- Binance and Polygon have verified more unique addresses than any other chain.

- TVL and volume have decreased despite the number of unique addresses.

Recent data shows that Binance (BNB) and Polygon (MATIC) have the most active addresses. Nonetheless, it is important to analyze how this has affected volume and total value locked (TVL).

Also, how have BNB and MATIC trended based on the volume of unique addresses on their networks?

Binance and Polygon Leading Rankings

In the recently conducted ranking of the top blockchains by unique address, Cryptocurrency RankingBinance Smart Chain and Polygon took the top two positions.

According to data from the ranking platform, Binance Smart Chain has over 444 million unique addresses, while Polygon has over 419 million unique addresses.

These numbers are notable because the combined unique addresses on these platforms exceed the combined unique addresses on the next three platforms:

It also surpasses major platforms such as Ethereum (ETH) in terms of unique addresses, indicating significant user adoption and activity.

How does it affect volume and TVL?

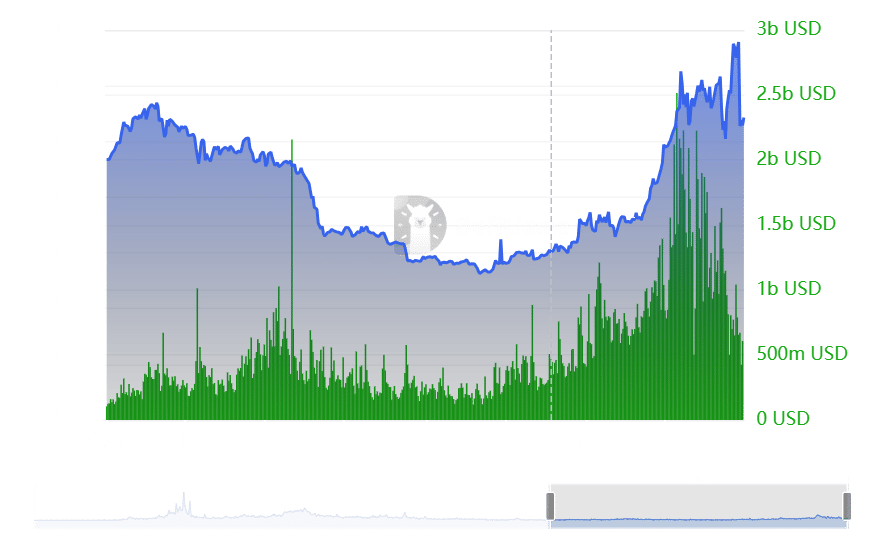

An analysis of the trading volume and total value locked (TVL) of Binance Smart Chain (BSC) using DefiLlama data shows a lack of significant movement recently.

The network experienced notable activity around March, with consecutive volume surges peaking at over $2.5 billion. However, as of the latest data, that amount has decreased to about $614 million.

Likewise, TVL saw a brief rise above $6.7 billion last week, but has since declined to around $5.4 billion.

Source: DefiLlama

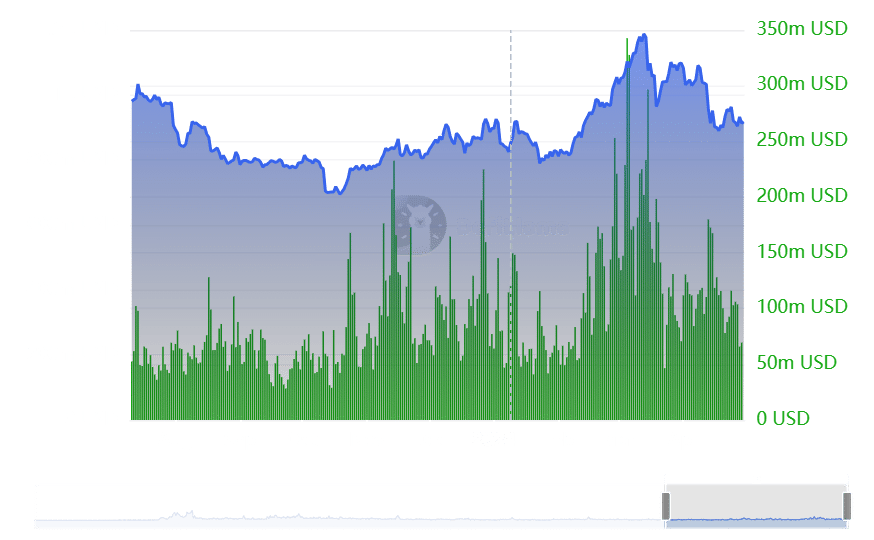

Likewise, AMBCrypto’s examination of Polygon’s volume and TVL revealed a lack of notable recent trends.

At the time of analysis, trading volume was approximately $69 million and has recently been declining. TVL also recently showed a decline, to about $917 million.

Source: DefiLlama

These metrics suggest that despite the surge in unique addresses, there has yet to be a corresponding increase in activity or participation on these networks.

