- The Arbitrum indicator shows positive signs as activity increases.

- Despite these factors, the price of ARB continued to decline significantly.

Arbitrum (ARB) has seen very positive execution, with the protocol outperforming its competitors in most areas.

One of the key areas where Arbitrum excelled was its networking activities. Over the past few weeks, there has been a significant increase in activity and transactions taking place on the network.

There are some problems ahead.

However, amidst the flurry of activity, Arbitrum’s Total Value Locked (TVL) and Decentralized Exchange (DEX) trading volumes declined. This signaled potential challenges within the decentralized finance (DeFi) sector.

Declining interest in DeFi may impact user engagement and overall platform utilization in the future.

Source: Token Terminal

At the same time, the price of ARB showed a sharp decline, plummeting 8.91% in 24 hours. This sharp decline raises concerns about investor sentiment and market confidence in ARB.

This price surge also led to an increase in the number of liquidations, changing the market mood. Trader sentiment surrounding ARB was predominantly bearish, with the percentage of short positions increasing to 53%.

The change in sentiment reflects a lack of confidence in ARB’s near-term prospects and could exacerbate token selling pressure, further impacting price dynamics.

Source: Coinglass

Looking at the data

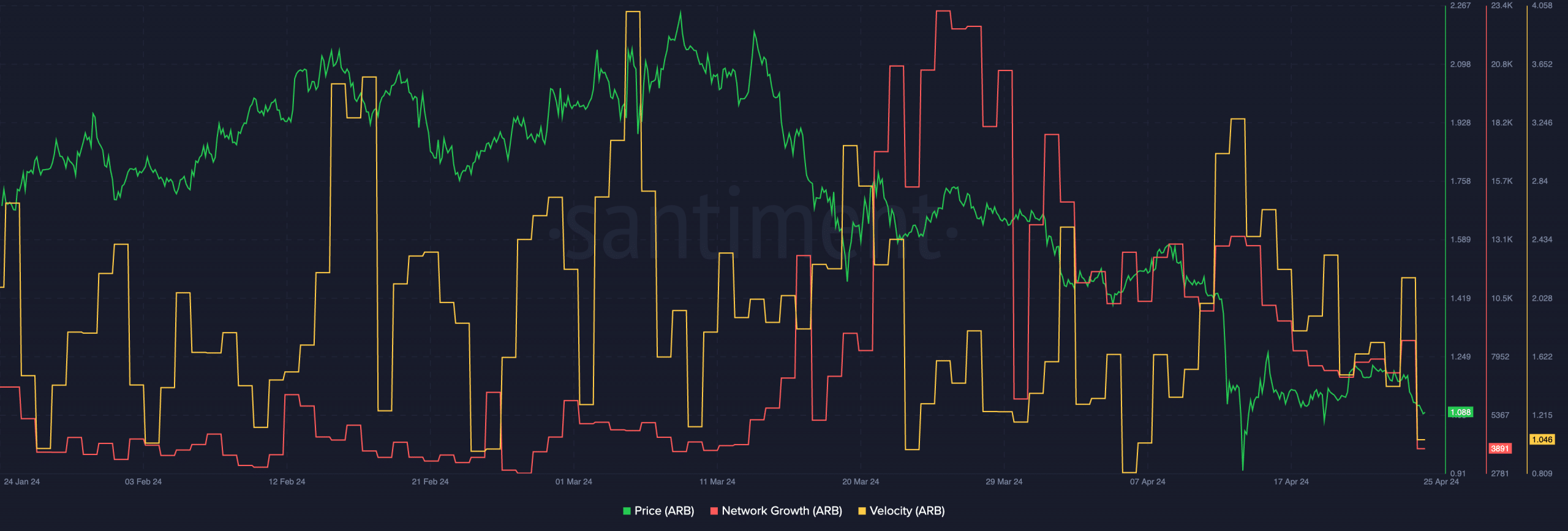

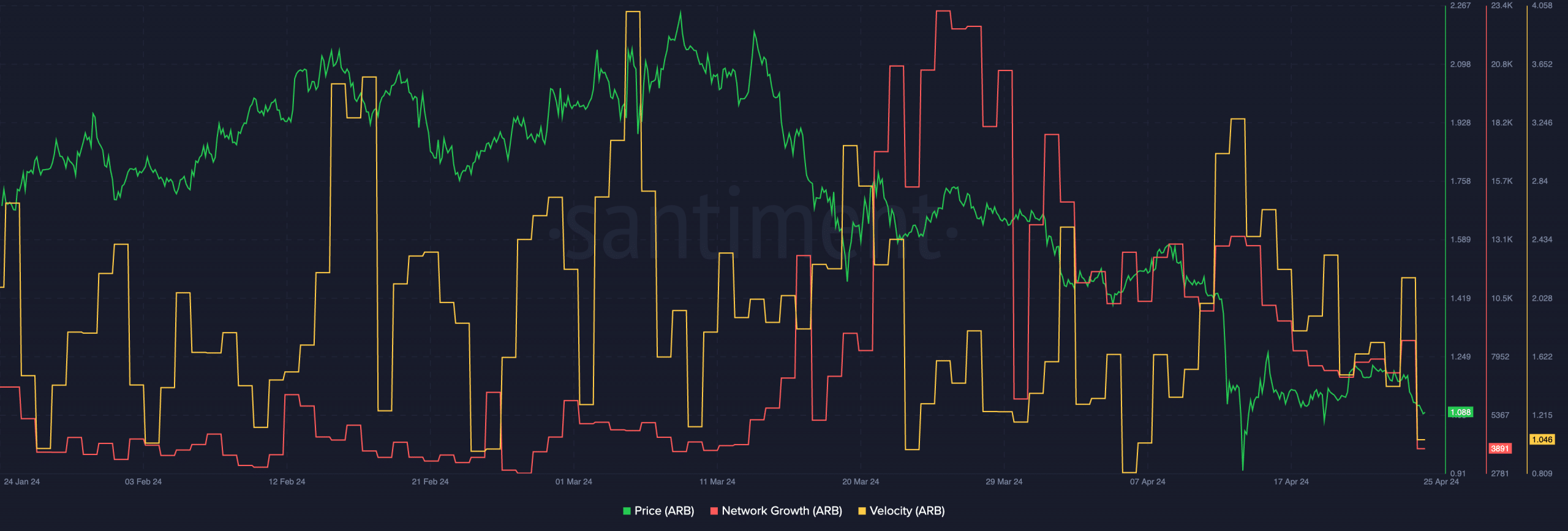

AMBCrypto’s analysis of Santiment’s data shows that ARB’s network growth has decreased significantly. This decline indicates a potential decline in interest from the new address.

If interest from new addresses continues to decline, ARB prices could be negatively impacted. Additionally, slower ARB transactions mean less transaction activity within the network.

This could impact ARB’s overall liquidity and cause more problems for the token in the future.

