- During the March lockdown, only about 25% of team members and investor allocations were unfrozen.

- ARB has plunged 26% since the lockdown was lifted in March.

While the massive unlock of 1.1 billion units is over, holders of layer-2 (L2) token Arbitrum (ARB) should brace for greater volatility and potential price declines in the coming months.

Unlocks are expected every month

According to Arbitrum’s unlock schedule, nearly 93 million ARBs, worth $136 million at current market prices, will enter circulation on a monthly basis over the next three years.

In particular, the unlocked supply is relevant to Arbitrum team members/contributors and investors. During the last lockdown in March, only about 25% of total allocations were unfrozen.

In the cryptocurrency realm, token unlocking involves the staggered release of a fixed number of tokens at predetermined time intervals and distributed to specific members.

This is generally considered a bearish catalyst as additional tokens on the market can cause selling pressure.

How did ARB handle the last unlock?

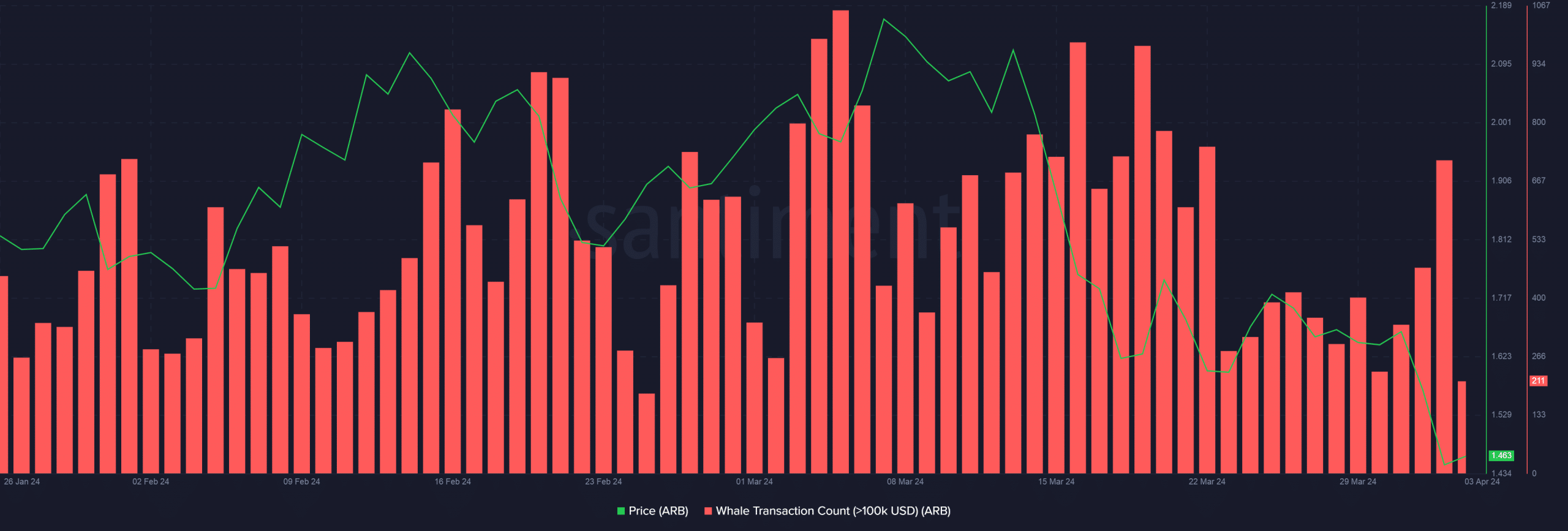

According to the narrative, ARB has plummeted 26% since the massive unlock on March 16, according to CoinMarketCap. In fact, ARB began to decline ahead of the unlock event, foreshadowing anxiety.

We observed large transactions over $100,000 starting to increase just before the lockdown was lifted and continuing for almost a week after the event. Subsequent price action suggested that selling pressure was stronger than buying pressure.

Using data from Santiment, AMBCrypto found that whale trading also surged in the first two days of April, causing prices to fall further.

Source: Santiment

Realistic or not, ARB’s market cap in BTC terms is:

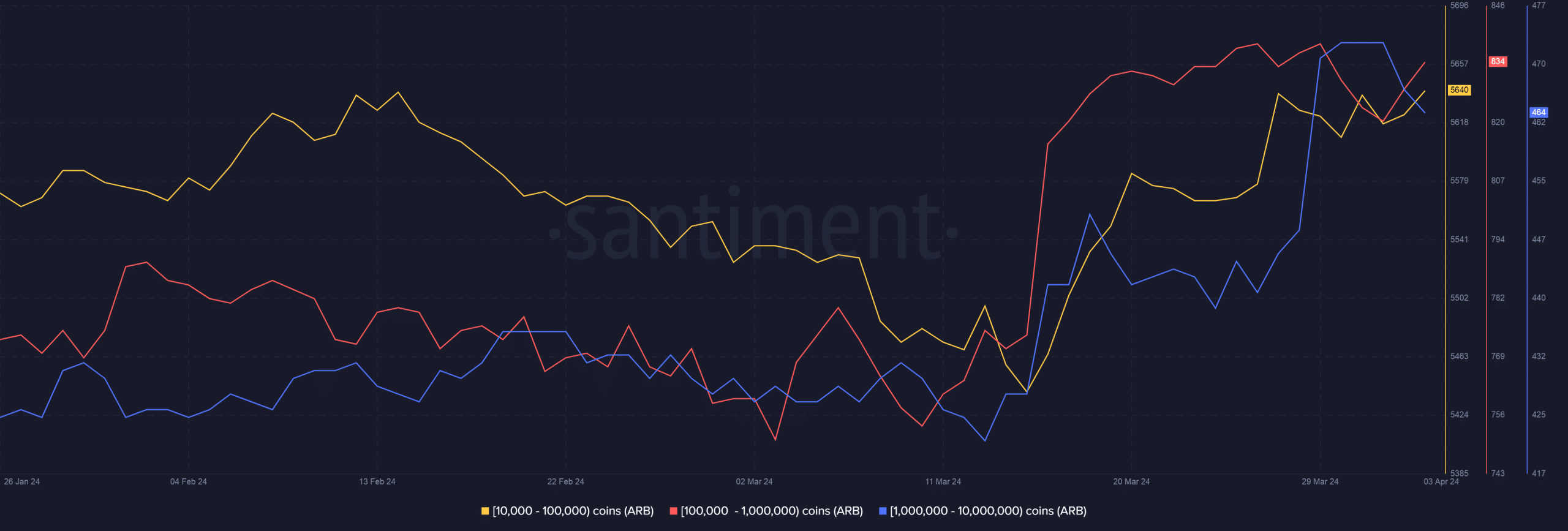

In other words, large whale holdings increased significantly following the event. There may be two explanations for this.

Firstly, wallets were inflated due to decentralized tokens, and secondly, some investors actually took advantage of the opportunity to buy tokens at low prices.

Source: Santiment