- Binance sent $ 32 million to Wintermute, and Coinbase sent $ 30 USDC to potentially buy dip.

- Solana’s market decreased by more than 10% over the weekend and potentially occurred due to Binance’s charges.

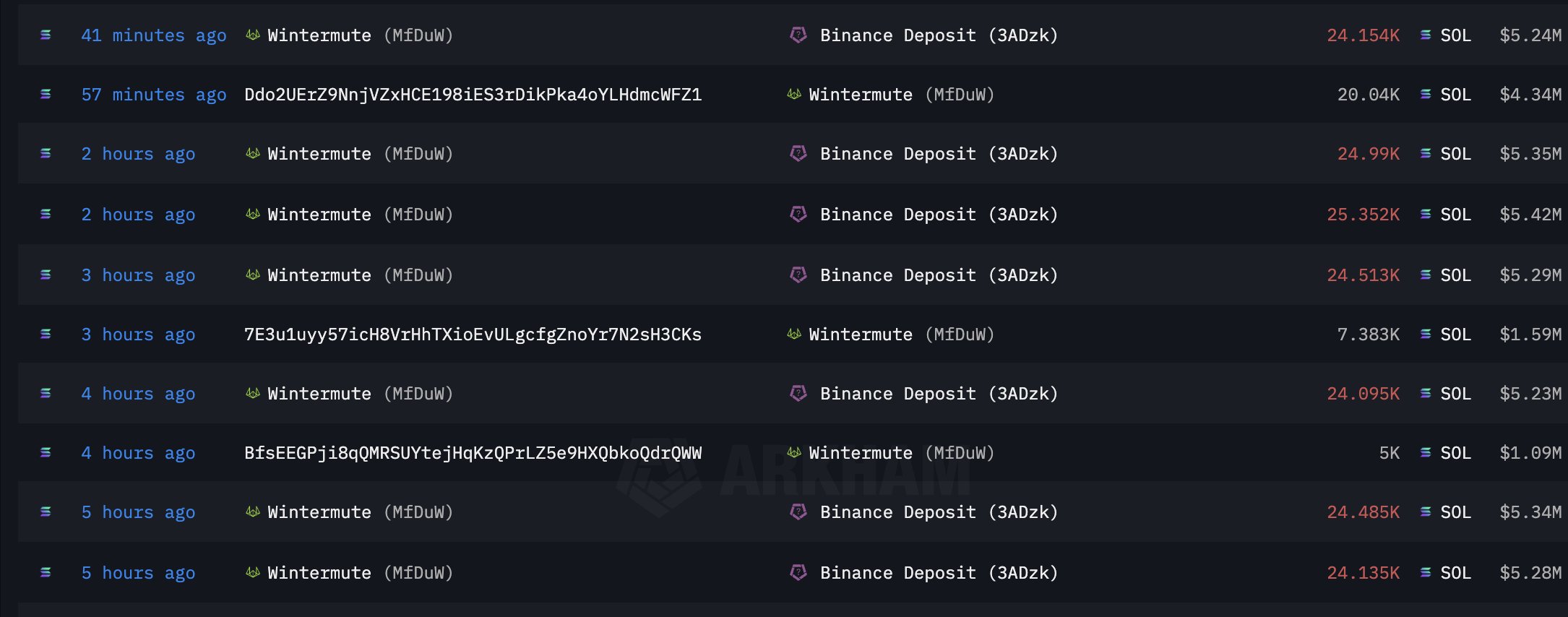

Binance Exchange recently sent Wintermute to the market maker for a low dose of $ 33 million Solana (SOL) and participated in “flushing” or “liquidation hunting.”

The intention was clear. Push the price of SOL to a low range so that the long leverage trader can clear its position.

This strategy is especially effective on weekends where the market is more vulnerable to manipulation, especially because of its natural low trading volume.

According to AMBCRYPTO’s Arkham data, Wintermute played a role in selling SOL at a lower price, abandoning the price, and re -purchasing at artificially depressed charges.

Source: Arkham

When the DIP is manufactured, Wintermute used the price difference by returning more SOL to Biny than the first received.

This was a win -win scenario for both institutions, but according to the encryption commentator, MARTYPARTY,

“The loser is a leverage trader and panic seller.”

Similarly, Coinbase sent $ 30 million to Solana’s Wintermute, and it is known that DIP has been used in response to recent arguments that SOL retention occurred recently.