Source: Santiment

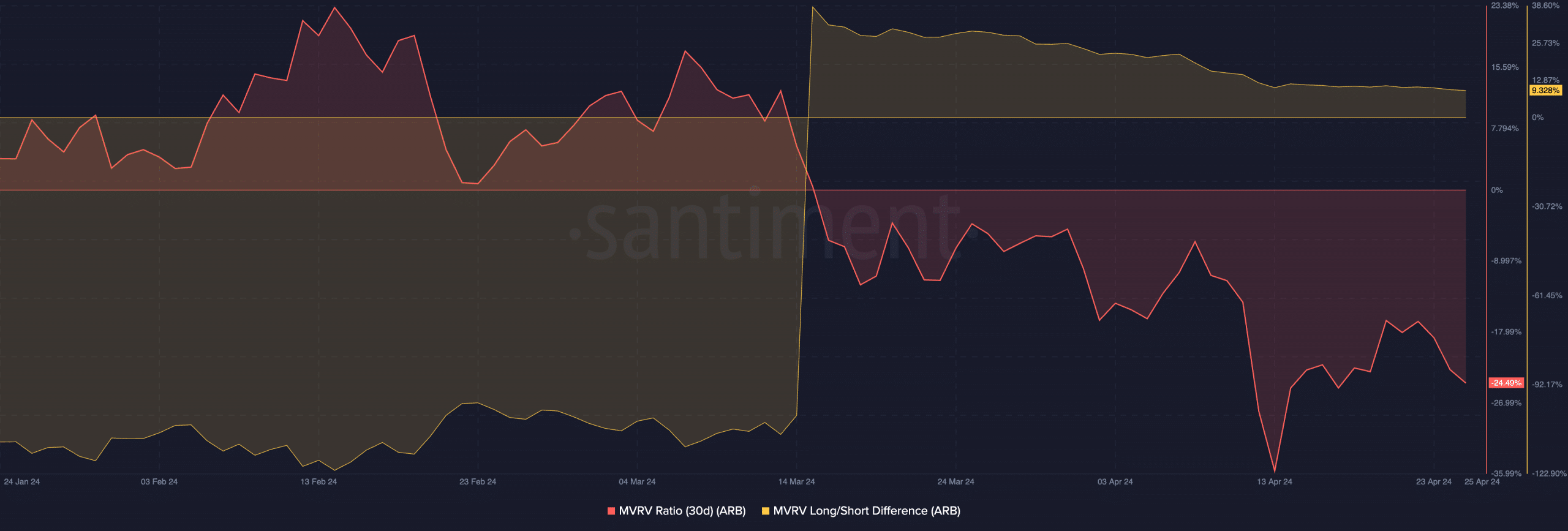

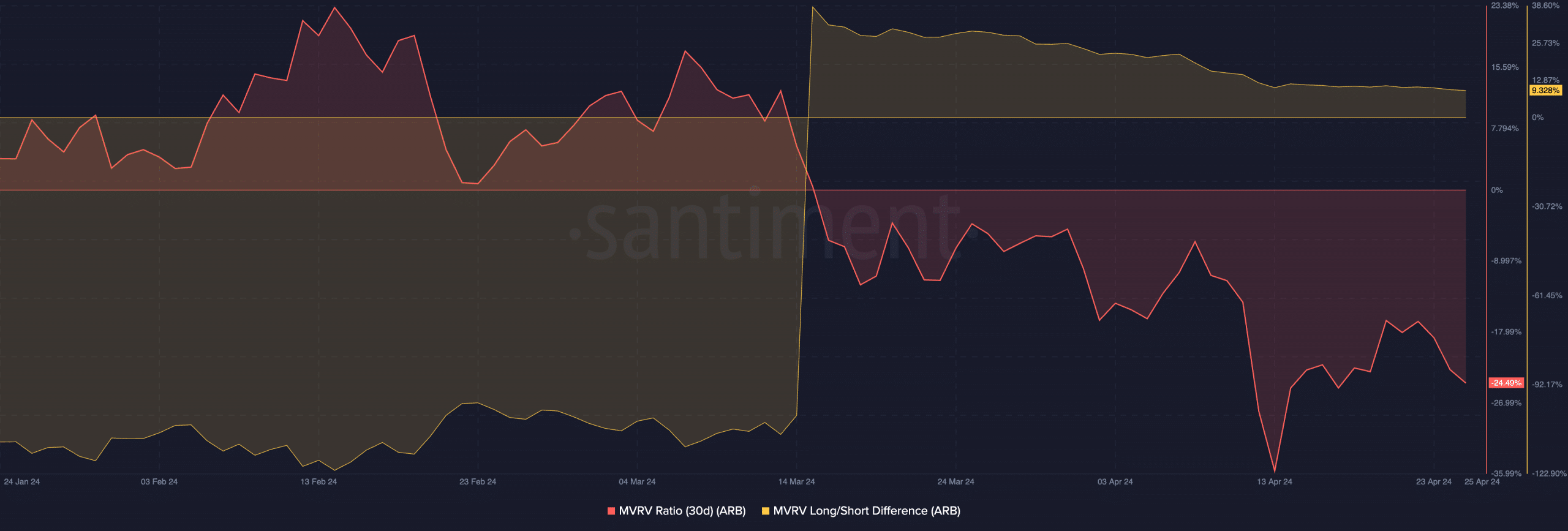

ARB’s MVRV ratio has decreased, reflecting declining profitability for holders. This suggests that selling pressure on existing holders has decreased as most have not had much incentive to liquidate their holdings.

Realistic or not, ARB’s market cap in BTC terms is:

Despite the price decline, the long/short differential remained high, indicating that there were significant long-term holders who were less willing to sell their positions.

These factors could help ARB maintain its current price levels and could help the token absorb some selling pressure.

Source: Santiment