BNB and MATIC have a negative start to the week.

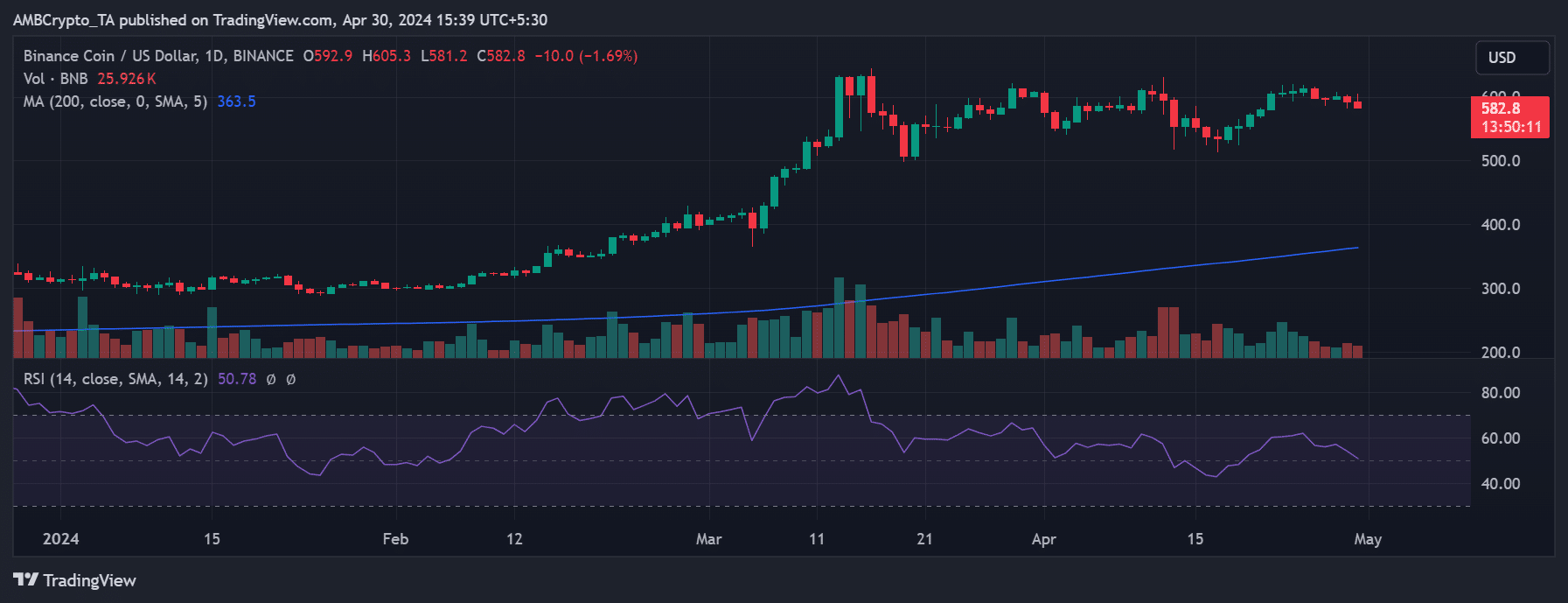

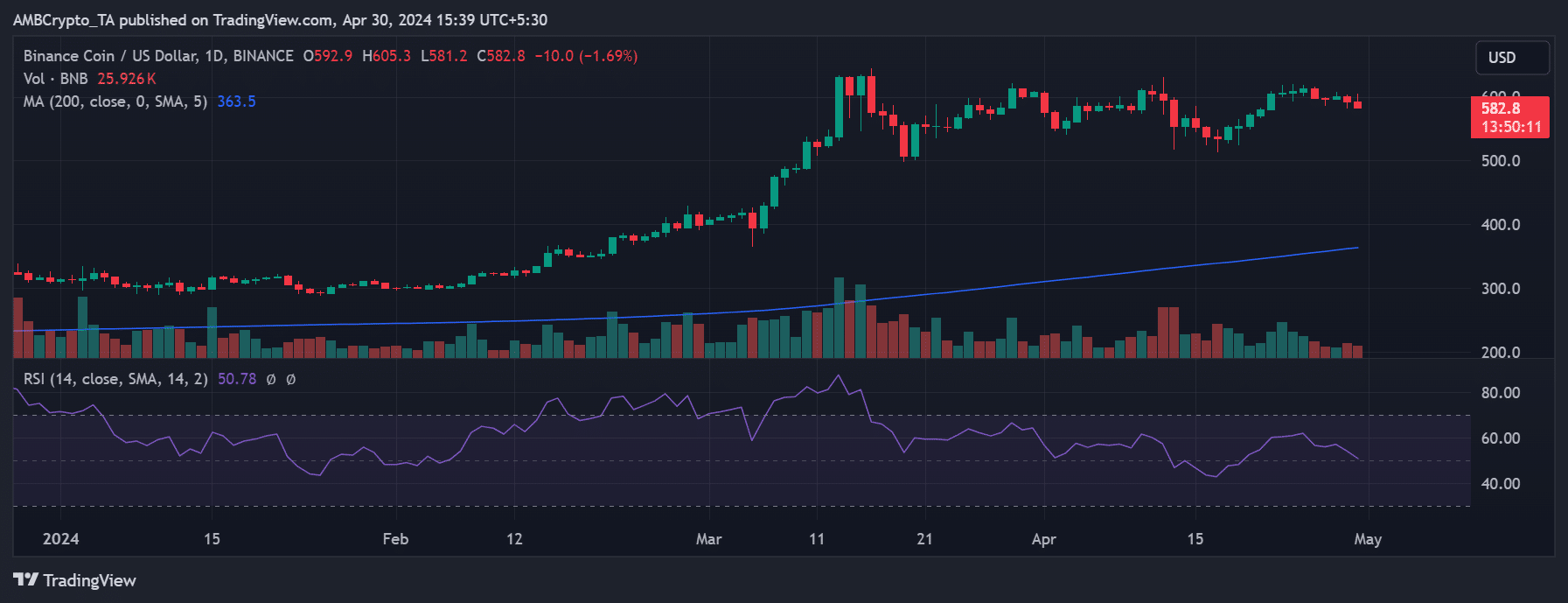

AMBCrypto’s analysis of BNB shows that the week is off to a positive start, with trading for the coin declining.

On April 29, BNB closed at around $592.7, down 1.23%. At the time of this writing, there has been a further decline of 1.72%, bringing the transaction price to approximately $582.9.

