- APT has a very optimistic outlook for the coming weeks.

- The short-term bias has also been strong, but BTC volatility could damage it.

Aptos (APT) has a bullish structure on the weekly chart and has maintained an upward trajectory despite market volatility and fear over the past week. A break above $7.5 sent the price down along with the rest of the market.

However, higher periods are not a sign that a bearish trend is underway. A decline below $7.23 would be the first sign of a bearish scenario. Such a decline seemed unlikely based on current evidence.

Aptos crypto retests August high approval ratings.

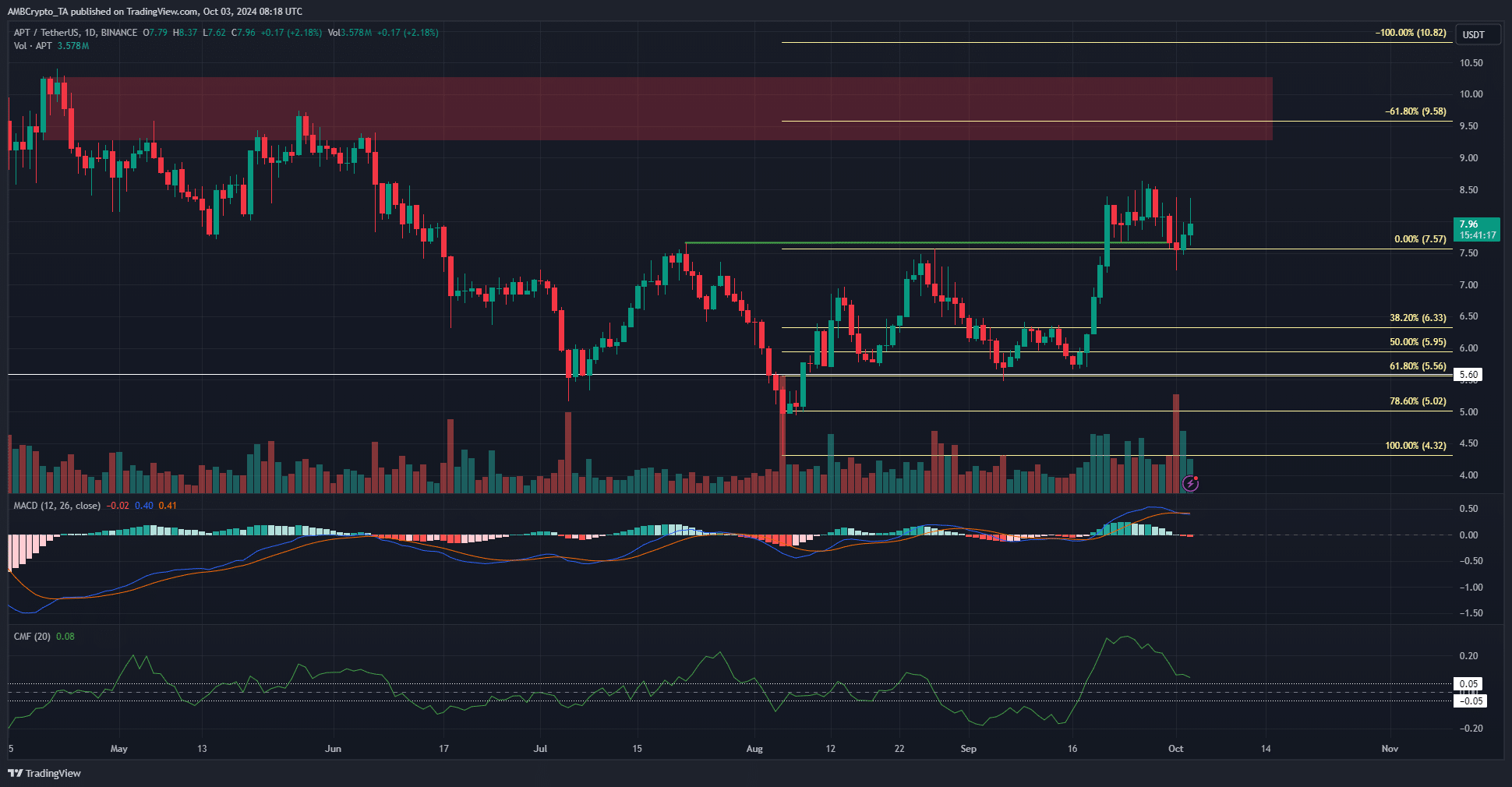

Source: APT/USDT on TradingView

Volatility on Tuesday October 1st resulted in very volatile intraday trading, with Aptos down 1.56% on the day. The trading volume is equivalent to the time of the panic on August 5th.

