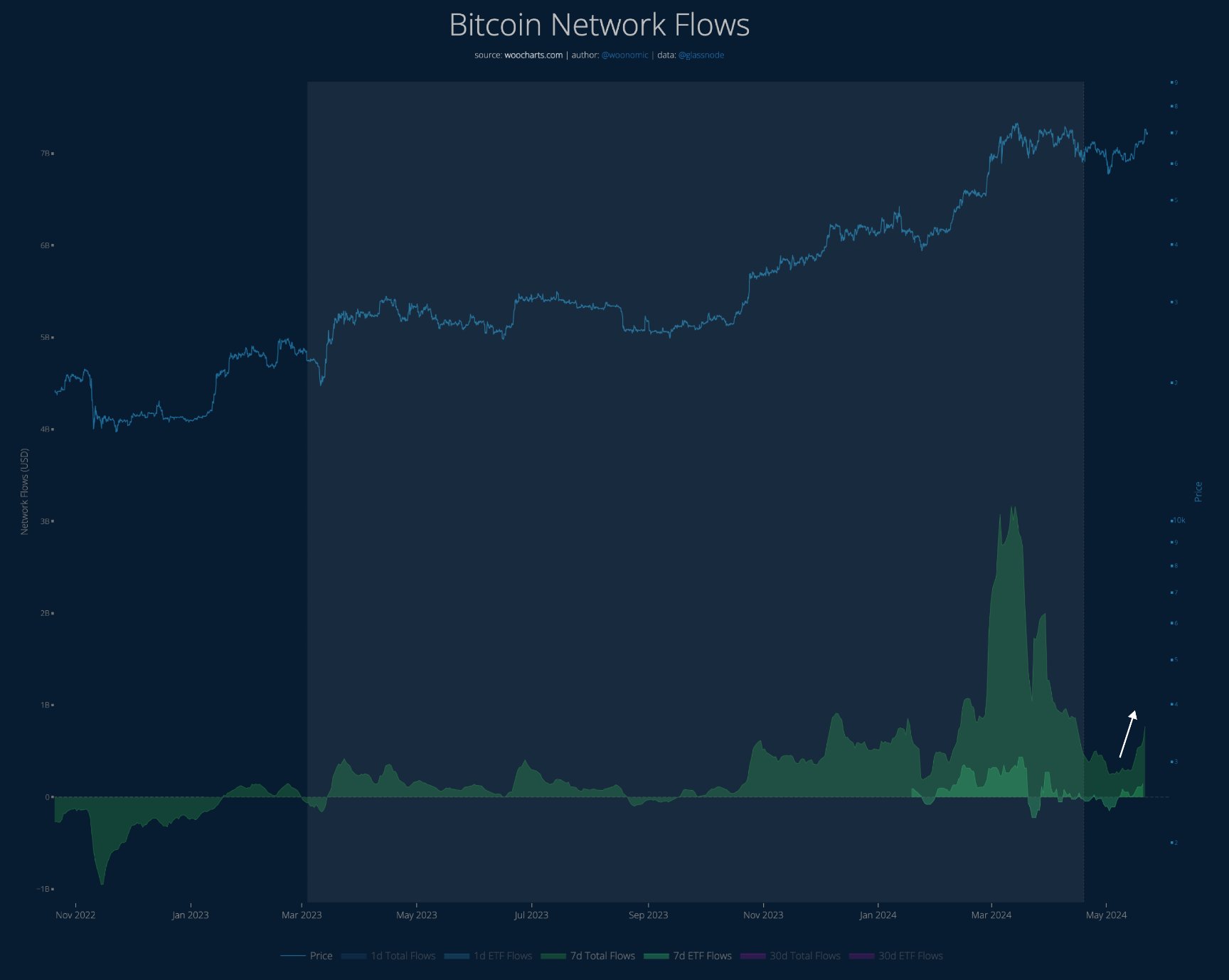

In another X post, Woo also discussed how capital inflows into Bitcoin are starting to bounce back after previously experiencing a steep decline.

As you can see in the chart, network inflows hit an all-time high, but then saw a significant slowdown during consolidation.

Cash exchange-traded fund (ETF) inflows, highlighted in bright green, also disappeared earlier, but are now back with these new capital inflows.

BTC price

Bitcoin appears to have been on a downward trend over the past few days, having previously risen as high as $71,000 but is now back below the $68,000 level.

Featured image from Shutterstock.com, woocharts.com, charts from TradingView.com

Source: NewsBTC.com