- AVAX is down 5.13% in the last 24 hours.

- A bearish crossover could cause the Avalanche to move lower while remaining in a consolidation range.

After experiencing a sustained uptrend and hitting recent highs of $55, Avalanche (AVAX) has struggled to maintain upward momentum.

As a result, altcoins fell to a low of $40. Over the past two weeks, AVAX has been trading in a consolidated range between $47 and $55.

In fact, at the time of writing, Avalanche was trading at $49.49 on the daily chart, down 5.13%. The altcoin also showed a downward trend on the weekly chart, down 2.93%.

Prior to this, Avalanche was on the rise, rising 55.26% over the past month.

Current market conditions raise questions about Avalanche’s future price movements.

What AVAX’s Bearish Crossover Means

AMBCrypto’s analysis shows that AVAX was under strong downward pressure amidst increasing selling pressure at press time. The upward momentum of altcoins was slowly waning as bears attempted to take over the market.

Source: TradingView

This downward trend is confirmed by the bearish crossroads of the Stoch RSI over the last 24 hours. This crossover at 30.09 indicates near-term bearish momentum.

This reflects a change in sentiment from bullish to bearish, which suggests that sellers may be gaining control.

This change becomes more pronounced when the SMA reverses the price, signaling bearish momentum. Therefore, the market trend may enter a correction phase.

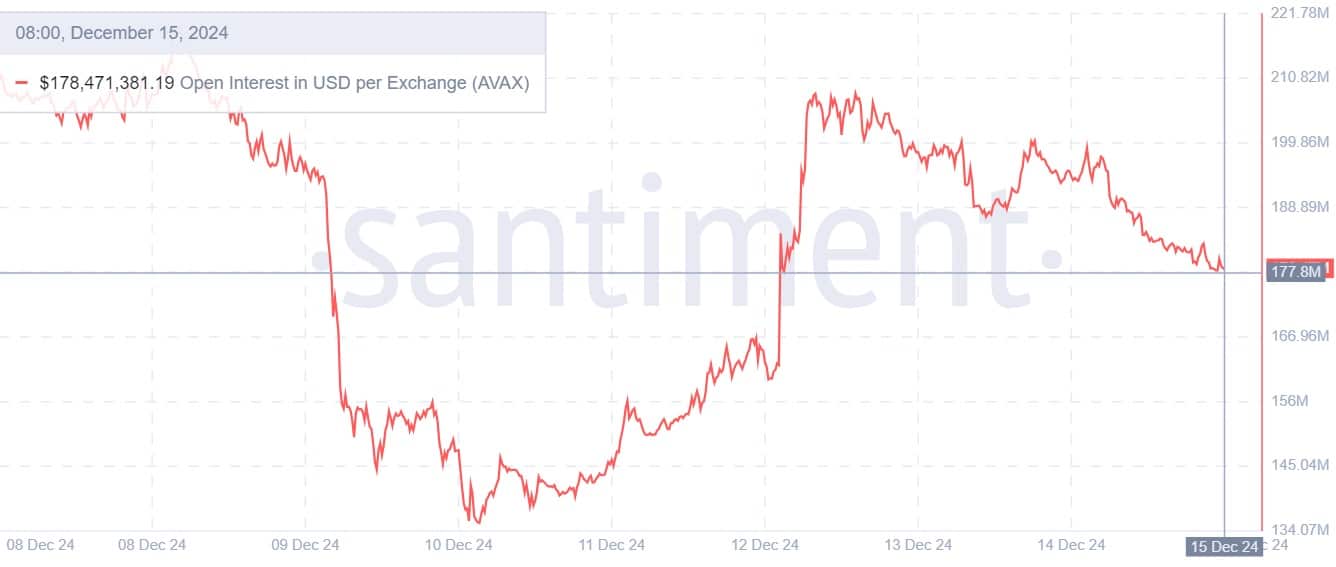

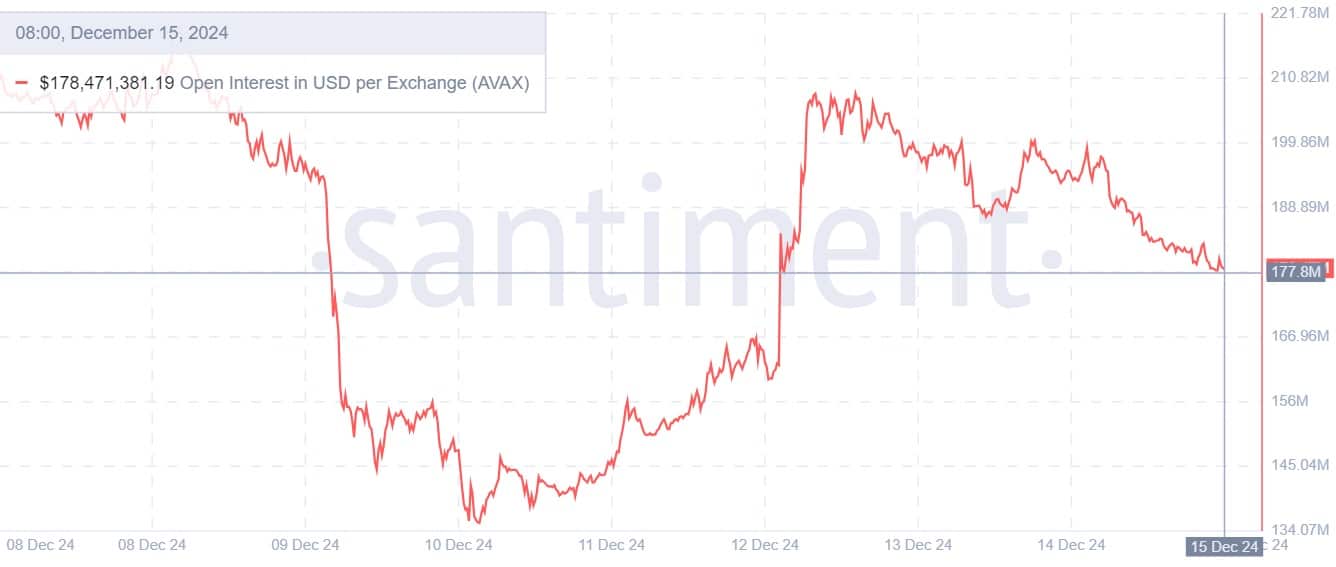

Source: Santiment

Looking more closely, Avalanche’s open interest per exchange decreased from $219.5 million last week to $178.4 million.

