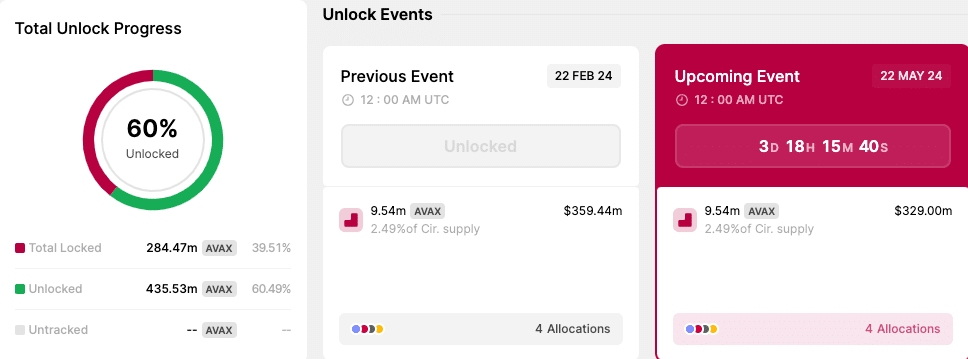

- Volatility around the token may be low considering it previously released 60% of its supply.

- AVAX could reach $43.50 if volume continues to support the price action.

According to data from CoinMarketCap, the price of Avalanche (AVAX) is up 7.80% in the last 24 hours. At press time, the token price was $37.48.

Amazingly, this happened less than four days before the project’s next token unlock.

According to data from the Token Unlocks platform, AVAX plans to release 2.49% of its total supply into circulation on May 22nd.

This percentage represents 9.54 million tokens, worth $329 million. This means that once launched, 62.49% of the total AVAX supply will be part of the circulating supply.

Source: Token Unlock

AVAX takes a big piece of the pie.

Unlocking tokens is not always a good thing considering their high volatility. The greater the unlock, the lower the price will be.

However, projects that have secured around 60-70% of their supply tend to have lower volatility.

In some cases, they are offered at a higher price, especially in the early stages of the unlock schedule. Interestingly, the same seems to be the case with AVAX.

