- BNB’s trading volume remains below $3 billion on the charts.

- Volatility is still low

Trading volume for Binance Coin (BNB) recorded a significant increase earlier this month, reaching levels not seen since 2022. How has BNB performed since then and are there any signs that suggest significant price movement is likely soon?

Binance Coin trading volume has returned to normal

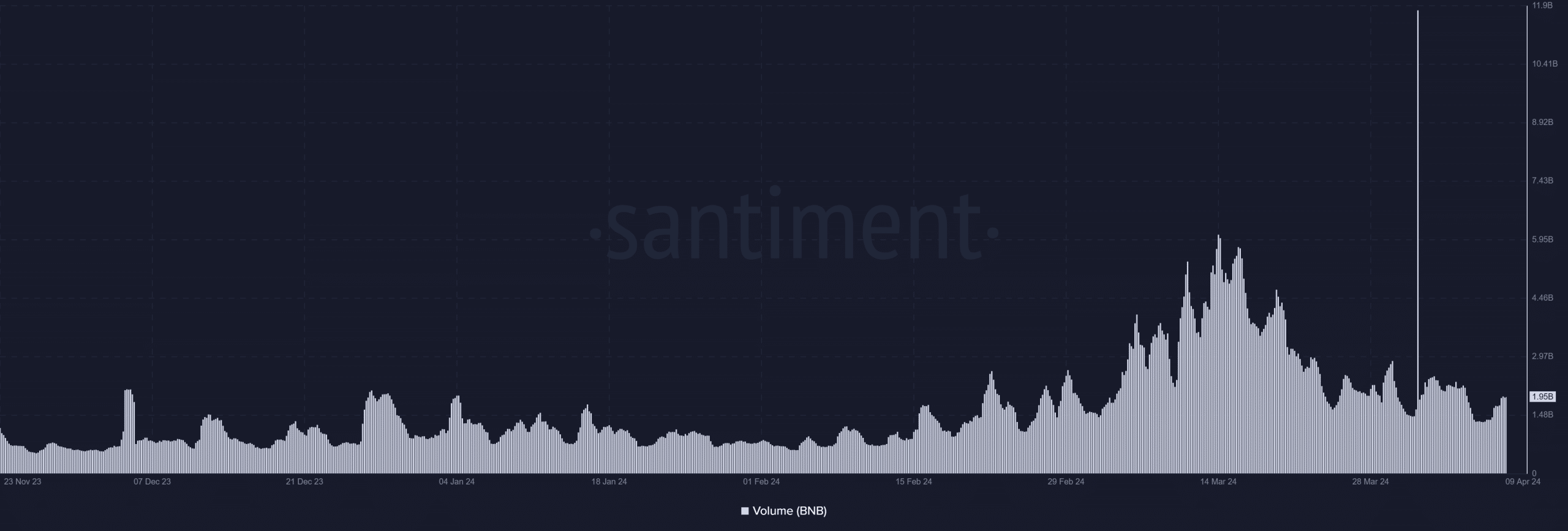

Santiment’s analysis of Binance Coin’s trading volume shows that it surged to over $11 billion on April 1. However, this surge was short-lived as subsequent analysis showed a return to previous volume ranges. Examination of the charts shows that following the surge, volume remained within the $2 billion threshold.

At the time of writing, it was worth about $1.9 billion. Moreover, there has been no noticeable change in prices since this surge.

Source: Santiment

Intensified chart volatility

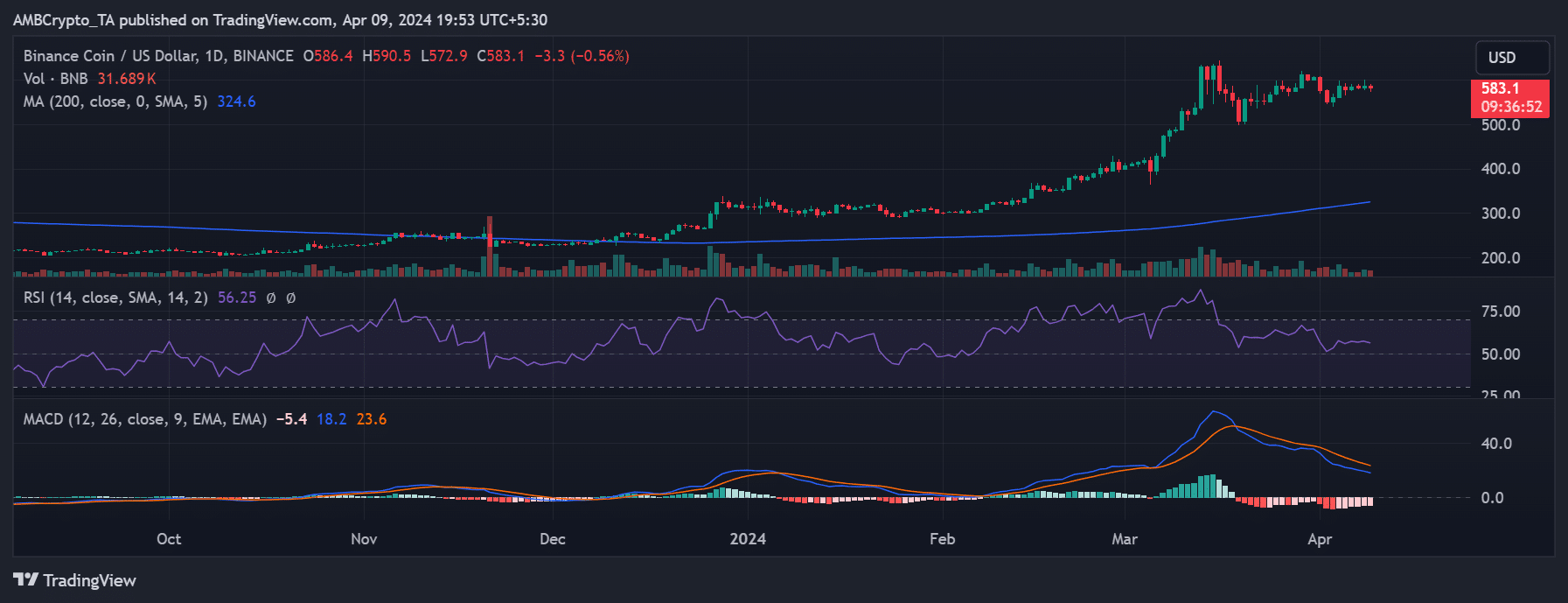

Analysis of daily timeframe charts shows that the price of Binance BNB did not react significantly on days when trading volume surged. In fact, the chart shows a price drop of more than 5%, taking the price from over $600 to around $570.

Source: TradingView

There was then an attempt at price consolidation around $580. At press time, BNB was trading around $583 and down less than 1%. Additionally, the Relative Strength Index (RSI) analysis shows that it is maintaining a stable bullish trend. Additionally, an examination of the Bollinger Bands shows that volatility is minimal, meaning the likelihood of sudden price movements is reduced.

Because traders are cautious…

Examination of Coinglass’s funding rate chart shows a gradual rise into positive territory, indicating that BNB buyers have regained market power. At the time of writing, the funding rate was around 0.02%. However, this indicates relatively weak sentiment despite bets on price increases.

– Is your portfolio environmentally friendly? Check out the Binance Profit Calculator

Finally, we analyzed the price movements and found that there is not much activity at the moment. At the same time, open interest hovers around $600 million, implying moderate cash inflows.

These indicators collectively suggest that traders are not fully committed to BNB. Therefore, consistent with the trend seen on the price chart, a major price move for BNB does not appear imminent.