The decline in open interest reflects investor sentiment as new entrants continue to close positions while avoiding entering the market.

Source: IntoTheBlock

This decline is even more pronounced among AVAX whales. Accordingly, the inflow of large holders decreased from 8.55 million to 2.12 million.

This sharp decline means that capital inflows among whales have decreased and they are not purchasing altcoins.

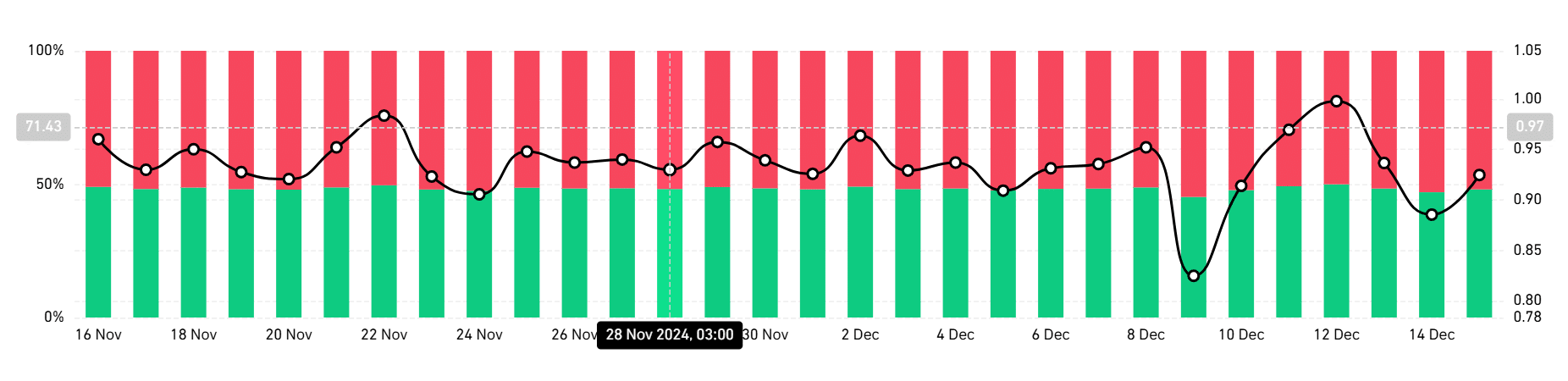

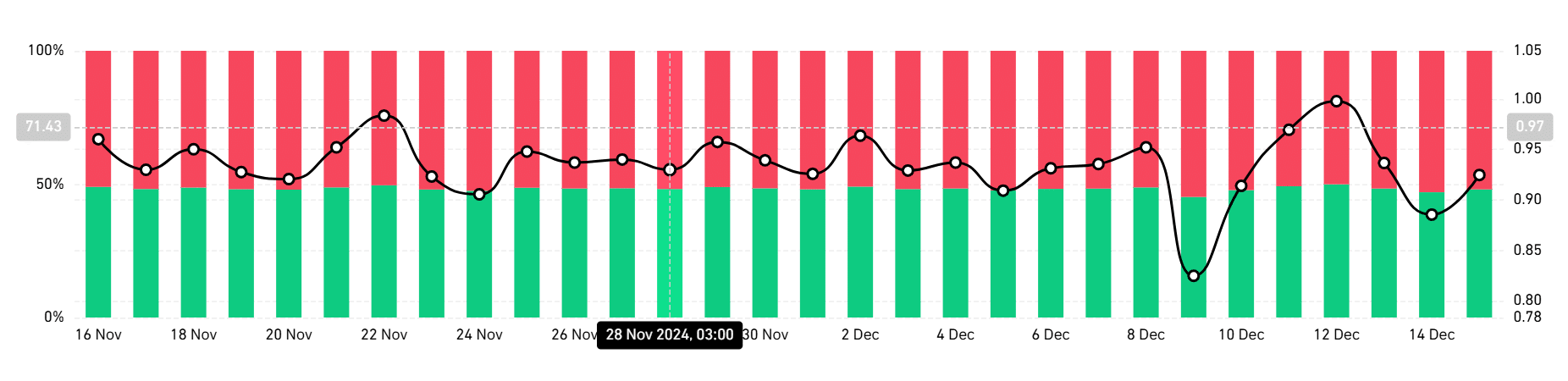

Source: Coinglass

Finally, investors who took short positions dominated the market on the daily charts. According to the long/short ratio, short position holders account for 51.96% of total positions.

Most investors taking a short position means that most market participants are betting that the price will fall.

Simply put, the Avalanche is currently experiencing near-term bearish sentiment, as evidenced by its bearish crossover.

Read Avalanche (AVAX) price prediction for 2024-2025

Current market conditions point to a potential continuation of the trend, which could push AVAX down to $43.

After that, a break out of this consolidation will allow AVAX to claw back $55, having faced two rejections in the past few weeks.