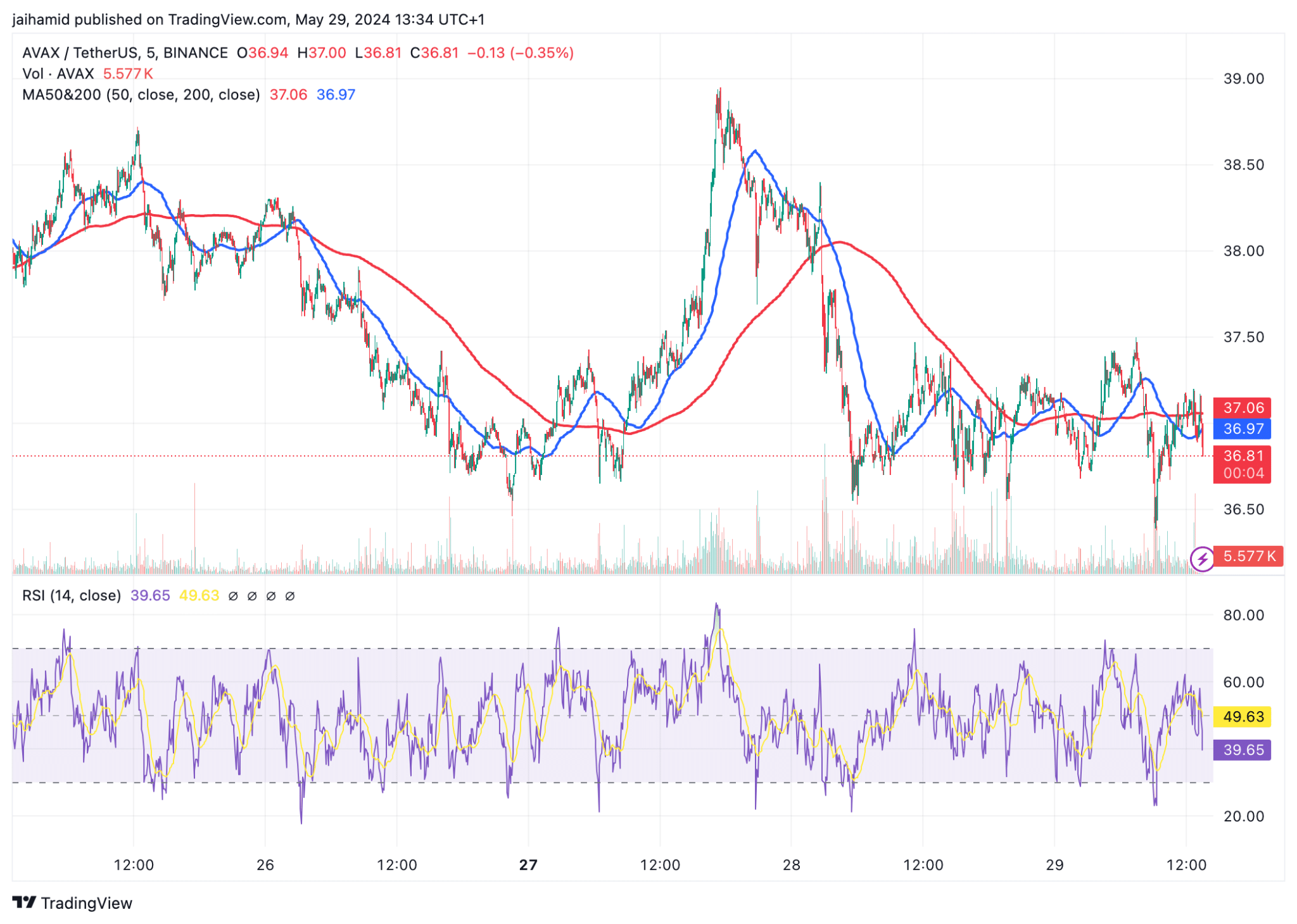

- AVAX is consolidating with prices between MA50 and MA200.

- Lacking strong momentum, it remains in the neutral zone, with support likely to drop lower as bearish pressure strengthens.

Once again, Avalanche (AVAX) is in the doldrums due to price action. AVAX was little moved as the broader market faced a slight correction and Bitcoin and Ethereum lost some of their gains.

There was a balanced order between the bulls and bears, with neither side having complete control. However, in the current trading activity, bears may slowly gain the upper hand.

Analysis of current trading activity for AVAX/USDt chartWe observe that the avalanche moves within a defined range, represented by the interaction of the 50-day moving average (MA50) and the 200-day moving average (MA200).

