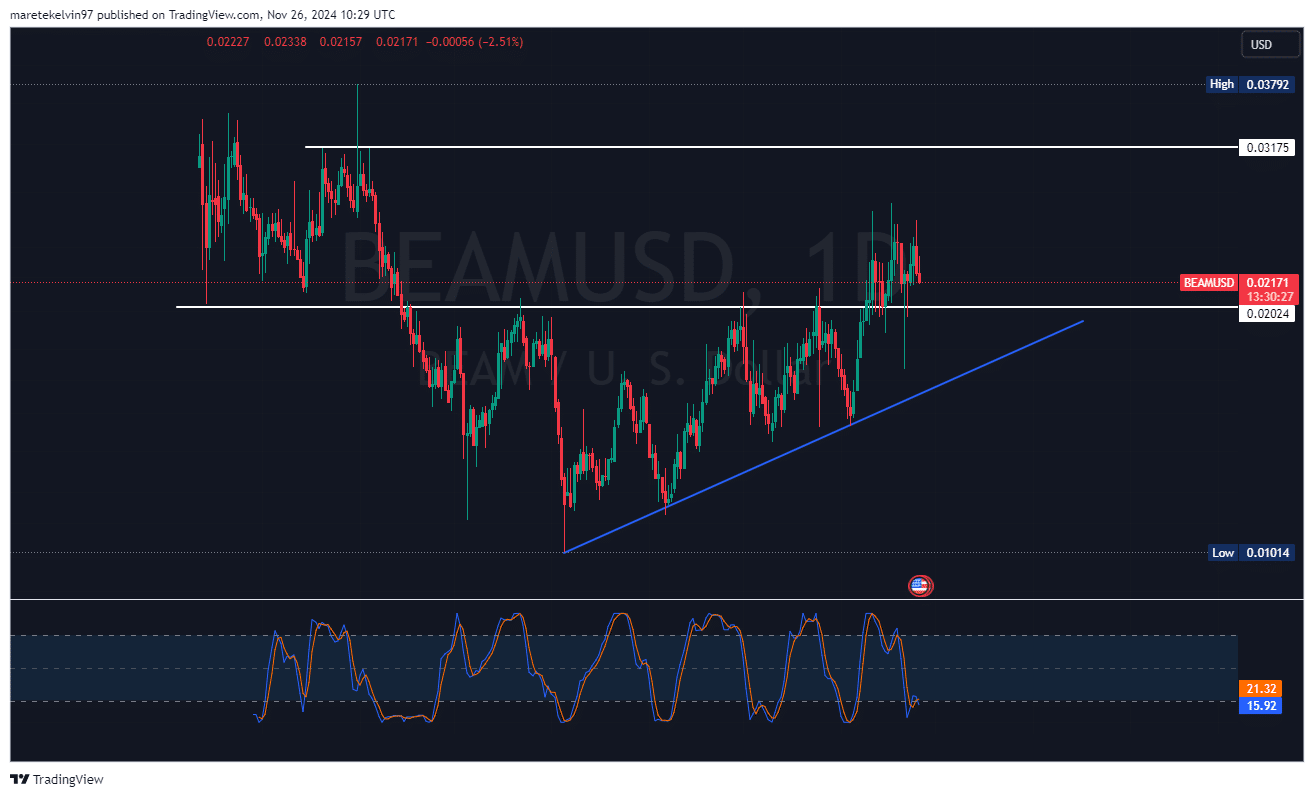

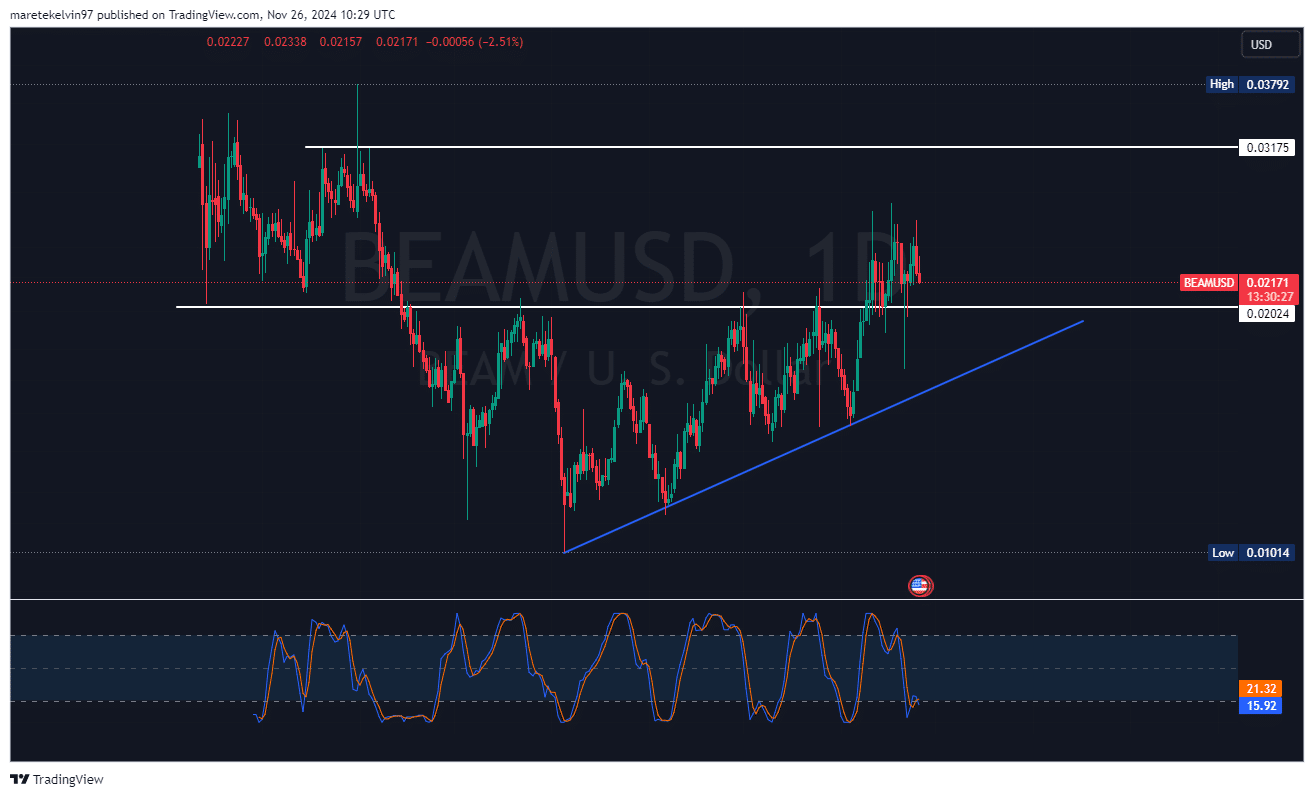

- Beam was approaching the critical support level of $0.0202 at press time.

- On-chain indicators indicate a decline in whale and trading activity.

Beam (BEAM), a privacy-focused cryptocurrency, underwent a significant test on the daily chart as its price neared a key support level at $0.0202.

The asset plunged more than 16% in less than 48 hours, raising concerns among market participants about its near-term trajectory.

Source: TradingView

As the price of Beam continued to fall, the stochastic RSI was approaching oversold territory at press time.

These developments could signal a potential price reversal, a near-term bounce, and could provide a glimpse of hope for Beam’s upside.

