Cryptocurrency markets continue to navigate seas of uncertainty, and Avalanche (AVAX) is no exception. AVAX has shown some resilience compared to its altcoin peers, but a closer look shows the market struggling with conflicting signals that mix cautious optimism with fundamental anxiety.

Related Reading

An optimistic whisper or a mirage?

AVAX’s future is still surrounded by uncertainty. While some positive signs exist, such as relative performance and bullish sentiment, they are countered by indicators such as reduced market control and a significant decline in trading activity.

Avalanche: Increased resistance level

A look at AVAX’s six-month chart reveals a roller coaster ride characterized by sharp highs and lows. This volatility highlights AVAX’s sensitivity to broad market trends and its dependence on specific developments within its ecosystem.

Over the past few months, AVAX has seen sharp corrections, as has a pattern of price surges. Currently, the altcoin appears to be consolidating around $38 after recent declines from April highs.

If AVAX can maintain support at the crucial $35 level, it has the potential to head north, especially if a broader bull market in the cryptocurrency market materializes.

However, significant resistance awaits at $48 and $53, price points that AVAX has repeatedly tested but failed to surpass in recent months. A sustained break above this level would signal a significant change in momentum, potentially pushing AVAX to $80 or even $100 by the third quarter.

A Tale of Two Markets: Where Are the Traders?

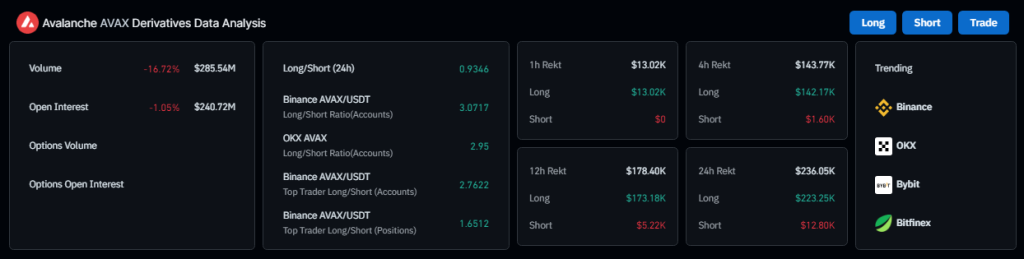

The trading scene surrounding AVAX presents a strange dichotomy. Coinglass data shows a sharp 60% drop in trading volume, indicating a significant decline in market activity. This is further confirmed by the relatively balanced long/short ratios across the various platforms, suggesting general indecision among traders regarding the future of AVAX.

However, there is some optimistic sentiment emerging from prominent cryptocurrency exchange Binance. The long/short ratio here is skewed quite high, indicating a potentially more optimistic outlook among individual traders for this particular platform.

Meanwhile, the current AVAX market situation, with the fear-greed index reaching 40%, shows a neutral atmosphere, indicating that investors have balanced opinions.

Related Reading

Loss of control, decreased interest?

AVAX’s struggles extend beyond trading. Altcoins appear to be loosening their grip on market share as search interest declines. This means less market control and potentially weaker general interest. This is not a recipe for success for tokens targeting significant profits.

Featured image by Summitpost, chart by TradingView