The MA50 around $36.97 acts as a short-term resistance level, while the MA200 around $36.81 provides some support. These closely spaced moving averages suggest a consolidation phase in tight trading conditions.

Source: TradingView

The relative strength index (RSI) is 49.63, indicating a neutral stance. Lack of strong bullish or bearish momentum.

For AVAX to break out of its slump, it will need to close firmly above the MA50 resistance line. Failure to do so could potentially lead to a retest of lower support near $36.50.

If bearish pressure intensifies, especially if the broader market correction deepens, AVAX may test lower levels further.

A move below $36.50 could set up follow-on support near $36.00, which would be important to prevent a further decline into the sub-$35.50 area.

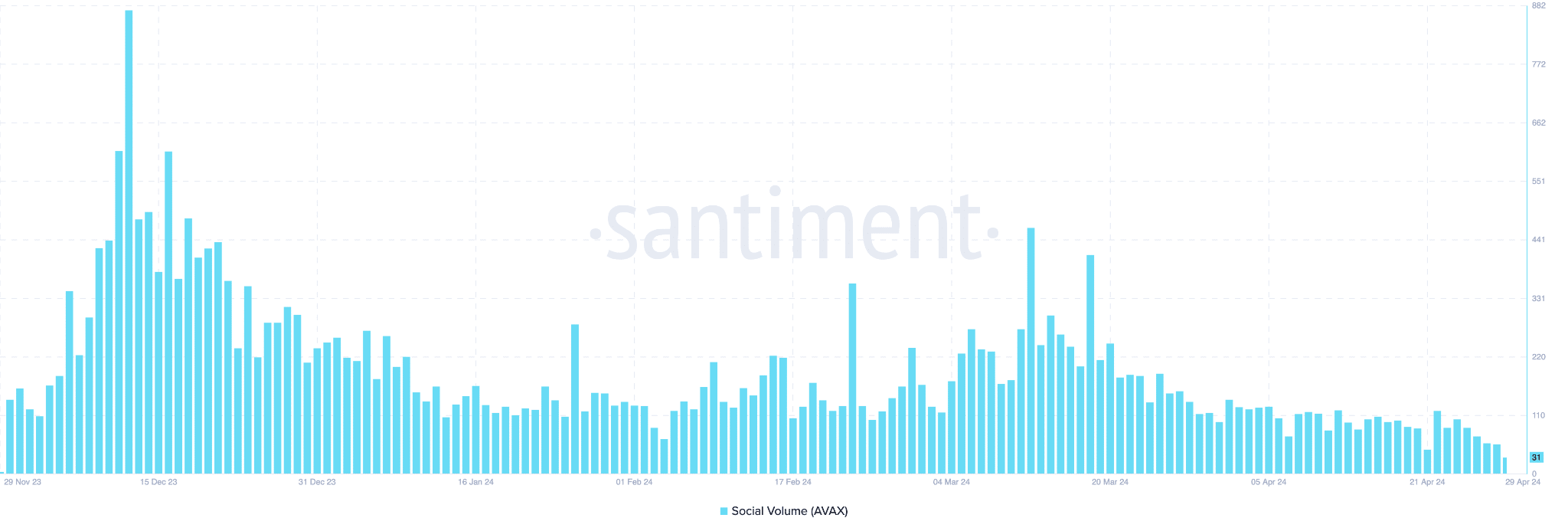

Meanwhile, AVAX’s overall tendency Social volumes have declined significantly in an effort to maintain higher price levels or generate mainstream trading enthusiasm.

Source: Santiment

From a technical perspective, this decline in social engagement could signal a cooling-off period where the bulls take a break until prices break above short-term resistance.

