Global digital asset investment products recorded significant inflows last week, totaling $2.45 billion.

CoinShares’ latest weekly report confirms that inflows into digital asset investment products have surged, with assets under management reaching a high not seen since early 2022 (currently $67 billion). The US spot ETF market played a pivotal role in these developments, securing $2.4 billion in inflows last week.

Bitcoin remains the clear market leader, accounting for approximately 98% of total inflows last week. The increased confidence also seeped into Ethereum, which received $21 million in inflows. Altcoins such as Litecoin and XRP saw minimal but consistent inflows during the period.

The report also highlights regional trends in these influxes. While the United States is ahead, other regions are showing mixed reactions. For example, Switzerland and Germany reported inflows of $16.7 million and $13.3 million, respectively, compared to outflows from Canada and Sweden. The geographic distribution of these inflows and outflows highlights a nuanced global perspective on digital asset investing.

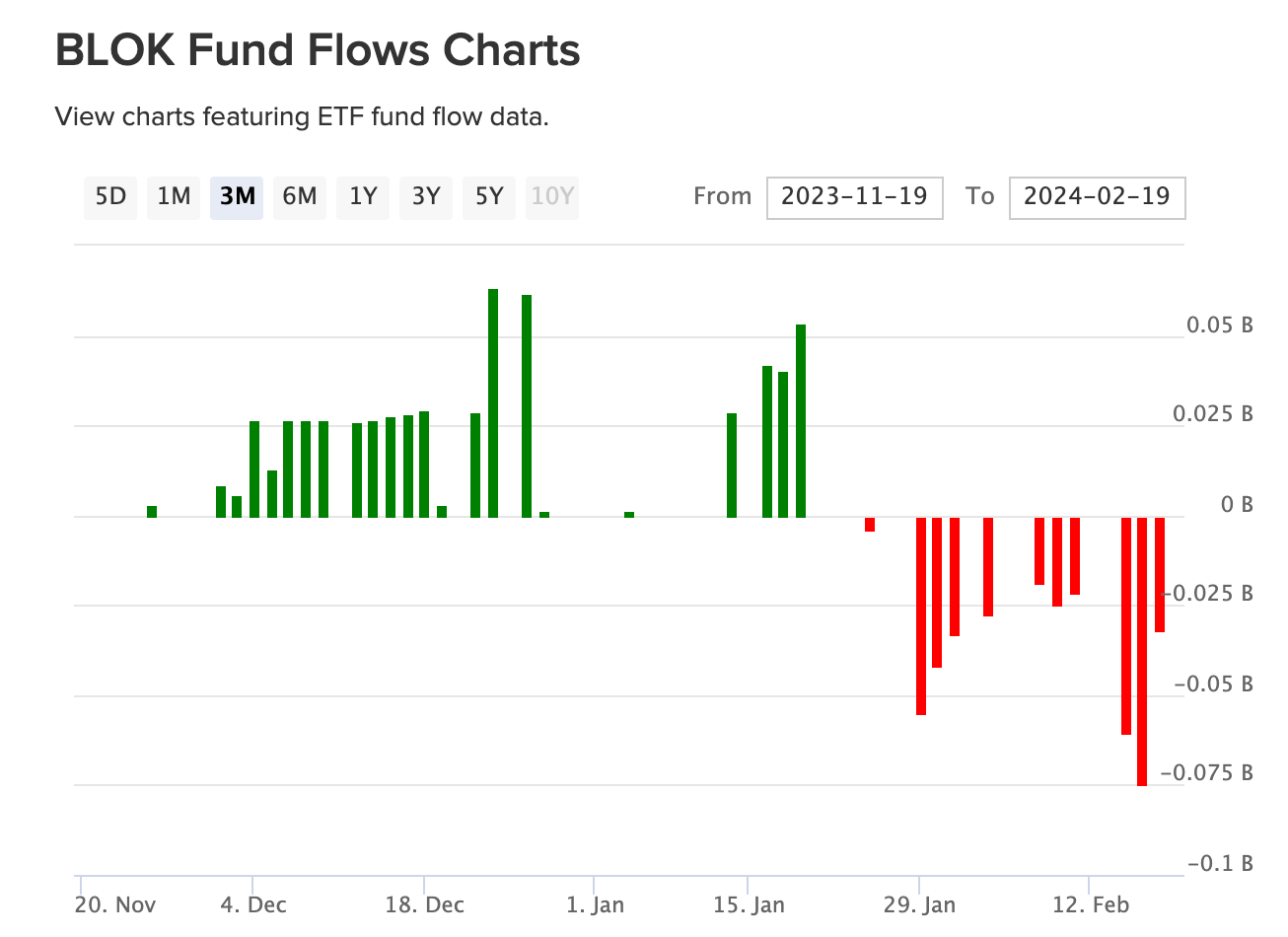

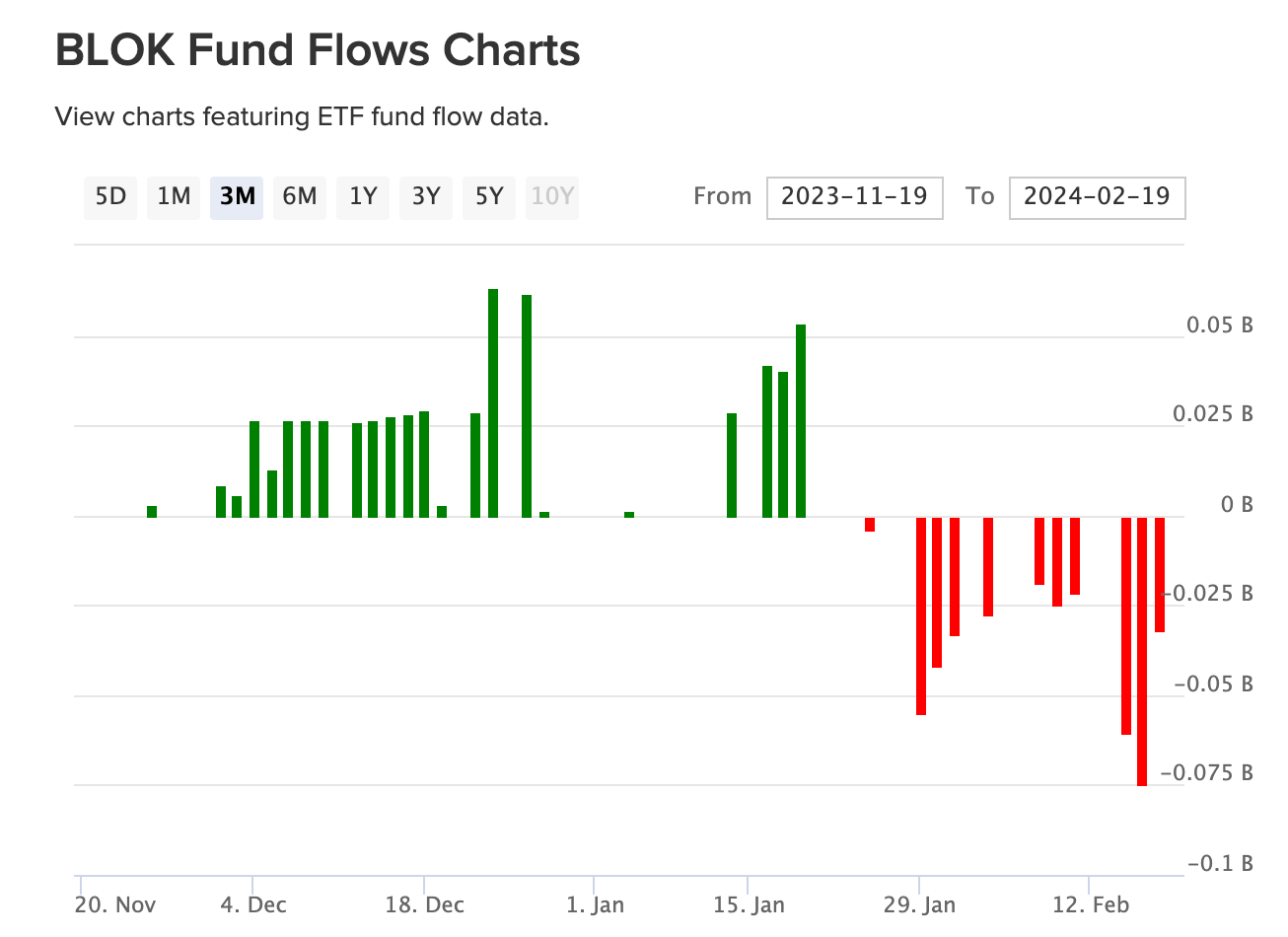

The overall trend for digital asset investment products is positive. However, blockchain stocks experienced a mixed bag, with the Amplify Transformational Data Sharing ETF (BLOK) seeing notable outflows totaling $171 million, while other stocks saw net inflows totaling $4 million. This contrast illustrates the different investment sentiments and strategies going on in the broader cryptocurrency and blockchain investment landscape. BLOK has seen consistent outflows since mid-January, according to the VettaFi ETF database.

In summary, the latest CoinShares report highlights strong inflows of capital into digital asset investment products, along with continued focus on Bitcoin. Significant inflows, highest AuM since December 2021 peak, and regional variations in investment flows reflect the increasing maturity and complexity of the cryptocurrency investment space.

Fix: Updated AuM missing latest influx.