- Ethereum loses more ground compared to Bitcoin in NFT trading volume.

- Apecoin continues to decline.

Ethereum (ETH) remains prominent in the NFT conversation. However, recent data shows that dominance has declined.

ApeCoin (APE), the ecosystem token associated with the Bored Ape Yacht Club (BAYC), an Ethereum-based NFT collection, has experienced a decline in relevance, reflecting the recent BAYC floor price drop.

Ethereum NFT trading volume continues to decline.

NFTs have been primarily associated with Ethereum in the past, given the large number of projects hosted on the platform. However, the emergence of alternative platforms has broken down these monopolies.

In recent months, Bitcoin has emerged as an unexpected competitor in the NFT space, even though it operates differently.

Crypto Slam’s analysis of NFT trading volume shows that Bitcoin’s trading volume has surpassed Ethereum over the past 30 days.

Specifically, NFT trading volume on the Bitcoin network was over $455.59 million, while on Ethereum it reached $291.15 million.

Data shows that Bitcoin collections occupy the top three positions by trading volume. In contrast, popular ETH collections such as Bored Ape Yacht Club (BAYC) are only ranked 6th.

Explore trends in BAYC

An analysis of the overall price trends for Bored Ape Yacht Club (BAYC) in NFT low prices shows that BAYC low prices have declined significantly over the past few months.

In particular, the lower limit price fell noticeably in April.

At the time of writing, the lowest price was around 10.89 ETH. The floor price represents the lowest price for the collection of Ethereum-based NFTs, which the chart shows has fallen by more than 67% over the past year.

The decline in BAYC and other Yuga collections also affected ApeCoin, pushing it near record lows.

APE close to ATL

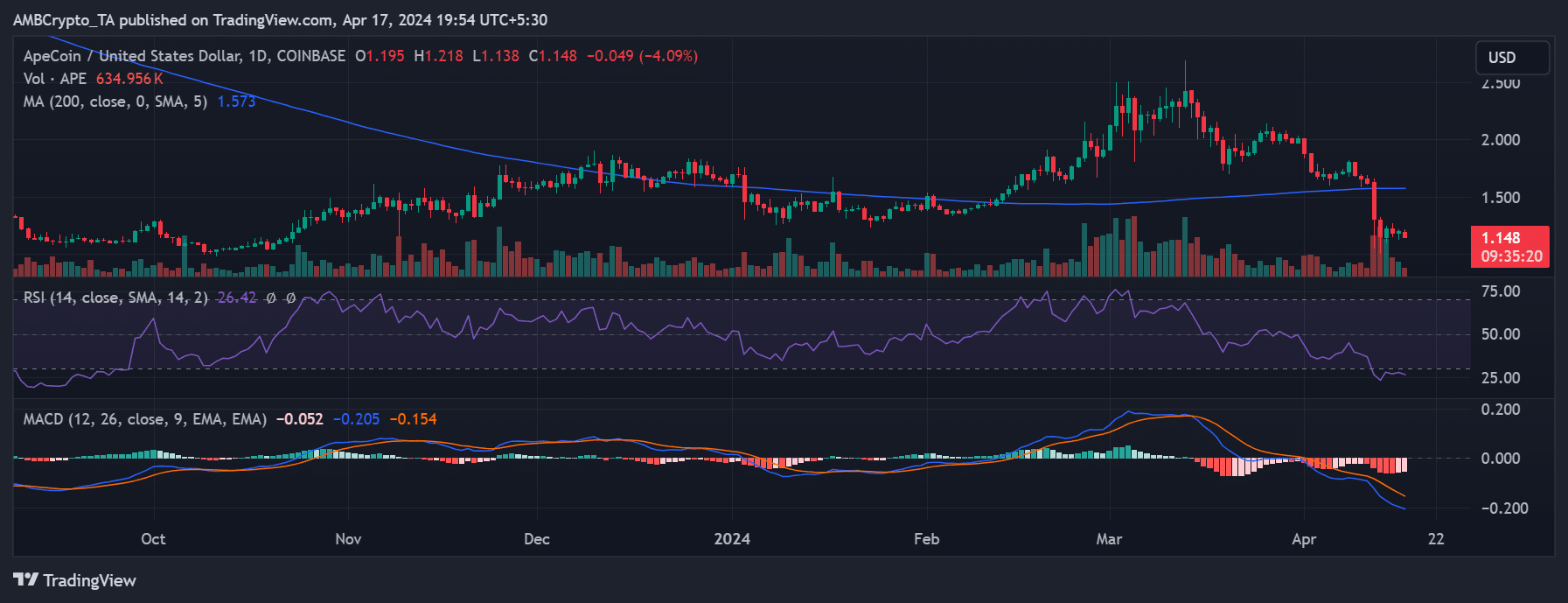

ApeCoin analysis indicates a negative trend for the Ethereum-based collection of de facto ecosystem coins. An examination of the Relative Strength Index (RSI) shows oversold conditions.

Realistic or not, the APE market cap in BTC terms is:

At the time of writing, the RSI is below 30, indicating a strong bearish trend and oversold conditions. Additionally, APE was trading at around $1.15, reflecting a drop of more than 4%.

Further analysis showed that APE’s all-time low was around $1.01, suggesting that further declines could push prices higher in the region.

Source: TradingView