- Analysts expect moves by the Federal Reserve and the U.S. Treasury to impact markets in a slow but positive way.

- Hayes notes Solana, a “puppy coin” for momentum trading as liquidity improves.

Market analysts expect a slight bullish impact. Bitcoin (BTC) Recent “unsophisticated” Federal Reserve interest rate decisions and overall market for U.S. Treasury bills QRA (Quarterly refund notice)

The U.S. Federal Reserve and QRA were “more dovish than expected,” according to Singapore-based institutional cryptocurrency trading firm QCP. that famous that,

At the FOMC, Chairman Powell said the Fed had no intention of raising interest rates and announced that it would slow quantitative tightening (QT) from $60 billion to $25 billion per month. In the case of QRA, the Treasury will keep longer-maturity issuances unchanged, reducing fears of a spike in longer-dated yields. This will help curb USD appreciation, which is positive for risk assets.”

Arthur Hayes, co-founder of BitMEX echoed A similar sentiment, but emphasized that the liquidity impact would be minimal on the charts.

“The impact of this QRA is slightly positive for dollar liquidity, but it will help pump the bag slowly over time.”

Hayes pays attention to Solana, a ‘puppy coin’ for momentum trading

Hayes added that the current negative price movement is likely to weaken as liquidity slowly improves each month. In fact he BTC is expected to recover $60,000 and remain ranged in the $60,000-$70,000 range until August.

But that’s not all, and the executive expects other altcoins to perform better. For his part, Hayes is taking note. Solana (SUN), dogwifehat (WIF), Dogecoin (DOGE) For momentum trading. Part of his statement follows:

“I am purchasing Solana and Puppy Coins for momentum trading positions.”

Momentum trading is the art of buying and selling assets that are extremely moving in one direction and ends when the price receives a reversal signal. Asset management company Franklin Templeton also presented an optimistic outlook. inclination Toward Solana

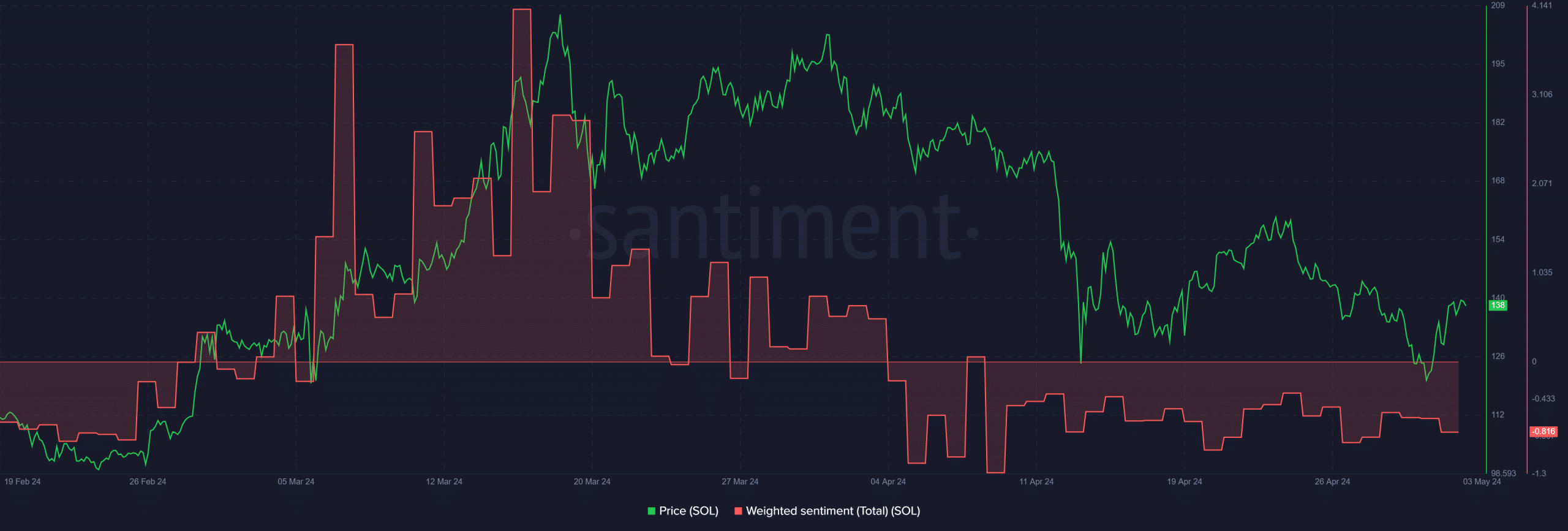

but, SOL’s Latest Price Action It notes a downtrend and reveals that short-term traders have profited from the market sell-off. At press time, it was trading at $136, down 35% from its all-time high of $210 in mid-March.

However, the bulls defended short-term support at $126 twice in mid-April and early May. Even so, A decisive trend reversal can only be realized if the price moves above the previous low of $160.

Additionally, overall market sentiment surrounding SOL remained negative, as evidenced by the negative weighted sentiment figure, according to Santiment data. Therefore, a strong upside reversal is unlikely in the near term.

Source: Santiment