Despite this dire setup, the price never fell below $7.57. This level was the August high used to mark Fibonacci retracement and extension levels. The 61.8% extension to $9.58 aligns well with the weekly bearish order block around $10.

The 100% extension level was the December 2023 resistance area of $10.82. Swing traders will likely target this level in the coming months.

The trend on the daily and weekly charts was bullish, although the MACD formed a bearish crossover to show bearish near-term momentum. CMF also fell significantly, but still exceeded +0.05, indicating significant buying pressure.

Changes in open interest trends

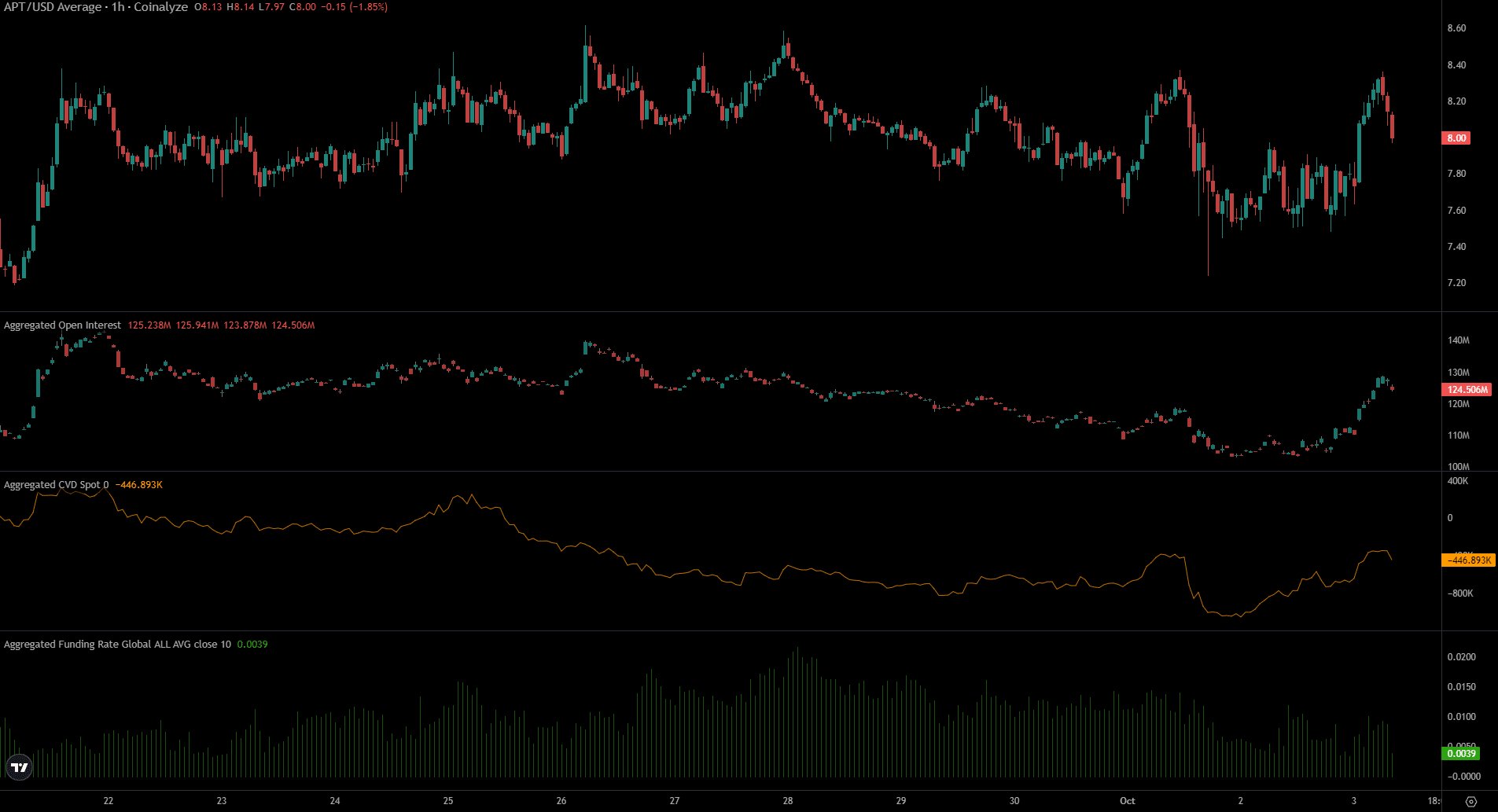

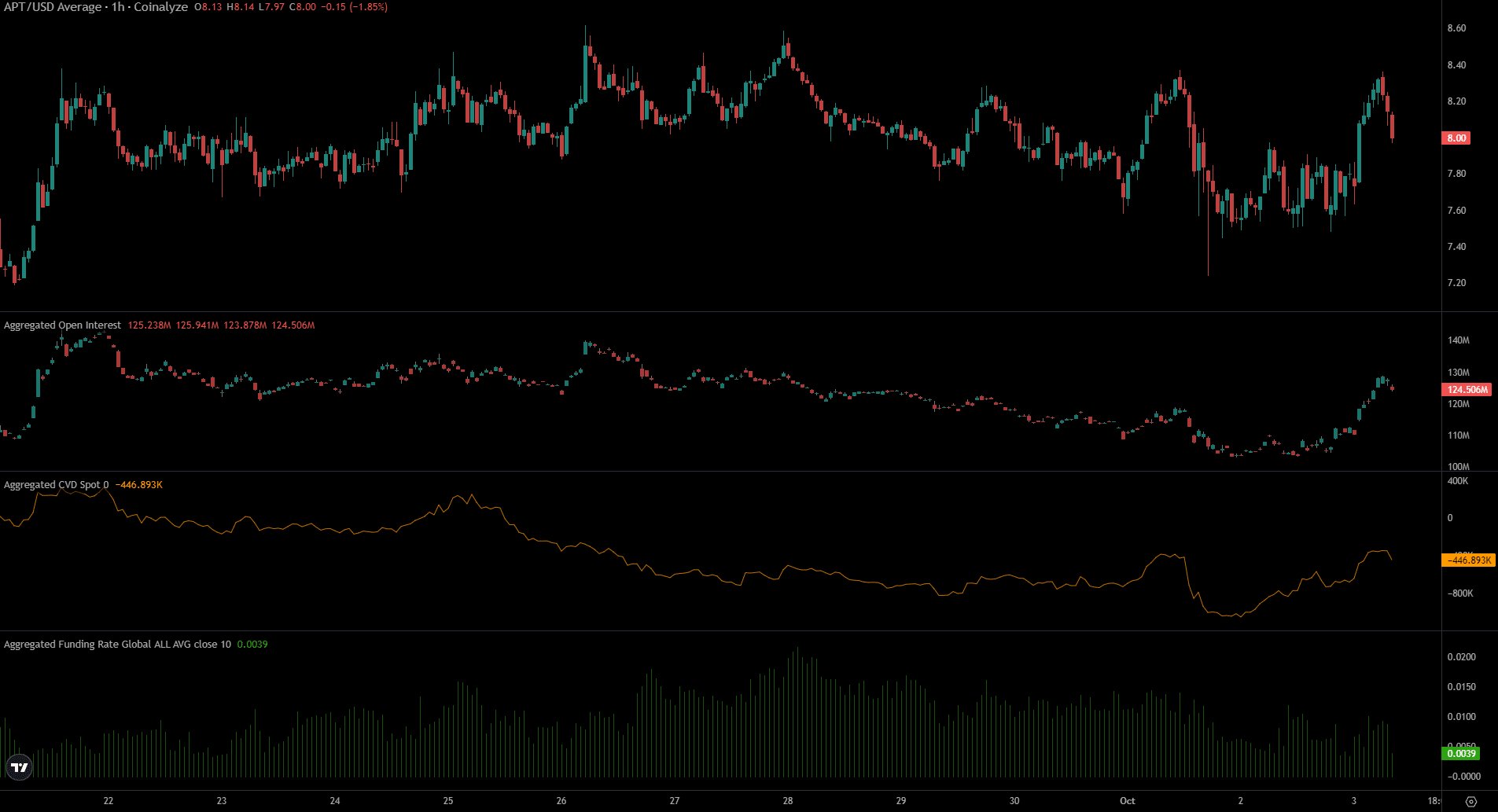

Source: Coin Analysis

Open interest has been declining over the past week, but has changed significantly over the past 24 hours. OI increased from $104 million to $124 million and APT rose 7.2%.

Is your portfolio green? Check out the Aptos Profit Calculator

Spot CVD has also shown a steady increase recently. Together, they showed that near-term market sentiment is optimistic and participants expect more profits.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.