Source: TradingView

Realistic or not, the BNB market cap in BTC terms is:

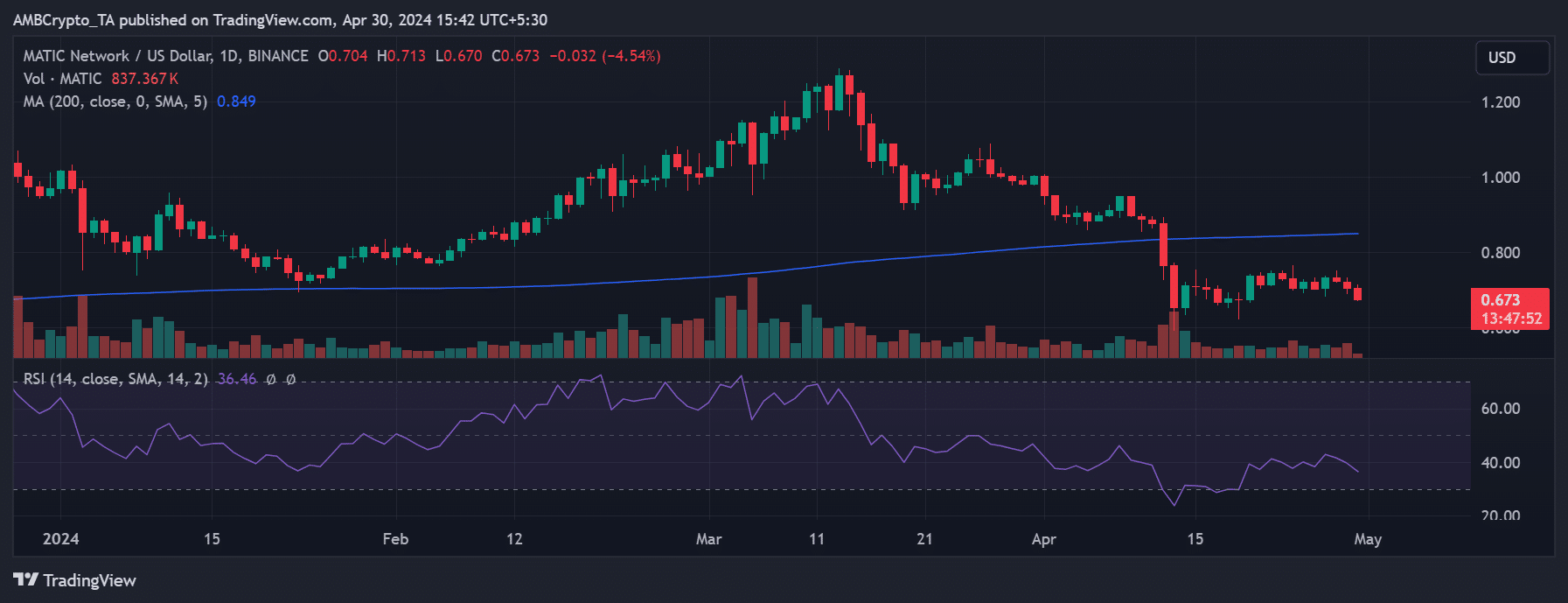

Likewise, MATIC has shown a more negative trend, with a downward trend since the beginning of the week.

At the time of analysis, MATIC was trading at approximately $0.67, reflecting a decline of more than 4%.

Source: TradingView