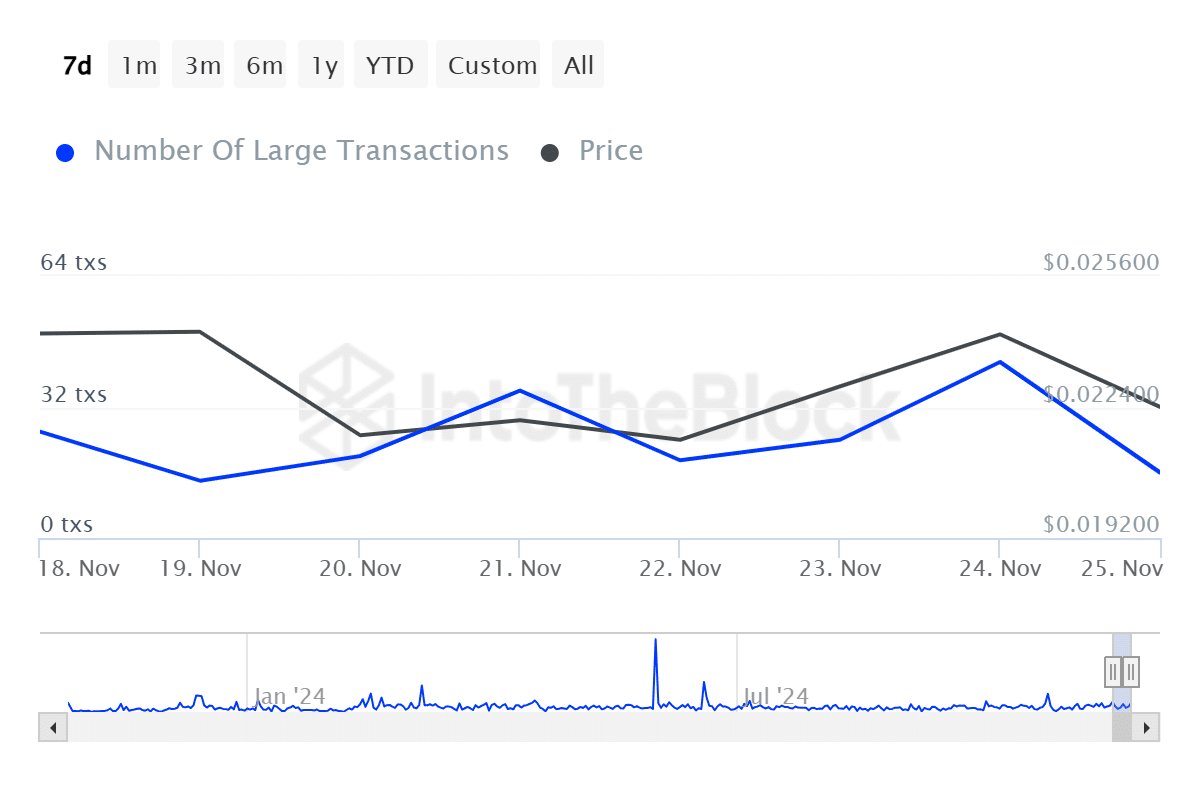

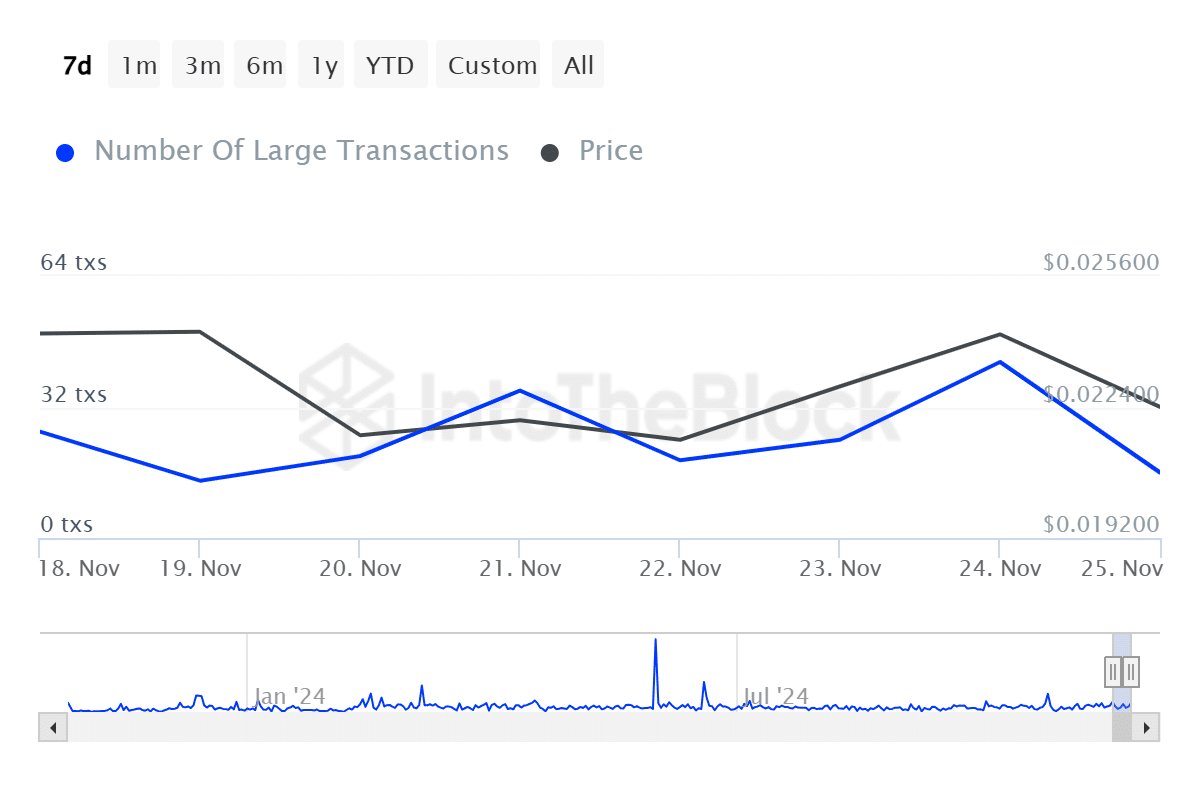

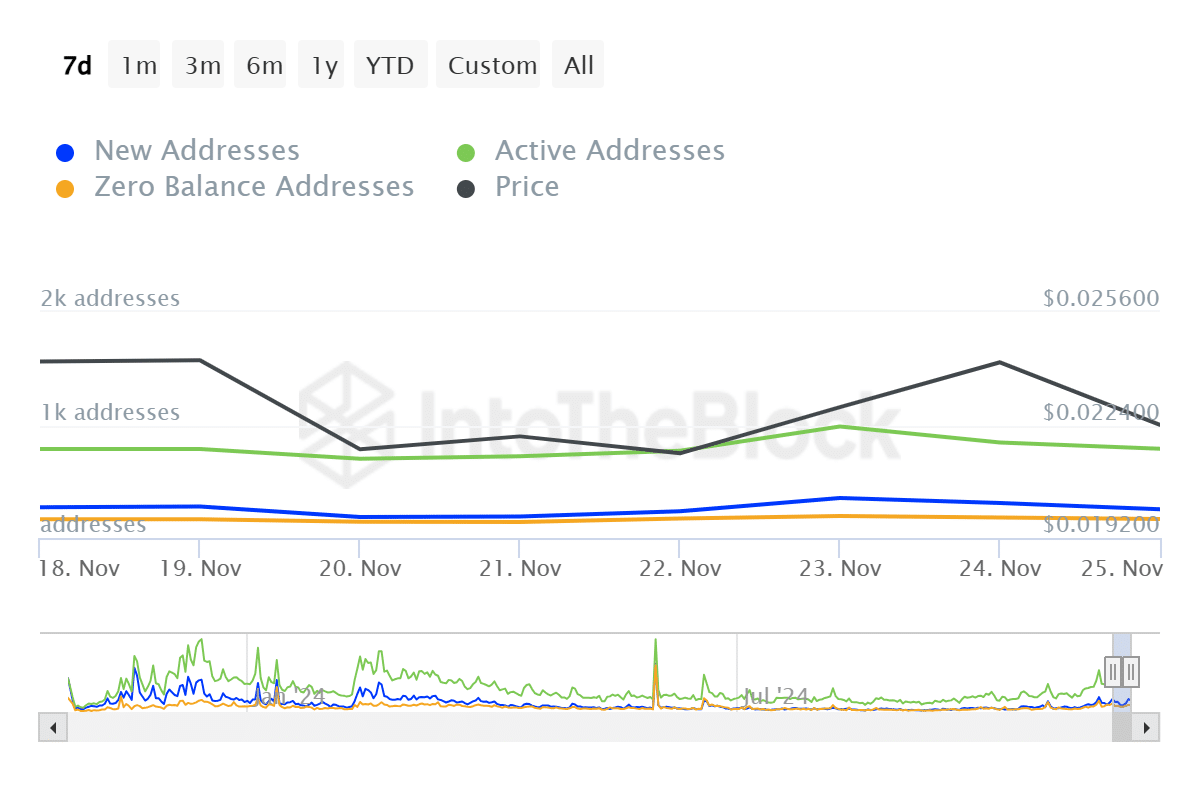

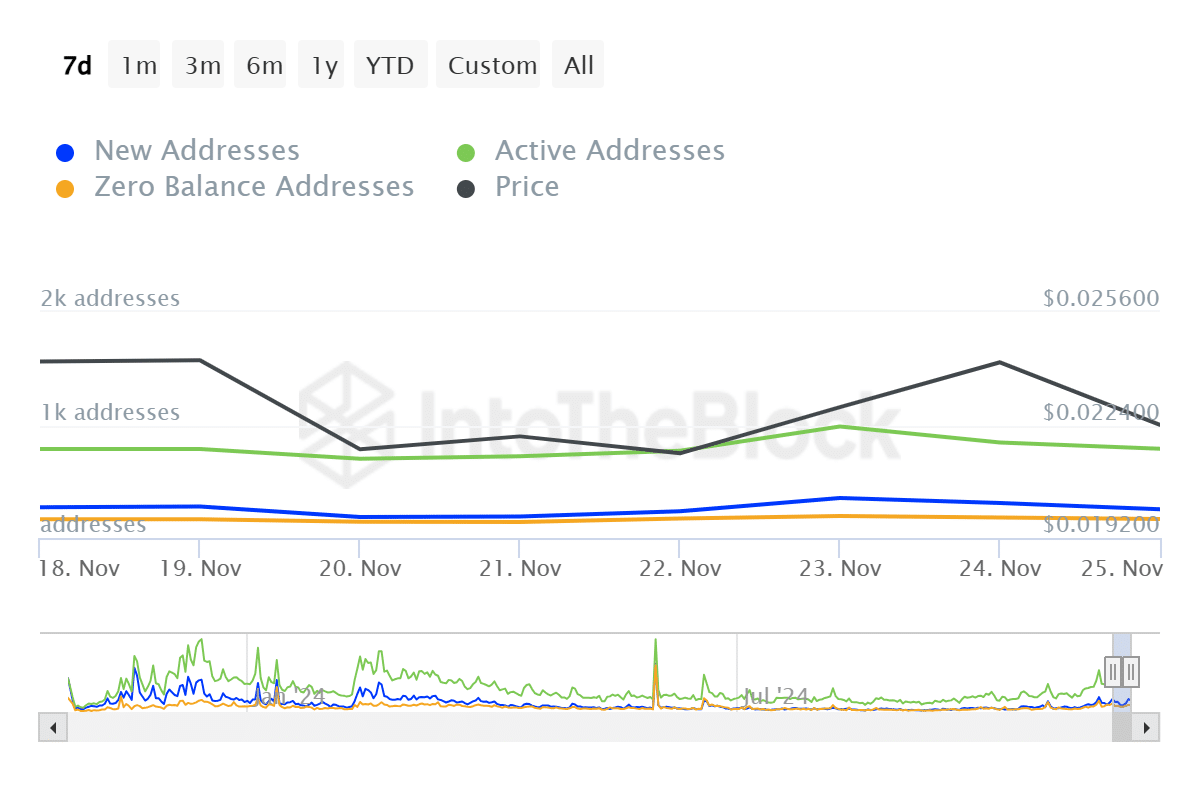

Decrease in whale and trading activity

AMBCrypto’s analysis of IntoTheBlock’s data shows that most parameters are trending downward. This was mainly driven by: There has been a decline in large transactions, down 69% in the last 24 hours.

This suggests that the big players are in a “wait and see” situation. Whales are watching Beam’s reaction to the $0.0202 support level.

Source: IntoTheBlock

The decline in whale activity was further reinforced by a 7% decline in active addresses. The significant decrease in the number of active addresses indicates a decrease in overall Beam transaction activity on the network.