Is your portfolio green? Check out the AVAX Profit Calculator

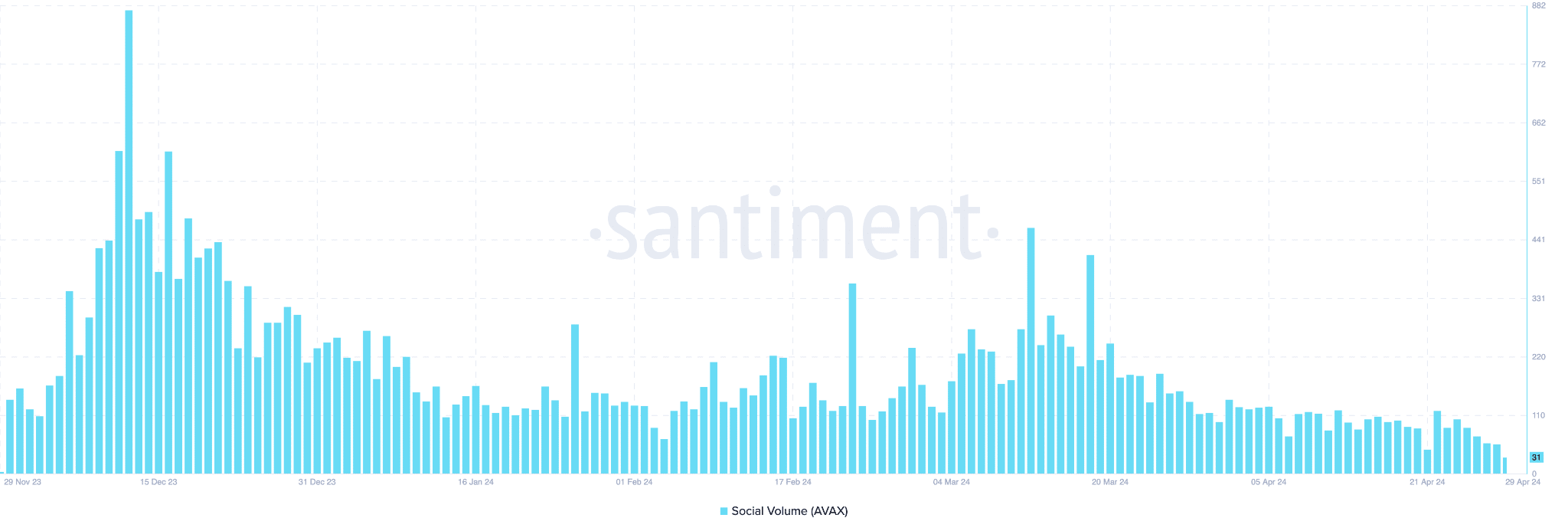

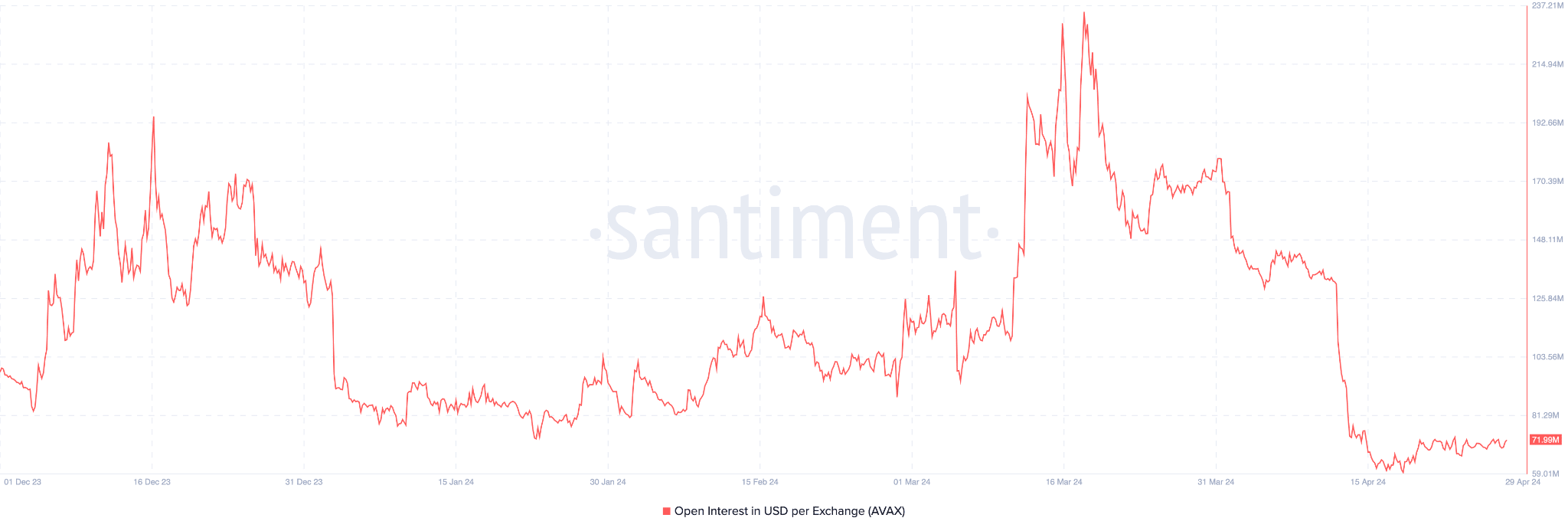

