In a dramatic turn of events that echoes the prescient warnings of Bitcoin creator Satoshi Nakamoto, the financial system has witnessed yet another stark contrast between the faltering traditional banking sector and the growing cryptocurrency market.

New York Community Bank (NYCB), whose stock price plummeted, received attention. Worrying revelations about financial health and management turmoil sent the stock plummeting by more than 40%. The turbulence comes as Bitcoin is up 58% year-to-date, hitting an all-time high of $69,000.

NYCB Goes Bankrupt While Bitcoin Hits All-Time Highs

The plight of NYCB, a regional lender based in Hicksville, New York, became public knowledge when it disclosed “material weaknesses” in its internal controls. This resulted in shareholders losing a whopping $2.4 billion last quarter.

The leadership shake-up further compounded the bank’s difficulties. Alessandro DiNello assumed the role of president and CEO, and a series of credit rating downgrades pushed NYCB’s debt into junk territory.

This series of misfortunes mirrored the earlier collapse of First Republic Bank. This therefore hinted at potential systemic problems within the local banking sector. Nonetheless, NYCB has secured a massive cash infusion even as it grapples with internal turmoil and is likely to undermine depositor confidence.

“In evaluating this investment, we were mindful of the bank’s credit risk profile. With over $1 billion of capital invested in the bank, we believe we now have sufficient capital in case we need to increase reserves in the future to match or exceed the coverage ratios of NYCB’s large bank peers.” Treasury Secretary Steven Mnuchin said:

Read more: US Banking Crisis Explained: Causes, Impact and Solutions

These financial difficulties stand in stark contrast to the thriving cryptocurrency market. The unprecedented investment and accumulation of Bitcoin has earned strong trust from both new and veteran investors.

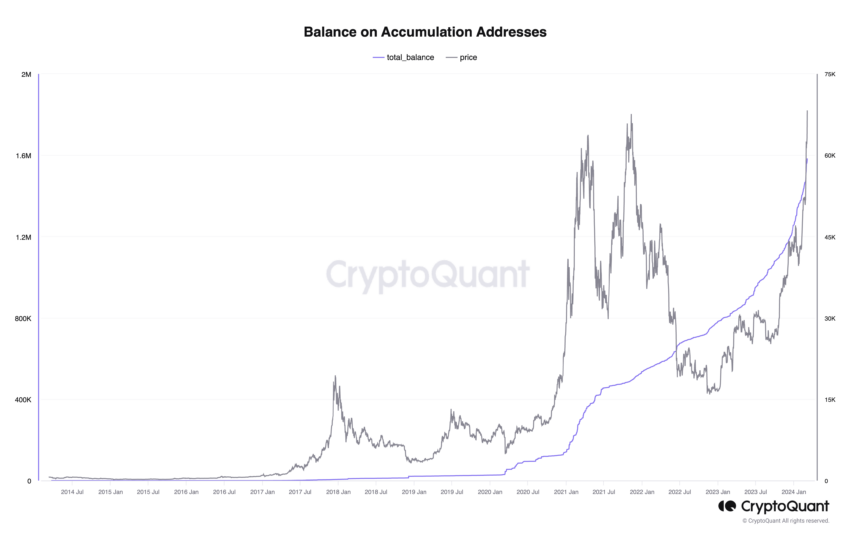

Significant inflows into cumulative addresses support Bitcoin’s resilience and growth. Likewise, the rise in exchange-traded fund (ETF) holdings reflects growing demand for Bitcoin in contrast to the instability plaguing the traditional banking industry.

The differences reflect a broader shift in investor sentiment as many seek refuge in what they perceive as a more decentralized and safer financial future.

“Total Bitcoin holdings of cumulative addresses have also reached an all-time high. This address currently has a total holding of 1.5 million Bitcoin. This address represents an investor who only accumulated Bitcoin and never sold it. Therefore, a surge in Bitcoin holdings is a sign of high demand,” an analyst at CryptoQuant told BeInCrypto.

But not everything is smooth sailing for Bitcoin. Despite increased demand and new price increases, other indicators suggest that Bitcoin may be entering an overheating phase. These indicators show complex times when a sharp rise can trigger an equally quick pullback.

“With prices rising too quickly in relation to key on-chain indicators, short-term pauses/corrections may occur… Moreover, traders’ unrealized profit margins have now exceeded extreme levels, which has led to selling pressure from these market participants. It can be expected.” CryptoQuant analyst added.

Read more: Bitcoin price prediction for 2024/2025/2030

As Bitcoin continues to chart its course, the fate of traditional banks could serve as a warning to an industry at a crossroads, navigating the difficult waters of modern finance in the shadow of Satoshi Nakamoto’s remarks.

“Banks must be trusted to store our money and transfer it electronically, but they lend in waves of a credit bubble with virtually no reserves. We need to trust them to protect our privacy, and we need to trust them to prevent identity thieves from leaking our accounts,” Satoshi Nakamoto wrote.

disclaimer

All information contained on our website is published in good faith and for general information purposes only. Any action you take upon the information on our website is strictly at your own risk.