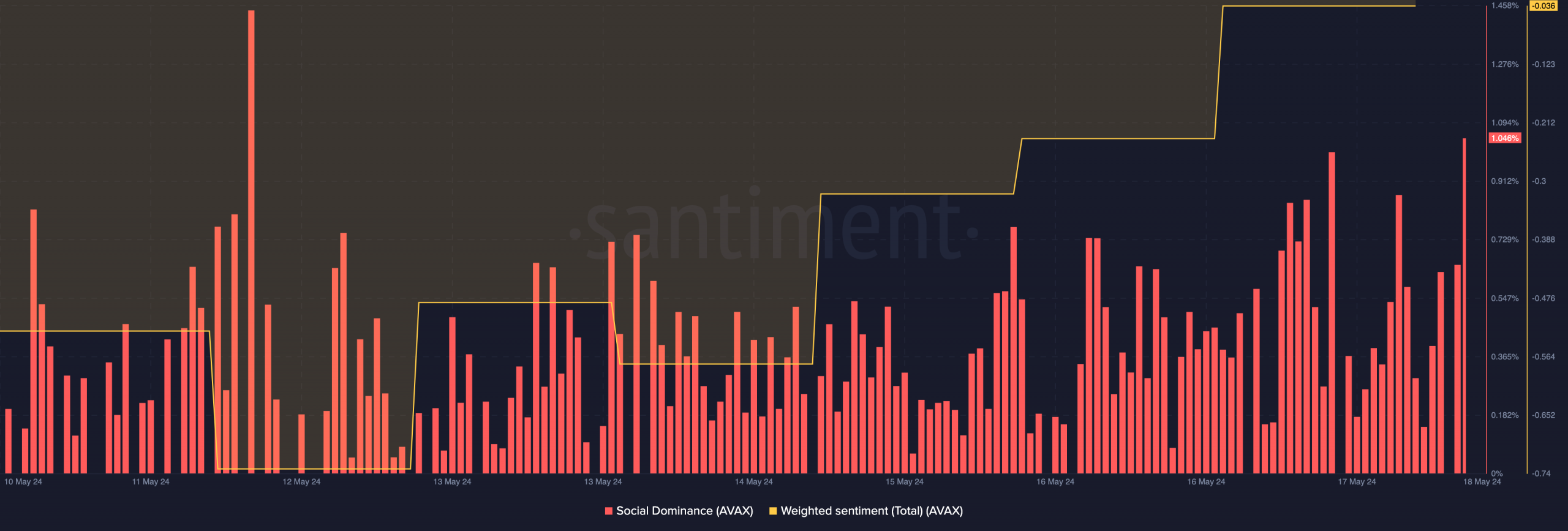

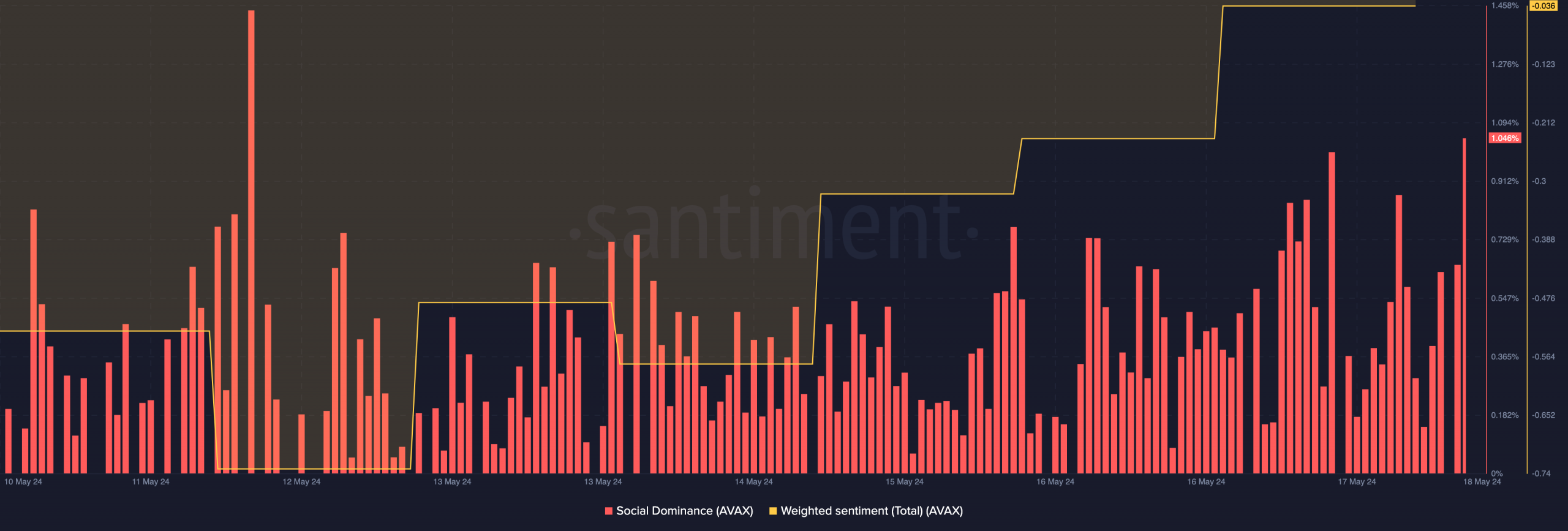

To determine the token’s potential, AMBCrypto investigated what was happening with the token on-chain. Our first observation was the rise in Weighted Sentiment.

As of this writing, the Weighted Sentiment for the Avalanche project was -0.036.

Although the figure was negative, it was a notable increase compared to -o.574 on May 15, indicating that participants were shedding their bearish bias.

Social dominance has soared, as has sentiment. At press time, this indicator was at 1.046%, meaning that discussions around the project have improved.

Source: Santiment

Is it impossible to stop price increases?

The combination of negative sentiment and increased social dominance can increase value for money.

This could push the price of AVAX towards $40 in the near term, or towards $43.50, a very optimistic target, before the scheduled unlock.

However, traders may need to be careful. If social dominance becomes too high, it may be a sign of FOMO. FOMO stands for Fear of Missing Out.

Last time, the metric was higher than at press time, with AVAX plummeting from $35.08 to $31.42 in three days.

On the other hand, if sentiment jumps into positive territory, the bullish case may be vindicated.

