- According to Ali Martinez, MATIC’s key indicators presented a buying opportunity.

- There is still a lot of bearish sentiment in the token market.

Crypto analyst Ali Martinez said the Market Value to Realized Value (MVRV) ratio of Polygon’s native token MATIC has sent a buy signal. post to (formerly Twitter).

According to the analyst, the token’s MVRV ratio evaluated against various moving averages returned negative values. sugar of santiment According to the data, at the time of writing, MATIC’s 30-day and 365-day moving average MVRV ratios were -10.11% and 11.99%, respectively.

The MVRV ratio tracks the ratio between the current market price of an asset and the average price of all coins or tokens acquired for that asset.

A positive MVRV ratio higher than 1 indicates that the asset is overvalued. This means that the current market value of the asset is much higher than the price at which most investors acquired it.

Conversely, a negative MVRV value indicates that the asset is undervalued. This means that the market value of the asset in question is lower than the average purchase price of all tokens in circulation.

As Martinez noted, MATIC’s negative MVRV ratio indicates “perfect buying time.” This is because at current prices, MATIC is trading at a discount to its historical cost basis.

Are the MATIC bulls making a comeback?

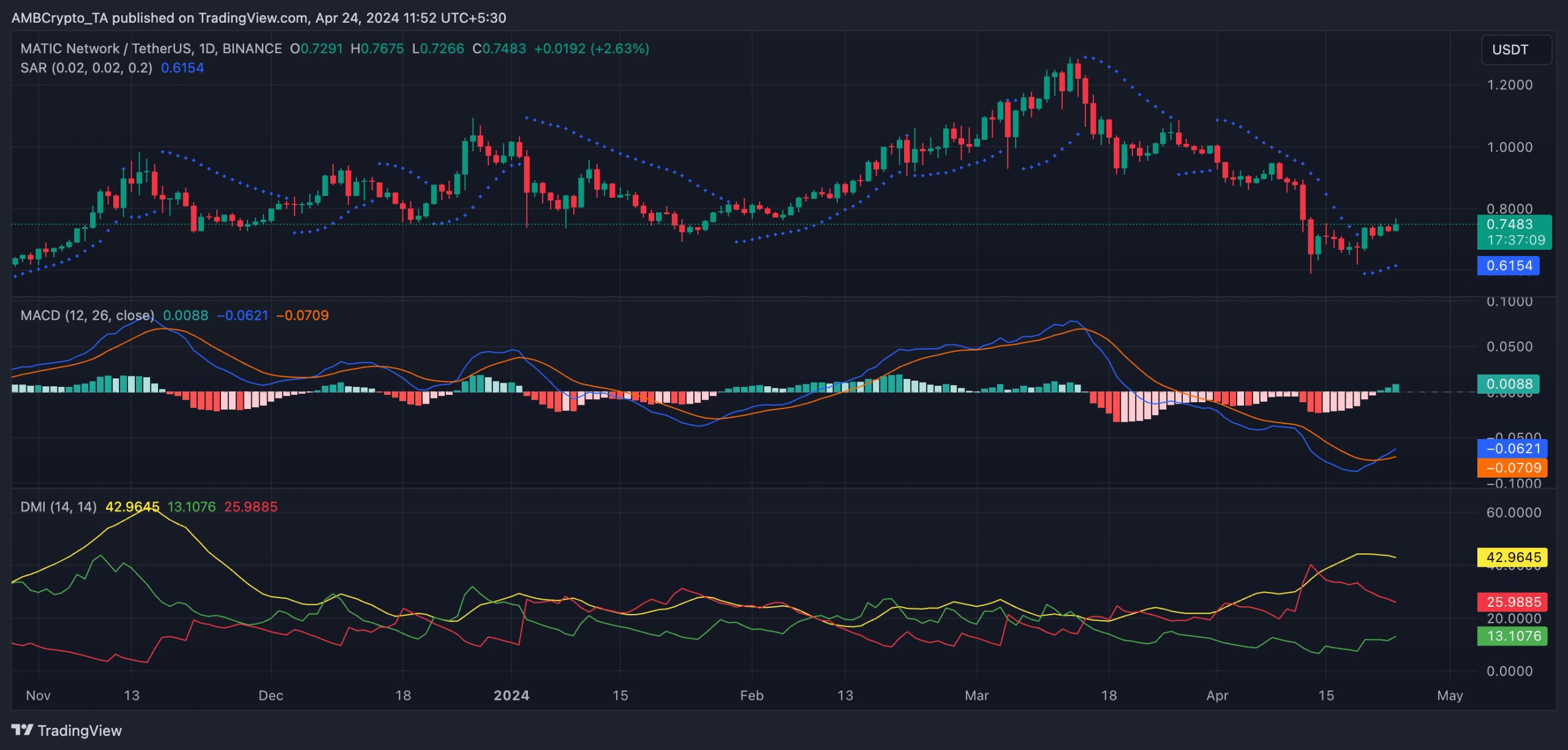

Evaluating the price movement of MATIC on the 1-day chart, we observed that the market sentiment is slowly moving from bearish to bullish.

First, looking at the token’s parabolic SAR indicator reading, the dots appear to be below the price at the time of writing. This indicator is used to identify potential trend directions and reversals.

When the dotted line is below the asset price, the market is said to be in an upward trend. This indicates that asset prices are rising and may continue to rise.

Likewise, MATIC’s MACD line (blue) is above the signal line (orange) for the first time since March 15th. When these lines are laid out this way, the short-term average of the asset is higher than the long-term average.

This is a bullish signal, and market participants take it as a signal to take buy positions and close sell positions.

Read Polygon (MATIC) price forecast for 2024-2025

However, although buying activity has returned to the MATIC market, bearish sentiment remains significant. For example, the negative direction exponent (red) is still higher than the positive exponent (green).

This means that the strength of the MATIC bears far outweighs the strength of the bulls as selling momentum is still high.

Source: MATIC/USDT on TradingView