- Whale activity has intensified and prices have fallen sharply due to significant POL selling.

- A break below the key support level at $0.3634 could trigger further declines.

Polygon (POL) has gained 13.74% over the past week, but the asset’s trajectory has turned bearish due to changes in market sentiment.

In the last 24 hours alone, the price of POL has fallen by 8.12% and further declines are expected in the coming days.

POL decline accelerates due to whale sale

POL is under extreme selling pressure, with whale activity declining sharply and experiencing bearish changes.

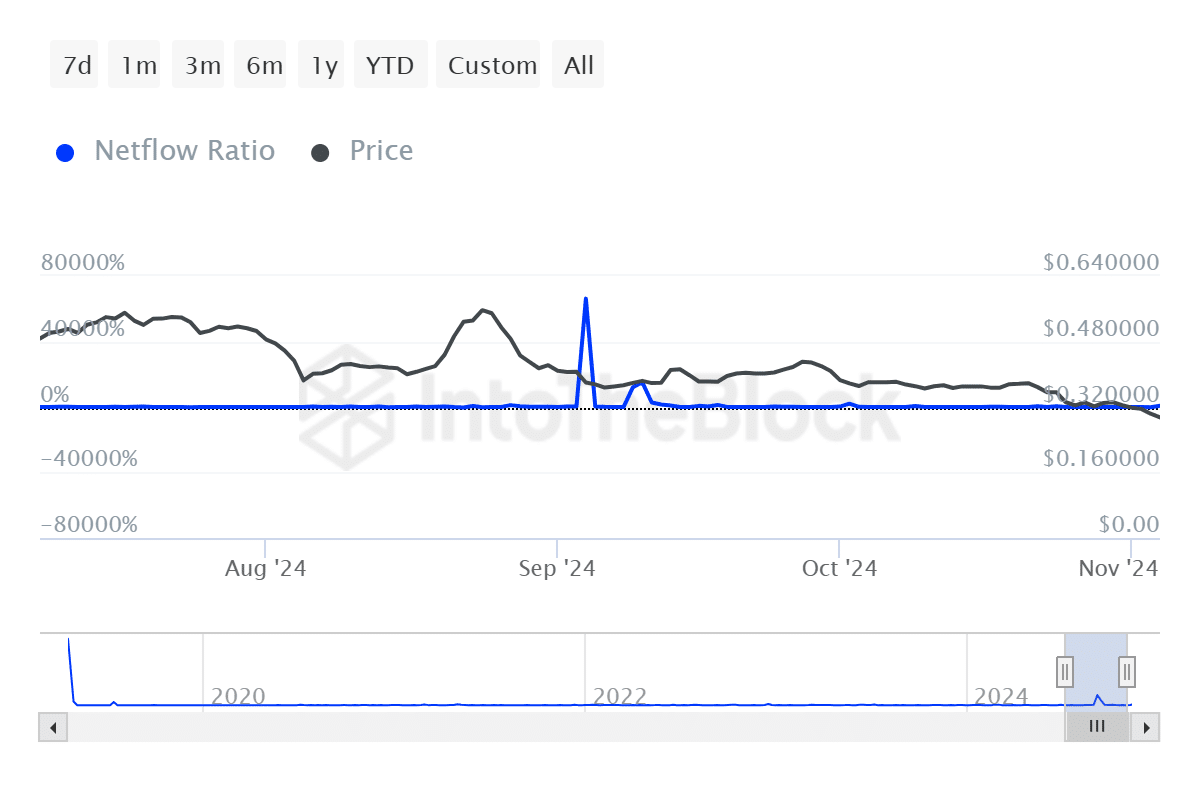

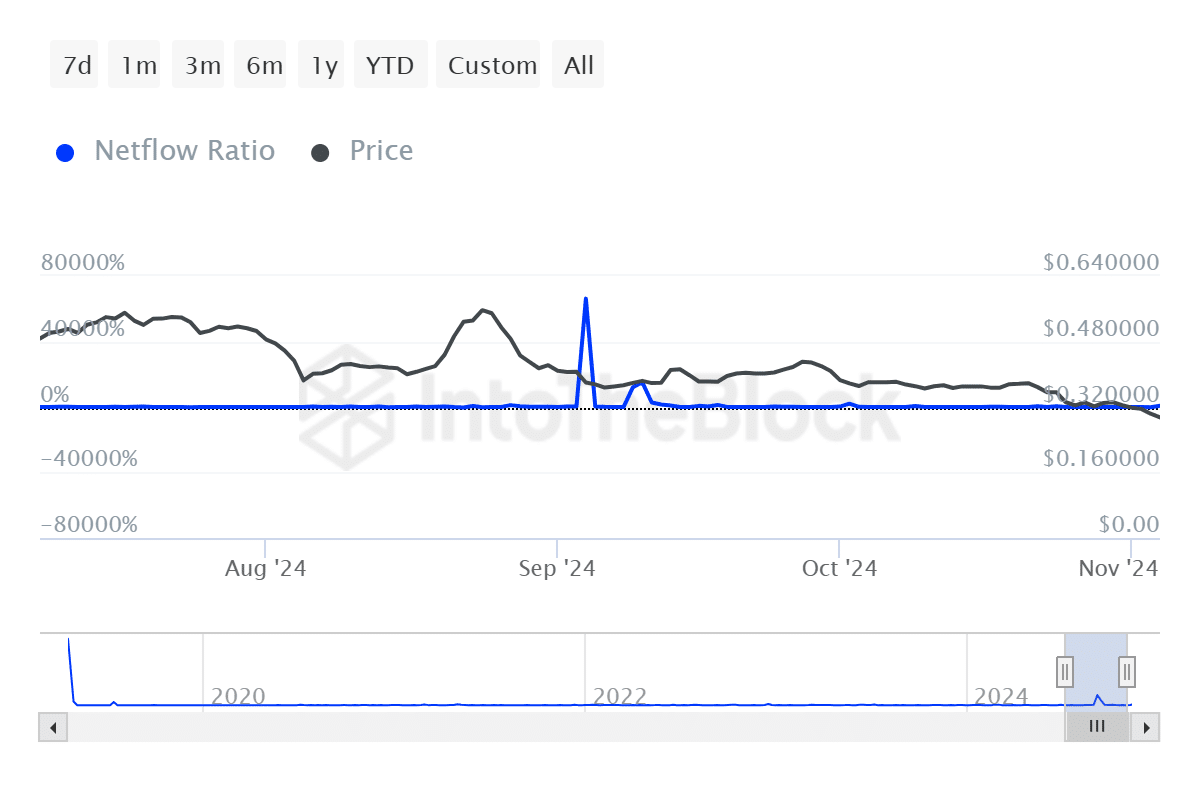

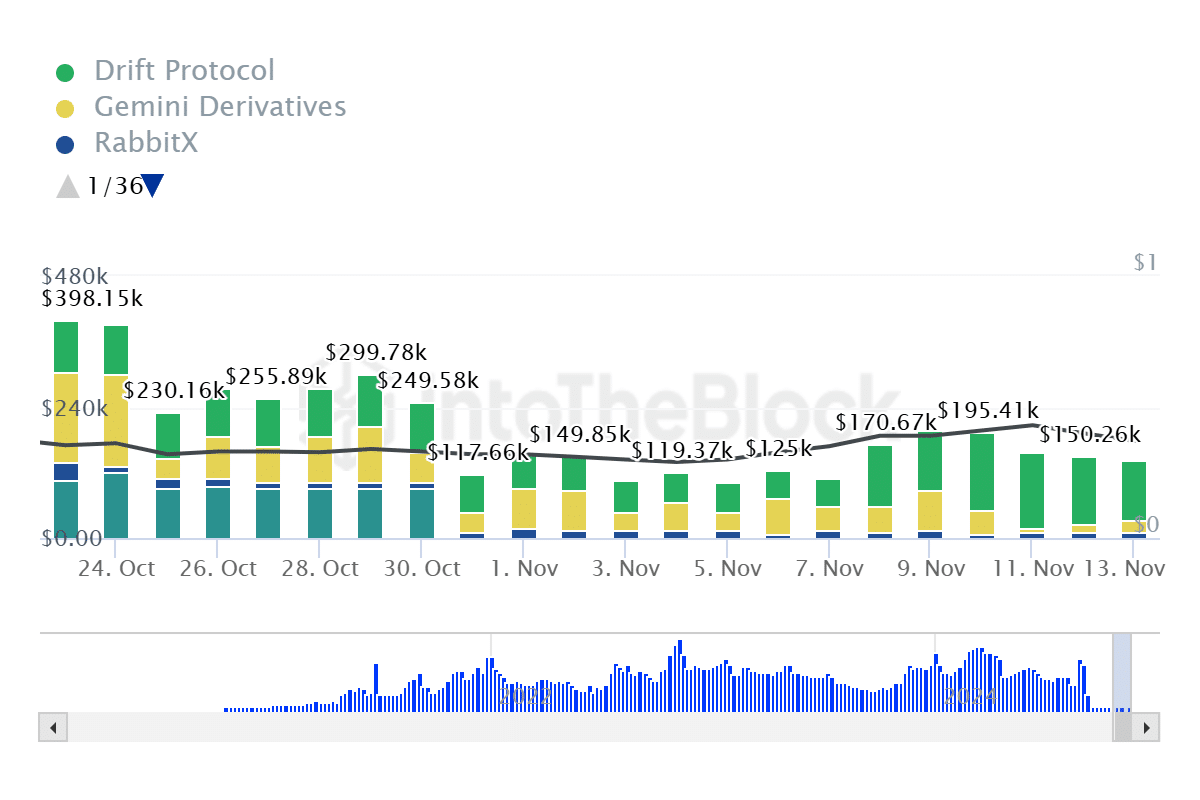

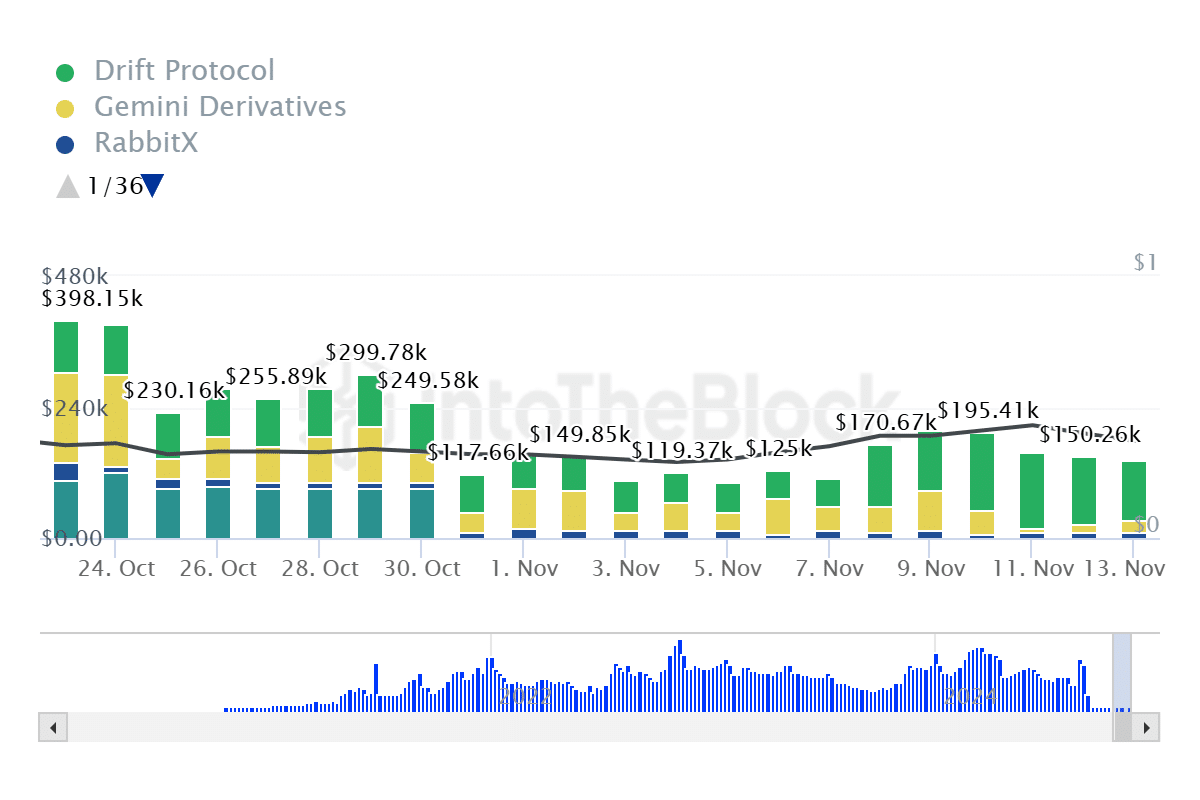

IntoTheBlock’s two key metrics – Netflow to Exchange ratio of large holders and large trading volume – highlighted this trend.

The Large Holder Net Flow to Exchange ratio measures the flow of assets from large holders (or “whales”) to exchanges. A spike in this ratio along with a falling price often indicates increased selling pressure.

For POL, this ratio has surged 737.00% in the last 24 hours and 2,474.58% in the last 7 days, which is consistent with the broader bearish sentiment as whales sell off their holdings.

Source: IntoTheBlock

This bearish sentiment was further reinforced by a large increase in trading volume, with 78 major trades recorded during the period.

Is it likely to crash or bounce back?