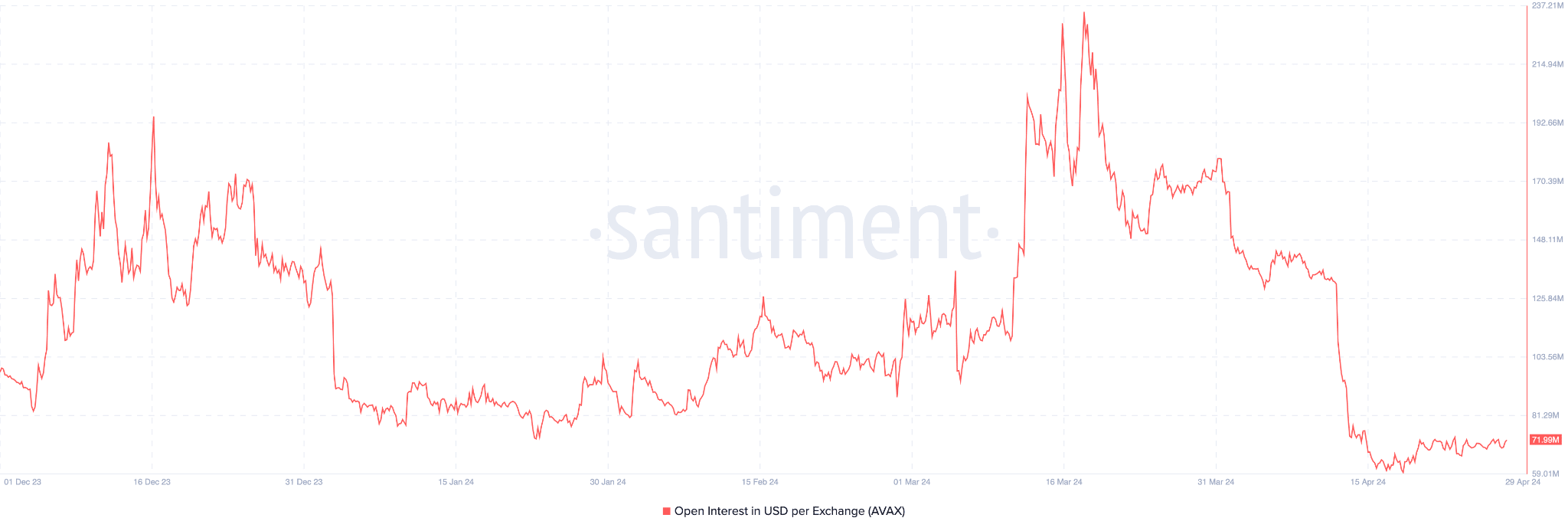

This same trend is reflected in open interest levels on several exchanges.