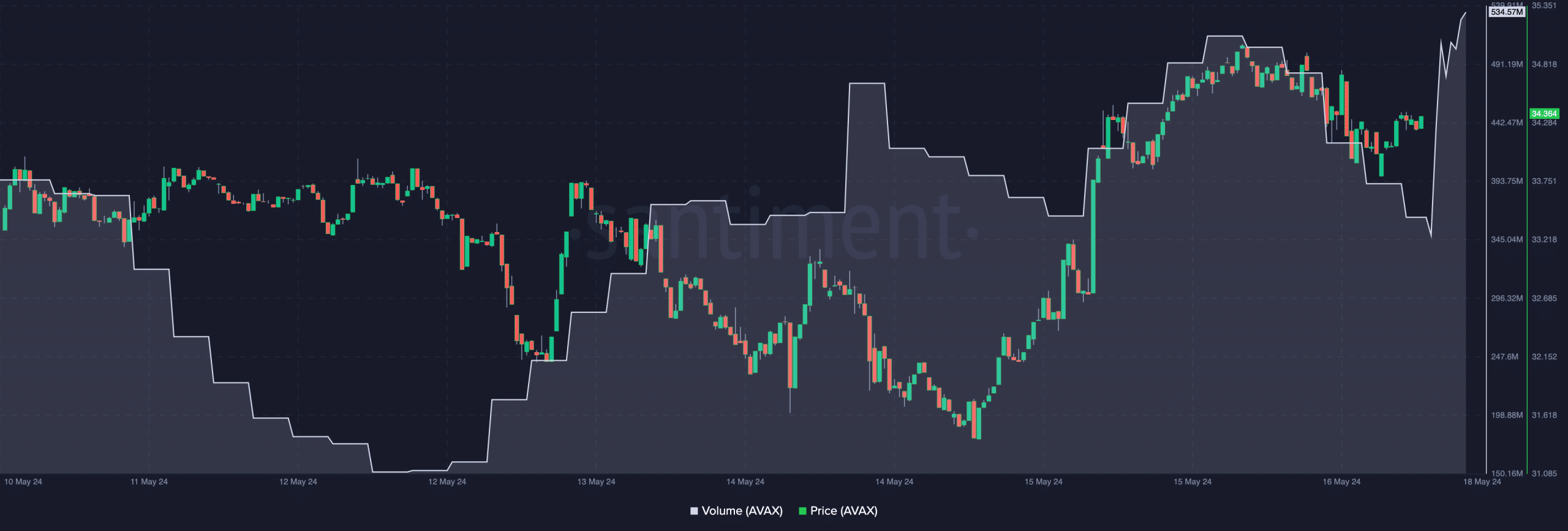

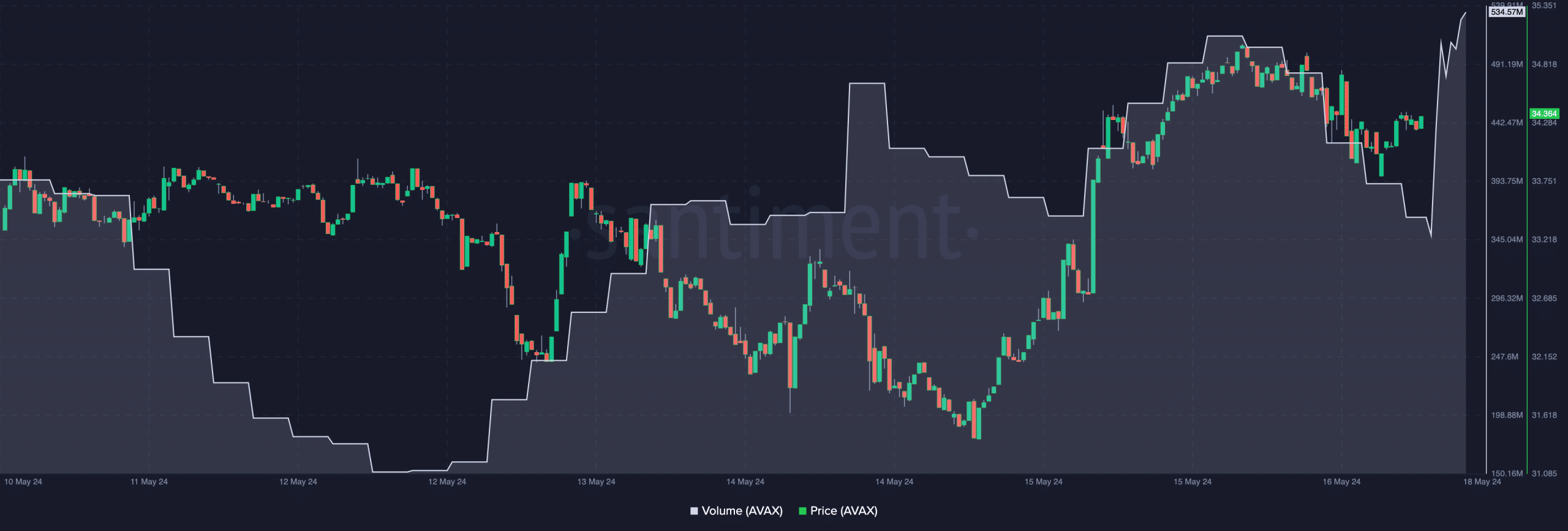

In addition, volume also supported the price rise. At press time, on-chain data from Santiment showed AVAX’s trading volume reached $534.57 million, the highest in the past seven days.

Source: Santiment

Is your portfolio green? Check out the AVAX Profit Calculator

If volume continues to increase while the price rises, a move towards $50 could occur in the short term.

However, if sales increase as prices fall, or vice versa, this is evidence of decreased demand. In this case, the bullish forecast may become invalid.