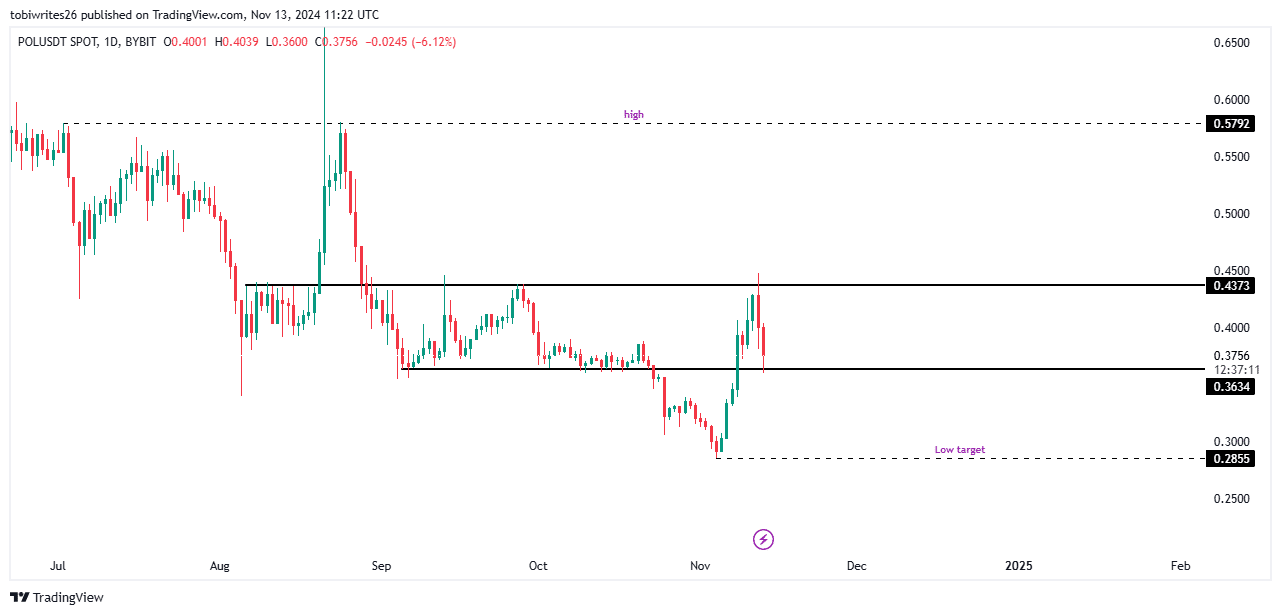

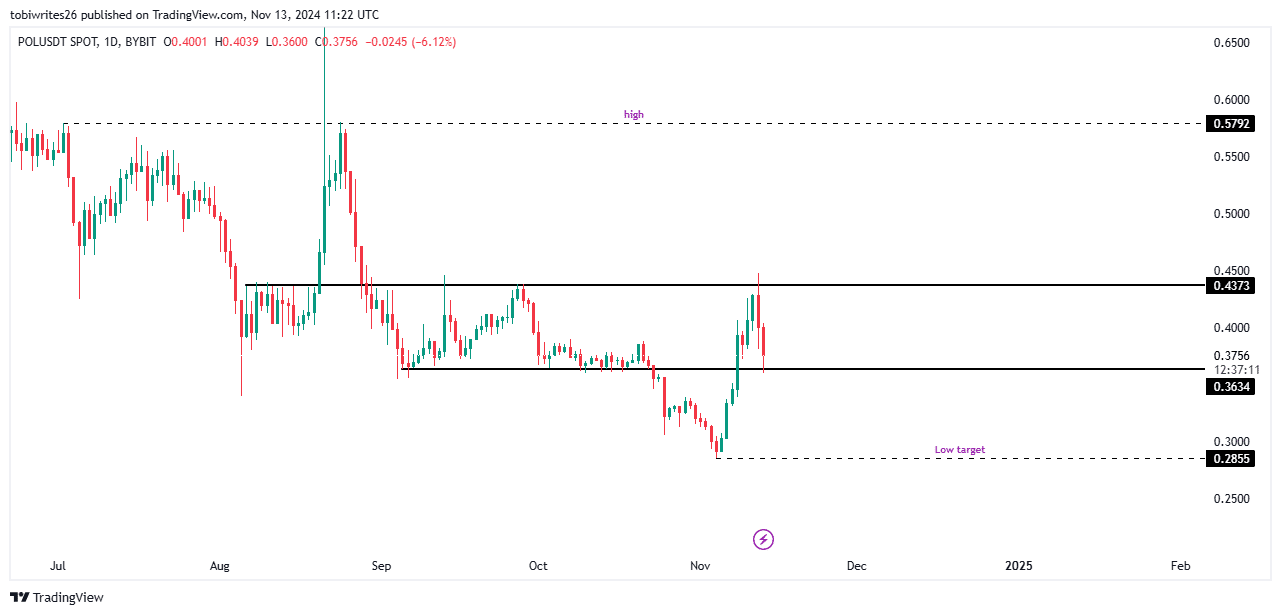

The daily chart shows that despite the ongoing whale sell-off, POL could find a temporary bottom at a critical support level, potentially setting the stage for a rebound.

The support level at $0.3634 could exert enough buying pressure to shift momentum, with the possibility of a price rebound targeting $0.5792.

However, if selling pressure from large holders continues, POL faces further downside risk and could potentially fall as low as $0.2855.

Source: Trading View

Retail sales pressure intensifies

According to IntoTheBlock, POL’s open interest peaked at $198.56K on November 9 before plummeting to $142.53K in the last 24 hours.

Therefore, bears now dominate the open derivatives contracts in the market.

Source: Coinglass

Liquidation data from Coinglass further reflects this bearish sentiment. Short-term contracts closed at just $24.98K, while long-term contracts closed jumped to $685.75K.

Read Polygon (POL) price forecast for 2024-2025

This imbalance highlighted the prevailing bearish momentum as more buy trades were liquidated.

Given these changes, the likelihood of a further decline in POL appears higher than any expected rally.