Source: IntoTheBlock

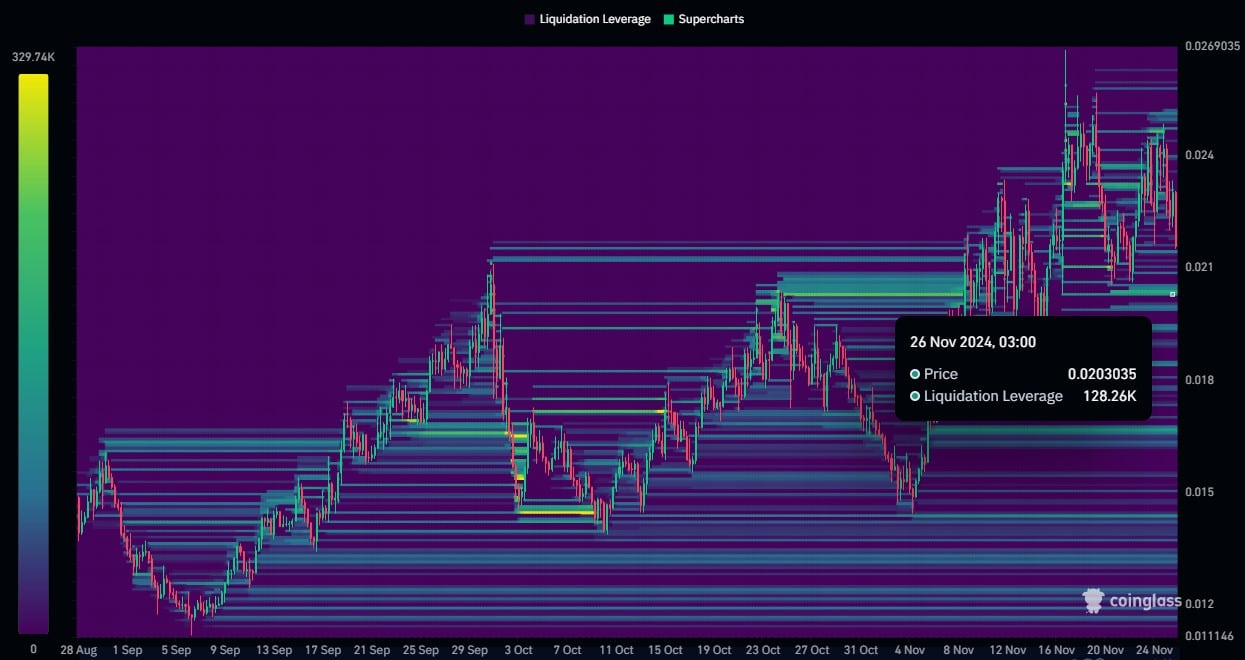

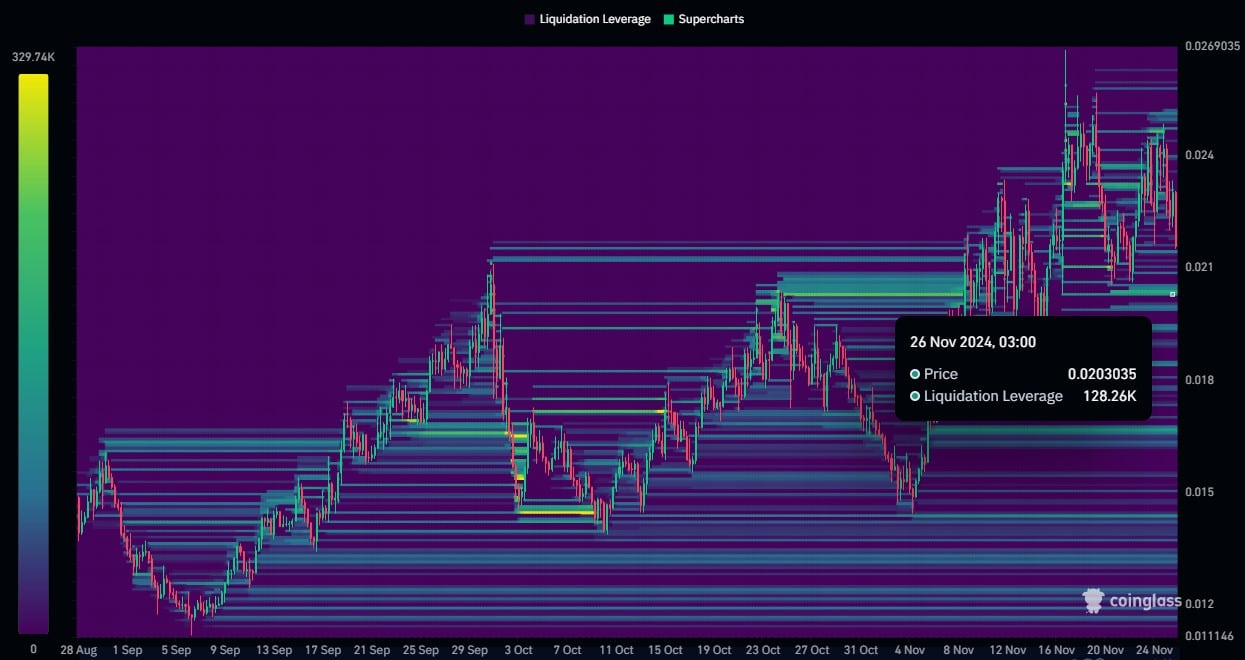

Liquidation pool to push prices higher

However, a significant liquidation pool worth 128.26K at the $0.0203 price level added to Beam’s bearish outlook.

This pull is in line with the key support level at $0.0202 and a breach could result in further downward pressure on the Beam price.

Source: Coinglass

What’s next for Beam?

The confluence of declining on-chain metrics and bearish price action paints a worrying picture for Beam’s near-term outlook.

Read BEAM Price Forecast for 2024-25

However, stochastic RSI provides positive support to the bulls as there could be a price correction in the long term.

$0.0202 support is important for the next price setup. A break below the price level could signal further weakness, while a bounce could build the foundation for a potential bullish rally.