Ether Lee (ETH) has increased almost 9% over the last seven days, showing signs of power, but the price continues to struggle about $ 2,000. Despite these upward movements, the main indicator suggests that the market still lacks decisive driving force.

From trend intensity to whale activities and support/resistance levels, many indicators refer to the integrated market. Whether Ether Lee is separated or decomposed here depends on how it reacts to the technology level and may vary depending on how to change investor behavior for the next few days.

Ether Leeum BBTREND is positive

Ether Lee’s BBTREND is currently sitting at 3.23 and remains in positive territory for three consecutive days. The indicator has recently peaked at 3.93 on March 22 and has a short -term strengthening trend.

This continuous positive reading suggests that Ether Lee is not actively, but can be rebounded again.

In particular, the last time BBTREND took fifth place on February 26, almost a month ago, was on February 26, a month ago. Since then, the indicators have shown medium intensity, but have not yet broke into the high momentum.

BBTREND’s short BBTREND is a technical indicator used to measure the strength of the price trend. How far from the average and how far you use the Bollinger band as a baseline.

The value of less than 0.5 often indicates that the trend or uneven condition is often informed, while reading values of 1.0 or more indicate that the tendency strength increases. More than 3 values are considered a sign of a solid trend, and exceeding 5 usually refer to strong or weaker movements in powerful directions.

In 3.23, Ether Lee’s BBTREND hovering suggests some direction beliefs, but it can suggest that it is not yet in the stage of escape or momentum while the ETH is popular last month without the readings of 5 years of age.

Whales are reaching a month

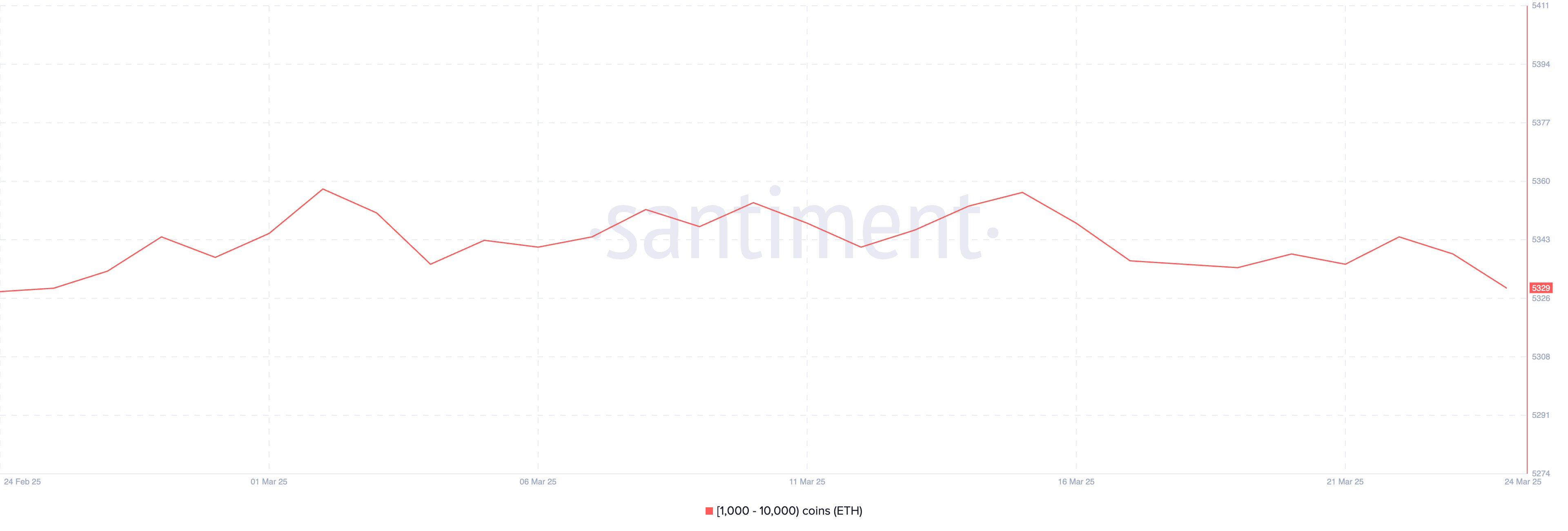

The number of Etherum whales with 1,000 to 10,000 ETH dropped from 5,344 to 5,329 three days ago.

This some notable reduction suggests a gradual reduction in large holder trust or positioning. Especially important is that this is the lowest number of whales observed after February 25.

Although the change may seem small, especially when Ether Lee’s trend indicators show only medium intensity, even the limitations of whale behavior can be ruptured through a wider market.

This large -scale holder has a power to affect prices through significant purchases or sales activities, so it is important to track the Ether Lee Rim Whale Whale.

Whales often serve as smart money, and changes in accumulation or distribution patterns can be used as an initial signal of a wider market shift. The number of whales that decrease can mean that some employment investors adopt profits, relocation or more careful positions.

The fact that the number of whale wallets is currently low in monthly prices can increase hesitation at a higher price level, and potentially potentially capturing ETH’s elevation exercise in the short term unless the new inflow or investor trust is profitable.

Will Ether Lee will fall to less than $ 2,000?

Ether Lee’s EMA line currently proposes an integration stage, and price behavior continues to struggle for $ 2,000. The lack of clear direction reflects the uncertainty of the market because ETH is traded within a narrow range.

Disadvantages, if Etherrium prices are tested for major support at $ 1,938, the next lower target is $ 1,867 and potentially reaches $ 1,759.

On the other hand, if Ether Lee is collecting strong momentum and constructing a continuous uptrend, the first main resistance of the watch is $ 2,320.

Successful brake outs that exceed this level can cause runs at $ 2,546, which can reach $ 2,855 when exercise accelerates.

disclaimer

According to The Trust Project Guidelines, this price analysis article is used only for information provision and should not be considered financial or investment advice. Beincrypto is committed to accurate and prejudice, but market conditions can be changed without notice. Always do your own research and consult with an expert before making financial decisions. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.