- Aptos has started a bullish rally over the past 24 hours, but volume has declined.

- As the rally continues, liquidations will increase, which may indicate that the trend is no longer sustainable.

Aptos (APT) There has been a significant uptrend in the last 24 hours, and the uptrend has come while the rest of the market is fairly stable. Why did this happen? Why is APT so high on the chart? And is there a chance that the rally will continue in the short term?

Check out Aptos’ bull rally

The price action of APT has gained bullish momentum, with its value increasing by almost 6.5% in the last 24 hours. However, the recent rise of this altcoin has not met investors’ expectations, especially since the cryptocurrency lost 3% of its value in the previous week. To be precise, the price of this token fell to $6.4 on July 26th. This is the lowest price of the last week.

According to CoinMarketCapAt the time of writing, Aptos was trading at $7.20 and had a market cap of over $3.3 billion, making it the 28th largest cryptocurrency in the world.

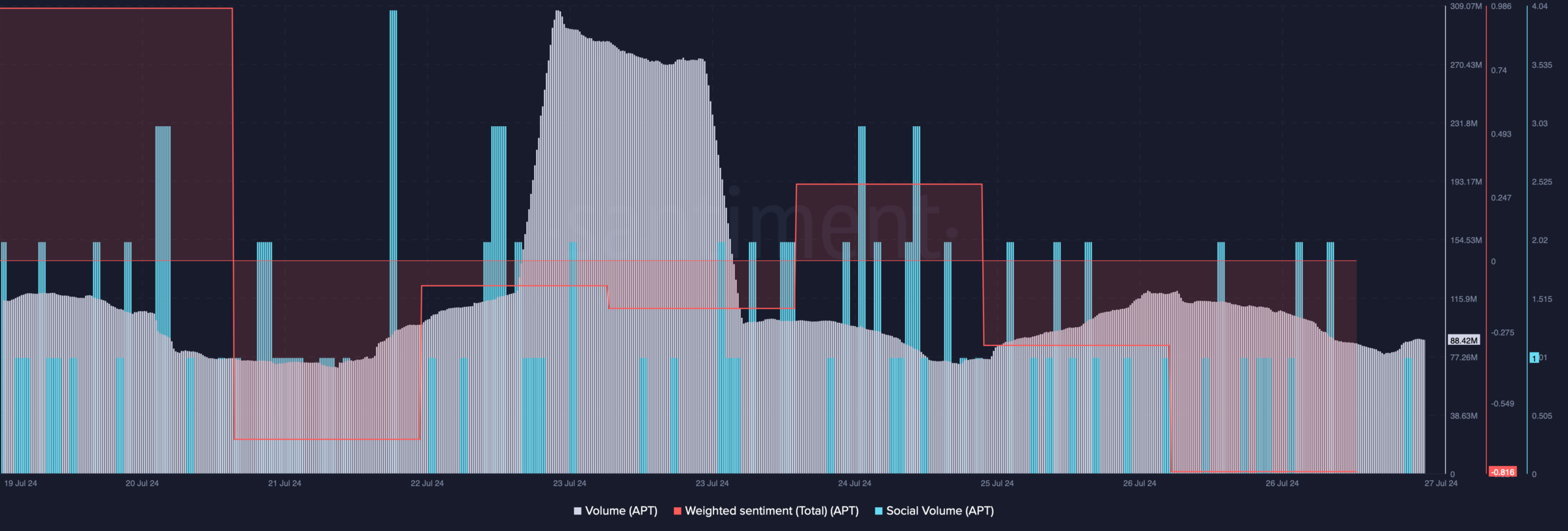

But when AMBCrypto checked Santiment’s data, we found a surprising development. According to our analysis, despite the recent price increase, the token’s weighted sentiment has fallen sharply. Each time the indicator drops, it indicates an increase in bearish sentiment toward the asset.

Social media activity also showed a similar downward trend, reflecting the decline in popularity.

In addition, APT’s trading volume has also decreased, indicating a downward trend.

Source: Santiment

Will APT’s Rally Last Longer?

AMBCrypto looked at other data sets to see if this recent price rally could be short-lived.

According to our analysis of Coinglass, dataAPT’s open interest has declined on the chart, indicating a possible trend reversal. Nevertheless, the long/short ratio has increased, indicating that there are more long positions than short positions in the market. This is a sign that bullish sentiment is dominant around the token.

Source: Coinglass

We then took a closer look at Aptos’ liquidation heatmap to learn more about possible resistance and support zones. If there is a sustained price increase, investors can see the token reaching $7.7 soon.

If it breaks that level, Aptos could reach $8.7. This is likely to happen as liquidations will rise above these two levels, which usually leads to short-term price corrections.

read Aptos’ (APT) Price Prediction 2024-25

However, if the bears take over the market once again, APT could fall to $6.3. A drop below that level could see the token fall into the $5 range in the coming weeks.

Source: Hyblock Capital