Source: Arkham

This movement proposed adjusted efforts to use market conditions and suggested that it could potentially stabilize or benefit from artificial volatility.

How to use SOL operation

Understanding these tactics can be important to traders. The trader can predict Solana, in which case, in this case, by monitoring abnormal large -scale transactions from the exchange to a market manufacturer.

One strategy that utilizes these manipulation is to wait for the signs of the forced liquidation event and then buy it in the DIP and expect a quick recovery as the market corrects it.

SOL has already recovered at one -third of the weekend decline.

However, this approach requires understanding of risks related to sharp market timing because all market manipulation does not lead to predictable recovery.

For those who are highly risk, such a strategy can provide the opportunity to benefit from the volatility that others are afraid of.

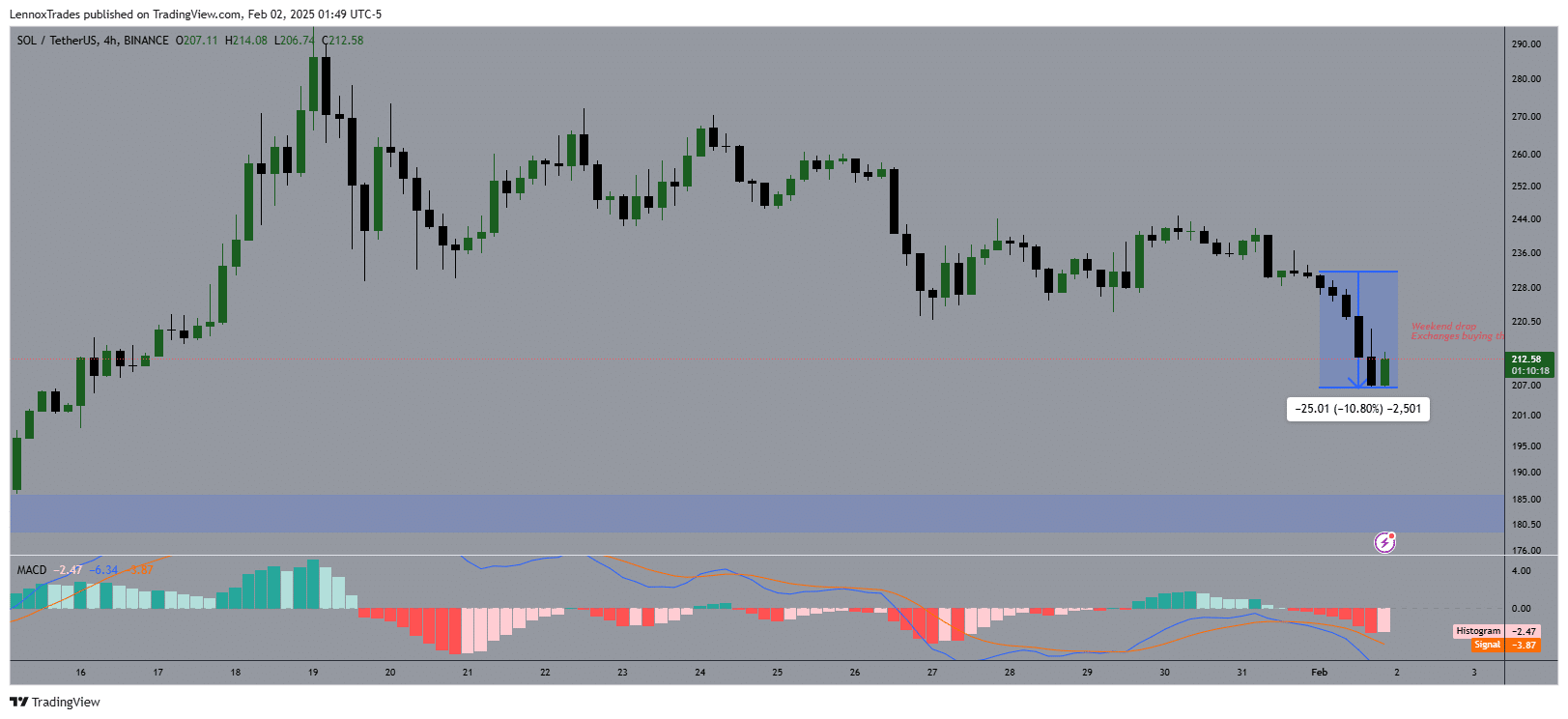

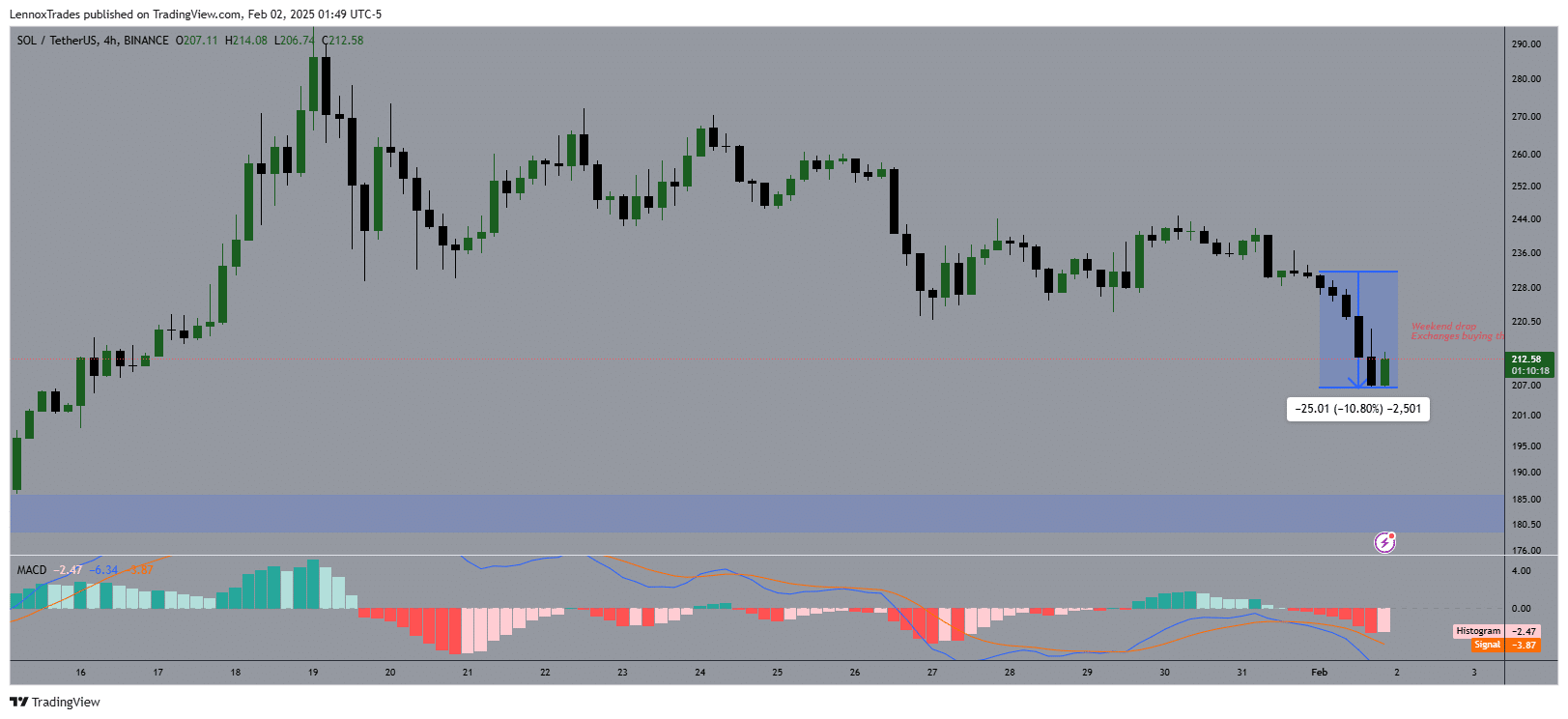

Source: TradingView

SOL’s price behavior chart reached the lowest level of $ 207 before rebounding as the exchange began. At this point, the weekend purchase by the exchange proposed a strategic purchase during the DIP.

Read SOLANA’s (SOL) price forecast 2025–2026

This behavior is associated with the fall of the MACD value, which has been reduced and moved positively after purchasing.

If these purchasing patterns continue, SOL can test higher resistance near $ 235. On the contrary, if you do not maintain its support, it can lead to a lower level of re -test.