Source: Santiment

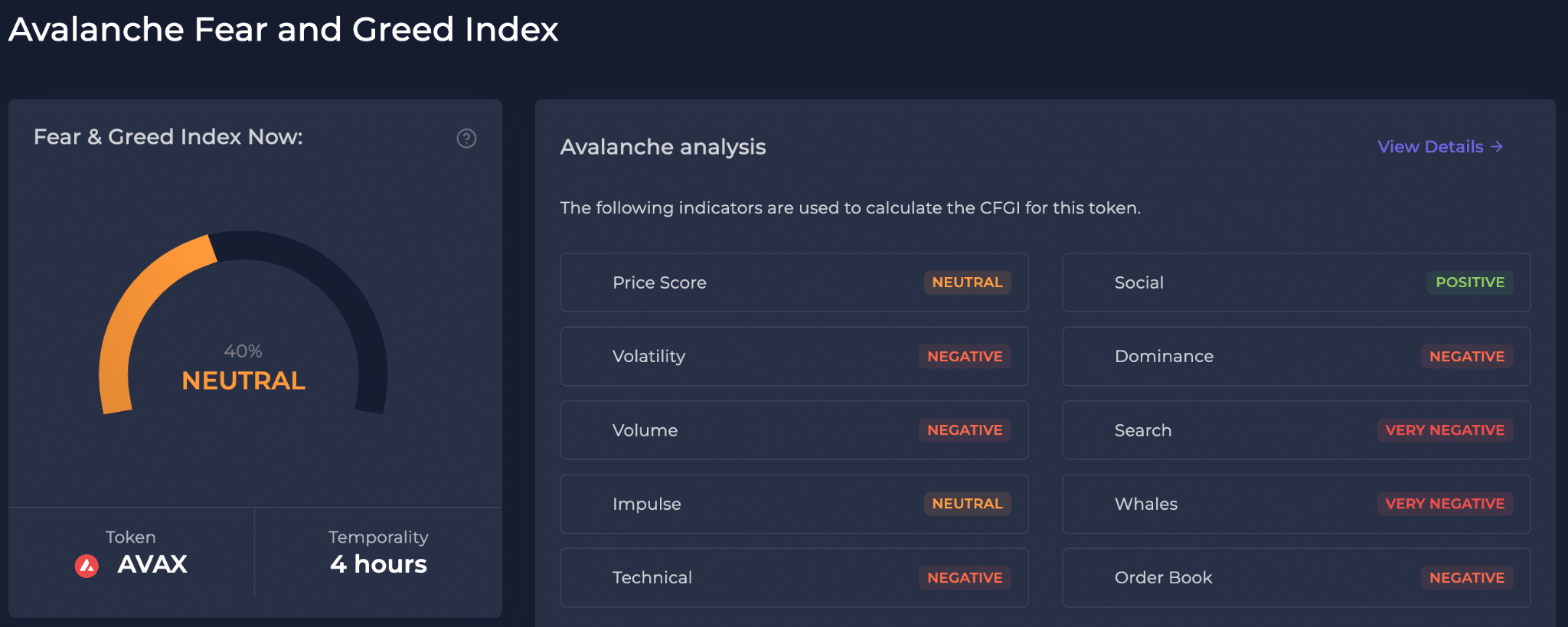

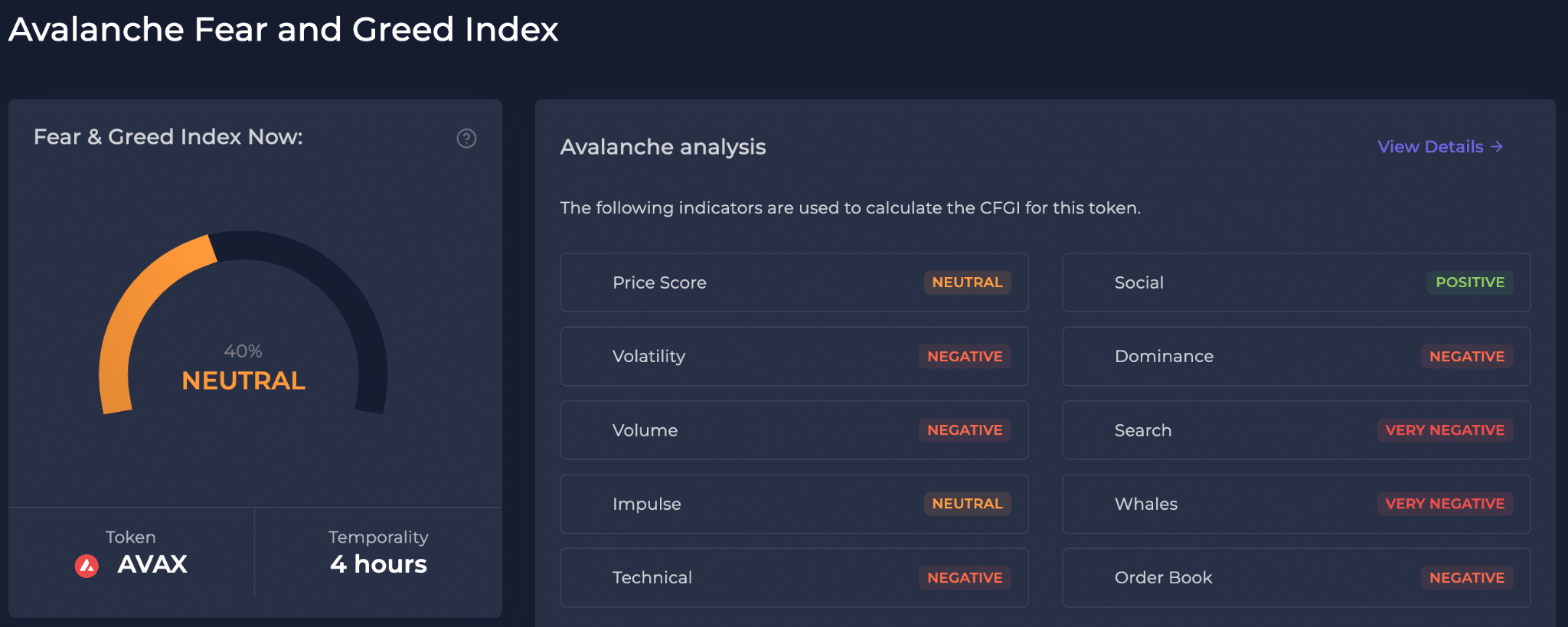

AVAX’s social sentiment shows a liquid market where downward pressure may be applied due to negative views on trading volume and dominance. Overall, AVAX doesn’t seem to have a clear path for the foreseeable future. A stronger catalyst will be needed for the market to fully rally.

Source: CFGI